Living has been a resilient real estate sector and it presents a compelling investment opportunity now.

The sector is characterized by long-term structural demand drivers, low supply, growth potential, and differentiated fundamentals across subsectors.

As the market evolves, adaptive strategies that prioritize sustainability and respond to affordability pressures will likely be key to long-term investment success.

In Europe, interest rates have begun to fall from their peaks, and that’s got property prices on, well, firmer ground. So it may be time to give the market’s “living” sector a second look. This real estate category – which includes student accommodations, senior-living residences, and privately rented housing – has seen its prices tumble, but with its resilience, inflation-linked cash flows, and consistent risk-adjusted returns, it’s showing off plenty of curb appeal.

It’s been resilient.

Over the past two decades, European living real estate has been an attractive place to invest, outperforming other sectors in terms of risk-adjusted returns. According to data from MSCI, European residential assets returned an average 7.2% per year between 2001 and 2023, while experiencing the lowest total return volatility of any real estate sector. And its resilience was particularly evident during the Covid-19 pandemic. abrdn’s proprietary data shows that rent collection fell by just 3%, compared with 15% in retail assets.

Now, living didn’t escape the bloc’s recent real estate correction unscathed – its values fell sharply as interest rates shot higher – but commercial assets were hit a lot harder.And that kind of resilience should carry on into the future, too. The living sector faces far fewer negative disruptors from flexible working, ecommerce, automation, or operational obsolescence through technological change. After all, humans will always need bathrooms, kitchens, living spaces, and a bed in which to sleep. Long-term decisions in private real estate must be backed by conviction in the relevance of the underlying use of the buildings for the foreseeable future. Residential has the clearest and simplest long-term use case of all the sectors. That’s why it’s at the top of investors’ “buy” lists.

The total returns and relative risk levels across real estate segments. Sources: MSCI Pan-European Index, abrdn.

It’s growing and maturing.

The size of the European investible universe has likely reached critical mass to support pan-European living real estate strategies. At an estimated €1.5 trillion ($1.6 trillion), living assets represent a surprising 36% of the broader investible European real estate market. The JLL global real estate services firm estimates that nearly 20,000 new apartments will be created through office-to-residential conversions just in Germany’s top seven cities.

And that just underscores the increasing relative importance and scale of the sector as part of the wider market.

What’s more, investment in the European living sector has seen substantial growth over the past decade, attracting increased attention from cross-border and institutional investors. Nearly €17 billion ($18 billion) has been invested in the sector already this year, accounting for 23% of all real estate investment in Europe, the highest share across all sectors. Within the region, the dynamics are maturing too. In 2013, 50% of total living investment in Europe was in Germany. But so far this year, Germany’s share has been just 20%, with the UK, France, Sweden, the Netherlands, and Spain taking a growing share of capital.And according to surveys, investors prefer living over all other real estate sectors for at least the next 12 months. This suggests the sector will continue to grow and converge with the more mature US market.

