Some of the best investors in the world have never worked a day on Wall Street.

While that’s not true of Peter Lynch (he managed Fidelity’s Magellan Fund for over two decades), some of his savviest investment ideas did begin with observations he made in his personal life.

But it is true of Chris Camillo. The retail investing standout turned $20,000 to $60 million using his “social arbitrage” method that leverages social media and common sense. He sees humanoid robots and bitcoin as two massive opportunities.

The thing about the world’s best investors is that they don’t all work on Wall Street. And, that’s because, quite frankly, you don’t have to. See, I’ve been thinking a lot lately about two highly successful traders – one of them an industry legend and the other a retail investing legend – and there’s a common thread between the two of them. And it’s a thread you can pull into your own portfolio.

First, let me tell you about Peter Lynch.

Peter Lynch managed Fidelity’s Magellan Fund from 1977 to 1990 – and boasted a cartwheel-inducing 29.2% average annual return, more than double the performance of the S&P 500 over the same stretch. He’s written several books on investing – Beating the Street and One Up on Wall Street are especially worth a read if you get the time.

He says investing doesn’t have to be complicated: in his words, “the simpler it is, the better I like it.” He believes you should invest only in what you know, and that your eyes, ears, and common sense are the very best tools for finding winning investing ideas. Once you spot them, he says, it’s just a matter of looking carefully at the company’s fundamentals, like its earnings prospects, financial strength, competitive position, and growth plans. “Once you’re able to tell the story of a stock to your family, your friends, or the dog, and so that even a child could understand it, then you have a proper grasp of the situation,” he wrote. He famously invested in Hanes, because of his wife’s preference for its L’eggs pantyhose, which were conveniently (and cleverly) sold in supermarkets.

He always said that anyone can pick stocks just as well as, if not better than, the average Wall Street expert, just by observing what’s happening around them.

And that’s even more true today. Back in the 1980s, pros like Lynch and Warren Buffett had quicker access to better information, which gave them a wide advantage. Now, however, that information gap has closed – giving everyday investors fast access to news, trends, and analysis, and cheap trading platforms to act on what they read.

And that’s kind of a perfect segue to the other trader that’s been on my mind: Chris Camillo.

Next, meet Chris Camillo.

Chris Camillo is a retail investor with an exceptional record – a roughly 68% average annual return over 17 years that’s allowed him to turn $20,000 into $60 million. Pause for a moment there: 68%, a year.

Camillo searches for stock ideas by observing trends in everyday life, a method he calls “social arbitrage”. Think of it as a modern twist on Lynch’s initial screening process. Camillo looks for things that are gaining popularity on platforms like TikTok, Twitter (now X), and Instagram. Of course, not every trend is worthy of an investment, so he zeroes in on the ones with the potential to impact the entire world or, at least, a really big group of people. Once he spots the trend, he searches for the publicly traded companies that are poised to benefit from it. It’s all about being early and beating the pros because once that idea hits Wall Street, those share prices will shift, shrinking the opportunity.

What’s cool is he shares his ideas on X and his YouTube channel Dumb Money – as a way of teaching others how to do what he does. He says it’s his way of working to narrow the wealth gap. It’s worth noting that Camillo’s massive stock returns were boosted by using options and leverage, which are a much riskier way to trade and won’t be everyone’s cup of tea. But let’s take a look at some of his recent ideas to help understand his method.

Because social media is where he hunts for ideas, it’s not surprising that consumer products appear time and time again among his top trades. Case in point: Celsius energy drinks. From early on, the brand had a strong social media marketing strategy, portraying the drinks not as a once-in-a-while indulgence, but as a daily ritual. And that started to catch on. Gen Z consumers soon started posting about the brand as their “breakfast of choice”.

