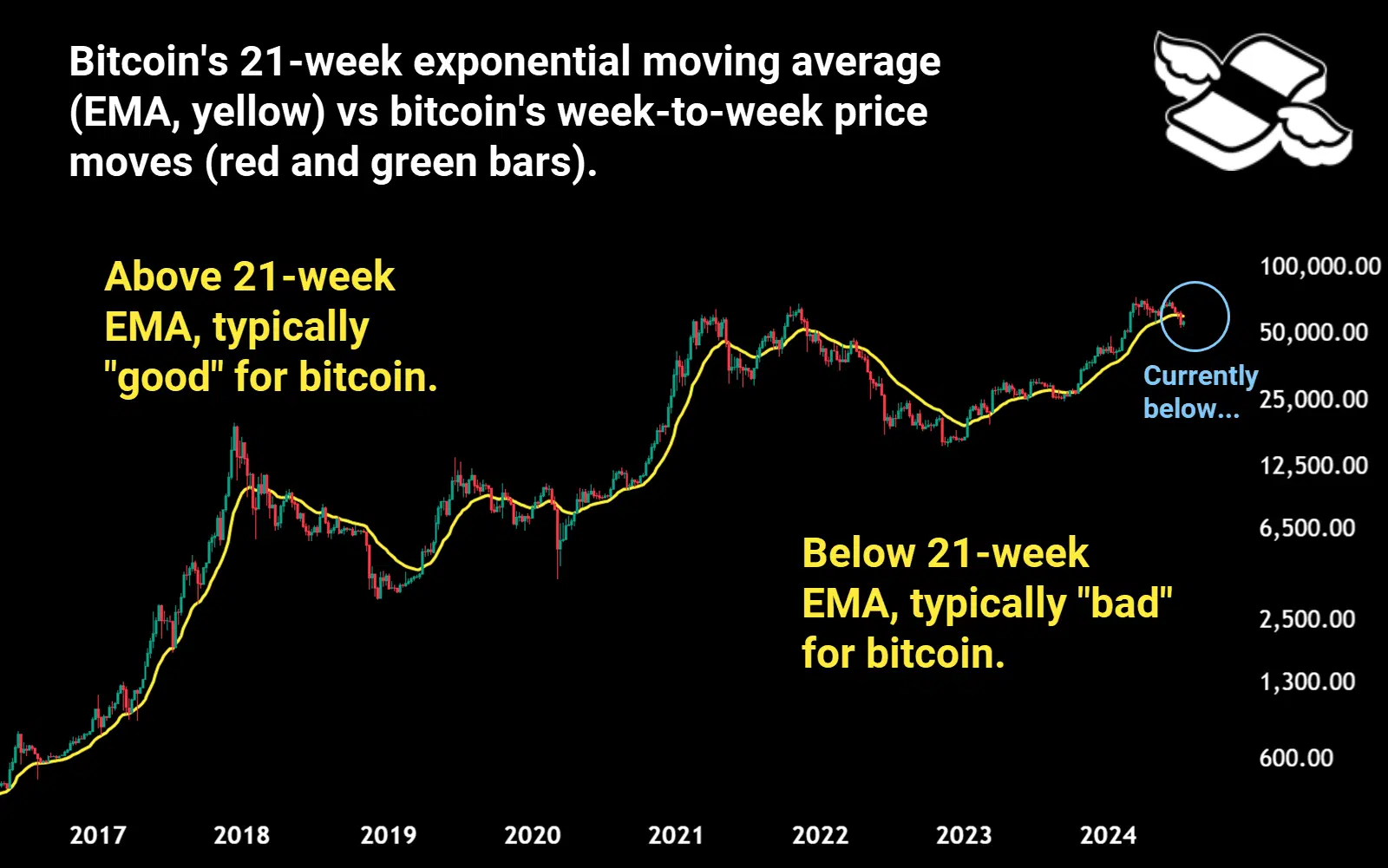

Bitcoin’s price has been languishing below its 21-week exponential moving average (EMA). If it pops above it, that could signal that buyers are back in charge, making it a potentially safer time to buy in.

