Nanette Abuhoff Jacobson of Hartford Funds believes that value stocks – which have underperformed growth stocks over the past two decades – are poised for a turnaround. And rather than just investing in cheap companies, Jacobson recommends looking at quality value stocks.

Bailad’s Eric Leve is quite excited about small-cap growth stocks because that’s where he sees the next wave of AI winners residing. What’s more, he says, these stocks are also exposed to another growing theme: cybersecurity.

Jack Janasiewicz of Natixis Investment Managers Solutions likes homebuilders. These stocks are cheap and benefit from the tight supply in the housing market and the booming demand from millennials.

It’s a truly splendid problem to have: you come into a little financial windfall – say, an overdue bonus at work or a tidy inheritance from a long-lost relative – and you just don’t know what to do with it. You can get decent yields on a money market or savings account these days, sure, but to generate higher returns, you’re probably better off investing it. Three leading wealth advisors recently shared their top ideas with Bloomberg, and I’ve taken them a bit further to help you put them into action.

Idea 1: Quality value stocks.

Nanette Abuhoff Jacobson, a global investment strategist at Hartford Funds, likes to check out the unloved corners of the market when putting new money to work. And one particular area that stands out to her is quality value stocks.

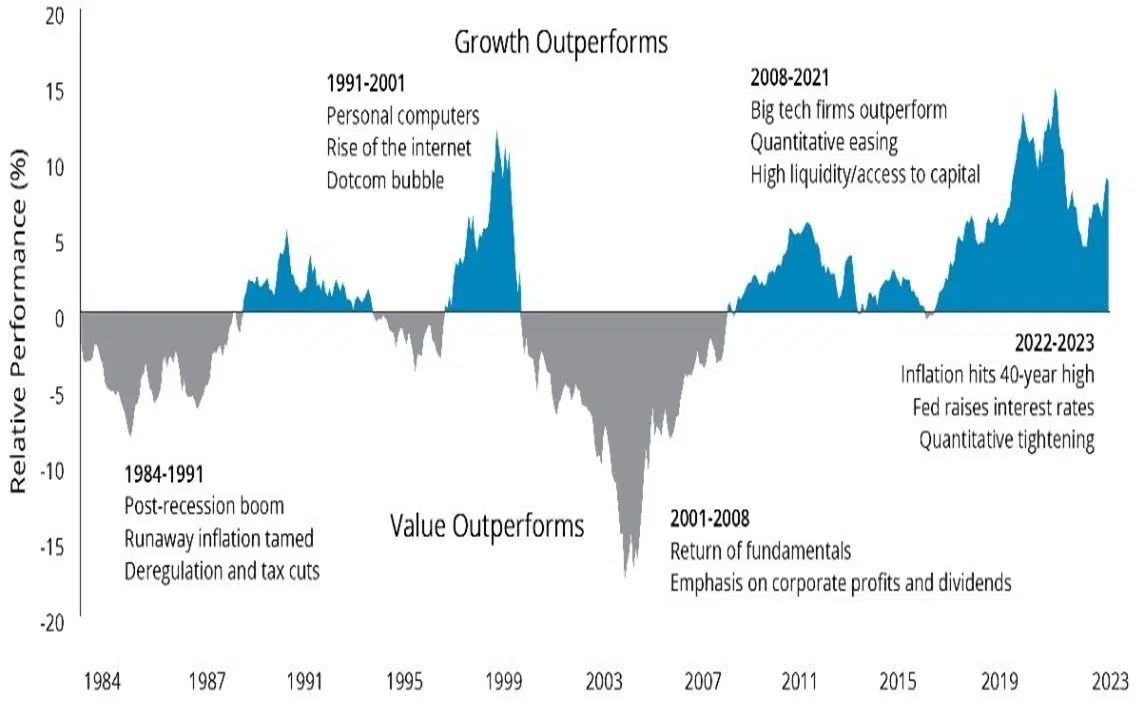

Now, growth-versus-value tends to have ten- to 20-year cycles of outperformance and underperformance. In other words, one particular style tends to outperform the other for a long time before the trend flips. And over the past two decades or so, growth stocks have handily beaten value stocks. But that outperformance is now in the mature phase of the cycle, according to Jacobson. That means value stocks could start to do well in the future (if you assume that history likes to repeat itself).

But rather than just investing in cheap companies, Jacobson recommends looking at quality value stocks. These are undervalued stocks that belong to companies with quality characteristics – like consistent revenue and profit growth, stable margins, low debt burdens, high returns on equity, and so on.

Here’s an ETF that could offer a good starting point.

Value-focused ETFs with a quality tilt include the American Century US Quality Value ETF (ticker: VALQ; expense ratio: 0.29%) and the Pacer US Cash Cows 100 ETF (COWZ; 0.49%). The latter screens the Russell 1000 index for the top 100 companies based on free cash flow yield – that is, free cash flow over the past 12 months divided by enterprise value.

And here’s my take.

It’s true that growth-versus-value tends to have long cycles of outperformance and underperformance, and that value stocks have lagged their growth counterparts for a while now.

Five-year monthly rolling returns of growth-versus-value-stocks in the US. Source: Hartford Funds.

However, I personally wouldn’t bet the farm on the assumption that value stocks will start to do well simply because they’ve been underperforming for a while. That’s because there are a few factors that could continue to favor growth stocks. First, you have the investor frenzy for all things AI, which many growth stocks are exposed to. Second, with economic growth falling this year, you could see investors pay more for companies that are still able to grow their earnings at a healthy rate. Last, with central banks expected to start cutting interest rates soon, growth stocks – whose valuations are more sensitive to changing rates – could get a boost.

