India is doing some serious flexing. It was a top contributor to global economic growth last year and, in the years to come, it’s expected to contribute even more.

This economic powerhouse is already becoming increasingly attractive to global manufacturers, and that shouldn’t come as a huge surprise: India’s got a young and growing population and some very inviting supply chain dynamics.

And, as an investor, there’s another reason to like India: right now, It’s the best place to find multi-bagger investments.

India is booming. The combined muscle of emerging markets may have helped push global economic growth last year, but, let’s face it, India was doing a lot of the heavy lifting. And, according to the latest forecasts from the International Monetary Fund (IMF), it’s likely to do even more next year and beyond. So let’s look at why you might want to add some of this country’s sheer brawn to your portfolio now.

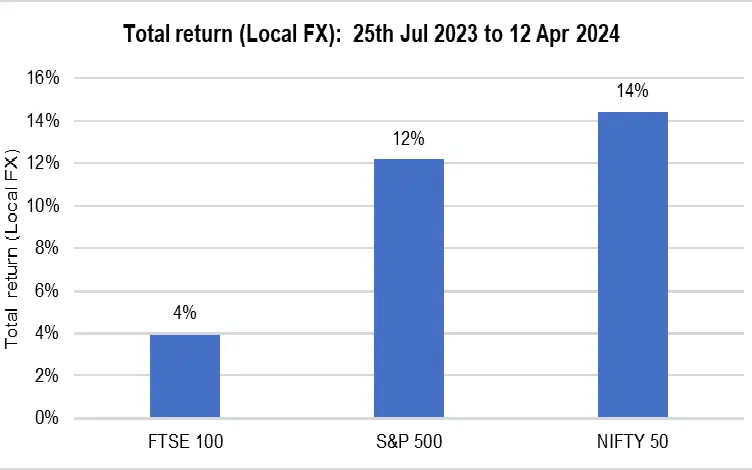

Returns in India’s NIFTY 50 have exceeded those of the US’s S&P 500 and the UK’s FTSE 100 since July 2023. Source: Google Finance.

