As inflation in Japan makes a comeback and China’s economy struggles, some of the biggest names along Wall Street have started recommending a new currency play: funding carry trades using the yuan instead of the longtime favorite yen.

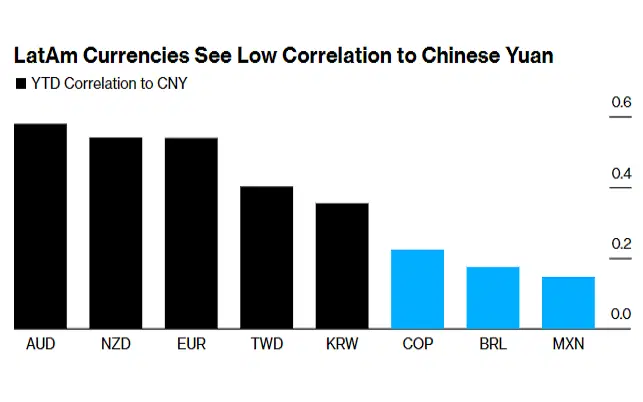

As an added perk, the yuan is less volatile than the yen and is mostly uncorrelated with the higher-yielding currencies of Latin America. And that could potentially minimize the risk of yuan-funded carry trades focused on the region.

But just because the carry trade has worked well in the past doesn’t mean it’ll do so in the future, and the yuan is no sure bet as a funding currency for these kinds of trades either. What’s more, emerging market currencies can be quite volatile, and the use of leverage (a common practice in currency trading) amplifies risk even more.

Currency investors love a good “carry” trade, and for years the best one started by borrowing yen. It didn’t cost a thing because of Japan’s negative interest rates, and they could invest the money anywhere where yields were higher. (And that basically meant anywhere in the world.) Recently, however, the yen’s been shoved from its perch, with the Chinese yuan becoming an attractive, low-cost alternative. And some of the biggest names along Wall Street are talking about it. So you might want this trade on your radar.

What is a carry trade?

A carry trade involves buying higher-yielding currencies – that is, ones from countries with higher interest rates – using funds borrowed in lower-yielding ones. In the currency, or FX, market, trades are done in pairs, buying one country’s currency and selling another’s. So, mechanically, this is done by simply buying, or “going long”, the currencies with high interest rates and selling, or “going short”, the ones with low interest rates. The rationale behind this strategy is that over the medium term, returns from higher-yielding currencies tend to outperform lower-yielding ones when you factor in both currency price moves and income (from the difference in interest rates).

How have traders been executing this strategy up until now?

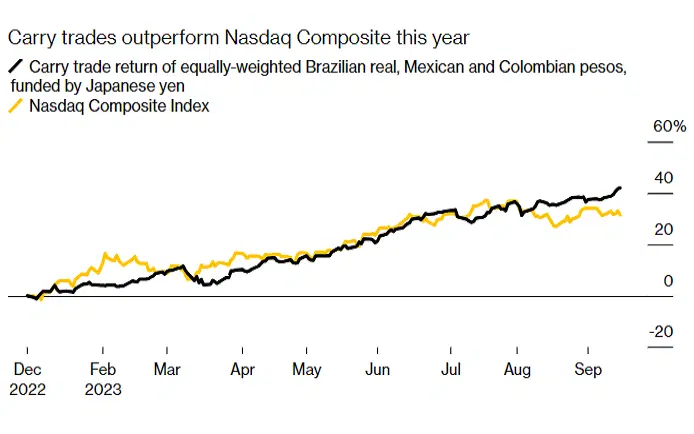

Over the past two years, market players have generally done carry trades using funds borrowed in (low-yielding) yen. It’s been a profitable move, to say the least, with nearly every central bank other than Japan jacking up interest rates. For example, a yen-funded carry trade that’s equally invested in the Brazilian real and Mexican and Colombian pesos has gained 42% so far this year – easily outpacing the Nasdaq’s rally.

This year, yen-funded carry trades in Latin America have been particularly profitable. Source: Bloomberg.

So what’s changing?

After being cold and dormant for decades, inflation in Japan has put on some heat, topping the central bank’s 2% target every single month since April 2022. That, coupled with signs of a growth revival in the world’s third-biggest economy, has sparked speculation that the Bank of Japan (BoJ) might end its seven-year policy of negative interest rates. If that happens and the central bank does start to hike interest rates, that would increase the yen’s borrowing costs and could potentially lead to the currency’s appreciation – a double-whammy for yen-funded carry trades.

