Central banks focus on keeping inflation low and stable, but they also keep a close eye on expectations – what people think will happen to prices in the future. That’s because those assumptions are often a kind of self-fulfilling prophecy. When folks believe inflation will be mild, they tend to act in ways that help keep it that way. On the flip side, when they expect high price increases, they might rush to buy things and demand higher wages, which can drive inflation up. Expectations also influence interest rates and the value of financial assets, affecting everything from financial markets to borrowing costs in the real economy.

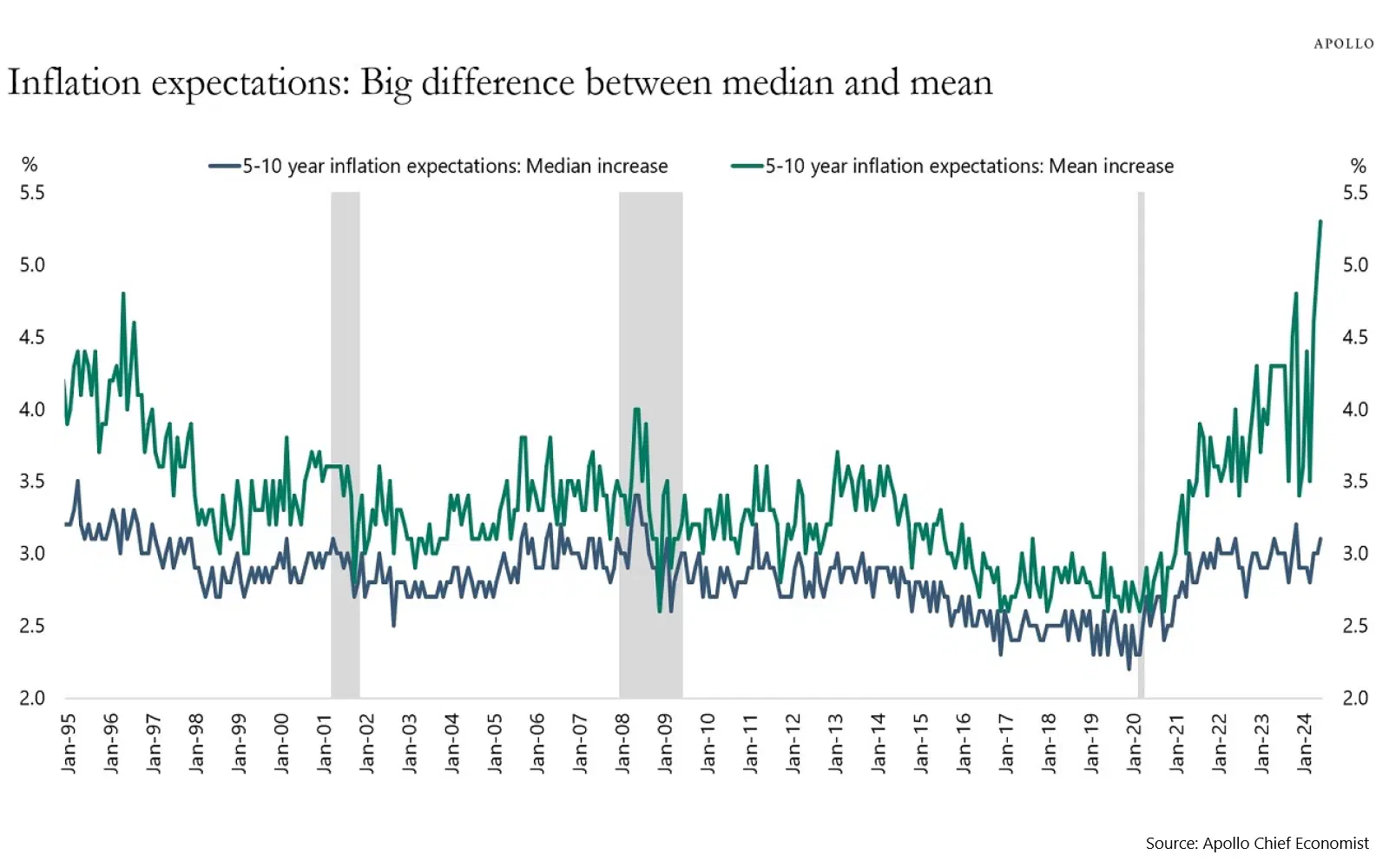

It’s no wonder, then, that the University of Michigan's recent consumer survey is raising eyebrows. It shows a big gap between the mean and median long-term inflation expectations. The median – the middle point of the data set – indicates that half of the respondents expect inflation to stay below 3.1%, and half expect it to go above. While this figure has been rising, it remains comfortably low.

However, the mean – which accounts for extreme values – tells a different story. It’s climbed to highs not seen in 30 years. Simply put, a significant part of the population fears inflation may become out of control.

The mean of inflation expectations has been rising much faster than the median, suggesting that while half the population is expecting stable inflation, the other half sees dramatically higher prices over the next five to ten years. Source: Apollo Global Management.

Fortunately, not all inflation expectation indicators are throwing up red flags. Market-based measures like breakeven inflation (the yield difference between regular Treasury bonds and inflation-protected ones) and professional forecasts still suggest that expectations are anchored at pretty low levels. And the more extreme inflation expectations are still concentrated among a smaller group (the more price-sensitive, lower-income respondents).

Still, it’s worth keeping a close eye on how things unfold – not just because higher consumer price rises could prevent the Federal Reserve from cutting interest rates, but also because if unanchored, inflation can quickly spiral out of control. At the end of the day, inflation hinges on trust in central bankers and the folks who hold the government’s purse strings. And if that trust should falter, keeping it in check could become a lot tougher.