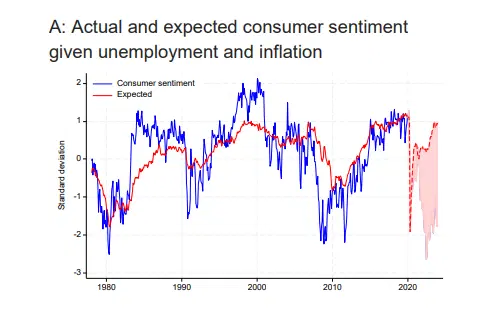

Inflation looks to be easing its grip, jobs are up for grabs everywhere, home prices are holding steady, and if you’ve got some skin in the stock market game, you’re probably feeling pretty smug right now. But consumers are still feeling kinda meh, with surveys showing that sentiment is much lower (red shaded area) than the robust economy would suggest.

Consumer sentiment (blue line, lighter since 2020) is much lower than employment and inflation data would suggest (red). Source: Bolhuis, Cramer, Schulz, and Summers.

And there are two big reasons for that.

First, even though inflation’s eased off of its more shocking highs, prices haven’t exactly done a full rewind back to the good old days, meaning the cost of a lot of things is permanently higher. And let’s be real: inflation hits everyone differently. If you’re not exactly rolling in dough, you’ve probably felt the pinch more than your richer neighbors. Essentials like groceries, childcare, and rent have all rocketed, and these basics take up a bigger chunk of the budget for those earning less. And the benefits of rising house and stock prices, and better savings rates mostly favor the wealthier too. So, as a whole, consumers may be in good health, but, if you take a closer look, you’ll see widening gaps that help explain why sentiment is something short of euphoric.

Second, new research shines a light on another culprit behind the sentiment gloom: higher borrowing costs for consumers. Look, it’s no secret those interest rate increases hit where it hurts: they’re a rude and pricey wake-up call for anyone dreaming of buying a home, getting a new car, or just making simple credit card purchases.

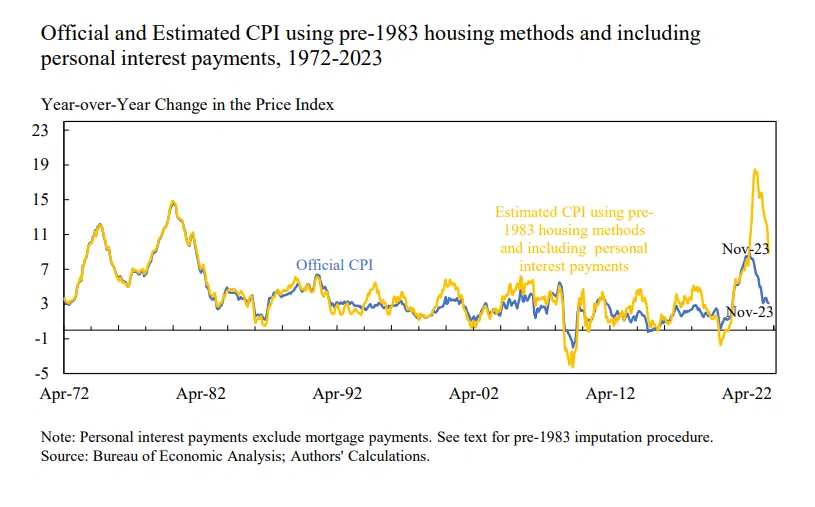

But that’s the thing that keeps getting overlooked when officials talk about how the everyday household is doing. See, these rising costs aren’t captured by the standard inflation measures, like the consumer price index (CPI). And that mismatch highlights a rift between the go-to economic indicators and the actual financial strain felt by regular folks.

Now, dive into the chart and you’ll see that if you toss in the costs of personal and mortgage loans (which, by the way, used to be part of the inflation fam until 1983), the cost-of-living vibe would look even worse than it did in the late 1970s. And yeah, it’s on a downhill run now (and the latest data aren’t in the chart), but we’re not exactly back to the easier-going levels we’ve been used to over the past four decades.

The consumer price index (CPI) paints a very different picture of the cost-of-living increases that people face when you add in the cost of housing and personal credit. Source: Bolhuis, Cramer, Schulz, and Summers.

This matters: incorporating these costs explains more than 70% of the average gap in economic sentiment in 2023, showing that inflation paints only a partial picture of consumers’ cost-of-living stress – and that consumer borrowing costs deserve more attention.

So, while inflation might be falling into line – at least, according to today’s standard metrics – that doesn’t mean everyone’s breathing easier. Those high interest rates are still a major buzzkill, and impacting the spending decisions of a whole lot of people. Let’s hope they continue to fall as quickly as they rose.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.