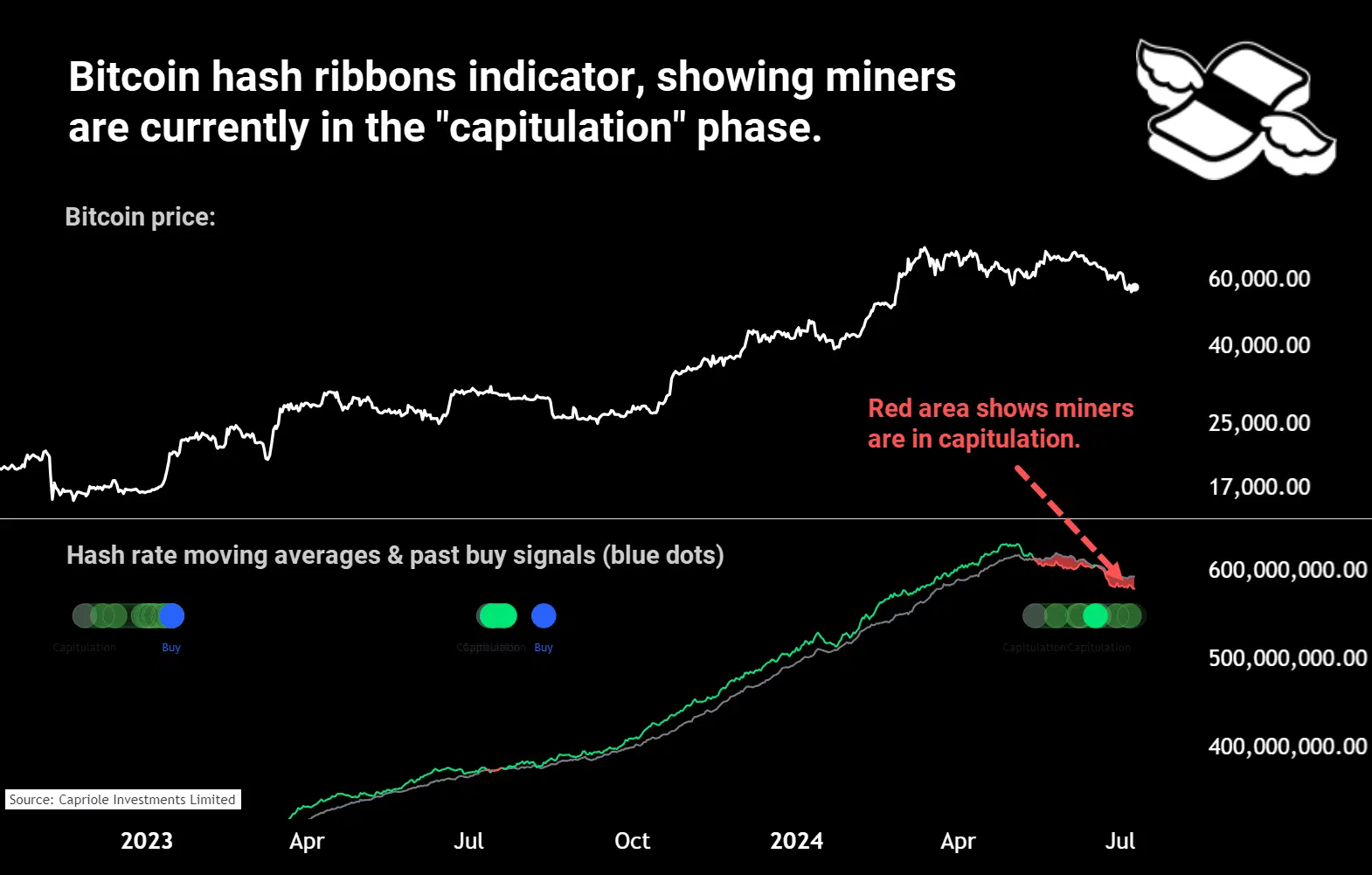

The hash ribbons indicator shows miners are currently in “capitulation” (with many now halting their mining activity because of lower profitability). A recovery in mining activity and price momentum would cause a bitcoin “buy” signal to flash.

