Most early-stage meme coin projects don't succeed, but once in a while, there will be a big winner.

Use DEXTools to screen for a list of more reliable projects, then research each project in detail before taking the plunge.

If you’re going to dabble in early-stage meme coins, consider taking the venture capital approach: pick a few projects at a “good” value, invest small amounts, and hope one of them succeeds.

Love them or hate them, meme coins have been one of crypto’s top performers this year. And some microcap meme coins – early-stage projects with total market sizes below, say, $1 million – have done even better. While most end up being duds, a few have blown up, making fortunes for their early investors (ahem... speculators). Here’s the lowdown on these things, how to spot opportunities, and how to manage the risks.

First, here’s how the meme coin market works.

Let’s get this out the way up front: if you’re looking for cash-flow-generating investments with intrinsic value, you’ll want to stay far away from meme coins. These projects are like the GameStops of crypto – driven by hype and speculative trading. The play here is to try and scout good opportunities before the hype happens.

Now, it’s easy for developers to launch meme coins on blockchains like Ethereum and Solana. First, they pick a meme concept (e.g., a dog, cat, frog, celebrity, or political persona) that might resonate with certain online communities. Then, they develop the project using smart contracts on their chosen blockchain. Once the coin is created, it gets listed on decentralized exchanges (DEXs) like Uniswap (on Ethereum) or Raydium (on Solana). That allows investors to buy or sell the coins directly from decentralized crypto wallets like MetaMask or Phantom, which plug into DEXs.

Next comes the harder part: developers and community members will promote the coin through social media platforms like Twitter, Reddit, and Telegram – often relying on viral marketing and influencer endorsements to create buzz and attract early investors. They’ll also work with crypto data platforms like Coingecko and Coinmarketcap to get their projects seen by more people.

If enough investors jump on board, centralized crypto exchanges might take notice. Their market makers (big traders who provide exchange liquidity) would then buy up the coins on DEXs and shift them over to centralized exchanges. This process usually starts with lower-tier centralized exchanges before the coins get their shot at the big leagues – top-tier exchanges like Binance, Bybit, and Coinbase (which have tons of users and hefty trading volumes).

Next, how to spot microcap meme coin opportunities.

Again, let me be clear: most early-stage meme projects never get off the ground. And often, when they do, they don’t stay in the air for long. But if you fish in the right waters, you could end up with a decent catch. Here’s how.

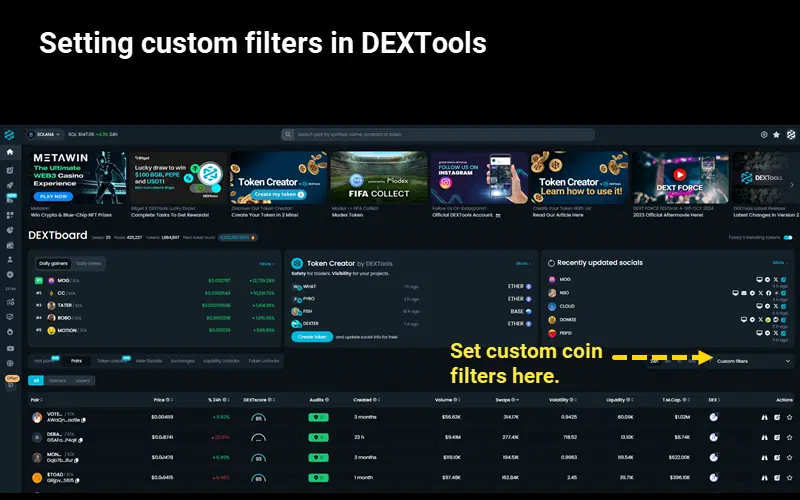

Start by getting familiar with the DEXTools.io platform. This front-end user interface aggregates real-time blockchain data for all sorts of crypto projects, including early-stage meme coins. It allows you to set custom filters to display an initial list of projects. For example, you can filter by blockchain and market size to suit your preferences.

How to set custom filters in DEXTools to screen for projects that meet certain criteria. Source: DEXTools.

In the filter, go for projects with a DEXTools score of 80 and above (out of 100), and set your list to show “only audited contracts”. These projects have passed an initial security review, so there’s a lower risk of scams and contract vulnerabilities. Once you’ve set your filter, you can sort your list by attributes – things like trading volume, DEXTools score, days since launch, market cap, liquidity, and volatility. This is more of an art than a science and may involve some trial and error. But generally, you’re looking for newer coins with lower market sizes that have relatively high trading volumes and liquidity.

