Morgan Stanley sees a positive year ahead for global stocks, but predicts more upside for Japanese and European ones, compared to those in the US.

The investment bank has also taken a shine to the world of private credit. And fortunately, there are a few assets that give retail investors access to that mostly closed-off market.

The bank also likes Indian and Asia tech stocks, and commodities, particularly uranium and copper.

The midpoint of the year is always a good time to take stock– as they say. And that’s what Morgan Stanley’s been doing. In its latest report, the big Wall Street bank did a full review of markets and assetsaround the world. So let’s take a look at its outlook and the investments it likes above all others.

First, what’s the outlook?

Morgan Stanley’s prediction for US growth over the next 12 months isn’t likely to bowl anyone over. It sees more of the same: stable growth and a continued slowdown in inflation. And it expects the Federal Reserve to make its first cut to interest rates in September.

That will be a fair bit later than the European Central Bank, which it predicts will lower rates this week, and the UK, which it sees making a trim in August. Those rate cuts – and others like it in other places – will help boost the recovery in Europe and emerging markets. That, in turn, will make for a positive backdrop for risky assets like stocks.

Morgan Stanley likes the look of European and Japanese shares, with their companies trading for cheap and likely to see higher profit growth. Europe’s forward-looking sentiment indicators suggest its worst economic days are behind it, so the firm has penciled in a stronger growth outlook for the rest of 2024.

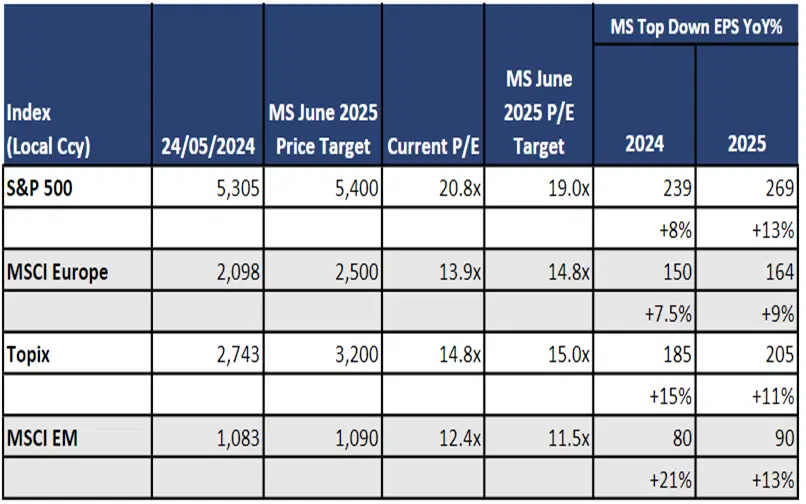

The investment bank sees the MSCI Europe index gaining 19% by June of next year, and Japan’s Topix index gaining 16%. In emerging markets, it likes India’s shares, and semiconductor and tech stocks from Korea and Taiwan, but is less interested in the rest.

Recent levels for the S&P 500, MSCI Europe, Japan’s Topix, and MSCI emerging markets, in the far left column. Morgan Stanley’s base case targets for June 2025 for each index, in the second column from left, followed by each index’s price-to-earnings ratio, and expected earnings per share growth. Source: Morgan Stanley.

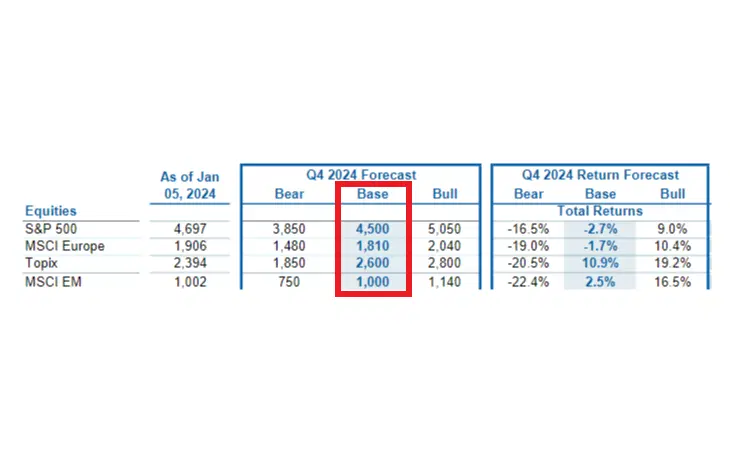

The midyear forecasts mark an improvement over the ones the bank published just six months ago. And that makes some sense: those proved too pessimistic, as every one of the indexes is now trading above those forecasts. Its predictions were especially off the market on US and European stocks: the S&P 500 is trading around 5,400 nowadays – 17% above the initial target – and MSCI Europe is 16% above.

