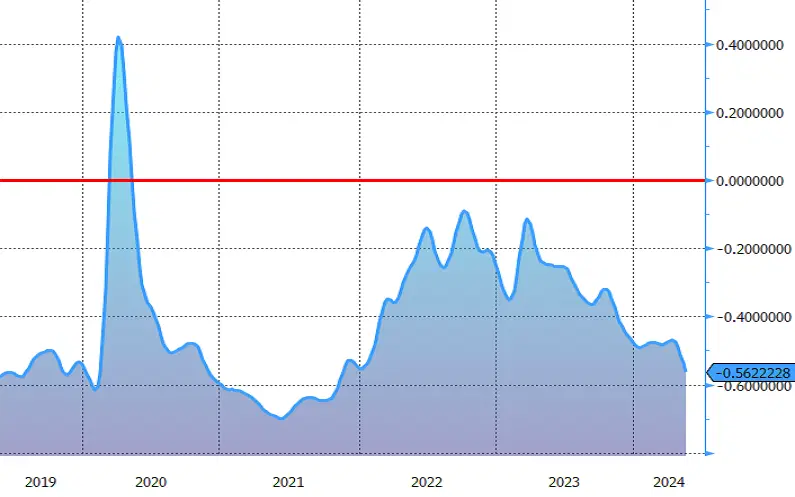

You’d be forgiven for thinking that the Federal Reserve’s (the Fed’s) second most aggressive rate-hiking cycle in history would have significantly increased the cost for companies to raise fresh cash. Instead, surging share prices and falling corporate bond yields have sent an index of US financial conditions to its lowest level since November 2021. See, interest rates aren’t the be-all and end-all of financial conditions. Yes, higher rates generally mean pricier loans – but a whole lot of other factors affect how easy or tough it is for firms to get financing and keep the economic show on the road. Think about the cost for companies to borrow compared to governments (known as credit spreads) and how well the stock market is doing (another source of financing). Enter the Chicago Fed’s National Financial Conditions index: it measures how easily companies can raise cash by looking at more than 100 indicators across money, debt, and stock markets. There are two key aspects to interpreting this index. First, a rising value indicates tightening financial conditions, while a decline indicates easing conditions. Second, positive values denote tighter-than-average conditions compared to historical norms, whereas negative values indicate looser-than-average conditions. The latest reading showed the index decreased to -0.56 in the week ending May 17 – its lowest level in two and a half years.

The latest reading showed the index decreased to -0.56 in the week ending May 17 – its lowest level in two and a half years. That came after data last week showed US inflation was slightly cooler than expected in April, which sent bond yields lower and US stocks to a record high as traders increased their bets on rate cuts this year.

The Chicago Fed’s National Financial Conditions index has fallen to its lowest level since November 2021. Source: Bloomberg.

But here’s another thing that stands out from the chart. If you look closely, you’ll see that financial conditions tightened in 2022 and 2023 as the Fed hiked interestrates – which is to be expected. However, during this entire time, the index remained in negative territory. Put differently, financial conditions were still looser than average despite those surging borrowing costs. That could be another explanation for why the US economy avoided a recession. After all, with companies still finding it easy to raise cash, they wouldn’t have had to cut back on their investments – a key driver of economic growth.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.