The costs to ship goods across the world have increased sharply, with container traffic being rerouted from the Suez Canal in the Middle East to the southern tip of Africa.

If this out-of-the-way rerouting continues, it could have some big implications for inflation, interest rates, and the stock market.

Right now, shipping stocks are trading at cheap valuations, and they could be a useful hedge for your portfolio if the increase in shipping rates adds new heat to global inflation.

You can’t always see a market disruption coming, but this one’s very clearly on the radar. Recent attacks on cargo ships traveling through the Suez Canal in the Middle East have led to virtually all shipping being rerouted around the southern tip of Africa, a wildly out-of-the-way diversion that has already led to a sharp rise in both transport rates and shipping companies’ share prices. If this continues, it could impact global inflation and markets. Here’s what you should know…

What’s just happened?

Since November, Yemen’s Houthi rebels have launched dozens of attacks on commercial ships in the Red Sea, making it riskier and costlier to use the crucial shipping lane and sending nearly all container traffic south – like, way south – around Africa’s Cape of Good Hope.

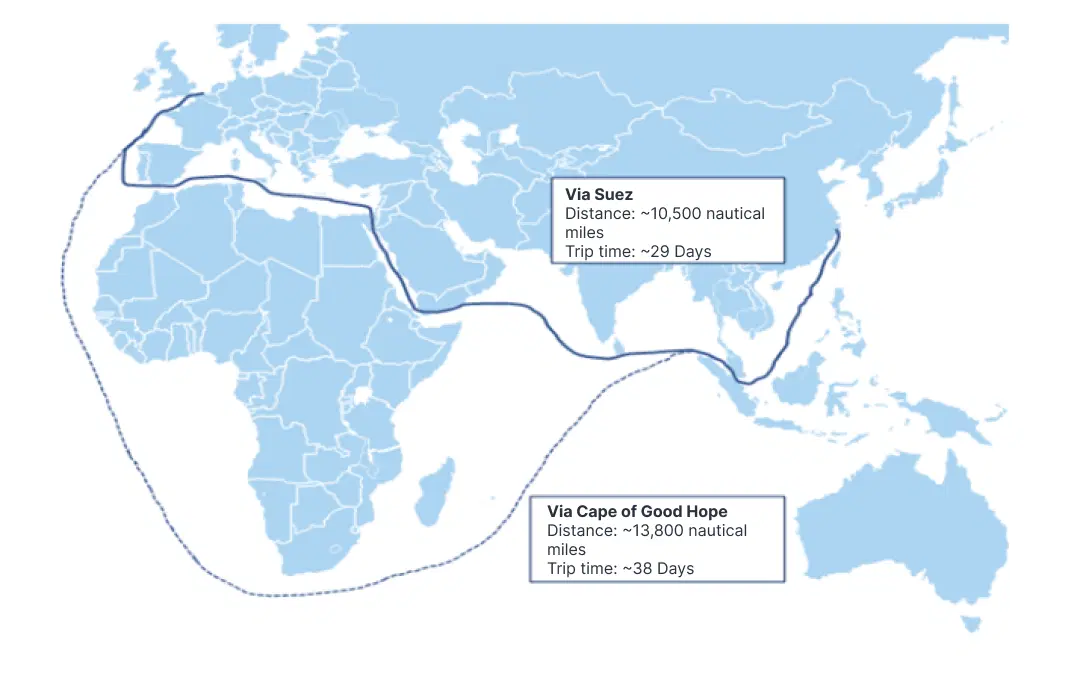

It takes a container ship about 30% longer to travel from Shanghai to Rotterdam via the Cape of Good Hope, rather than via the Suez Canal. Sources: Goldman Sachs, Clarkson.

The detour adds about 30% more miles to the journey from Shanghai to the Dutch city of Rotterdam, and the additional days and fuel required are helping to drive the cost of shipping things higher – not just on Asia-to-Europe circuits, but also on Asia-to-US ones. But there’s another factor at play too: these longer routes are causing a shortage in available container ships worldwide.

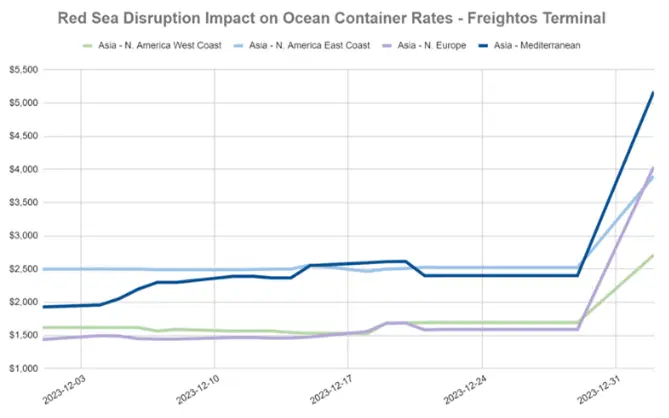

Ocean container prices saw a steep surge higher in late December, amid disruptions in the critical Red Sea shipping lane. Source: Freightos Terminal.