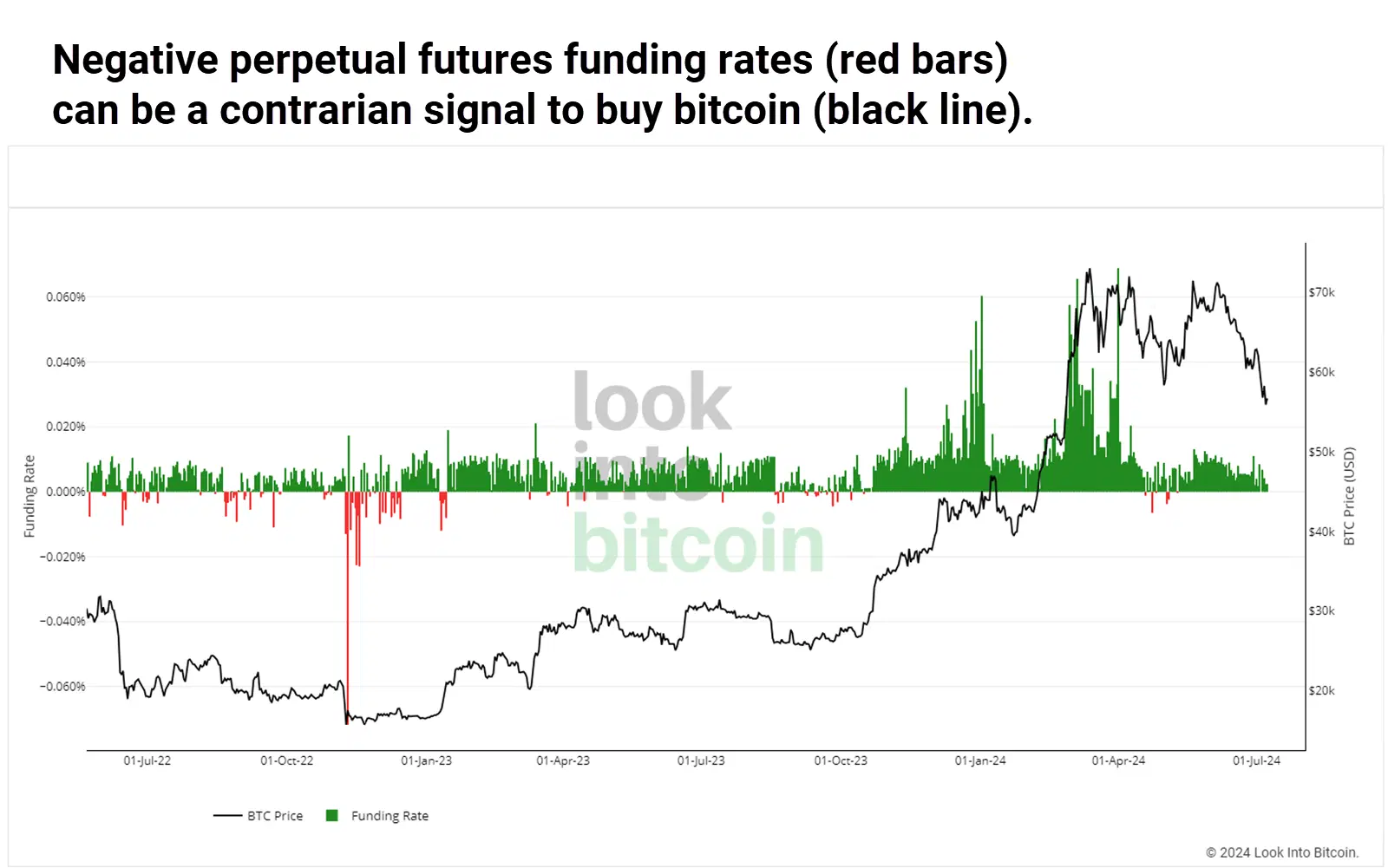

Negative futures funding rates suggest high demand for bitcoin futures short positions. If they turn negative, it might be a contrarian signal to buy bitcoin.

