What just happened?

Wall Street’s big investment houses have been trying to get these approved for literally years: bitcoin spot exchange-traded funds (ETFs) that would give everyday people exposure to the cryptocurrency by buying shares, just as they would with a stock.

Already, there were a few ways to invest in bitcoin. The two most common methods were to own the crypto directly and keep it in a digital wallet or to invest in a bitcoin futures ETF. Bitcoin futures ETFs – which have been around since 2021 – allow you to invest in the crypto without owning the underlying asset. Essentially, you’re betting on the price of bitcoin futures, i.e. contracts that let investors buy or sell an asset for a set price at a later date. Bitcoin futures track the price of bitcoin closely, but not perfectly.

Like bitcoin futures ETFs, these new bitcoin spot ETFs will allow you to invest in bitcoin without directly owning it. (That’s the job of the ETF provider – those big investment houses, generally). That means you do away with digital keys and the hassle of securely storing your bitcoin. And that’s a plus, yes, but on paper, the difference between investing in a bitcoin spot or bitcoin futures ETF isn’t massive. It’s simply a closer reflection of the price.

So why all the fuss?

Until now, regulators had rejected Wall Street’s bitcoin spot ETF applications on concerns that these new products would be vulnerable to fraud and market manipulation. However, that began to change over time. And late last year as regulators appeared to get closer to issuing approvals, the OG crypto climbed over 150%. The rally was at least partly because investors were enticed by the increasingly real prospect of a more stable and accessible crypto market. Indeed, proponents of these ETFs have high hopes, and some analysts estimate they could unleash $30 trillion of wealth onto the token.

That anticipation was shown to be especially hot earlier this week, when the SEC appeared to announce on X (formerly Twitter) that those approvals were a go. Investors immediately flocked to buy bitcoin, sending the crypto higher, and then sending it right back down again when the US regulator clarified that the “reveal” was nothing more than a social media hack. A day later, the SEC made its actual – now far less climatic – approval public.

Which bitcoin ETFs got the go-ahead?

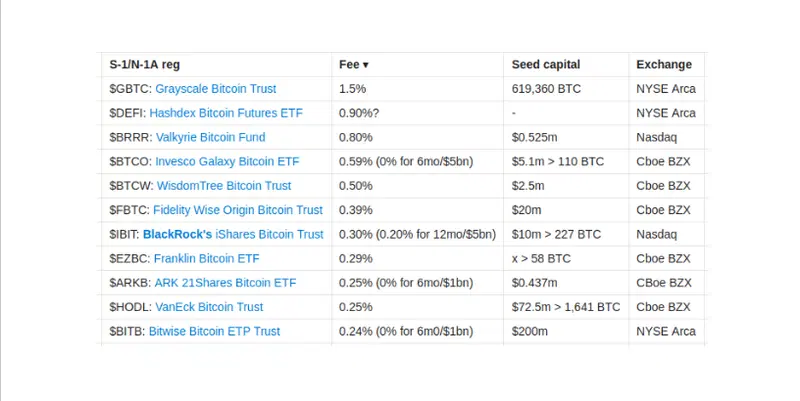

Funds from BlackRock, Invesco, Fidelity, and Grayscale were among those that got the green light. They start trading today. The full list is:

Grayscale Bitcoin Trust

Hashdex Bitcoin Futures ETF

Valkyrie Bitcoin Fund

Invesco Galaxy Bitcoin ETF

WisdomTree Bitcoin Trust

Fidelity Wise Origin Bitcoin Trust

BlackRock’s iShares Bitcoin Trust

Franklin Bitcoin ETF

ARK 21Shares Bitcoin ETF

VanEck Bitcoin Trust

Bitwise Bitcoin ETP Trust

Approved bitcoin spot ETFs and fees.

Why should you care?

Let’s be clear, you don’t have to. But this latest batch of regulatory approvals has sent a jolt through the market, with some saying it’s a game-changer for bitcoin. And it could be. Here’s a bit from both sides.

Three reasons to be optimistic:

1. The ETFs could push bitcoin’s price up. We’ve seen this happen before: when a major gold ETF started trading in 2006, the precious metal’s price steadily doubled over the following four years.

2. Bitcoin access just got easier and cheaper. Providers offering spot bitcoin funds could pull in a fresh bunch of retail crypto enthusiasts and big institutional investors who prefer a lower-effort approach to the asset, along with the smaller fees, and potential tax benefits that are associated with ETFs.

3. Retail investor optimism is already pulsing. We’ve got the first-hand stats to prove it. The Finimize Q1 2024 Modern Investor Pulse showed that 23% of retail investors plan to invest in the digital asset space in the next six to 12 months, up from 18% in the previous quarter. And that’s coincided with increased optimism about bitcoin’s prospects: while last quarter, investors were split roughly down the middle about whether the OG cryptocurrency would be higher in a year, 56% now expect its price to rise over the next 12 months. And that was before this week’s approvals…

And two reasons not to be:

1. Some will argue it’s much ado about nothing. Analysts at JPMorgan have said the potential impact of these new ETFs is overstated. They note that the bitcoin futures funds haven’t drawn a ton of investor attention since 2021, and they argue that’s unlikely to change with the marginal difference that spot bitcoin ETFs would offer.

2. And there’s still a lack of key crypto use cases out there. While ETF approval could make the digital currency more mainstream, the biggest proof of concept would be if crypto coins became legal tender at everyday outlets like Walmart and McDonald’s. But ETFs are still no use at the checkout, so that price-propelling move may only come much further down the line.

-

Capital at risk. Our analyst insights are for information purposes only.