Meanwhile, amid heavy debt, a property market downturn, and deflation concerns, China’s central bank has reduced its key short-term rate, the seven-day reverse repo rate, twice since June to a record low of 1.8%. And there’s likely to be more where that came from, with economists expecting the People’s Bank of China (PBoC) to slash rates to rock-bottom levels in a bid to prop up the country’s struggling economy. Those cuts will make the yuan even weaker and cheaper to borrow, boosting the appeal of yuan-funded carry trades.

That’s why several major financial institutions have started to revisit their carry trade strategies. Goldman Sachs, for example, recommended funding purchases of Brazilian reais and Colombian pesos with the yuan. Strategists at TD suggested borrowing yuan to buy Indian rupees, Mexican pesos, and Brazilian reais. Citigroup put a good word in for selling the yuan against a basket of currencies that includes the US dollar and the euro.

And adding to the appeal of yuan-funded carry trades is the fact that the currency is less volatile than the carry champion yen these days. Fluctuations in the yen have ramped up recently, leading Japanese officials to voice concerns over any perceived excessive weakness – and that’s a worry for carry traders. The last thing you want to happen to your funding currency is for it to suddenly shoot higher in value. By contrast, China’s frequent interventions in the FX market to stabilize the yuan might actually be beneficial to those carry traders. Those moves reduce volatility, making profits from yuan-funded carry trades more predictable. Currently, the yuan's three-month implied volatility is at 5.6% – that’s the third-lowest among all the major currencies and considerably smaller than the yen's 9.3%.

How do you do this trade?

Before I get into all that, it’s important to note that CNY and CNH represent the same Chinese currency but are traded in different markets. CNY is the currency code for the yuan traded onshore, within mainland China, and is subject to Chinese government restrictions. CNH, then, is the currency code for the yuan traded offshore, primarily in Hong Kong, and it’s not as tightly regulated. International investors typically trade the CNH because the offshore market offers more flexibility and is not subject to the same capital controls as the onshore yuan, allowing for more speculative activities (such as shorting the CNH to fund carry trades).

Now, if you want to construct a yuan-funded carry trade, you can start by having a look at the interest rates set by the world’s central banks (this website has them all). You’ll see, for example, that the Turkish lira (TRY), Brazilian real (BRL), and Hungarian forint (HUF) offer the highest interest rates. So to construct the trade, you’d buy each one by selling the offshore yuan (CNH). For every day that you hold these positions, your FX broker will deposit the difference in interest rates between the currencies through a mechanism called “rollover”. And as an added bonus, you’re likely to see gains in the currencies you bought, since higher-yielding ones tend to go up in value as they become more popular with investors.

If you’d like your trade to align with what the major financial institutions are doing, they recommend building yuan-funded carry trades that focus on Latin American currencies like the Brazilian real and the Mexican and Colombian pesos. A key advantage of these is their low correlation with the yuan, which could potentially minimize the risk. According to calculations by Bloomberg, the Brazilian real and Mexican and Colombian pesos have an average yield of around 12.5%. Since it costs about 4% to borrow offshore yuan to fund the carry trade, that implies an annualized return of roughly 8.5%, if exchange rates remain stable. (But since these trades are almost always highly leveraged, actual profits could be many times greater.)

Latin American currencies have low correlations with the yuan. Source: Bloomberg.

What are the risks?

First, as with so many things in investing, just because the carry trade has sung in the past doesn’t mean it’ll hold a tune in the future. And since carry trades – especially the more profitable ones – tend to be overcrowded, the strategy can crash hard during times of market stress as traders rush to the exit all at once.

Second, emerging market (EM) currencies like those from Latin American countries can be volatile. Economic issues in developing regions have a history of spiraling out of control, and that can lead to big collapses in currency values. And that can lead carry traders to lose whatever interest rate differentials they were pocketing – and more. There also can be a contagion effect: economic crises in EMs have been known to spread well beyond their starting points, causing several currencies to fall at the same time.

Third, FX trading is often done using leverage: you stump up a small amount of capital, which is then magnified on your behalf. That amplifies your potential for gains, but it also means small currency movements in the wrong direction can lead to big losses. If you do decide to trade on leverage, you’d be wise to do so sparingly.

Fourth, the yuan is by no means a sure bet as a funding currency for carry trades: there’s always the risk that Chinese authorities will aggressively intervene in the market, sending the currency higher. And, if China’s economic growth picks up steam again, that also could send the yuan higher. And finally, central banks in Brazil, Mexico, and Chile have started to lower their interest rates, shrinking the rate differentials you’ll see on some of the most lucrative carry trades. As always, tread carefully.