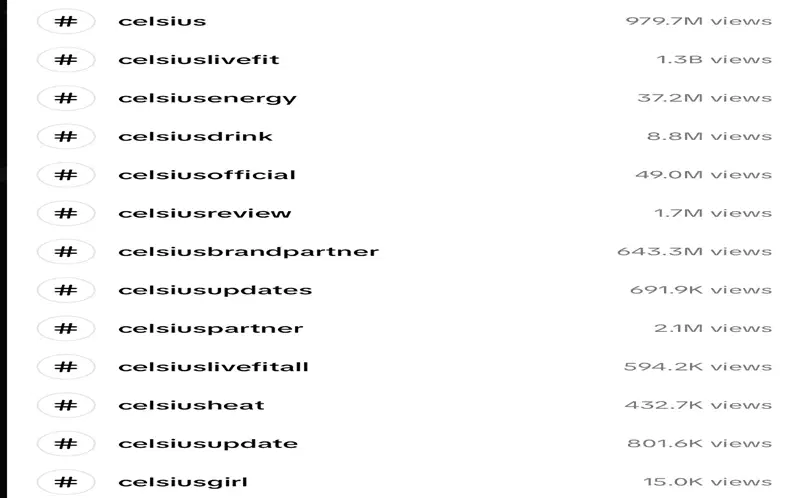

So Camillo decided to do a little research. He searched TikTok for #CELSIUS and found some impressive reach and positioning.

The results of Chris Camillo’s #CELSIUS search on TikTok. Source: Chris Camillo on X.

His follow-up research included asking his local convenience stores about demand trends, which helped confirm his view. He made a big bet on Celsius in early November when shares were going for around $50. And considering they were trading this week for above $94, that’s been a pretty great call.

A similar approach – spotting a brand on social media and asking his friends and family about it – has led him to other investments, like e.l.f. Beauty Products and Deckers Outdoor clothes and shoes. When he started seeing a certain slipper from the Australian brand UGG everywhere, he had a look into that too.

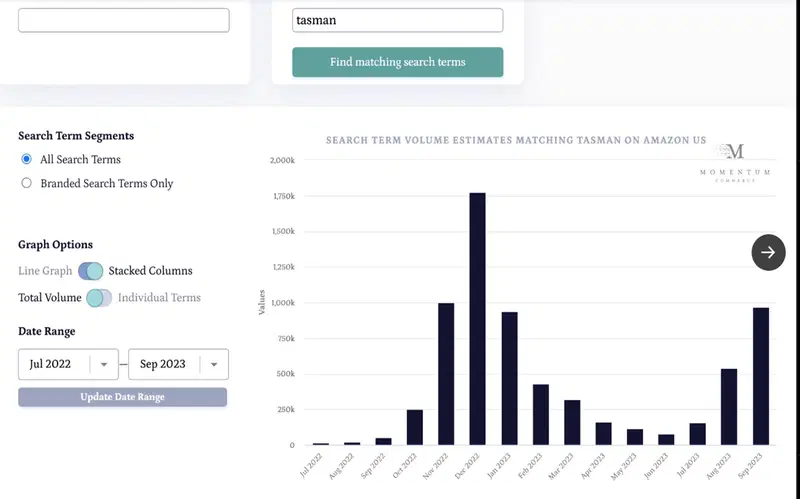

Camillo had a look at “Tasman UGG” shoe search trends on Amazon.com and posted the results on his X account. Source: Chris Camillo X account.

You can do your own checks on Amazon search trends, using Momentum Commerce. It’s a pretty cool site.

Finally, here’s what you can take from these guys.

Now, Peter Lynch has long since retired, but you can follow in his footsteps – noting your observations, doing some research, and acting on your investment ideas.

As for Chris Camillo, you can follow his footsteps, well, in real-time, on X or by watching DumbMoneyTV.

And since his record is so strong, you might be interested in some of his latest ideas. For example, he bought shares in Supermicro for less than $260 and sold most of his position during this year’s rocket-fueled rally. He has also posted about AI robotics and humanoids, and has said he sees Elon Musk’s Optimus humanoid as potentially adding $10 trillion to Tesla’s valuation by 2030. That projection assumes some pretty aggressive future revenue forecasts for the EV maker, but if he’s right about the rise of the humanoids, Tesla may prove to be a strong way to play it, along with the Global X Robotics & Artificial Intelligence ETF (ticker: BOTZ; expense ratio: 0.69%).

He has also posted about bitcoin, noting that the gold-loving baby boomers are set to transfer some $80 trillion in wealth to younger generations. That handover, he says, will increase bitcoin’s usefulness as a digital “store of value”, and drive up the price of the world’s oldest cryptocurrency.

Mind you, no method has a 100% success rate. And social arbitrage is no different here. Camillo was bullish on the Swiss running shoe and apparel company On Holding, which announced some disappointing quarterly earnings this week and fell 9%. And that’s a good reminder that it’s important to follow your investing process and size your position correctly to make sure that whatever happens, you’re around to invest another day.

-

Capital at risk. Our analyst insights are for information purposes only.