BlackRock recently dropped its second-quarter economic outlook. And the world’s biggest asset manager made just one revision to its stock allocation: bumping up its overweight position on Japanese stocks.

It also sees opportunities in four of the world’s mega forces – AI, the digitalization of finance, the low carbon transition, and geopolitical fragmentation (onshoring). And those investments are keeping the firm’s US stock exposure on the heavier side.

That’s working for now, BlackRock says, but sticky inflation and a potential shift to higher-for-longer interest rates could undermine the current optimism.

Going into 2024, BlackRock wasn’t exactly looking at the investment world through rose-colored sunglasses. It saw mostly slower growth, hotter-than-ideal inflation, higher interest rates, and greater volatility ahead. And Japan was the only advanced economy putting a glimmer in its eye. Now, a few months later, the biggest asset manager on the planet is looking back at those calls – and mostly doubling down. So let’s check out the firm’s Japan bet and the other places where it sees opportunities.

What’s BlackRock’s view on Japan now?

Japan’s had an absolutely stunning year so far, and BlackRock’s certainly noticed. Japan’s Topix index returned 17.8% in the first quarter, or about 11% in US dollars, since the Japanese yen fell roughly 7% against the US dollar. And that market seesaw is the usual way of things: a weak yen often goes hand-in-hand with a boost in the country’s stocks because it typically leads to better profits for Japan’s big, export-driven companies.

BlackRock made just one revision to its stock allocation when it did its second quarter review of its 2024 outlook: bumping up its overweight position on Japanese stocks. That’s a pretty punchy call after such a strong start to the year.

BlackRock’s bursting optimism is based on several factors: companies have been returning record amounts of capital to shareholders, corporate profits have been on the rise, foreign investors have plenty of room to buy more, and domestic investors are being incentivized to put their huge savings deposits to work. The firm also expects the Bank of Japan to keep interest rates low, which tends to support the economy and stock market.

With the yen looking fairly cheap compared to its rivals, you could consider investing in the country’s shares via the iShares MSCI Japan ETF (ticker: EWJ; expense ratio: 0.5%) or for European or UK investors, via the iShares Core MSCI Japan IMI UCITS ETF (SJPA; 0.12%). That would allow you to benefit from gains in Japan’s shares and its currency.

Where are the other places where BlackRock sees opportunities?

BlackRock has drawn a bright green circle around four mega forces, highlighting them as key building blocks for investments – AI, the digitalization of finance, the low carbon transition (the need for resources/copper), and geopolitical fragmentation (onshoring).

The firm recommends only a neutral (or proportional) weighting for US stocks, but once you add in some mega force investments, you end up overweight. After all, most AI-related companies are listed in the US.

BlackRock says high-quality earnings and AI-exposed names, notably from the tech and telecom sectors, are helping US stocks overcome the drag of higher interest rates. It prefers betting on “quality” companies over chasing small-cap laggards. You could consider betting the same way, with the SPDR S&P 500 ETF (SPY; 0.1%), the iShares MSCI USA Quality Factor ETF (QUAL; 0.15%), or the Invesco Nasdaq 100 ETF (QQQ; 0.15%).

But there are ways to play the mega force game outside of the US, too. For example, BlackRock likes emerging market stocks from India and Mexico, even though their relative valuations seem rich. To bet on some mega trend love in those markets, you could consider the iShares MSCI India ETF (INDA; 0.65%) and the iShares MSCI Mexico ETF (EWW; 0.5%)

What are the risks, then?

Like a lot of investors, BlackRock is mostly encouraged that things are headed in the right direction – with inflation generally continuing to cool toward central bank targets, economic growth generally holding up, and interest rate cuts likely on the way. That’s a good mix for riskier assets, like stocks and crypto, and that’s the key reason why the fund manager is keeping its “risk on” attitude for now.

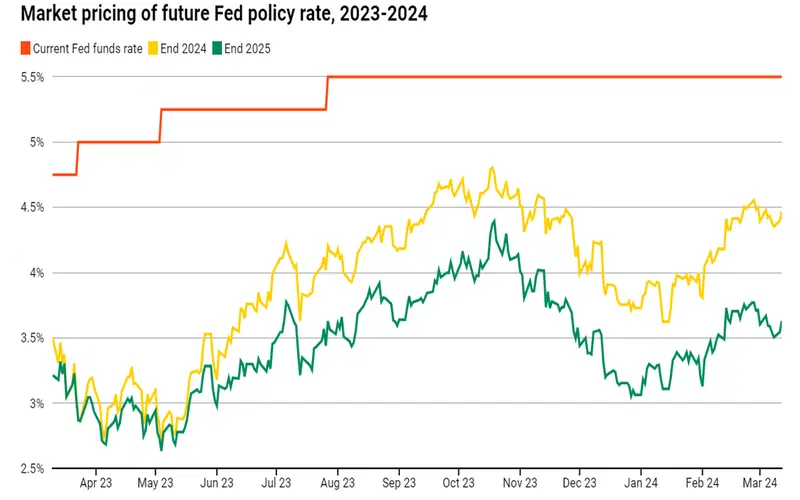

But it still sees uncertainties – and rightly so. Yeah, US consumer price rises might continue to fall toward the Federal Reserve’s (the Fed’s) 2% target this year, but that doesn’t mean they’ll stay there. With some hefty wage increases across the economy’s huge services sector, inflation could perk back up again next year, settling around 3% over the longer term.

And that’s likely to be a shock to the system for the many stock investors who’ve been pinning their hopes on seeing super-deep interest rate cuts.

The Federal Reserve's (the Fed’s) key interest rate (red line) and market forecasts for the end of 2024 (yellow line) and end of 2025 (green line). Source: BlackRock.

Higher interest rates, after all, tend to weigh down share valuations – and that kind of drag is what’s keeping BlackRock a bit cautious on stocks in the first place. If markets have to adjust to structurally higher long-term interest rates, and the narrative changes from “immaculate disinflation” to “higher for longer”, you may need to be very nimble with your investments.

And that’s one reason why BlackRock recommends investing a little in short-term government bonds. So the iShares 1-3 Year Treasury Bond ETF (SHY; 0.15%) or for European or UK investors, the SPDR Bloomberg 1-3 Year US Treasury Bond UCITS ETF (TRS3; 0.15%) could be worth a look.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.