1. India’s a top contributor to global economic growth.

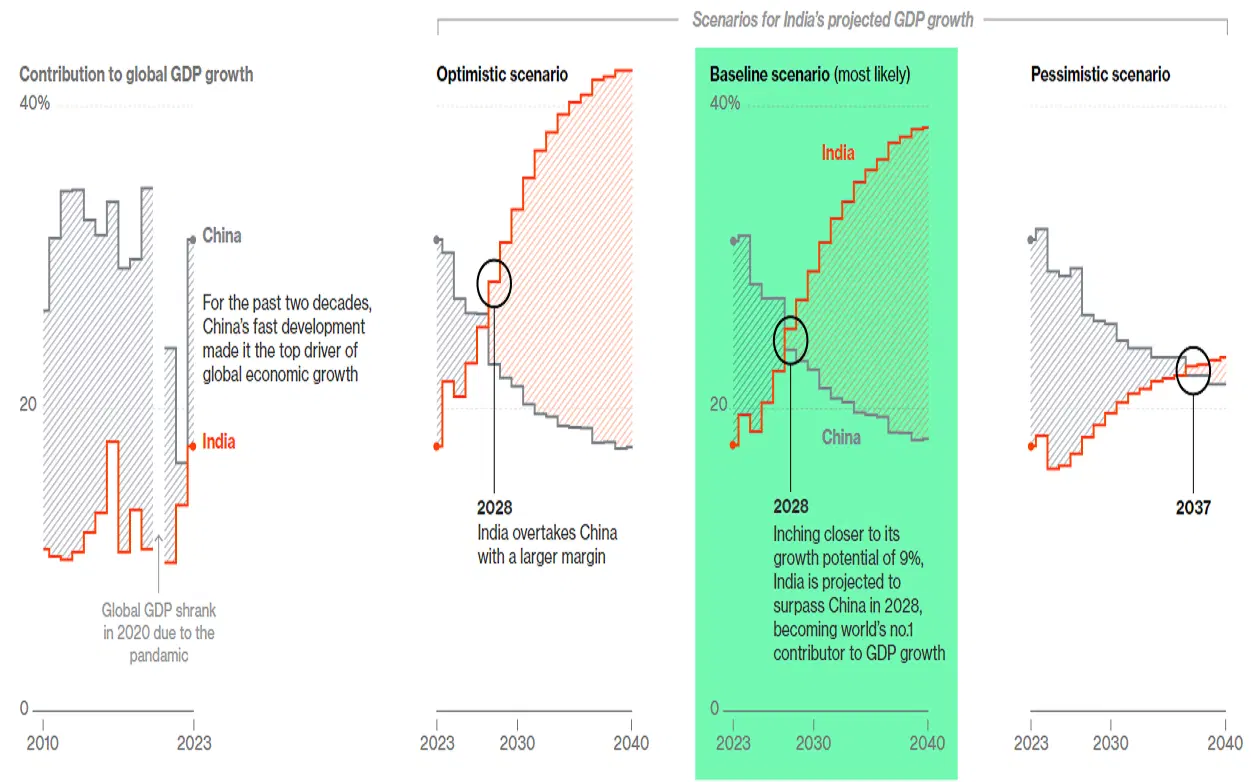

India could overtake China as the world’s leading contributor to global economic growth by 2028, according to Bloomberg Economics. The team’s analysts plotted three scenarios for India’s projected economic growth and found the country likely to unseat China in 2028 under both the optimistic (at left) and baseline (center) situations. In more pessimistic conditions (right), India would become the top contributor nine years later, in 2037.

The optimistic scenario, at left, assumes India's growth rises to 10% by 2030. The pessimistic scenario, right, assumes the IMF forecasts for the next five years and extends them forward, with potential growth dropping from today’s 6.5% to below 6% over the next decade. Source: Bloomberg Economics.

Mind you, a lot of assumptions go into these estimates, but the key ones are the pace of the infrastructure improvements to attract global manufacturers and the availability of workforce needed to support the manufacturing infrastructure. Keep reading and I’ll untangle both issues and a few others.

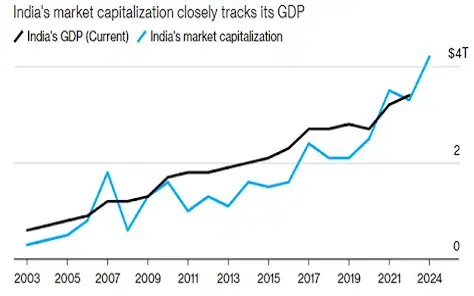

India’s market conforms to the common theory that an accelerating economic growth run rate reflects itself in stock market performance with improved earnings, outlook, and valuations. And, given the improving economic outlook, it makes sense to want to be invested in India right now.

India’s market capitalization closely tracks its gross domestic product (GDP) – a measure of the value of the goods and services produced by an economy. Sources: World Bank, Bloomberg.

2. It’s becoming increasingly attractive to global manufacturers.

India attracts investments from two perspectives – from its rising status as a global manufacturing hub and from its key business reforms.

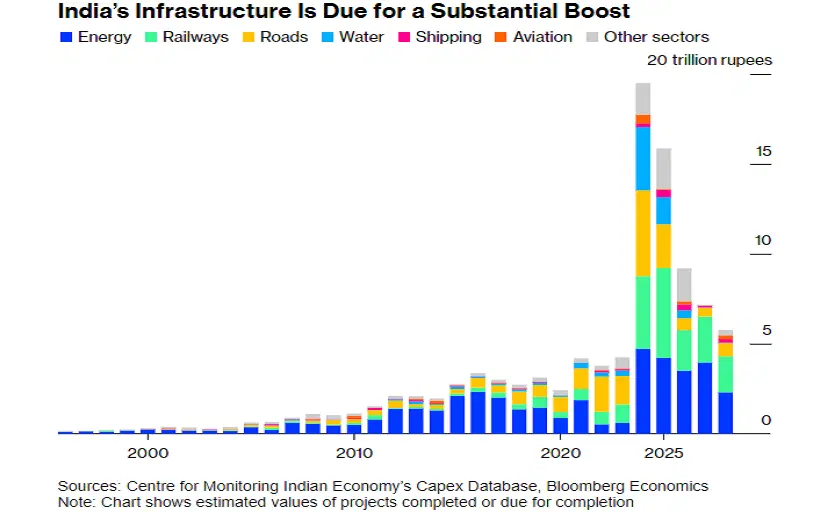

From a hub perspective, the country is still a work in progress, but its infrastructure is progressing at a fast pace. The government’s spending for the current fiscal year has tripled from just five years earlier to $240 billion. And it’s set to rise even more, as the country looks to upgrade its shoddy roads and inadequate airport capacity. However, progress is being made with massive projects such as a new Mumbai-to-Delhi corridor and some 80 new airports due for completion in the next 12 months. Further down the road, improvements in energy, rail systems, and the road network are the key priorities – each meant to support manufacturing growth.

