Robeco’s base case for earnings is pretty bearish, even compared to its big investing house peers. But it does see value in European and Japanese stocks.

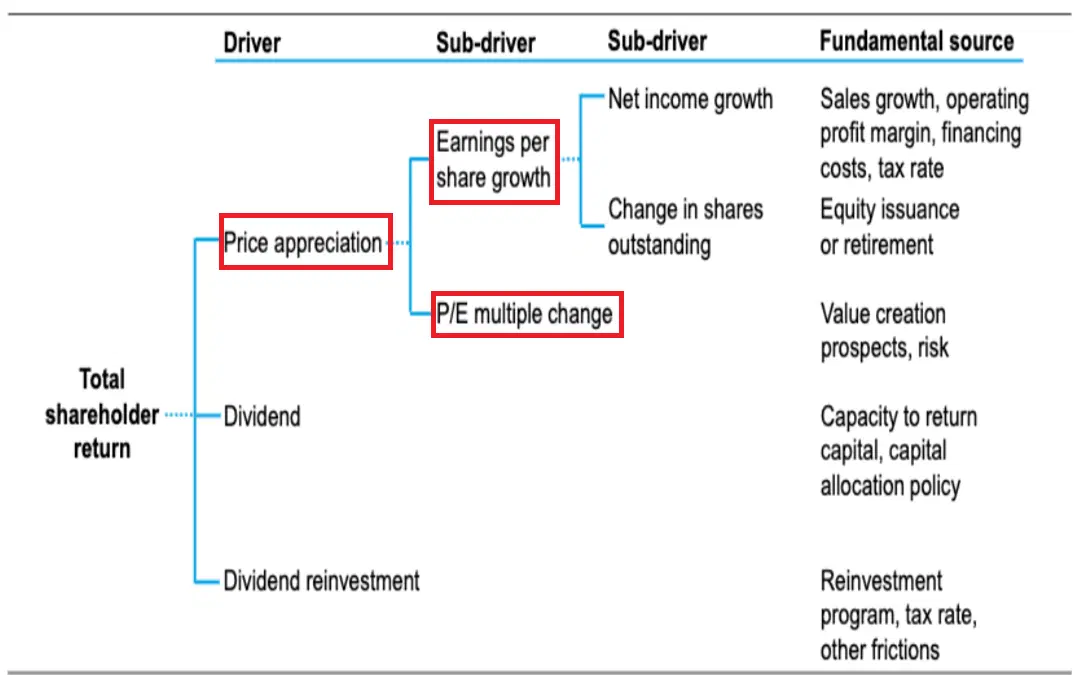

Total shareholder returns come from dividends and price appreciation. And when there’s no earnings per share growth, you’d need higher multiples for share prices to increase.

Robeco says an upside surprise for markets could come from an improvement in productivity – driven by AI adoption. And it says that could lead to a soft landing, Goldilocks outcome, allowing central banks to cut interest rates and freeing up earnings multiples to expand.

Dutch investment house Robeco opened its 2024 outlook with a piece of humble pie. It had predicted – wrongly, as had so many others – that both the US and the eurozone would tumble gracelessly into a recession in 2023. But, of course, that didn’t happen. And though it admits it was a bit too pessimistic this time last year, it’s not exactly wrapping its latest global forecasts in rainbows and sunshine.

So what is Robeco’s 2024 outlook then?

Well, let’s take a look at its three potential scenarios – its most likely “base case”, its most optimistic “bull case”, and its most pessimistic “bear case”.

Its base case sees the Fed’s projections – median unemployment of 4.1%, core inflation at 2.6%, and a recession-free US economy as a fairy tale outcome. It sees unemployment rising by a percentage point or two, not a measly 0.3 percentage point, as forecast by both the Fed and ECB envisage.

Robeco’s not looking to rain on anyone’s parade here, it just thinks the harsh after-effects of an aggressive run of interest rate hikes will inevitably cause the Group of Seven (G7) major industrialized economies to stagnate. And it doesn’t see core inflation moving convincingly far below 3% without a noticeably painful increase in unemployment. And getting to the central banks’ 2% target, it says, will be exceptionally difficult.

On its sunnier side, Robeco’s got its bull case scenario, with the two economies making a “soft landing” – that’s the dream outcome of deploying just enough interest rate hikes to bring down inflation without actually triggering a recession. In this scenario, the G7 economies see an “immaculate disinflation” – with ultralow unemployment, despite all those interest rate hikes. And the good times just roll on, as AI adoption keeps labor cost increases in check and sends core inflation to 2.5% or below. And this all sets the stage for central banks to begin to cut interest rates again, allowing earnings to recover.

