The SEC approves the first Bitcoin spot ETFs

For the first time, the US SEC has said yes to Bitcoin spot ETFs. This big decision opens doors for investors to easily put their money in Bitcoin through Wall Street and beyond. The approval comes after a long wait of over ten years and follows an important court ruling that questioned the SEC's previous rejections. The SEC, however, clarifies that this doesn't mean they fully back Bitcoin itself. These new ETFs, offered by big names like BlackRock and Fidelity, will make it simpler for everyday folks and big investors to include Bitcoin in their investment portfolios. This move is seen as a major step for Bitcoin and could bring more trust and stability to the world of cryptocurrency.

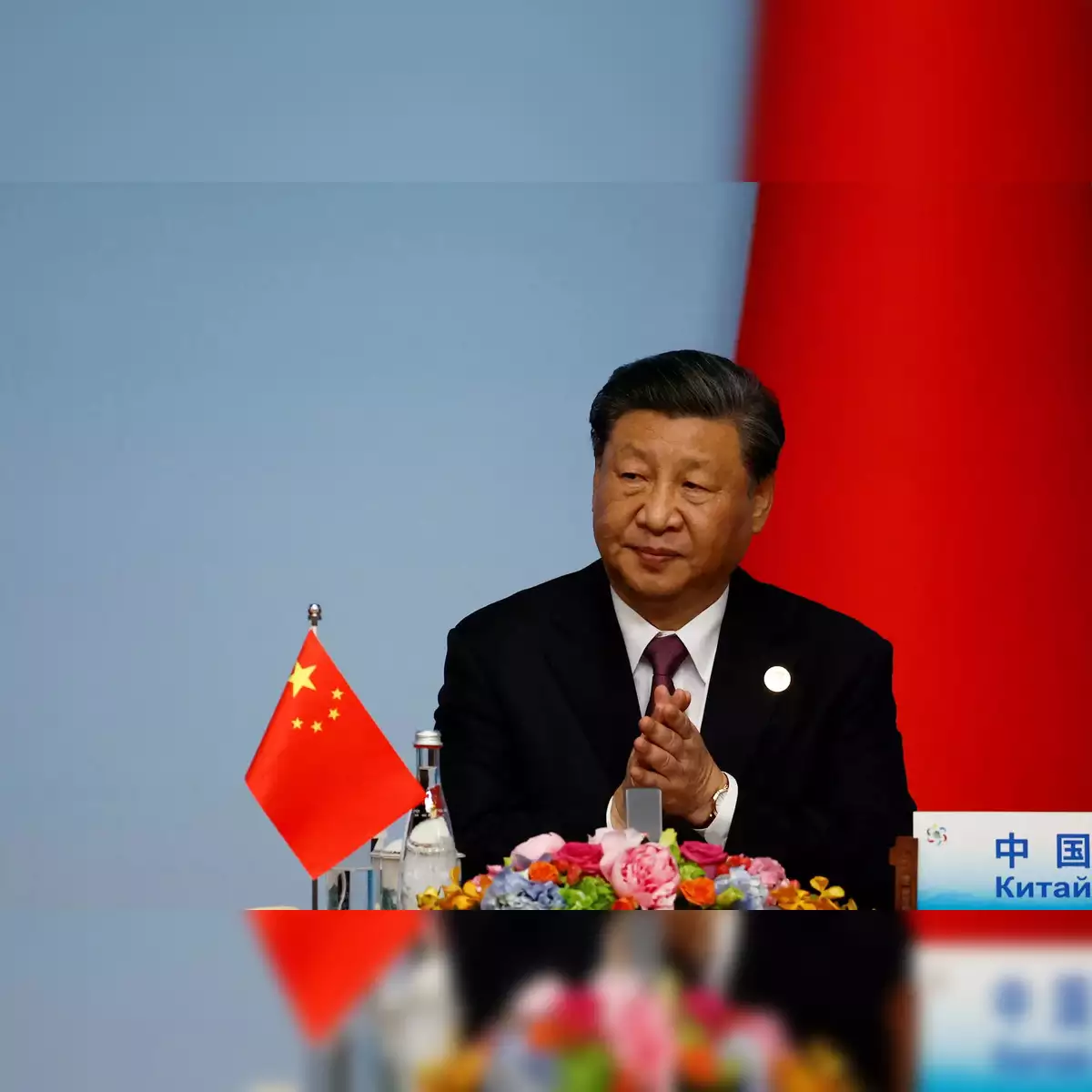

China's charm fades for global investors

Big investment funds in the USA are stepping back from China's stock market, a change from a few years ago when everyone wanted a piece of it. Since 2020, top US pension funds have been cutting their investments in Chinese stocks. The reasons? Worries about China's long-term economic plans, a struggling property market, and tensions with the USA. China's share in key global investment indexes has dropped, and even though Chinese stocks are cheap, investors are cautious. Instead, they're looking at other emerging markets. Places like South Korea and India are getting more attention, while China's tricky business environment is making investors think twice.

Japan's stock market hits a 30-year high

Japan's stock market is shining bright, reaching its highest point in over three decades. This big news comes as China, usually a global economic leader, is still trying to find its feet after the pandemic. Japan, on the other hand, is looking up thanks to its booming export business. With Chinese markets struggling, Japan's Nikkei index has soared to levels not seen since the 1980s. Deflation, a tricky problem where falling prices discourage spending, has been a challenge for Japan. But now, with prices slowly rising, there's hope that people and businesses will start spending more. This boost in spending could help keep Japanese stocks strong, marking a new chapter of economic growth for the country.