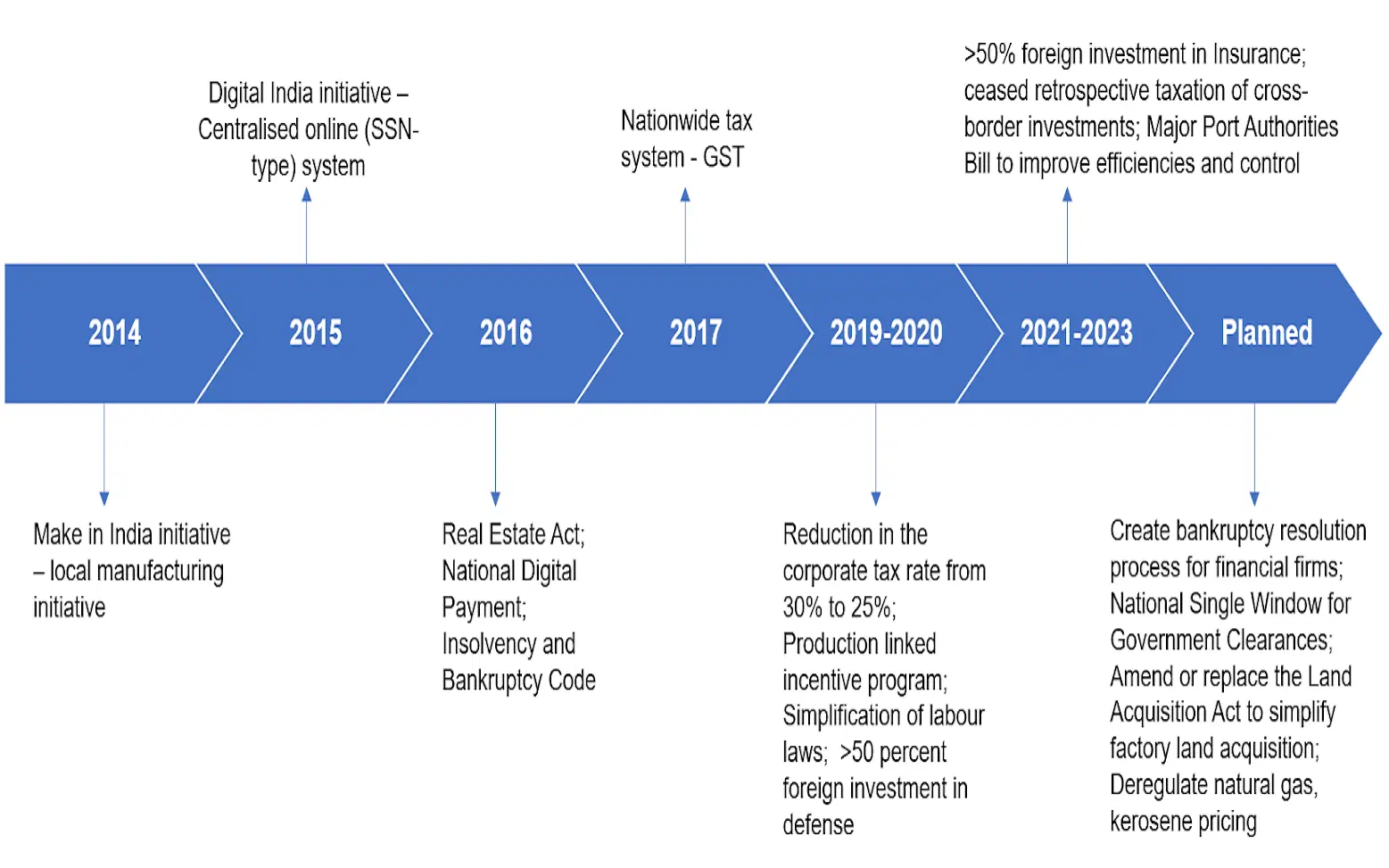

Estimated values of projects, priced in Indian rupees, that either have been completed or are due for completion in India, by year. Sources: CMIE Capex Database, Bloomberg Economics.

From a financial reform perspective, the government has adopted a bunch of pro-growth policies aimed at catching the attention of global investors. And, well, so far so good. Those changes have included ending retrospective taxation of cross-border investments, creating a unified payments interface to move money more easily online, launching a goods and services tax that unified India’s states and territories into a single market, adopting a biometric identification system (similar to the US Social Security number) that makes it easier for Indian consumers to access subsidies and pension payments, and allowing foreign direct investments in sectors such as defense and insurance.