Of course, Robeco’s got its darker worries too: its bear case scenario is for “stagflation” – a sickly brew of high inflation and low growth. It warns that further geopolitical disturbances could lead to a recession, with inflation getting stuck well above central bank targets. Against this backdrop, earnings would decline 20% and stocks would head back into a bear market.

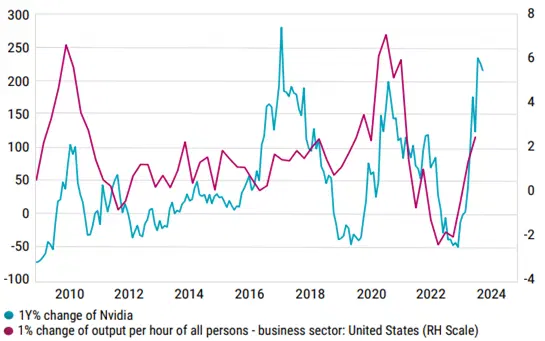

A key factor for each of these scenarios is the potential impact of AI. Some 80% of global companies have been planning for AI adoption, but we’ve yet to see in the productivity data any major impact from the technology in shrinking labor costs and disinflationary pressures. But Robeco is keeping an eye on Nvidia – the maker of all those AI-powering graphics processing units (GPUs) – viewing its performance as a potential leading indicator for US productivity growth.

Nvidia’s recently stellar performance could signal that US productivity is about to rocket, Robeco says. Sources: LSEG Datastream, Robeco.

Corporate capital spending usually leads to productivity – often after a bit of a time lag – so Robeco is thinking that the massive increase in Nvidia orders and sales will probably lead to a sizable increase in productivity in 2024.

What does this mean for valuations?

Well, during an economic slowdown, multiples and earnings usually both take a hit. And in a nutshell, that’s what Robeco sees coming.

It predicts greater multiple compression – meaning, lower valuations – for stocks next year. It sees turbulent geopolitics, higher interest rates, and shrinking liquidity all weighing on valuations and economic activity.

Robeco says the current 2024 consensus of 11.4% earnings per share (EPS) growth for the MSCI ACWI (big- and mid-cap companies across 23 developed economies and 24 emerging economies) will be impossible to meet. And it’ll be impossible, the fund house says, because of flatlining growth for the G7 countries. Remember, returns to shareholders come from both dividends received and share price appreciation, the latter of which becomes awfully difficult without economic growth. Share price appreciation can come from EPS growth or changes in the price-earnings ratio (PER) multiples.

This clever chart shows the drivers of total shareholder return. Source: Counterpoint Global.

Robeco’s base case sees earnings estimates surprising to the downside and earnings multiples falling as central banks continue to shrink their balance sheets, draining the market of liquidity and making it more expensive to borrow. With all that going on, Robeco expects it’ll be hard for share prices to make unexpected gains from here.

What’s the opportunity then?

Robeco finds Europe attractive – primarily because EPS consensus growth estimates look a bit too downbeat at 3%. The investment firm figures that even if there’s a mild eurozone recession on the not-to-distant horizon, share buybacks from cash-rich European companies should provide a floor under stocks, and prevent them from falling far.

Remember, one of the drivers of earnings per share growth is share buybacks – as the shares bought back are usually canceled and as a result, existing shareholders see a higher EPS from the basic math as the total number of shares outstanding shrinks. To bet on gains in European stocks, you could consider buying some iShares MSCI Eurozone ETF (ticker: EZU; expense ratio:0.52%).

Robeco also sees value in Japan right now, with its stocks’ forward price-to-earnings ratio looking especially cheap. To bet on Japan’s stocks, consider the iShares MSCI Japan ETF (EWJ; 0.5%).

The US, meanwhile, looks expensive at 30x PER – but as we’ve noted before, outside the technology sector, the US market does boast some reasonable values.

Look, there’s a chance that Robeco turns out to be all too gloomy two years in a row. It’s possible that multiples broadly expand, motivated by a steep decline in inflation that allows the Fed to cut interest rates and beautifully stick the soft economic landing. And as the main cause of this outcome would likely be an AI-driven surge in productivity growth, you could consider buying some exposure to the technology, perhaps with the Invesco QQQ Trust Series 1 (QQQ US; 0.2%).

-

Capital at risk. Our analyst insights are for information purposes only.