Back in June 2023, it looked like the battle against inflation was almost won. A heavy barrage of interest rate increases had stomped consumer price rises down to a yearly pace of just 3%, compared to 9.1% in June 2022. But then, well, things kind of stopped in their tracks. And, more worryingly, inflation rates have started to creep up again.

Last month, the yearly all-items consumer price index (CPI) rate was 3.5%. And the so-called core measure – which takes out the more unpredictable stuff like food and energy – was even higher, at 3.8%.

The trouble becomes crystal clear when you look at the monthly pace of core inflation: it hasn’t dipped below 0.2% since 2021 and it’s actually climbed back up to 0.4% in each of the past three months.

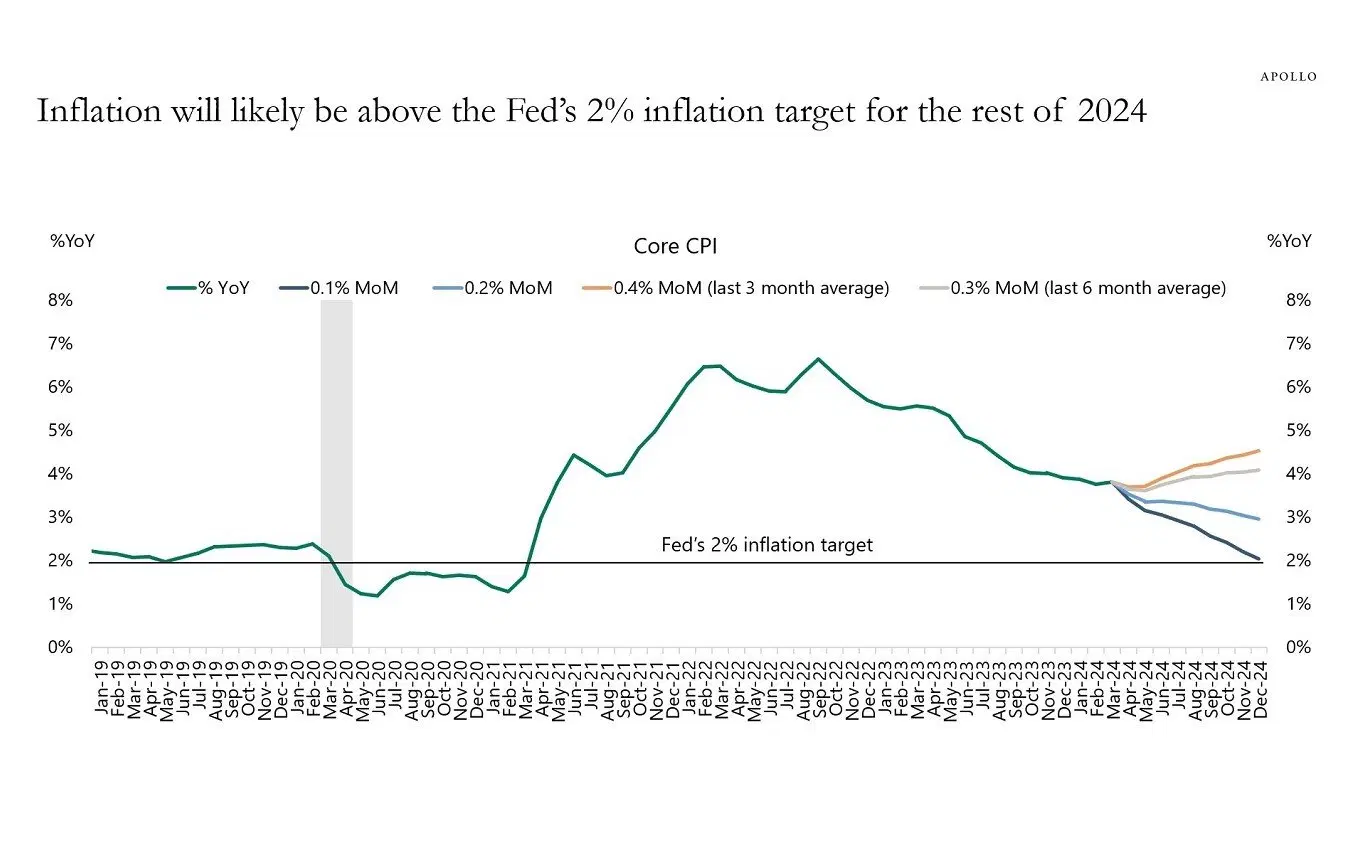

And that suggests that the annual pace of inflation is pretty unlikely to come within striking distance of the Fed’s 2% target this year. This chart from the Apollo asset management house illustrates varying trajectories for core inflation depending on upcoming monthly data.

The annual pace of inflation would still be higher than the Fed’s 2% target at the end of the year unless the monthly pace of price increases slows to 0.1% or less. Source: Apollo Global Management.

If the monthly pace sticks to its current three-month average of 0.4%, the yearly inflation level will end up at 4.5% by year’s end.

If it slows to its six-month average of 0.3%, inflation will close the year at 4%.

And even if it dips back to a chill 0.2% – a low not often seen in the past two years – that annual pace would still drop only to 3%.So to hit the Fed’s 2% comfort zone, core CPI would need to average a scant 0.1% a month for the rest of the year, a rate last seen (and only briefly) back in 2021.

Here’s the bottom line: unless the economy and consumer spending take a serious nosedive, hitting that inflation target this year is a very, very long shot. And what’s worse, inflation could shoot back up again.

That would put the Fed in a tight spot. It would either have to ramp up its efforts to squash inflation (for example, by jacking up interest rates a bit more), or have to accept its quicker pace. Either move could shake up markets, which have been banking on seeing inflation and interest rates fall back to their old lows.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.