Investing in IPOs can often end in tears: growth companies can take longer than you expect to turn profitable and cash flow positive. (If they manage to at all.)

Dual-class share structures, weak corporate governance, and super-high valuations should be red flags when you’re considering an IPO buy.

Uber is finally turning profitable and cash flow positive, long after its 2019 stock debut. If it can meet analysts’ growth expectations in the next few years, it has the potential to produce strong share price gains.

In 2019, two buzzy, disruptive startups had plans to float shares in an initial public offering (IPO) in New York – one with a valuation of around $47 billion; the other $100 billion. In the years since, they’ve each burned through a remarkable $10 billion in cash, but with very different outcomes. One, WeWork, filed for bankruptcy just a few weeks ago, and the other, Uber, turned profitable and free-cash-flow positive for the first time this year.

So it’s worth taking a look now at both companies, if only to ask two questions. One, what can be learned from WeWork’s unraveling and Uber’s success? And, two, is it time to give Uber’s stock a ride in your portfolio?

First, let’s look at WeWork’s demise.

WeWork sought to disrupt and revolutionize the office space market by offering more flexible co-working spaces for entrepreneurs and other people in cities around the world. The startup took out long leases on big properties and rented stylish, renovated spaces to freelancers, entrepreneurs, and even some bigger companies with accommodating agreements and leases that could be as short as a month. But WeWork’s plans to list on the stock exchange in 2019 failed and its CEO and co-founder stepped down, because investment bankers couldn’t persuade Wall Street money managers to buy its shares. WeWork finally did gain its public listing in 2021 via a so-called blank-check vehicle called a special purpose acquisition company (SPAC) and with a pretty chunky equity value to boot – at $9 billion.

But it’s worth revisiting the reasons why those big-money fund managers turned up their noses at the IPO just two years earlier. Fact is, there were some issues that should be considered potential red flags for any investment. First, WeWork was set up with a dual-class share structure that gave co-founder and CEO Adam Neumann a special set of stocks with extremely favorable terms. Flags don’t get much redder: ideally, all shareholders should be treated equally. Those special shares gave Neumann a lush $1.7 billion payout when WeWork needed a financial bailout – an impressive payout for failure.

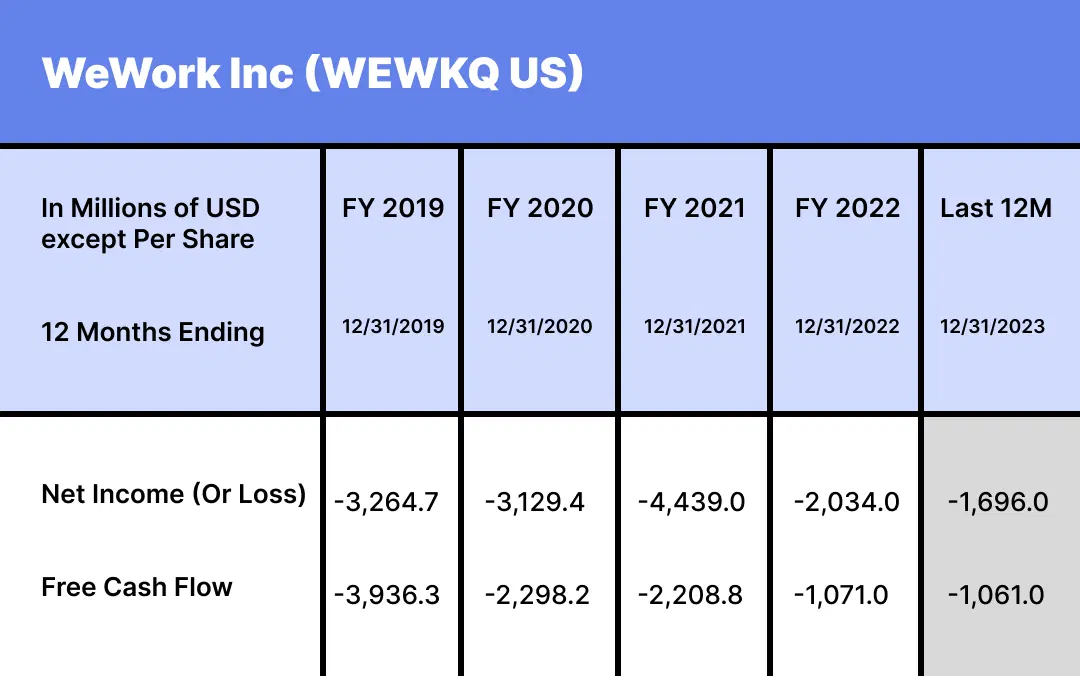

WeWork net income (loss) and free cash flow (negative) from 2016 to 2023. Source: Bloomberg.

Next, there was its weak corporate governance: WeWork had an all-male board, one loaded with early investors and other stakeholders, when the most effective boards are diverse. And there were concerns too about leadership accountability, oversight, and conflicts of interest. The whole organization smacked of a lack of internal controls particularly around Neumann, a CEO described as an intense, eccentric, almost messianic character, with aims to apply the still-unproven WeWork model to schools and housing and more. And, frankly, that put a lot of investors off.