Timeline of major reforms since 2014. Sources: Capital Group, the Indian government, and news reports

3. It’s got a young and growing population.

A young workforce is more productive, has a greater and longer duration of income growth, and is the key spender in the economy. And that’s the enviable demographic that India’s got. China and developed market economies, meanwhile, have aging populations, a tricky scenario that brings increased healthcare costs, unsustainable pension commitments, and changing demand drivers.

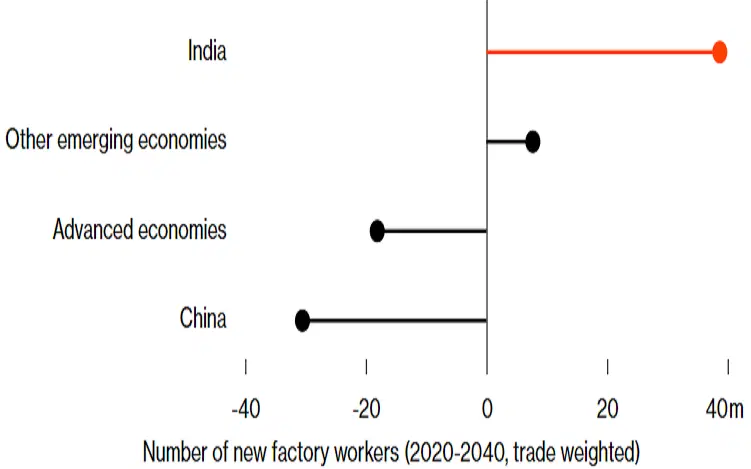

According to Bloomberg estimates, of the world’s total medium-skilled workers, 49 million will retire from China and developed economies from 2020 to 2040, while India will add 39 million.

India is set to see a rise in medium-skilled workers from 2020-2040, while much of the world will see that workforce shrink. Source: Bloomberg Economics.

This situation sets India up to become a major manufacturing hub with a massive consumer market. As of 2022, more than half of India’s population was 25 years old or younger, giving it a distinct advantage over China and other Asian manufacturing regions, such as Vietnam, Cambodia, or Sri Lanka.

4. It’s a more inviting link in the supply chain.

Developed market economies now view China more as a rival than an ally. The gradually rising tension between China and both the US and Europe has meant that companies are looking for new manufacturing hubs. Only India has a labor force and an internal market that’s comparable in size to China’s (and it certainly helps that the majority of India’s population speaks English). Apple is shifting production facilities from China into India. Samsung has followed suit and Tesla is in discussions to do the same.

5. It’s the best place to find multi-bagger investments.

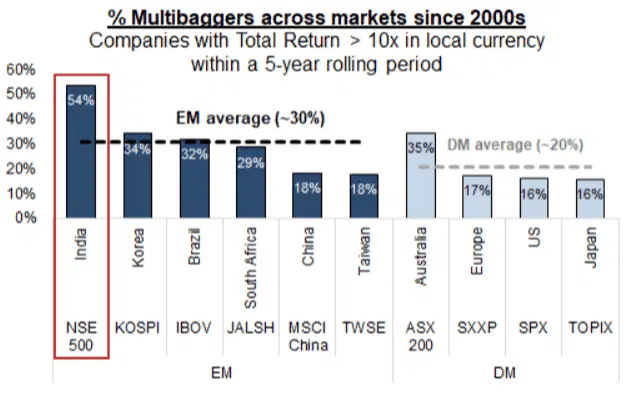

According to Goldman Sachs, India’s stocks delivered the best compound annual returns in Asia over the past two decades, and significantly more than the broader emerging market or world indexes. So if you’re looking to pick stocks that can appreciate by 10x or more, Indian stocks are worth a look.

Goldman’s study showed that within a five-year rolling period since 2000, more than half of the stocks trading on the Nifty 500 Indian index generated over 10x returns – way better than in China, the US, or Europe.

Companies that have given investors more than ten times total returns within a five-year, rolling period. Source: Goldman Sachs.

