iShares see three thematic areas of opportunities next year: artificial intelligence, medical innovation, and reimagined globalization.

AI adoption is only just beginning, so they see a broadening of AI beneficiaries beyond the “magnificent seven” companies, to also encompass the healthcare sector.

As the world becomes more fragmented, Mexico and India could be near-term beneficiaries of the de-globalization trend.

Interest rate cuts may be showing up on more 2024 prediction lists, but even if that comes true, that’s no reason to scrub a recession off your forecast. That means you still need to be extra selective with your investments – which you could achieve by using thematic strategies. In essence, these strategies involve strategically aligning your portfolio with significant, long-term structural forces that have the potential to profoundly reshape the economy. iShares has pinpointed three such forces, and with investors nursing roughly $6 trillion in cash right now, it probably won't be too long before these trends start catching some eagle eyes.

Artificial intelligence’s rapid expansion

No one’s winning any prizes for guessing this theme, but the way investors will tap into the tech next year is likely to differ from what you might expect. After all, AI moves fast, and a new batch of investment opportunities will be born with each advancement and new capability. iShares isn’t just predicting wider AI adoption and business integration in the coming year: the firm thinks we’ll verge closer to multi-modal AI, systems that can analyze and make sense of different types of data beyond text.

So next year, iShares expects investors’ options to widen. The theme has already been picked up in the last few months, meaning any so-called easy wins have been snapped up and are now prohibitively expensive. So as AI becomes more powerful, you could do well to look beyond graphics processing units (GPUs). Other hardware companies will become major benefactors, including ones that produce central processing units (CPUs), application-specific integrated circuits (ASICs), power-management chips, high performance solid-state drives (SSDs), and networking hardware.

The "Magnificent Seven" ran 2023, scoring an average return of 108% and leaving the NYSE FactSet Global Robotics And AI Index in the dust at 32%. But that gap means investors can find overperforming companies – or at least ones with above-average potential – for decent prices. iShares is keeping an eye on companies focused on enterprise and product adoption, multi-modal advancements, and the growing hardware scene. Most importantly, iShares believes smaller and middling-sized companies could offer the best bang for your buck.

If you want to branch out within the AI theme, you could consider the BlackRock Future U.S. Themes ETF (ticker: BTHM; expense ratio: 0.6%), the iShares Robotics and Artificial Intelligence Multisector ETF (IRBO; 0.47%), the Global X Artificial Intelligence & Technology (AIQ; 0.68%), or the WisdomTree Artificial Intelligence UCITS ETF (WTAI; 0.4%) .

