Solana is built for speed and could get much faster when its Firedancer software, designed by Jump Crypto, becomes a new software option for validators.

Polygon is upgrading to Polygon 2.0. That could make it faster, more secure, and better suited to DeFi financial services and blockchain gaming. Its MATIC token will become the Polygon Ecosystem Token (POL), with more utility and voting rights.

Chainlink is going after the biggest prize in blockchain: running the data feeds for real-world asset tokenization to help put traditional finance on the blockchain.

Bitcoin briefly broke above its old all-time high of $69,000 this month, stirring up crypto excitement, and giving other big cryptos a license to shoot for new records, too. So here are three projects that could follow in bitcoin’s wake this year (with the usual volatility along the way). Each one is carving out a niche in the crypto sphere – and has a catalyst on the horizon that’s got investors talking.

1. Solana (SOL)

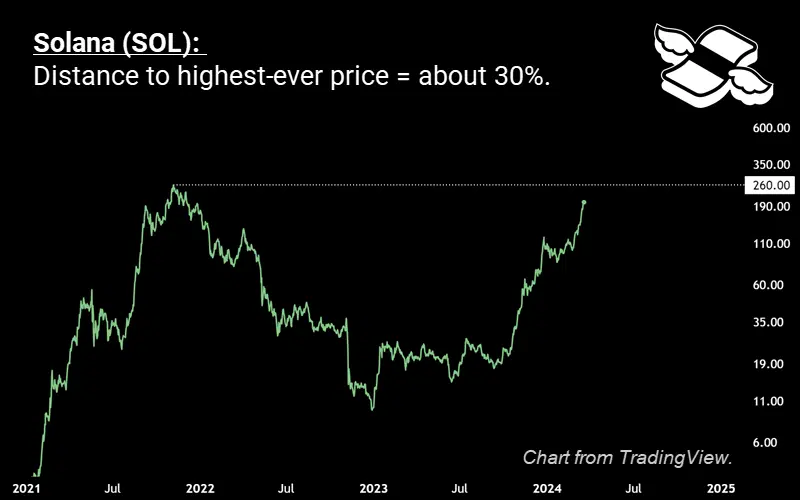

Solana’s been a top performer this crypto cycle – and for good reason. It’s known as the fastest, cheapest, and most scalable “layer 1” blockchain. And with its new Firedancer software aiming to launch in the fourth quarter, Solana could extend its lead on all those counts.

Firedancer was created by Jump Crypto – the crypto arm of high-frequency trading firm, Jump Trading. So as you can imagine, it’s built for speed, throughput, and security.

Here’s the gist. Like Ethereum, Solana uses a system of validators, who stake their own coins as collateral to verify transactions and maintain the network. Validators currently use software called Solana-core to do that. But later this year, they could also have the option to use Jump’s Firedancer. Now, it’s been in “testnet” since October, but the rumor is, Firedancer can handle up to a million transactions per second. If those numbers translate to the “mainnet”, Solana would be about 20 times faster than it already is.

Solana (SOL) would have to rally about another 30% to hit its all-time high of $260. Chart made with TradingView.

2. Polygon (MATIC)

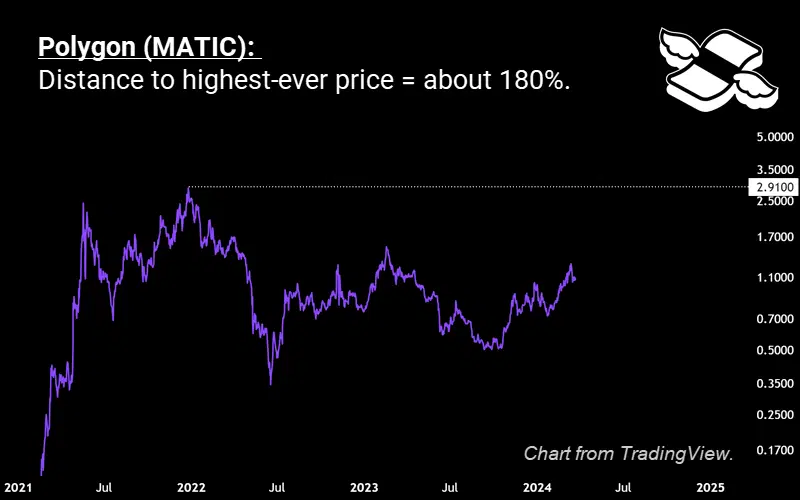

Polygon is a “layer 2” Ethereum scaling solution, built to help Ethereum (the biggest layer 1 blockchain) reach its full potential. Its MATIC token has lagged the rest of the market over the past year – but it’s now starting to show a pulse. That might have something to do with the Polygon 2.0 upgrade, which developers are rolling out in several stages.

