UK stocks have been beaten up by hot inflation, higher interest rates, and steady fund outflows, leaving their valuations looking cheap relative to their own history and their developed market peers.

Total shareholder returns of around 6% for UK stocks mean that investors are rewarded for patiently waiting for an improvement in sentiment and fund flows.

If inflation and interest rates both fall in the UK next year, as expected, and the economy can continue to surprise to the upside, the mid-cap focused iShares FTSE 250 UCITS ETF will likely do well.

The UK’s stocks are at, well, almost embarrassingly low levels. And it’s not entirely their fault: a whole lot of ultra-hot inflation, a run of aggressive interest rate hikes, worries about economic growth, and some heavy investor outflows have all taken a toll on valuations. But there are hopes now for a turnaround. So it’s worth taking a closer look now to see what Britain’s stock market has to offer…

What’s been happening?

The story in the UK has been much like the rest of the world’s advanced countries: faced with scarily high inflation in 2022 and 2023, its central bank – the Bank of England (BoE) – unleashed a series of inflation-cooling (and economy-cooling) interest rate increases. That drove interest rates to 5.25%, from nearly zero, and as the cost of goods and the price of borrowing both shot higher, consumer confidence and investor sentiment took a nosedive. But, somehow, the UK economy held up OK this year, performing better than most expected and avoiding the recession that once seemed somewhat inevitable.

Then, more recently, some really encouraging signs emerged: that off-puttingly high inflation started to dramatically drop off, and the UK began to see real wage growth (that is, a pay increase even after factoring inflation in). And that’s given consumption and consumer confidence a welcome boost.

And yet, despite that good news, the UK’s stock market has barely budged.

Take a look at the UK’s FTSE All-Share Index – which includes most of the companies on the London Stock Exchange's main market: it’s trading at around a 10x P/E ratio, based on a 12-month forward earnings estimates. And that’s cheap, relative to its history.

Here’s a look at the valuations of Britain’s stocks. This chart shows the UK’s FTSE All-Share forward price-to-earnings (P/E) ratio over time, based on consensus estimates for earnings in 12 months. Source: JP Morgan Asset Management.

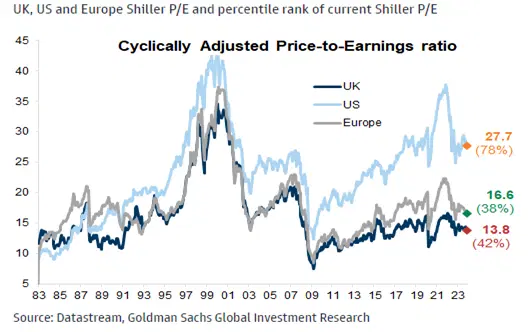

Of course, it’s not enough to compare these stocks’ valuation to their own history: if you really want to understand how well the UK’s stocks are priced, it’s worth comparing them against stocks from the US and Europe. And, when you do that, you’ll see that the UK’s shares are trading at a pretty steep discount to both, based on the Shiller P/E ratio. That ratio is calculated by dividing the stock price by the average of the company’s earnings for the past ten years, adjusted for inflation.

The UK trades on a lower absolute Shiller P/E than the US and Europe, and below its historical average. The Shiller P/E ratio – also known as the Cyclically Adjusted Price-to-Earnings (CAPE) ratio – is calculated by dividing the stock price by the average of the company’s earnings for the past ten years, adjusted for inflation. Sources: Datastream and Goldman Sachs.

Why so cheap?

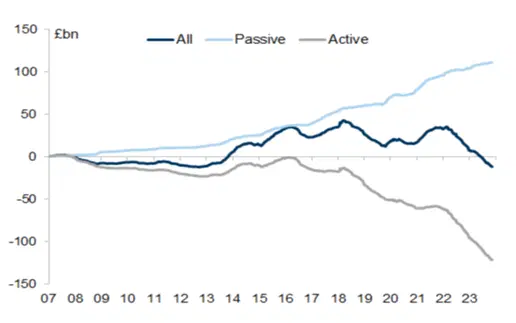

One of the big challenges that come with value investing is that you have to be patient – sometimes very patient. See, even if a stock is trading at a super cheap valuation, that doesn’t automatically make it a winner. You need other investors to invest too, and push the share price higher. And that’s been a key sticking point for UK stocks: net fund flows have been negative in the past couple of years, marked by a steady outflow, in particular, from active fund managers.

UK weekly fund flows, in billions of UK pounds, from January 2007 through November 2023. The steady outflow, from UK active managers, has helped drive the underperformance of UK stocks. Sources: EPFR, Haver Analytics, Goldman Sachs Global Investment Research.

