Siemens’s €3 billion motor business sparks bidding war

Japan's Nidec Corp and the US-based KPS Capital Partners are in a race to buy Siemens AG’s Innomotics motor unit, valued at about €3 billion. The deal, if secured by Nidec, would be their largest yet, boosting their portfolio significantly. Siemens, aiming to revamp its business towards more profitable sectors, plans to sell Innomotics, which specializes in heavy-duty electric motors. The sale is advised by Goldman Sachs and BNP Paribas, with Siemens exploring the option to either sell or list Innomotics on the stock market. This strategic move comes as Siemens shifts focus to software-driven products, shedding its heavier equipment divisions.

Saudi Aramco defies odds with bigger dividends despite profit dip

In a surprising move, Saudi Aramco upped its dividends to stakeholders by 30% to almost $100 billion last year, despite a profit fall of 25%. The dip was due to Saudi Arabia's oil production caps, aimed at boosting oil prices through controlled scarcity. Looking ahead, Aramco is not just resting on its laurels; it's exploring gas projects globally and planning to increase its gas production by 60% by 2030, aligning with a shift towards cleaner energy sources. This strategy not only underscores Aramco's pivotal role in Saudi Arabia's economy but also highlights its proactive stance in adapting to the evolving energy landscape.

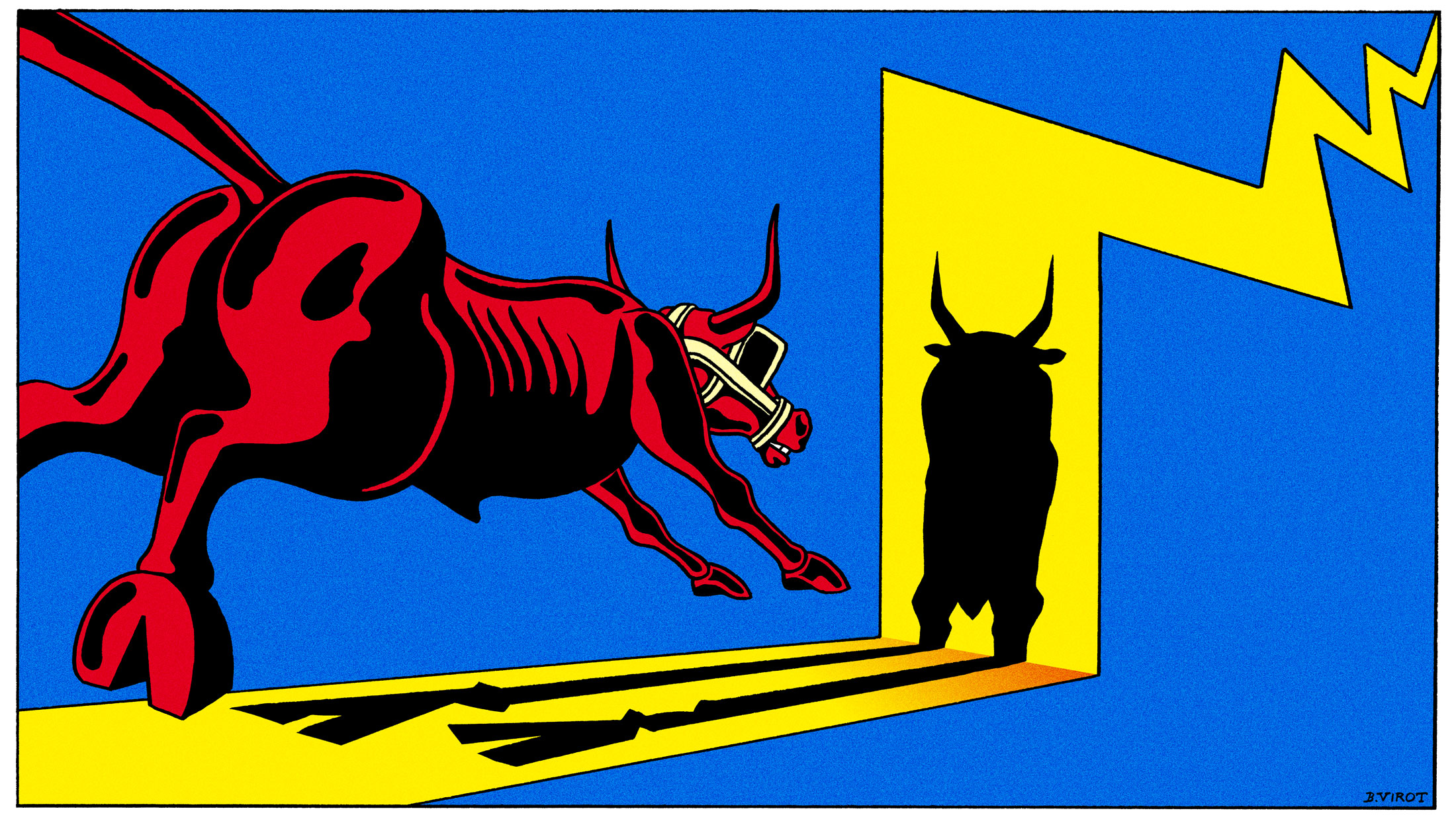

Private Equity firms have been safekeeping a record number of assets

Private equity firms are facing an unprecedented challenge: they’re holding onto a record 28,000 unsold companies, valued at over $3 trillion, due to higher interest rates making it difficult for potential buyers to borrow money. With over 40% of these assets around the four-year mark, PE firms are under pressure to find liquidity to satisfy their investors. In a bid to manage this, they're resorting to borrowing against these unsold assets, essentially piling new debt on top of old. However, there’s a glimmer of hope with the IPO market warming up: European companies have raised more than $3 billion through IPOs early this year, signaling a potentially lucrative exit route for these PE-held businesses looking to go public, marking a possible shift in the tide after a sluggish period.

-

Capital at risk. Our analyst insights are for information purposes only.