DappRadar data shows that Polygon “1.0” has more users than any other layer 2 blockchain – and the most traffic coursing through its decentralized applications (or “dapps”). And I think the 2.0 upgrade could help keep Polygon in pole position here, for a few reasons. First, it’s going to make transactions faster and more private using a technology called zero-knowledge proofs. Second, the chain development kit (CDK) will give developers more freedom to build customized blockchain projects. And third, Polygon 2.0 is upping the ante on blockchain games and DeFi financial services – to make them slicker and more user-friendly.

As for the token, MATIC will morph into the Polygon Ecosystem Token (POL) as part of the upgrade. It’s more than just a rebrand, though. It’s more like a conversion of shares to give investors more voting rights and utility. POL already trades on a few crypto exchanges and tracks the price of MATIC one-for-one. But, personally, I’d rather trade MATIC for now as there’s more liquidity (and it’s not yet clear when the final switch will happen). If you’re holding MATIC on an exchange at that time, they’ll probably convert it for you – just be sure to stay updated with their announcements. But if you’re holding the token in self-custody, it’ll be more complicated, and you’ll need to follow migration guides from official Polygon channels.

Polygon (MATIC) would have to rally another 180% to reach its all-time high of $2.91. Chart made with TradingView.

3. Chainlink (LINK)

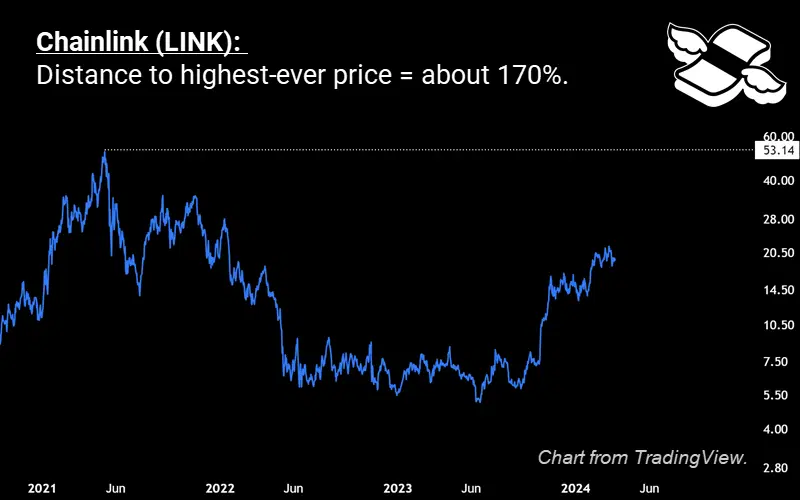

Blockchains need accurate data to compete with centralized services. Decentralized exchanges (DEXs), for example, need reliable price feeds for different assets. And a game that runs on blockchain might need data from the real world to influence its outcomes. That’s where oracle networks come in – and Chainlink is the kingpin in that area (see our Chainlink guide).

But here’s where things could get real for Chainlink. It’s set on running the data feeds for blockchain’s biggest use case: real-world assets (RWA). Like me, BlackRock CEO Larry Fink believes that financial services will eventually go on the blockchain. That means assets like real estate, bonds,stocks – you name it – will all be tokenized. And why not? I’m sure you’d rather buy a token for your new home than jump through all the old-school hoops. Of course, it’s all a pipe dream without reliable data flowing through the blockchain. That’s Chainlink’s forte, and it charges LINK tokens for its data.

Chainlink (LINK) would need to rally another 170% or so to touch its record high of $53.14. Chart made with TradingView.

There’s also a new oracle network in town: Pyth Network (PYTH), which has partnered with Solana. It might be more volatile than LINK (it’s newer and less battle-tested), but it may be worth checking out if you’re looking to spread your bets in the oracle niche.

What’s the opportunity here?

Stock investing giants Peter Lynch and Warren Buffett have a few things in common: they buy quality shares at fair prices, don’t chase shiny objects, and invest in companies that stand out in their niche. You can apply that logic to crypto too.

Sure, plenty of fresher projects might beat the blue chips in a bull run – as traders hop from one bandwagon to the next. But in the long run, fundamentals do matter in crypto – just as they do in stocks. And Solana, Polygon, and Chainlink each have something special going for them on that front. Just be sure to spread your bets in case one or two of them don’t deliver.

-

Capital at risk. Our analyst insights are for information purposes only.