Morgan Stanley’s previous base case target levels for December 2024 for the S&P 500, MSCI Europe, Japan’s Topix, and MSCI emerging markets for indexes. Source: Morgan Stanley.

The bank is pretty jacked about the future of US interest rates – it sees the Fed cutting interest rates three times this year and four times in 2025 and sees the 10-year Treasury yield declining to just 3.75% by June 2025, from today’s 4.5%. But it doesn’t want to get too excited about US stocks either, because of their high valuations: the bank is looking for their price-to-earnings ratios to fall to around 19x, from the current 21x.

What assets are in Morgan Stanley’s good books?

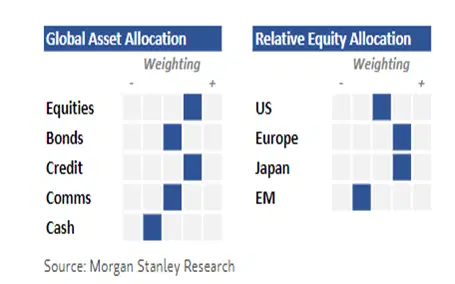

The investment bank is holding a bigger-than-benchmark, or overweight, position in stocks and private credit, a neutral weighting in bondsand commodities, and an underweight position in cash.

Morgan Stanley’s preferred asset allocation and regional preference for stocks for the next 12 months. Source: Morgan Stanley.

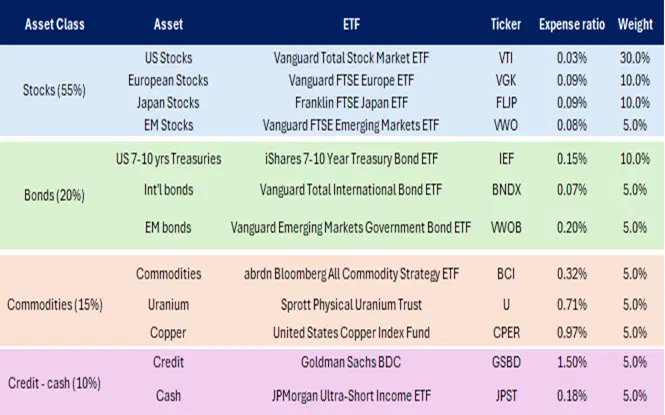

So, if you wanted to model your portfolio on Morgan Stanley’s, you could go for something like this: 55% in stocks, 20% in bonds, 15% in commodities, and 10% in private credit and cash. Mind you, you could tweak those to match your own appetite for risk.

Stocks (55%). Now, Morgan Stanley says it prefers European and Japanese stocks and recommends an overweight position on those. But that doesn’t mean they should dominate your portfolio: US companies account for around 70% of the value of all the developed market stocks in the world, so most of the shares you hold will still likely trade in New York. So, let’s say that leaves you with about 30% of your total portfolio in US stocks, and chunky weightings of roughly 10% each in European and Japanese stocks.

The Vanguard Total Stock Market ETF (ticker VTI; expense ratio: 0.03%) holds small, mid-size and big-cap US stocks. If Morgan Stanley’s correct with its lower interest rate outlook, I’d expect US small-cap stocks to perform well because the current, higher interest rates haven’t been too kind to them. On the other hand, the bank could be wrong: like most of Wall Street, Morgan Stanley’s been way off base on inflation and interest rates so far this year.

Private credit (5%). This has been a popular and successful asset for big institutional players. Recent high interest rates mean that companies are paying more than 10% in annual interest to borrow money, often from private lenders. See, banks have been facing stricter regulations on loaning money, so private firms have stepped in and filled that gap. Problem is, it’s hard for retail investors to access this specialized market: there just aren’t a lot of options. One you could consider though is the Goldman Sachs BDC.

Bonds (20%). If Morgan Stanley’s forecasts for lower inflation and interest rates come together, the iShares 7-10 Year Treasury Bond ETF (IEF; 0.15%) will provide good returns. And you could diversify your mix here with some global and emerging market bonds.

Commodities (15%). Morgan Stanley is pretty fond of metals right now, especially uranium and copper – which are in growing demand as AI and the green transition stoke more need for energy. But it sees copper trading at just $9,700 a year from now, which is below its current price of around $10,300. So the price might not see much gain from here, but it just might add some balance to your investment mix.

For a commodities play, you could consider a 5% portfolio weighting in the broad-based abrdn Bloomberg All Commodity Strategy K-1 Free ETF (BCI; 0.32%), and then add in a little uranium and copper to track the bank’s picks.

Cash (5%). With interest rates still above 5%, cash is by no means unattractive. So the JPMorgan Ultra Short Term ETF (JPST; 0.18%) – which invests in short-term investment-grade debt to give you a return on your cash – could also be worth a look.

A potential portfolio based on Morgan Stanley’s midyear outlook. Source: Finimize.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.