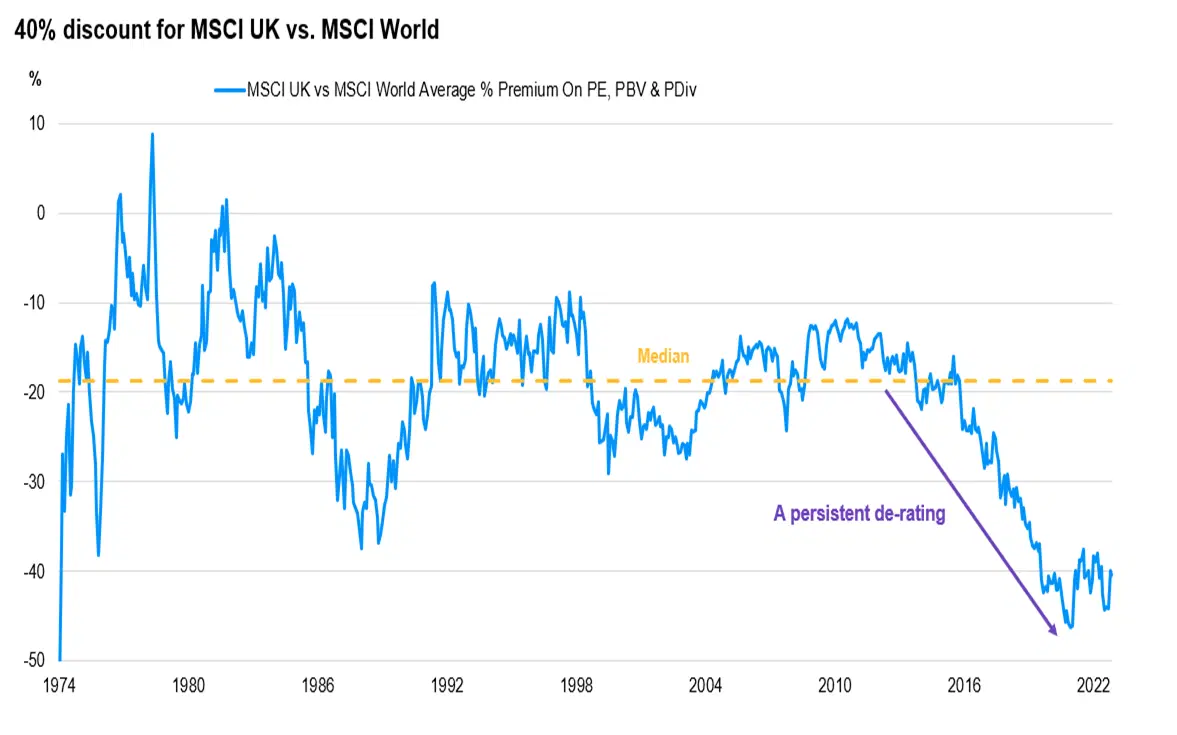

The widening underperformance has left the UK market trading around a 40% discount, compared to other developed markets. And that’s roughly double the average discount of the past 50 years.

The valuations of the MSCI UK index versus the MSCI World index, from 1974 through October 19th, 2023. Since 2016, the UK’s stocks have suffered a persistent derating based on price-to-earnings, price-to-book, and price-to-dividend. Sources: JPMorgan Asset Management, MSCI, Morgan Stanley.

Those discounts might not shrink as fast as you might think. In recent years, there’s been a pretty noticeable rise in passive investing, not just in the UK, but also across all global markets. And, as the number of active fund managers declines, it’s becoming harder for companies to reach potential investors, and sell them on their strategies and plans. And without new investors coming into the market, valuations could remain cheaper for longer.

What’s the opportunity, then?

Well, with inflation coming down and interest rates probably having hit their peak, the two big monkeys around the neck of the UK’s stocks might soon be getting lighter. Still, the outlook isn’t all rosy – Goldman Sachs is predicting that the UK economy will grow by only 0.6% in 2024, quite a bit less than other developed markets. That’s why analysts at the investment bank say that among UK stocks, they’d favor the more internationally exposed big-cap FTSE 100, where an estimated 75% of sales come from outside the UK – over the more domestic-focused FTSE 250 index.

JPMorgan Asset Management has been thinking along the same lines: its analysts say that even though the UK stock market has been cheap for, literally, years, its high dividend yields and heavy weighting in energy stocks – think: BP and Shell – could provide good portfolio diversification if fuel prices perk up again and challenge the optimistic disinflation narrative. If you agree, the iShares Core FTSE 100 UCITS ETF (ticker: ISF; expense ratio: 0.07%) could be a good bet.

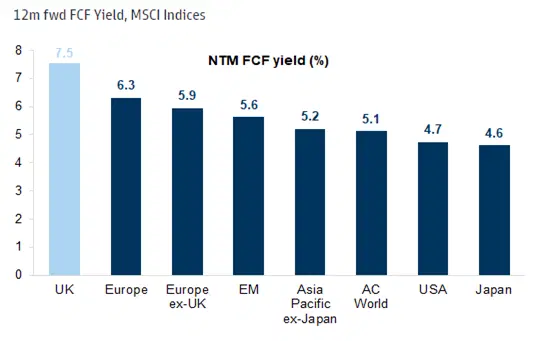

And there is a certain upside to being a patient investor in UK stocks and it’s this: you actually get paid to wait. UK stocks boast high shareholder returns – that is, dividends and share buybacks – of around 6% per year, driven by some very strong free cash flow yields.

The UK’s estimated free cash flow yield for the next twelve months (NTM)is 7.5%, about 3 percentage points higher than the yield in the US. Sources: Factset, Goldman Sachs.

Now (as ever), you don’t want to forget the wise words of that classic 1980s glam rock ballad: every rose has its thorn. High shareholder returns might be attractive in the short term, but over the longer haul, they do mean that companies have less capital to invest back into their business – and that can drag down the growth prospects. But, for the time being, if the UK’s inflation pressures ease, interest rates take a trim, and the economy can continue to surprise to the upside, the iShares FTSE 250 UCITS ETF (MIDD; 0.4%), which is loaded with midsize British firms, is likely to perform well in 2024.

-

Capital at risk. Our analyst insights are for information purposes only .