Medical innovation, supercharged by AI and an aging population

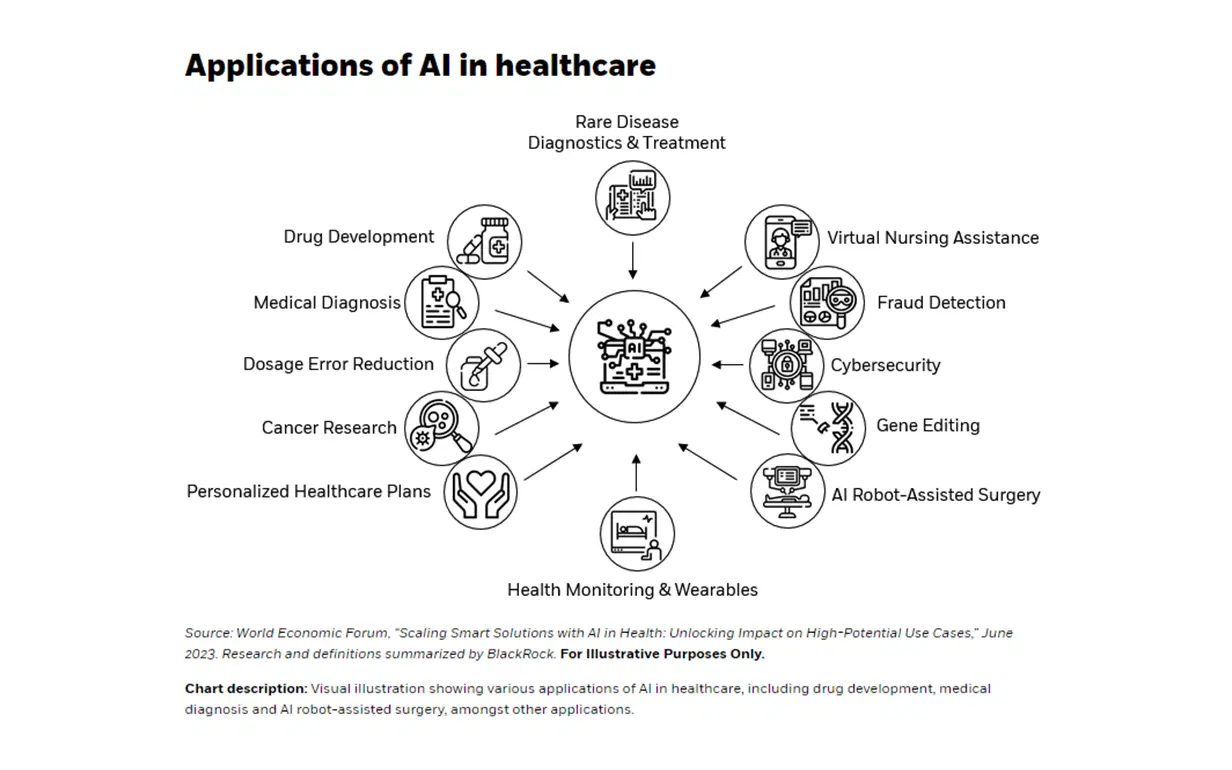

An increasingly aging population is set to weigh on healthcare systems, and provide lucrative rewards for companies that can revolutionize care. US demographics are shifting, with the number of over-65s overtaking the 15-and-under category for the very first time. In fact, more Americans will turn 65 next year than ever before.iShares believes that AI is already accelerating advancements in healthcare, particularly in neuroscience, genomics, and broader biotech, and stands to do more in the imminent future.

AI models can swiftly process vast amounts of health data, including clinical studies, brain maps, and genetic information, outpacing human capabilities. That accelerated analysis has the potential to save biotech companies 25% to 50% of the time and costs they spend bringing new drugs to market. Research also suggests that by 2025, over 30% of new drugs will be discovered through generative AI techniques.The AI healthcare market was valued at $9 billion in 2022, and based on projections of 40% annual growth, should reach $188 billion by 2031.

But despite that, healthcare stocks – especially those linked to medical innovation – weren’t a popular pick 2023, as higher interest rates worked against their valuations. That’s where the opportunity lies: keen-eyed investors could spot breakthrough themes at manageable prices if they beat the crowds.

Source: World Economic Forum, “Scaling Smart Solutions with AI in Health: Unlocking Impact on High-Potential Use Cases,” June 2023. Research and definitions summarized by BlackRock.

If you’re interested in healthcare opportunities, you could check out the iShares Healthcare Innovation UCITS ETF (HEAL; 0.4%), the iShares Neuroscience and Healthcare ETF (IBRN; 0.47%), the Fidelity Disruptive Medicine ETF (FMED, 0.5%), or the VanEck Genomics and Healthcare Innovators UCITS ETF (CURE; 0.35%).