Bitcoin dropped 27% between March 14th and July 6th, the biggest fall since it bottomed near $15,000 a coin back in November of 2022. And if you track its week-to-week price moves, you’ll see the crypto kingpin is now in a downtrend for the first time since then – making lower lows and lower highs. And, sure, you can YOLO into bitcoin now and things could work out great. But what if this dip keeps… dipping?

If you’re the more cautious crypto type, you might want to see one or more safety signals before buying in. Here are three to look out for.

Safety signal 1: Bitcoin reclaiming its 21-week exponential moving average.

Let’s be clear: no one has a crystal ball when it comes to bitcoin, and buying it (or any investment, for that matter) is never going to be completely “safe”. But if you’re looking for a barometer for bitcoin’s general trajectory, the 21-week exponential moving average (EMA) usually does the trick. It tallies up bitcoin’s closing prices over the past 21 weeks to get an average price line (yellow, in the chart). But, unlike a simple moving average (SMA), the EMA gives extra weight to recent weeks – making it more responsive to bitcoin’s latest moves.

The 21-week exponential moving average can give you a clear indication of bitcoin’s general price trajectory. Chart made with TradingView.

Notice in the chart that bitcoin closed last week below its 21-week EMA, which has started to slope downward. You’ll want to see bitcoin close a week back above that average – and then stay above it – to signal that buyers are back in charge of the trend.

Safety signal 2: Bitcoin’s hash ribbons indicator firing a “buy signal”.

Since the halving in April, miners have spent more time and energy to produce the same number of coins. That’s caused weaker miners to stop mining, leading to a drop-off in Bitcoin’s “hash rate” (the total computing power miners use). The hash ribbons indicator by Capriole Investments currently shows that miners are in the “capitulation phase” – when the 30-day moving average of the hash rate is below the 60-day moving average.

The bitcoin hash ribbons indicator shows miners are currently in the “capitulation” phase. If bitcoin's hash rate recovers and its price stabilizes, the indicator would fire a “buy signal” (blue dot). Chart made with TradingView. Source: Capriole Investments.

Now, two things need to happen for the hash ribbons indicator to fire a bitcoin “buy” signal (blue dot in the chart). First, the hash rate’s 30-day moving average must climb back above the 60-day one (to show that mining activity is on the mend). Second, the ten-day moving average of bitcoin’s price must be above the 20-day moving average (to show buyer momentum is on the mend too). By my count, the indicator flashed 14 long-term bitcoin buy signals since 2014, with a two-out-of-three strike rate. If you fancy those odds, this piece explains in more detail how to use the hash ribbons indicator.

Safety signal 3: Futures funding rates turning negative.

Perpetual swaps (a.k.a. “perps”) are a type of bitcoin futures contract available on major crypto exchanges like Binance, Bybit, and OKX. These derivative contracts allow traders to bet on bitcoin’s price going up (long) or down (short) using leverage (borrowed money). Unlike traditional futures, which trade on the Chicago Mercantile Exchange (CME), perps don’t have expiry dates. Instead, traders pay “funding rates” to keep the contract price in line with the spot price (the market price of bitcoin).

Negative futures funding rates can show “short-seller euphoria”, which can provide contrarian bitcoin buy signals. Source: LookIntoBitcoin.

Now, when there’s high demand for short contracts, those funding rates can turn negative. That means traders who are shorting bitcoin are willing to pay money each day to keep their positions open – a sign of short-seller euphoria, which can be a contrarian buy signal. Funding rates aren’t negative just yet (see the chart), but they’re getting pretty close to the mark. Now, those rates don’t have to go negative this time, but if they do, the probability of bitcoin finding a low here would go up in my books. That’s because big traders typically let go of their short positions (by buying back those contracts) when they get too expensive to hold.

What’s the opportunity here?

Look, blindly buying every bitcoin dip might pay off a lot of the time – especially if you’re in it for the long game. But if history is a guide, there will come a day when that strategy goes horribly wrong. Yes, bitcoin might’ve already bottomed here and could be ready for the next explosive leg up, meaning its price is likely to be higher before one or more of the above safety signals flash. But, hey, good risk management doesn’t always come cheap.