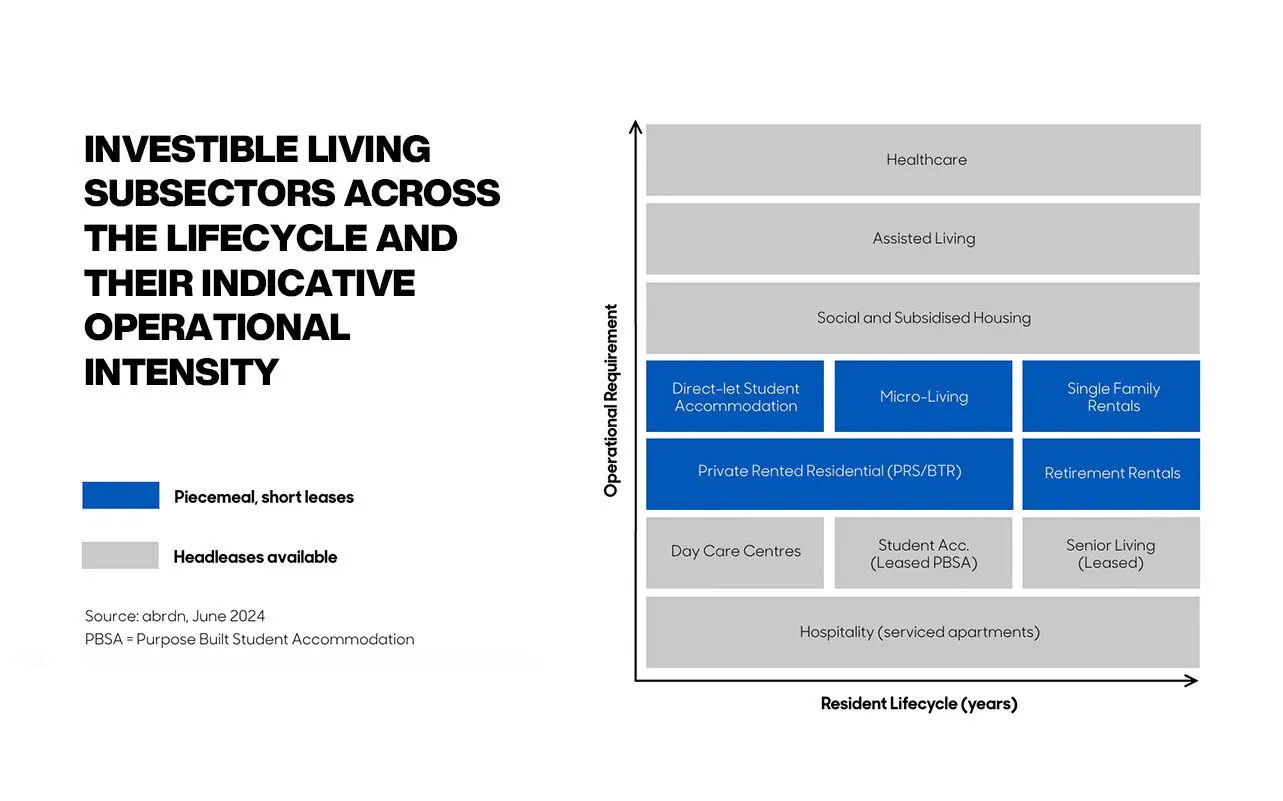

There could be even more growth to come. See, the definition of “living” goes beyond private-rented sectors and build-to-rent segments, and includes sleepier subsectors like purpose-built student accommodation, senior-living accommodation, serviced apartments, single-family rentals, and co-living. And each of those has strong demand fundamentals that supplement the whole category.

In PwC’s Emerging Trends in Real Estate Europe report this year, these living subsectors accounted for five of investors’ top ten preferred segments. The UK, France, Spain, and the Nordics offer particularly strong opportunities in these additional living subsectors, further increasing the potential breadth of living strategies across Europe.

Investible living subsectors across the life cycle and their indicative operational intensity. Source: abrdn.

This growth hasn’t just supported the potential for specialist residential vehicles to expand across the continent, though. Institutional products, typically invested in purely commercial sectors, are also growing their residential commitments. In 2023, 14% of the MSCI pan-European Property Fund Index was allocated to residential assets (5.6% in 2019), falling just shy of retail at 15%.

It’s got attractive demand and supply dynamics.

Key demand drivers – including home-ownership affordability constraints, urbanization, net migration, and other demographic changes – continue to support the sector. Europe’s cities are expected to grow by 6% on average between through 2035, while new housing development is predicted to fall by 10% over the next two years.

Lead indicators sit at depressed levels, with data from Germany symptomatic of the wider European skyline.According to data from Munich’s IFO indicators, German developers haven’t been this negative toward future activity levels in nearly 25 years.

They are planning to reduce headcount at the fastest rate since the global financial crisis, while capacity utilization (a measure of how full their order books are) languishes at the lowest level in over ten years. The sinking outlook for new supply is staggering in the face of increasing demand.The resulting challenge in housing affordability poses risks that investors need to understand and navigate. Indexation in lease terms and open-market rental growth both breached double digits in 2022, while headline rents increased by a further 7% annually across Europe in the first quarter of this year. Regulatory responses to these rental pressures also play a crucial role in shaping the investment landscape, but these policies have had a detrimental impact on supply levels.

Diversifying across multiple jurisdictions is one way that investors can limit their exposure to policy changes in one particular market. They can also focus on the mid-market or intermediate rentals category, and with a limit of 30% to 40% ratio of rent-to-household income.

It’s being shaped more and more by sustainability goals.

Sustainability and energy efficiency have become paramount, influencing asset values and investment decisions.

The EU Building Stock Observatory estimates that 38% of the region’s housing was built before 1970 – and that only 12% of that share has been upgraded to meet climate targets. With decarbonization deadlines ever closer, regulatory developments promoting energy efficiency are reshaping the investment criteria. Sustainability is now a pivotal factor in determining future performance.Look no further than the new carbon emissions tax introduced by the Bundesregierung in 2023, which forces a greater share of the carbon tax onto residential landlords in less-efficient buildings.

Carbon units must be purchased to offset emissions.

The cost of these units is currently fixed, but a step increase is scheduled for 2025 ahead of moving onto trading exchanges where pricing will be much more uncertain. In a sector where maximizing net operating income through cost control is the key to success, taxes levied on weaker buildings will further increase the importance of quality and sustainability as drivers of performance.