Copper has earned its nickname – Dr. Copper – over the years because its price so often moves in line with the economic cycle. It goes up when the economy is growing and down when it’s slowing. And right now, copper and copper-related stocks are rallying hard and it’s not all because of economic vim and vigor. It’s also because of AI.

Sure, economic health is one driver. Recent global surveys show that manufacturing activity – notably in the US and China – has started expanding again for the first time since September 2022, and that’s a great sign for the global economy. It’s also a great sign for the “doctor”: historically, the first expansion has led to an average 25% increase in the price of copper in the following 12 months, thanks to increased demand.

And Chinese economic stimulus projects are undoubtedly playing a role too: the country’s copper demand climbed by 12% in the first quarter of 2024, compared to last year, boosted by investments in the country’s electrical grid and renewable energy tech.

But in the US, demand for copper has been surging alongside a new – soon-to-be-relentless global trend – the construction of AI-related data centers. The red metal provides the lowest-cost and highest-performance solution in data center racks – compared to the more expensive optical cable alternative.

Man Group estimates that the US data center build-out alone could increase global copper demand by 0.5% to 1%. That may not seem a lot – but it’s enough to throw the copper market out of kilter. And when you consider the fact that these data centers are set to be rolled out globally, AI-driven demand is about to seriously shake things up.

If copper grew on trees (so to speak), all the new demand wouldn’t affect the price too much. But that’s not the case.

Copper mines are located in regions with patchy stability, including Latin America, Congo, Kazakhstan, and Mongolia. An estimated 3% to 5% of the global supply never made it to market in the past year because of operational and political disruptions. And the outlook for the current year remains uncertain: Chile is set to produce around 65% of global supply, but it’s facing tough union wage negotiations.

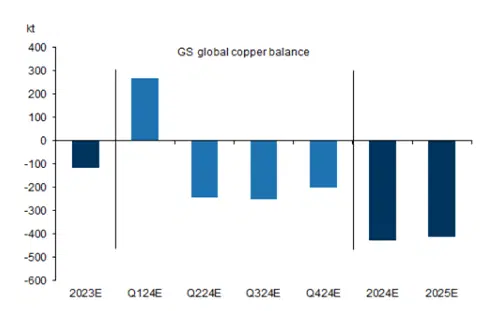

It takes a long time – say, ten to 15 years – to get a new copper mine up and running, so there’s no quick fix for the coming supply shortfall. Goldman Sachs expects the copper market to slide into a supply deficit this quarter, and remain there for the rest of the year.

Goldman Sachs’s refined copper market supply and demand outlook. Source: Goldman Sachs.

If supply shrinks and demand continues to increase, that will mean a higher price for the good doctor. So it could be worth considering investing in copper, either directly or through a copper ETF like the Global X Copper Miners ETF (ticker: COPX; expense ratio: 0.65%) or, for investors outside of the US, the Global X Copper Miners UCITS ETF (COPG; 0.65%).

-

Capital at risk. Our analyst insights are for educational purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render any investment advice and has no control over the content