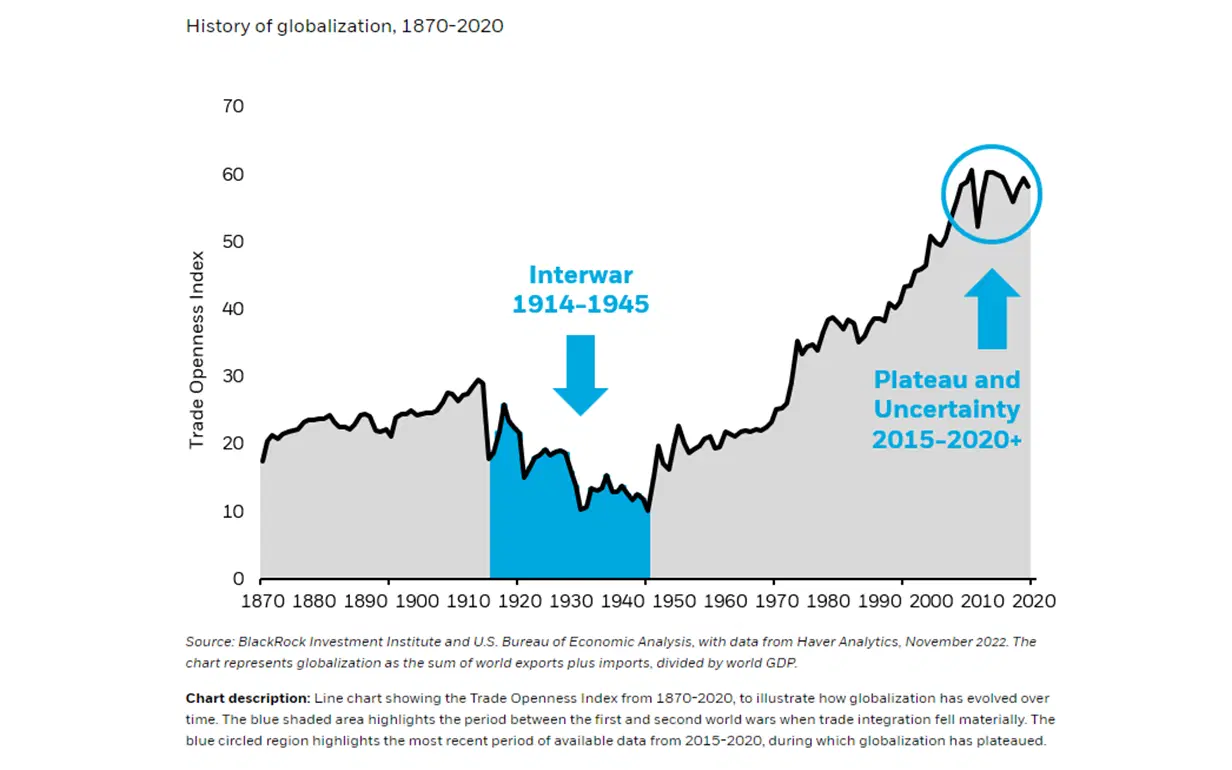

Deglobalization, where fragmentation creates opportunities

The idea of a world working together hasn’t panned out perfectly over the last few years, with the Covid pandemic, war in Ukraine and Gaza, and shifts in ideologies and environmental priorities deepening divides. Governments and businesses have been forced to rethink their reliance on external sources, opting to reinforce their internal resources and relationships with trusted partners instead.

Source: BlackRock Investment Institute and US Bureau of Economic Analysis, with data from Haver Analytics, November 2022. The chart represents globalization as the sum of world exports plus imports, divided by world GDP.

That means a bigger chunk of production is taking place in more expensive economies, like the US, Western Europe, and Japan. And in turn, that’s increasing the cost of goods that are usually made in cheaper factories, often located in Asia. But iShares sees opportunity here, with room for new players to enter the game.

Take Mexico, for example. The country’s proximity to the US and its lower labor costs make it an appealing option for companies with manufacturing needs. Plus, Mexico benefits from the United States-Mexico-Canada Agreement (USMCA), a free-trade deal that wipes out tariffs across North America. Surprisingly, despite the recent trend of jobs moving to Mexico, the country’s stocks are valued below their historical averages over one and three-year periods, as well as trading at a discount compared to broader emerging markets.

India, the world's fifth-biggest economy, is emerging as a force to be reckoned with among global supply chains and manufacturing too. In fact, economists predict it’ll be the third-biggest economy in the world by the end of the decade. It’s no wonder then, that investors are clamoring for a share of the pie, sending over $2 billion into Indian ETFs this year.

For those considering investing in emerging market (EM) assets, it's essential to remember that the EM world is diverse and not all countries will be equally affected by global changes. If you want to succeed in this style, you’ll need to be selective.

You could start by looking into the iShares MSCI India ETF (INDA; 0.64%), iShares MSCI Mexico ETF (EWW; 0.5%), or the Lyxor MSCI Emerging Markets Ex China UCITS ETF (EMXC; 0.5%).

-

Capital at risk. Our analyst insights are for information purposes only.