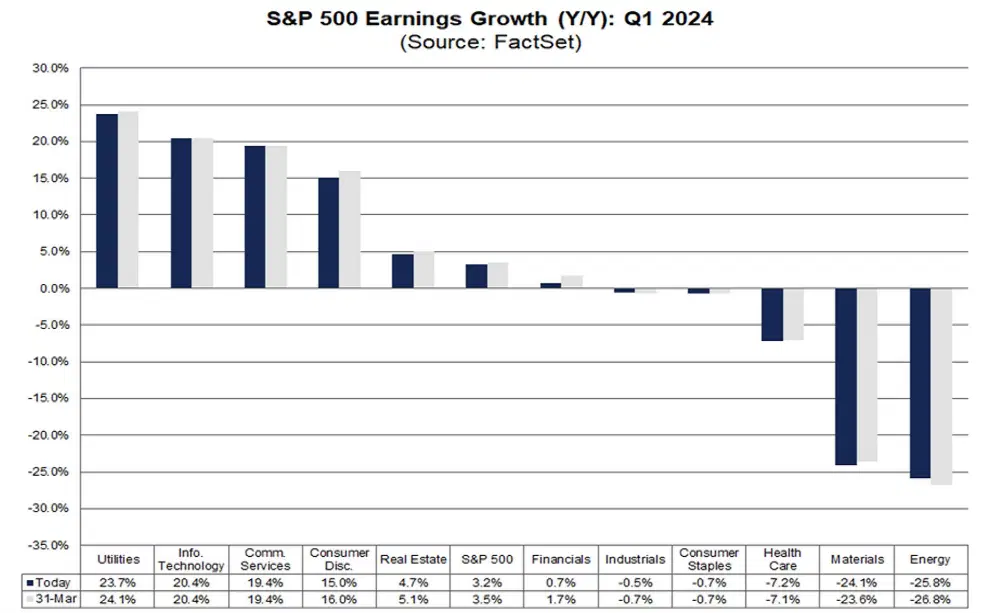

Analysts expect S&P 500 companies to report first-quarter EPS that are an average of 3.2% higher than the same time last year. That said, different sectors are expected to fare differently, with the bulk of the growth driven by the biggest tech firms.

Cash reserves and free cash flow are both at record highs in the US. That, coupled with an improving economic outlook, could encourage the biggest US companies to make increased payouts to stockholders or bigger investments into their businesses.

Profit margins are expected to improve throughout the year thanks to previously announced corporate cost-cutting measures as well as expected efficiency improvements stemming from AI.

Forget anniversaries, after-work drinks, or vacations: earnings season is the event that investors really clear their calendars for. So let’s take a look at what analysts are expecting before the final results roll in, so you can be as prepared as possible. Here’s a hint: it seems that no sector has been created equal this time around.

Analysts have downgraded their earnings predictions

At the start of this year, analysts were expecting S&P 500 companies to report first-quarter earnings-per-share (EPS) that were, on average, 5.7% higher than the same time last year. Since then, they’ve lowered their forecasts to 3.2%, which would mark the smallest expansion since 2019. Investors still seem optimistic, though, because the index actually rose 10% last quarter. The market may be onto something, because the mediocre earnings growth forecasts could turn out to be overly gloomy. After all, analysts had expected an underwhelming 1% uptick in S&P 500 companies’ earnings last quarter, but the real figure was over 8% instead.

Big Tech is still expected to lead the pack

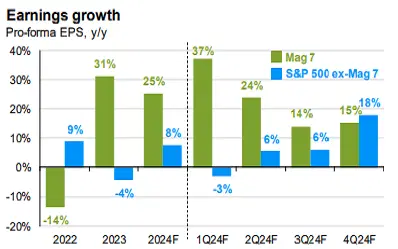

The “Magnificent Seven”, made up of the biggest US tech firms (Alphabet, Meta, Tesla, Apple, Nvidia, Amazon, and Microsoft), drove most of the S&P 500’s earnings growth last year. Well, they’re expected to continue reigning supreme for most of this year too. JPMorgan predicts that the cohort’s EPS will rise by an intimidating 37% in the first quarter. Take the seven out, and the rest of the S&P 500 index’s EPS is anticipated to shrink by 3%. That said, JPMorgan doesn’t expect that difference to stay as stark for the rest of the year. In the fourth quarter, for example, the Magnificent Seven firms’ EPS is expected to be up 15% from the same time last year, compared to 18% for the rest of the S&P 500.

Most of the S&P 500’s earnings growth is driven by the Magnificent Seven. Source: JPMorgan.

