You can obsess all you want about your stock picks, but the game-changer for your returns is most likely in your asset allocation. Studies find that about 90% of a portfolio's variability in performance is tied to how its investments are spread across asset classes – not the individual stocks or bonds it holds.

The reason boils down to this: different asset classes shine under different conditions. While stocks might rally during economic booms, bonds might be your best friend in a downturn. So your mix of investments – and the economic climate – can actually beam brighter than your choice between, say, Apple and Microsoft.

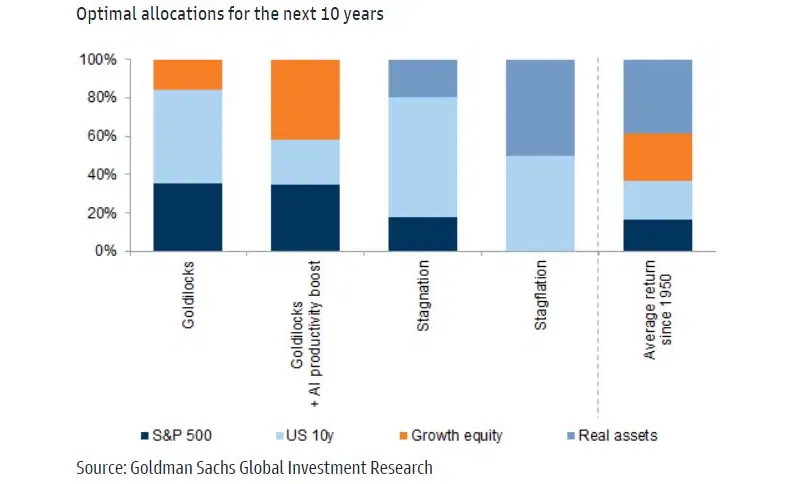

So you’ll want to get your asset allocation right. Luckily, Goldman Sachs has crunched some numbers, calculating what it considers to be the optimal investment mix – i.e., the one that would max out your risk-adjusted returns – for different economic scenarios.

The asset allocations that would maximize your risk-adjusted returns over the next decade under different economic conditions, according to Goldman Sachs. Source: Goldman Sachs.

There are some interesting takeaways. If growth is sluggish – either because of a stagflation or stagnation scenario – Goldman found it’s better to lean heavily on Treasury bonds and real assets, while minimizing your exposure to the S&P 500 and avoiding growth stocks altogether. In a “stagflation” situation – that’s low growth accompanied by high inflation – it says you’ll want an extra big piece of the pie going to real assets.

The investment bank also says you should go big on growth stocks only if you're betting on an "enhanced Goldilocks" scenario – with strong growth, low inflation, and a hefty AI-driven productivity bump. But even against that wildly rosy backdrop, Goldman finds that the allocation that maximizes your risk-adjusted returns is to cap your overall stock allocation at about 70%. In a more typical Goldilocks scenario, that chunk would drop to just 50%, which is probably lower than you thought.

And it’s lower because, even in the best of times, US Treasuries play a crucial role in maximizing risk-adjusted returns. This underscores their value as a key component, regardless of your outlook.

So, now that you’re not obsessing about your stock picks, here are three more useful things you can do. First, assess your current asset allocation and figure out what kind of economic future you're betting on. Second, if you've got a strong hunch about what's coming, adjust your asset mix to align with Goldman's optimal allocations. And third, if you don’t want to bet on a specific scenario, then don't overload on growth stocks, and instead make sure you've got a solid mix of real assets and Treasury bonds in the mix.