The price to move a shipping container from Asia to Europe has tripled since early December, according to Freightos, a huge booking and payments platform for international cargo. Meanwhile, the average China-to-anywhere rates have risen more than 70% since December 1st, according to the Shanghai Shipping Exchange.

And, of course, there are big ripple effects for stocks: the world’s major shipping companies have seen an upswell in their share prices.

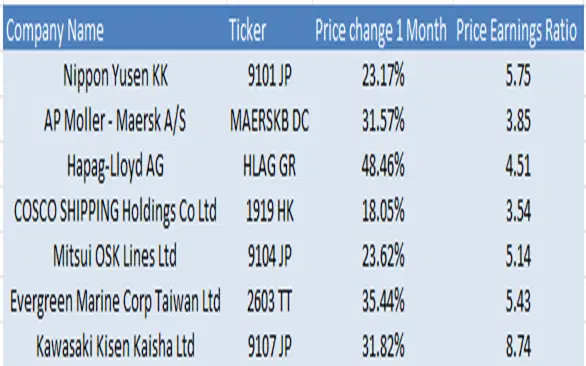

Global shipping company share price moves over the past month and their price-to-earnings (P/E) ratios. Source: Bloomberg.

The shipping sector is cyclical – meaning, its earnings tend to wax and wane with economic growth. But the disruptions in the Red Sea have upended that relationship. See, with slower global economic growth recently, the industry had been saddled with overcapacity (more available shipping supply than demand and that, in turn, had led to a drop in the price of container rates and very low price-to-earnings ratios. But with those Houthi attacks, that tide now has begun to turn.

What are the implications?

Roughly 30% of the world’s container-boat traffic passes through the Suez Canal, according to shipping specialist Clarksons. With the channel all but closed, Goldman Sachs expects the capacity crunch and the higher prices to linger – at least until the consumer-critical Chinese New Year in February. And it’s not just container traffic that’s affected: some 11% of the world’s crude is moved through the Suez Canal, so shipping costs and risks for crude tankers have also increased.

To be clear, this bottleneck isn’t likely to be as intense as the ones you recall from the pandemic era, when sky-high shipping rates helped catapult inflation worldwide, says Goldman. And there are four good reasons for that. First, container capacity is 20% higher now than it was before Covid and is expected to grow 10% this year and another 10% next year. Second, labor shortages at ports were a key contributing factor, and that’s mostly gone away. Third, the pandemic era saw a massive surge in demand for goods, which is unlikely to be repeated now, without ultra-low interest rates and government stimulus checks around to fuel consumer spending. And, fourth, today’s shipping costs are still way lower than they were during the pandemic – even after the recent jack-up in prices.

That’s not to say it’s going to be smooth sailing, mind you. The Panama Canal is another vital shipping route – accounting for about 7% of global trade. A drought last year has led to low water levels and new restrictions on the number of container ships allowed to pass through it. On its own, that’s not enough to significantly impact the overall market, but along with the Suez situation, it’s an added pain point.

If re-routing from both channels continues, supply chains will remain stretched – and freight rates elevated – all year. And the overall inflation that might result would, in all likelihood, delay interest rate cuts from the world’s central banks and might even spark a new round of economy-dampening interest rate hikes. As famed investor Mohamed El-Erian has said, the longer these disruptions persist, the stronger the low-growth and high-inflation “stagflationary” effects become for the global economy.

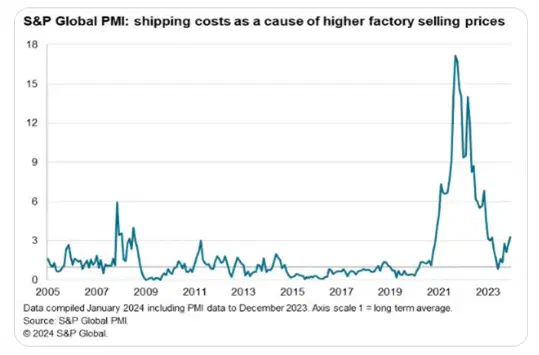

Already, some retailers are warning about shipment delays. What’s more, the number of companies worldwide that say they’ve raised their prices because of shipping costs is more than three times the long-run average, according to the latest JPMorgan global manufacturing purchasing managers’ index, compiled by S&P Global.

The number of companies worldwide that say they’ve raised prices because of rising shipping costs. Source: S&P Global PMI.

So what’s the opportunity here?

If the Suez Canal remains shut all year, the share prices of the world’s major shipping companies – Maersk, COSCO, and Hapag-Lloyd, to name a few – will likely rally further. And if the increase in shipping costs causes global inflation to heat back up or results in the dreaded “stagflation” combo of high inflation and low growth, shipping company stocks could act as a hedge for the rest of your portfolio –with those share prices likely to hold up well, and if the rest of your holdings take a hit. On the other hand, an end to the attacks would likely send shipping rates and those companies’ stock prices swiftly lower again. Whichever way the winds blow, it’ll be worth keeping an eye on this situation.

-

Capital at risk. Our analyst insights are for information purposes only.