Having said all that, the cyclical nature of growth-versus-value’s performance highlights the benefits of having both types of stocks in your portfolio. And Jacobson’s recommendation to focus on quality value stocks is sensible, as it makes it more likely that you’ll avoid value traps: stocks that appear cheap but actually aren’t because of their underlying fundamental problems.

Idea 2: Small-cap growth.

Eric Leve, chief investment officer at Bailad, likes smaller companies. More specifically, he’s quite excited about small-cap growth stocks. That’s quite the turnaround from what investors were flocking to last year. After all, 2023 was unquestionably the year for mega-cap growth stocks, as evidenced by the leadership of the Magnificent Seven. Investors loaded up on those names (Microsoft, Nvidia, Amazon, Alphabet, Apple, Meta, and Tesla) because they viewed them as the go-to beneficiaries of the AI boom. But now, smaller-cap growth is where the next wave of AI winners reside, according to Leve. What’s more, he says, these stocks are also exposed to another growing theme: cybersecurity.

Here’s an ETF that could offer a good starting point.

You can gain exposure to small-cap growth stocks through the Vanguard Small-Cap Growth ETF (VBK; 0.07%) or the iShares Russell 2000 Growth ETF (IWO; 0.24%).

And here’s my take.

There’s quite a lot to like about small caps these days. First, much like the growth-versus-value discussion above, small-versus-big-caps also tend to have ten- to 20-year cycles of outperformance and underperformance. And small caps’ underperformance relative to their heftier brethren over the past decade could start to reverse. (Sounds familiar). Second, small-cap valuations relative to large-caps are currently very low relative to their historical average, despite their better growth prospects. Third, smaller companies’ performance is more closely tied to the US economy, which is doing well.

As for the themes that Leve mentioned, I’d tend to agree. The AI frenzy has massively lifted the values of mega-cap growth stocks, so it does make sense to look for the next wave of winners. For example, the small-cap growth space has a lot of software-as-a-service companies, and those firms can leverage AI to enhance their products, dramatically boost their users’ productivity, become more efficient, and a lot more.

The small-cap growth space also has a lot of cybersecurity firms, which, as Leve alluded to, are experiencing booming demand these days. After all, Covid created a permanent shift in the number of people who work from home. Employees now handle their workload – and pretty sensitive corporate data – via the internet, while businesses worldwide have been forced to take their operations online – both of which have significantly bumped up the threat of cyberattacks.

The ongoing Russia-Ukraine conflict, meanwhile, has resulted in a spike in cyberattacks, and plenty of experts are worried that battlefield hacks might accidentally spill over to personal computers. Finally, other malicious groups are also trying to get their hands on vast amounts of encrypted information now to decrypt later, when quantum computers can easily hack even the most secure data.

Idea 3: Homebuilders.

Jack Janasiewicz, lead portfolio strategist at Natixis Investment Managers Solutions, recommends moving into homebuilders (and I’m pretty sure he intended the pun). Supply in the housing market is still tight: the industry is currently sitting on just three to four months of inventory, which is a lot less than the typical seven-month supply. What’s more, millennials, the biggest generation in the US, are increasingly looking to buy their own homes. Combine that strong demand with the shortfall in supply, and that suggests the housing market is going to stay in pretty good shape in the coming years.

What’s more, from a valuation perspective, homebuilder stocks look fairly cheap. Case in point: a popular ETF tracking the stocks has an average trailing price-to-earnings ratio of 17x – a steep discount to the S&P 500’s 27x.

Here’s an ETF that could offer a good starting point.

You can break some ground in your portfolio for homebuilders by investing in the SPDR S&P Homebuilders ETF (XHB; 0.35%) or the iShares US Home Construction ETF (ITB; 0.40%). But you should be aware that these ETFs go beyond just homebuilders, holding shares in companies that are tied to the homeowning trend, like Home Depot, Lowe’s, and Sherwin-Williams.

And here’s my take.

When I first came across this idea, my initial thought was that homebuilder stocks might not make the most sense in the current environment. After all, the Federal Reserve (the Fed) has just ended a very aggressive rate-hiking campaign, leaving interest rates at a 23-year high. That’s sent mortgage rates surging, which should, in theory, dent demand for housing by making borrowing more expensive.

However, when I looked at the SPDR S&P Homebuilders ETF’s performance since March 2022 (the Fed’s first rate hike), I noticed something extraordinary: on a total return basis, the ETF is up 49% since then, handily beating the S&P 500’s 19% return over the same period. Put differently, homebuilders have trounced the broader market since the start of the Fed’s rate-hiking campaign.

The SPDR S&P Homebuilders ETF has trounced the S&P 500 since March 2022. Source: Bloomberg

When I started investigating why, I arrived at a very logical explanation. See, higher interest rates are keeping many homeowners, who have locked-in mortgages at the previous, historically low rates, from selling their homes. They understandably don't want to get saddled with much higher mortgage rates when they move. In October last year, for example, existing home sales reached a seasonally adjusted annual rate of 3.85 million units, the lowest since October 2010. And this shortage of existing homes has driven up demand for newly constructed places, benefiting homebuilders.

And, now, with persistent US inflation putting the brakes on any Fed rate cuts, those homebuilders are sitting pretty. They can continue to benefit from this dynamic, as demand from millennials continues to boom. Throw in cheap valuations for these stocks, and I couldn’t agree more with Janasiewicz.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.