And, finally, not helping matters any was the fact that WeWork had been racking up huge losses, spreading doubt about whether the business would ever be profitable. (Spoiler: it never has been.) And even with those massive losses, the valuation being asked for was far higher than the average real estate company.

WeWork share price since its listing in 2020, versus the S&P 500 Index. Source: Bloomberg.

Now, let’s compare that to Uber.

Uber managed to debut its shares on the New York Stock Exchange in 2019, but then struggled for years to become profitable or cash flow positive. Like WeWork, it had an exciting initial long-term vision: a disrupting ride-hailing app that eventually would incorporate an expansive fleet of self-driving cars. Its original mission statement was: “Make transportation as reliable as running water, everywhere, for everyone.”

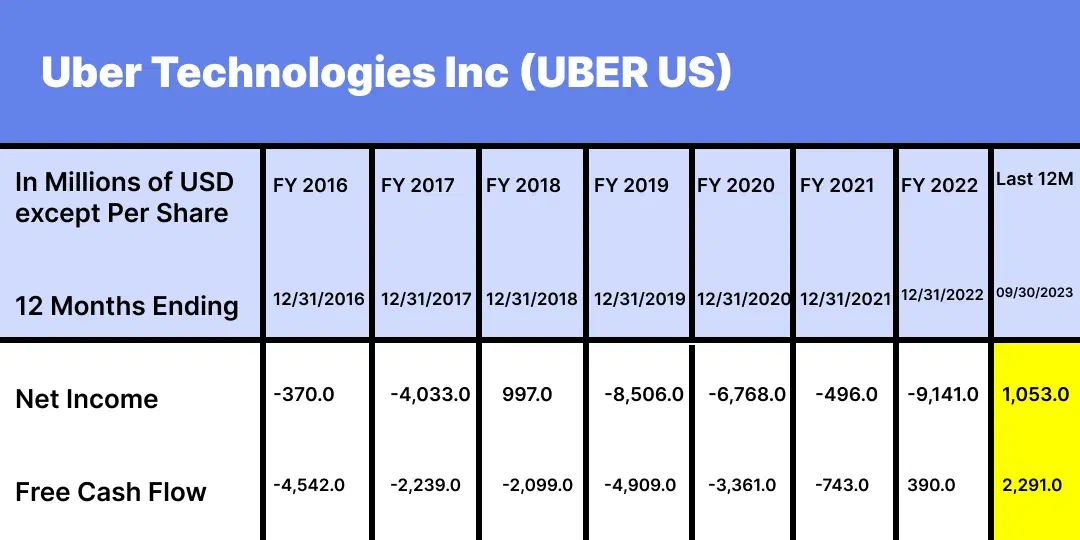

All sounds good, but from 2014 to 2022, Uber posted a net loss nearly every year, burning more than $16 billion of cash in the process.

Uber’s net losses (and profits) and cash flow from 2016 to 2023. Source: Bloomberg.

Today, Uber’s share price is $54, which gives it a market capitalization of $110 billion. Uber’s IPO price was $45, so its 21% return since its listing is a lot better than WeWork’s (those shares are down 99%), but it’s still way lower than the S&P 500’s 70% total return (including dividends) over the same period.

Uber's share price since IPO in 2019 versus S&P 500. Source: Bloomberg.

Let’s face it: for all its big dreams, Uber’s been a disappointing investment. Profits and positive cash flow have taken much longer than expected to materialize. And the company sank over $1 billion into its self-driving pipe dream before ultimately giving up on it. Despite all its go-go talk, you’d have been better off investing your hard-earned cash in the boring old S&P 500. And that’s a lesson from Uber: startups often take longer than they expect to reach their lofty ambitions – that is, if they reach them at all.

Nowadays, Uber’s outlook looks pretty promising. By the end of this year, it’s expected to make nearly a $1 billion profit and create a punchy $3.3 billion in free cash flow. What’s more, over the next three years, the company is expected to generate strong profit growth and free cash flow of nearly $15 billion.

Uber is a “consensus long” – meaning most Wall Street analysts think the stock’s attractive at current levels – and rated a “buy” by 49 out of 51 analysts. The average target price for the stock is $61, though, and that’s only a little more than 10% above where it sits now. What will be key for its share price is whether Uber can continue to grow its profits in the coming years.

See, target prices by analysts are usually based on profits one or two years in the future.

JPMorgan, for example, estimates Uber’s earnings before interest, tax, depreciation, and amortization (EBITDA) will be $8 billion in the year ending 2025. It uses a 15x EBITDA multiple of its December 2025 forecasts to calculate its $62 target price for the end of December 2024.

This is where it gets interesting. If Uber continues on its current growth trajectory over the next 12 months and seems likely to meet those targets, investors will start to think that the growth can continue. Currently, estimates are that EBITDA for 2026 will be $10.8 billion (up roughly 25% from the 2025 forecasts). And if you put the same 15x EBITDA multiple on that target, Uber’s target price would likely be revised upward to around $77 (approximately 25% higher than its current forecast).

So if you think Uber is past the worst part of its journey and analysts are right with their future growth forecasts, hopping into Uber now may turn out to be a good ride.

-

Capital at risk. Our analyst insights are for information purposes only.