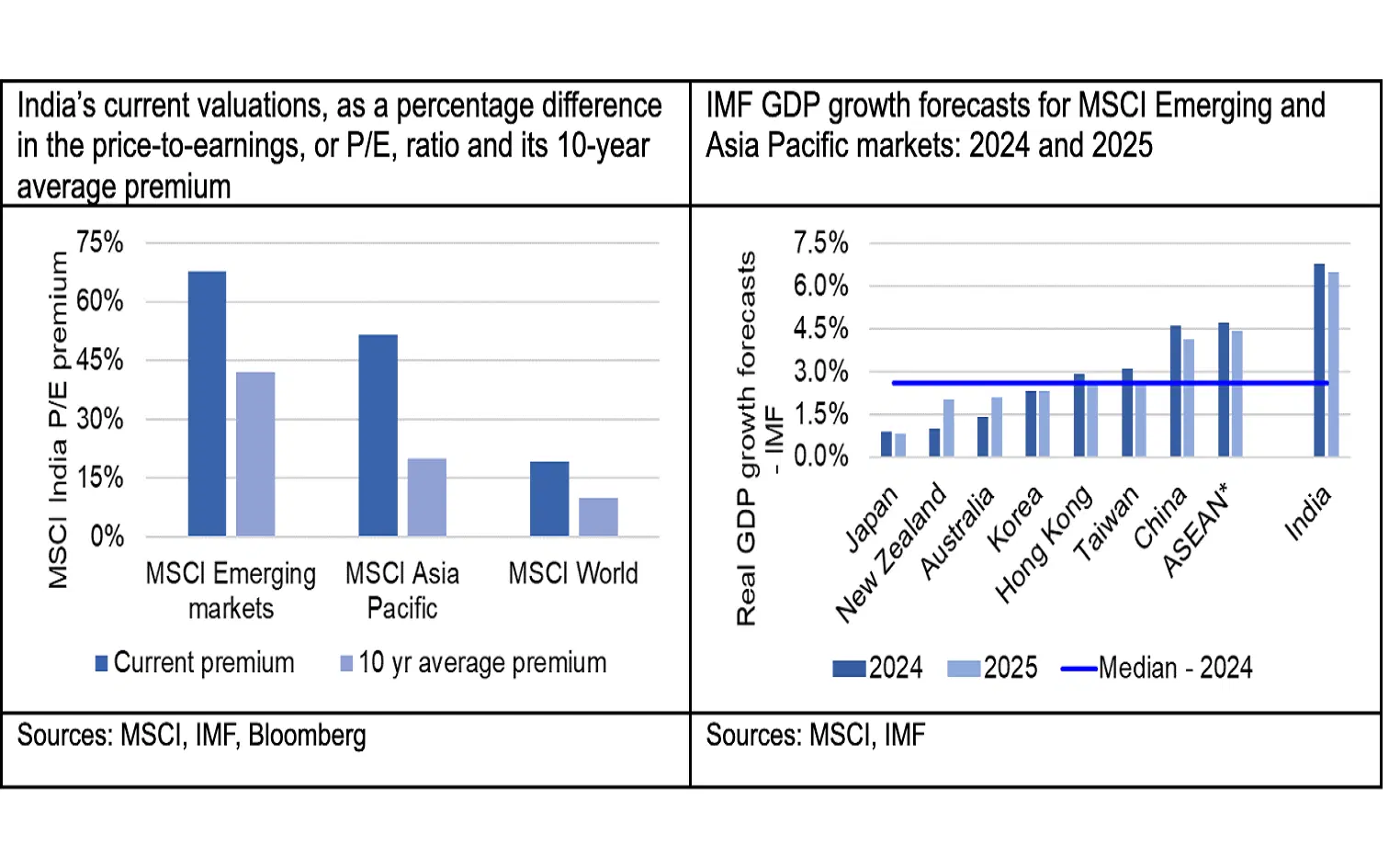

The chart below shows the MSCI India’s current price-to-earnings (P/E) and ten-year average premium relative to a few benchmarks. As you can see, the MSCI India index is currently trading at a premium that’s higher than its own historical levels and higher than its peers. While India seems expensive, that partly reflects its above-average growth profile relative to peer economies.

At left, India’s current valuations, as a percentage difference in the price-to-earnings, or P/E, ratio and its 10-year average premium. At right, IMF economic growth forecasts for MSCI Emerging and Asia Pacific markets: 2024 and 2025.

So what’s the opportunity here?

Now, this is a bit tricky. Because of government restrictions, there isn’t an easy way to invest directly in India-listed stocks. But there are ETFs and other funds that offer a way in. You could consider investing in a broad market index ETF like the iShares MSCI India ETF (ticker: INDA; expense ratio: 0.65%), or for non-US investors, the iShares MSCI India UCITS ETF (NDIA; 0.65%). The two funds track more than 100 small- and mid-cap stocks, which is what most of the index consists of. You might also consider the iShares India 50

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.