Your next step is to research the projects that passed your initial screening process. Check their website, their social media following, and (importantly) their price charts on DEXTools. You’ll want to see price charts that are building a base around a certain level or slowly trending higher – and avoid immediately acting on your FOMO if you see vertical moves.

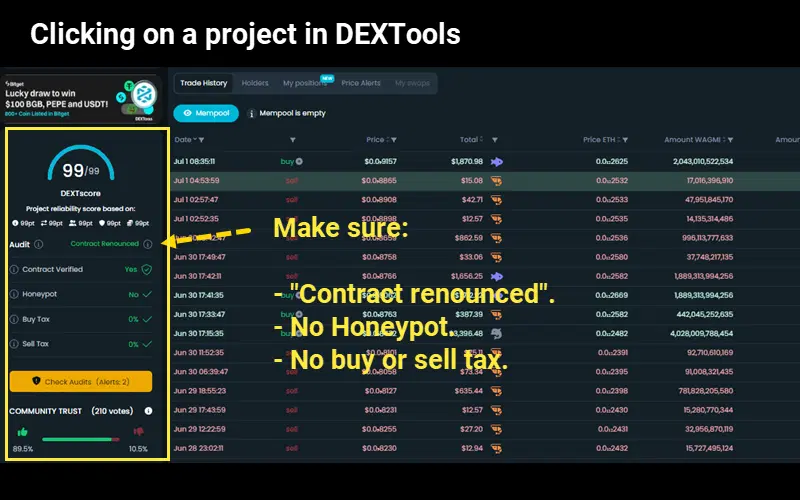

You’ll also want to make sure there’s no “honey pot” (a type of malicious contract), and that the contract has been “renounced” – meaning the original developers have relinquished control and can’t modify the contract to suit them out of the blue. And be sure to check there’s no buy or sell tax, either – these taxes can eat into your profits and are often a red flag for sketchy projects.

What you might see when you click a project on DEXTools, and a few things to look out for. Source: DEXTools.

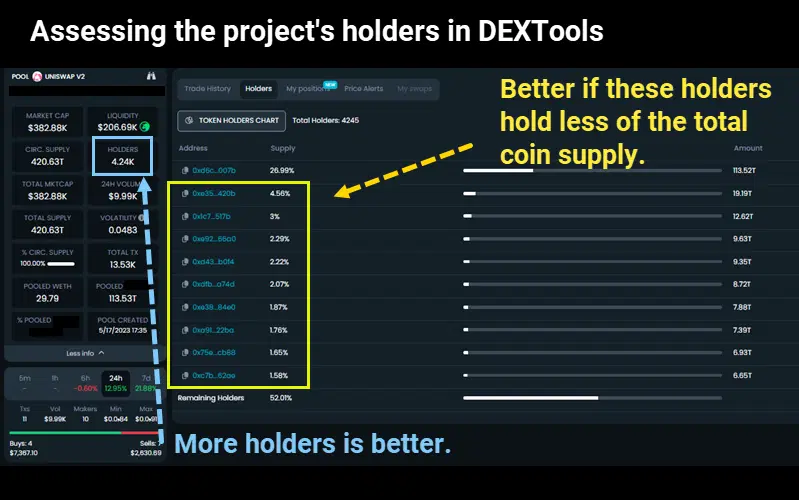

You can also check how many holders the project has in DEXTools – and in this case, the more, the merrier. For Ethereum projects, you can see the percentage holdings of the project's ten biggest investors. The top holder is usually the liquidity pool for trading, so it’s okay if that one’s got a significant chunk. But for the next nine holders, you’ll want to see smaller percentages – that lowers the chance of “whales” selling big positions and crashing the price.

What you might see when you check the number of holders and how much they hold in DEXTools. Source: DEXTools.

Finally, how to manage meme coin risks.

As with any financial market, meme coins have their own risk spectrum. On the one end, there are the newer, “high-risk” microcap meme coins with much smaller market sizes. They’re hit-or-miss, but if you catch onto a winner, the multiples can be huge. With these, it’s best to take the venture capital approach: pick a few projects at a “good” value, invest small amounts, and hope one moons. With these, remember to plan your exit strategy in advance, so you don’t hang on for too long (if the price falls) or let your greed get the better of you (if it rises).

Then there are the bigger, more established meme projects that already trade on major crypto exchanges – coins like Dogecoin or Pepe. These are more liquid than their smaller counterparts, and typically less volatile (to the upside and the downside). They trade more like traditional cryptos – so the usual risk management strategies apply: use a stop-loss, take profits on the way up, and don’t be left holding the bag through the next bear market.