JPMorgan Private Bank sees several attractive investment opportunities across different assets, with interest rates and inflation both still on the high side, but expected to fall.

Stocks and real assets remain a good hedge against the threat of a new inflation surge, the private bank’s analysts say, with the current stock momentum expected to continue. What’s more, valuations look fair and earnings are set to continue to grow.

Cash is currently yielding more than inflation, but that’s unlikely to continue over the long term. Bonds also remain attractive with their current higher yields and expectations that interest rates are set to decline from here.

At the end of 2023, JPMorgan Private Bank published a list of key things to watch for in 2024. It was an important moment, the bank said then, with higher interest rates having upended the status quo, making certain assets attractive for the first time in over a decade.

Like any good investor, the global wealth managers recently did a quarterly review of that list, just to see how it’s holding up. Here’s what they found and the four places where they see potential opportunities now.

1. Inflation and the need to hedge.

The Federal Reserve (the Fed) has made clear that it sees inflation continuing to fall toward its 2% target.

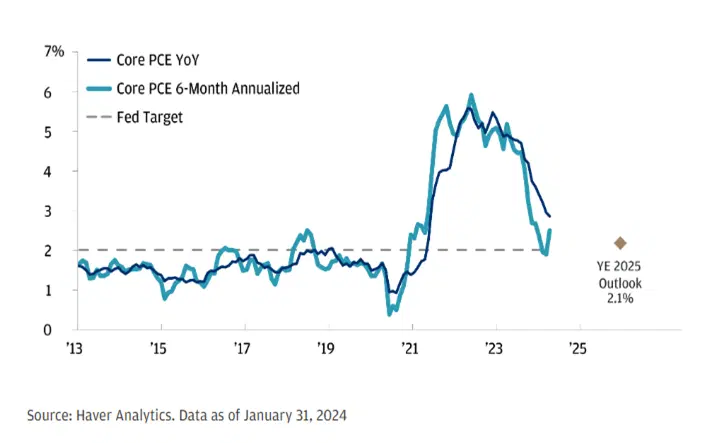

Core personal consumption expenditures (PCE) inflation, on a yearly basis (dark blue line) and a six-month annualized basis (light blue), from January 2013 to 2024. Source: Haver Analytics.

The personal consumption expenditures (PCE) report is generally believed to be the Fed’s preferred inflation gauge. And its “core” measure, which excludes more volatile things like food and energy, showed that prices rose at a six-month annualized pace of 2.49% in January, close to the Fed’s target. While other inflation data – the widely cited consumer price index, for example – have remained a bit hotter recently, the Fed and the folks at JPM Private Bank say the key drivers of inflation, such as lower wage pressures and more stable rental prices, should keep inflation on a downward slope.

What’s the opportunity?

While inflation and interest rates are both likely to simmer down, JPM Private Bank says it's still sensible to hedge against inflation risk. And it recommends two ways to do this: buying stocks and real assets.

For stocks, it sees valuations as being fair, especially with earnings growth already on the up and expected to accelerate ahead. A simple and cheap way to buy stocks if you’re in the US is via an index ETF, like the SPDR S&P 500 ETF (ticker: SPY; expense ratio: 0.09%). For UK and European investors, the SPDR S&P 500 UCITS ETF (SPY5; 0.03%) does the trick.

To invest in real assets, JPM Private Bank likes infrastructure assets: they’ve got a solid record of producing total returns above the rate of inflation. Finding broad exposure in a single asset is difficult, though. So you could consider a more diversified approach to real assets, for example via the FlexShares Real Assets Allocation Index Fund (ASET; 0.57%). It aims to mirror the performance of the Northern Trust Real Assets Allocation Index, which tracks inflation-sensitive securities in global infrastructure, global real estate, and global natural resources.

2. AI momentum.

No big surprise here: JPM Private Bank is bullish about AI and thinks the strong performance of the market, driven in large part by the Magnificent Seven, is more than just hype. The strong earnings of AI-linked companies underpin the enthusiasm that’s out there, and their high valuations appear reasonable when you factor in the strong growth that’s predicted.

The wealth manager sees Big Tech continuing its climb – and expects other sectors to join in as AI transforms industries – such as healthcare.

While you may be nervous about investing in the S&P 500 at record highs, the private bank crunched data going back to 1970 and found that if you’d invested in the S&P 500 at any all-time high during the past 54 years, your returns still would have been higher a year later 70% of the time, with an average return of 9.4%. Compare that to the 9.0% average return seen when investing at any random record or non-record time.

What’s the opportunity?

