ECB signals rate cuts in response to inflation pressures

The ECB is gearing up to lower its policy rate from the current 4% this coming June, due to ongoing high inflation issues within the eurozone. They plan a reduction of 25 to 50 basis points, while still maintaining a tight monetary policy to balance inflation control without hampering economic growth.

This decision is informed by a close watch on key economic indicators like unemployment rates and GDP growth. For investors, the ECB's cautious yet clear approach offers a more predictable economic environment in the eurozone.

Despite global economic challenges, the ECB is setting its own independent policy path, essential for managing the region's unique economic conditions effectively.

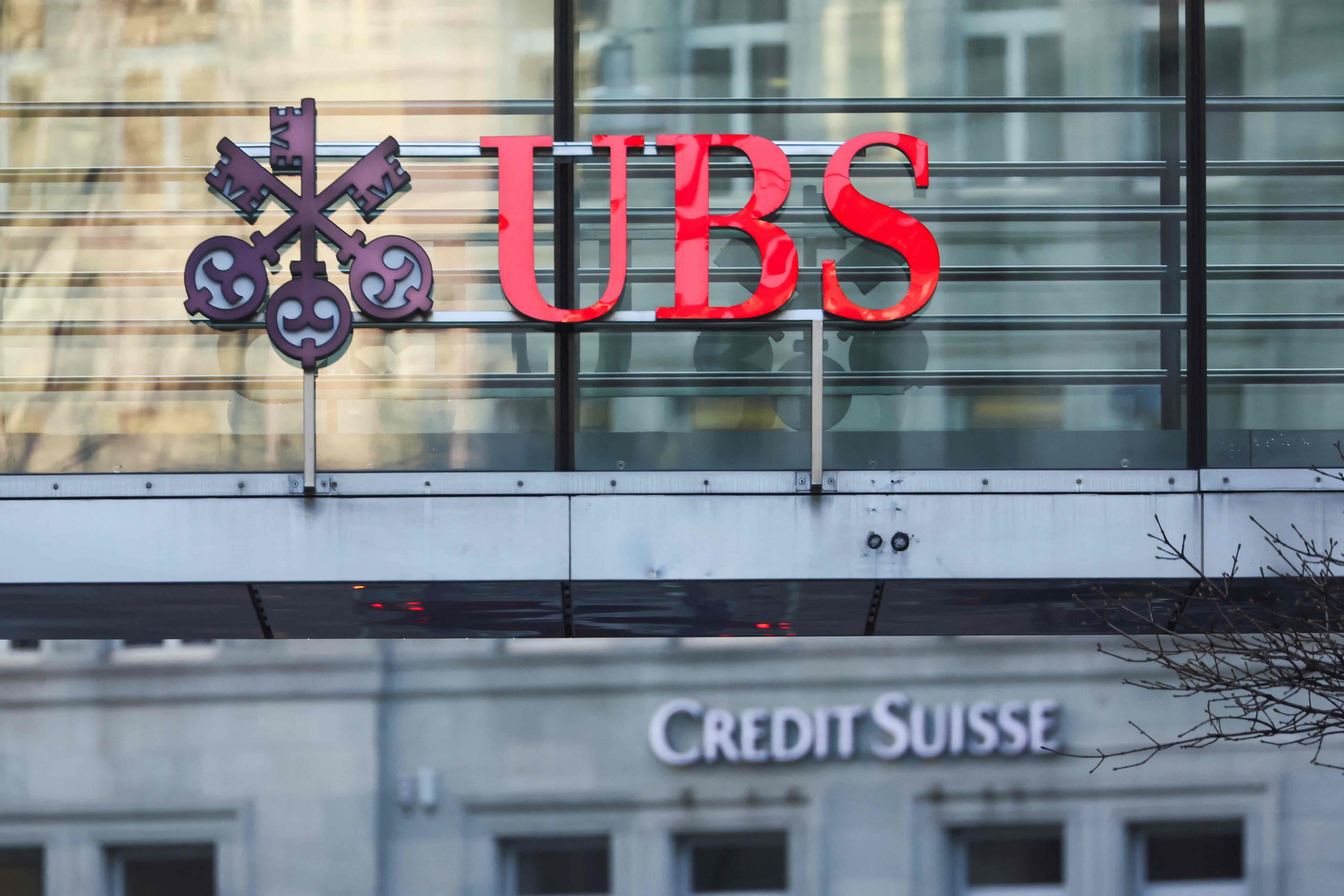

UBS prepares more job cuts post Credit Suisse merger challenges

UBS Group AG is set to make further job reductions as it integrates with Credit Suisse, which it recently took over. The cuts will affect various areas including the global investment bank and the wealth management and markets units.

This follows UBS's announcement of aiming to save about $6 billion in staff costs over the next few years. Additionally, UBS is facing financial pressure as Swiss regulators propose stricter capital requirements, potentially costing the bank $20 billion.

The bank's chairman has hinted at tough times ahead, especially with the ongoing legal mergers.

With orders coming in below expectations, ASML’s profit might take a dip

ASML has reported disappointing order numbers for their chip-making machines, with figures significantly below market expectations. Orders have fallen to €3.6 billion, a sharp decline from previous periods.

Despite this, ASML remains hopeful, predicting a recovery in orders later this year and a boost in 2025. The dip has caused a 6% fall in their share price as investors react to the current uncertainties. With new plant projects from major clients like TSMC, Samsung, and Intel, there's potential for recovery.

Meanwhile, the US's restrictions on chip tech exports to China haven't severely impacted ASML’s business, as the company still managed a robust sales performance in China last quarter.