Some sectors will fare better than others – and we’re not just talking tech

Traders aren’t anticipating share prices to move in lockstep this earnings season. A gauge of expected one-month correlation in the index’s stocks is hovering near its lowest since 2018, according to Bloomberg. A reading of 1 means securities will move in perfect unison, but it’s currently at 0.16.

The expected range of returns is wide because analysts expect the 11 different sectors in the S&P 500 to pull off varying degrees of success over the quarter. As you can probably guess by now, the technology and communication services sectors – which include Alphabet, Netflix, and Meta – are predicted to post strong profit growth. But even old-school sectors like consumer discretionary and utilities are forecast to see their EPS pick up by more than 15%. On the other hand, analysts believe that companies in the healthcare, materials, and energy sectors will see their EPS shrink, with the last two anticipated to post drops of around a quarter each.

Forecasts of first-quarter earnings growth (compared to the same quarter last year) for all 11 S&P 500 sectors. Source: FactSet.

Corporate America has a ton of cash, and analysts expect firms to spend it

Cash reserves and free cash flow are both at record highs in the US. In other words, corporate America isn’t just making a lot of money, but it’s also currently sitting on a huge pile of it. That could encourage the biggest US companies to make increased payouts to stockholders or bigger investments into their businesses. We saw signs of bigger payouts in the final quarter of 2023: the combined value of S&P 500 share buybacks and dividends rose by 13.2% from the quarter before, and 4.2% from the same time in 2022. Analysts expect that strong pace to continue, now that the economic outlook is improving and corporate America is holding record levels of cash.

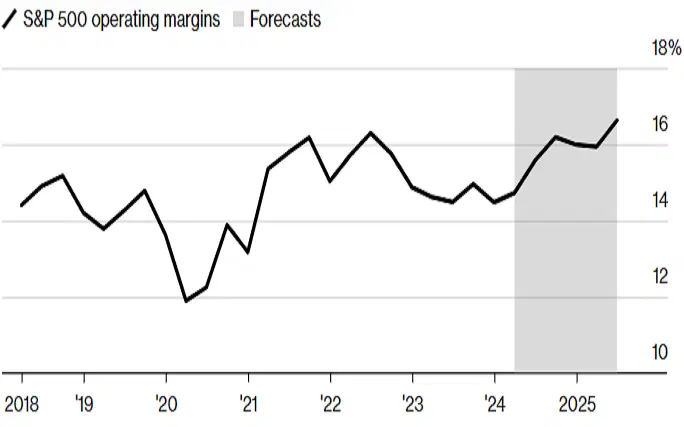

Analysts see profit margins putting on weight

As always, traders will be keeping a close eye on companies’ operating margins – an important gauge of profitability that gives clues on the future direction of earnings. S&P 500 operating margins fell last year, but the worst of the pain could be in the rear-view mirror. See, analysts expect margins to improve in the coming quarters, mainly thanks to previously announced corporate cost-cutting measures as well as expected efficiency improvements stemming from AI. In fact, analysts expect S&P 500 operating margins to rise to over 16% by the third quarter of this year, after staying below 15% in each quarter of last year.

S&P 500 operating margins are expected to improve in the coming quarters. Source: Bloomberg.

Banks should benefit from the change in interest rate expectations

Over the last two years, big banks like JPMorgan, Bank of America, Citigroup, and Wells Fargo charged more for their loans, roughly in line with the Federal Reserve’s (the Fed) increased borrowing costs. At the same time, they didn’t fully pass on those higher rates to their depositors, meaning they pocketed more profit. Now, at the start of this year, the banks warned investors that their profit from lending (known as “net interest income”) was expected to decrease in 2024. That was due to potential rate cuts and savers transferring funds to deposit accounts with higher yields.

But the financial outlook for the banking sector has taken a turn for the better in recent months. Traders currently expect only two interest rate cuts from the Fed in 2024 – down from an earlier forecast of six at the start of the year. Because of that, analysts believe that some banks could revise their full-year financial forecasts upwards when they give their first-quarter updates.

The medium-term growth outlook is promising

I’ve mainly focused on analyst expectations for the first quarter, but it’s important to consider the medium-term outlook too. For 2024 as a whole, analysts are projecting S&P 500 EPS growth of 10.9% and revenue growth of 5.1%. And looking ahead to 2025, they anticipate EPS and revenue growth rates of 11.6% and 5.9%, respectively.

Those hardy profit projections could help justify the index’s above-average valuation: its forward price-to-earnings ratio currently sits at 20.5x, which is higher than its ten-year average of 17.7x. What’s more, it’s worth noting that EPS is expected to grow at double the rate of revenue, which highlights some of the previous points we’ve made. Namely, that profit margins are expanding and that companies are buying back a lot of their stocks, which boosts earnings on a per-share basis.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.