For AI exposure, the Invesco QQQ ETF (QQQ; 0.2%) provides exposure to the Mag 7 as well as other exciting tech companies that seem to be winning from the AI revolution.

For UK investors, you may want to go for the Invesco EQQQ Nasdaq 100 UCITS ETF GBP Hedged (EQGB; 0.3%).

For healthcare innovation, you could consider the VanEck Biotech ETF (BBH; 0.35%). If you’re in the UK or Europe and need a UCITS version, the iShares Healthcare Innovation UCITS ETF (HEAL; 0.4%) provides the necessary exposure.

3. Cold hard cash.

Stock markets have hit record highs in the US and elsewhere, but global money market fund balances have also shot well higher – to a massive $6 trillion. And it’s no wonder as yields – the amount of interest earned on your savings – are currently outpacing inflation and are at the highest level seen in 20 years.

Three months ago, JPM Private Bank’s analysts said holding more cash may be a good decision. And it probably still is: they now highlight that short-term (three-month) yields are likely as high as they’re going to get for a while. And that’s because, like the Fed, they see inflation and interest rates falling in 2024.

Now, stuffing your mattress with cash is no way to try to reach long-term financial goals. JPMorgan Asset Management – the private bank’s sister fund-managing unit – has a super-impressive data-crunching model that estimates that, over ten to 15 years, global stock and bond annualized returns will outpace the returns earned on cash by 4.9 percentage points and 2.2 percentage points, respectively.

What’s the opportunity then?

To get high cash yields, look for bank accounts that pay more interest, or consider the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL; 0.14%) that only has exposure to short-dated super-safe government bonds (called Treasury bills, or T-bills). If you’re in the UK, the Vanguard Sterling Short-Term Money Market Fund invests in short-dated Sterling money market instruments and currently has an indicated 5.24% yield.

4. Bonds.

JPMorgan Private Bank liked the look of bond yields when it put out its original report way back in November. And they’re in roughly the same place now.

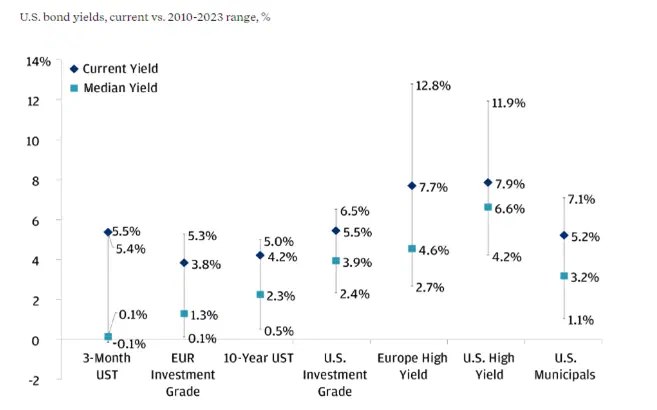

Yields on bonds as of March 4th, 2024, (dark blue diamonds) vs the range seen between 2010 and 2023. Sources: Bloomberg and JPMorgan.

The dark blue diamonds in the chart mark out the current yields offered by the different types of bonds. The lows and highs (on each vertical line) for the past 14 years are also shown as is the median (the light blue square). No matter how you look at this market, today’s yields are nicely higher than the median.

What’s the opportunity?

With both inflation and interest rates expected to decline, it’s a good time to lock in yields on longer-dated bonds, the private bank says, because when interest rates come down, these bonds will increase in price – increasing your total returns. Remember: when interest rates (yields) fall, bond prices rise. Depending on your risk tolerance, you could choose ultra-safe US Treasuries or dependable investment-grade bonds. Shorter-dated bonds – ones with two to three years to maturity – could be a sensible, more defensive approach, for example, if you think interest rates might eventually move higher again.

If you have the time to choose individual Treasuries, that’s usually a better option than opting for a government bond ETF, since there’s no real need for diversification when you’re buying government-issued debt. Nonetheless, there are plenty of bond ETFs out there: for 7-10 year bonds, you could consider the iShares 7-10 Year Treasury Bond ETF (IEF; 0.15%) or, if you’re in the UK, the iShares $ Treasury Bond 7-10yr UCITS ETF (IGTM; 0.1%) offers a hedged approach, priced in British pounds.

If you’re looking for slightly higher yields from a still-dependable asset, the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD; 0.14%) should meet your needs. If you’re in the UK, the iShares $ Corp Bond UCITS ETF (LQGH; 0.25%) does the same thing.

-

Capital at risk. Our analyst insights are for educational purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render any investment advice and has no control over the content.