Bank of Japan ends era of negative interest rates

In a historic move, the Bank of Japan bid farewell to negative interest rates, setting the stage for a new financial era with a policy rate range of 0% to 0.1%. After 17 years, this marks the first hike, yet the Bank left everyone guessing about any future increases. While they've scrapped some unconventional tools and will keep supporting long-term bonds, the BOJ is keen to maintain an easy financial vibe. The yen took a dip past 150 against the dollar, reflecting market uncertainty. BOJ Governor Ueda hinted at a cautious approach ahead, focusing on achieving a stable 2% inflation. This significant shift indicates Japan is cautiously stepping into a phase of financial normalization, without rushing further hikes.

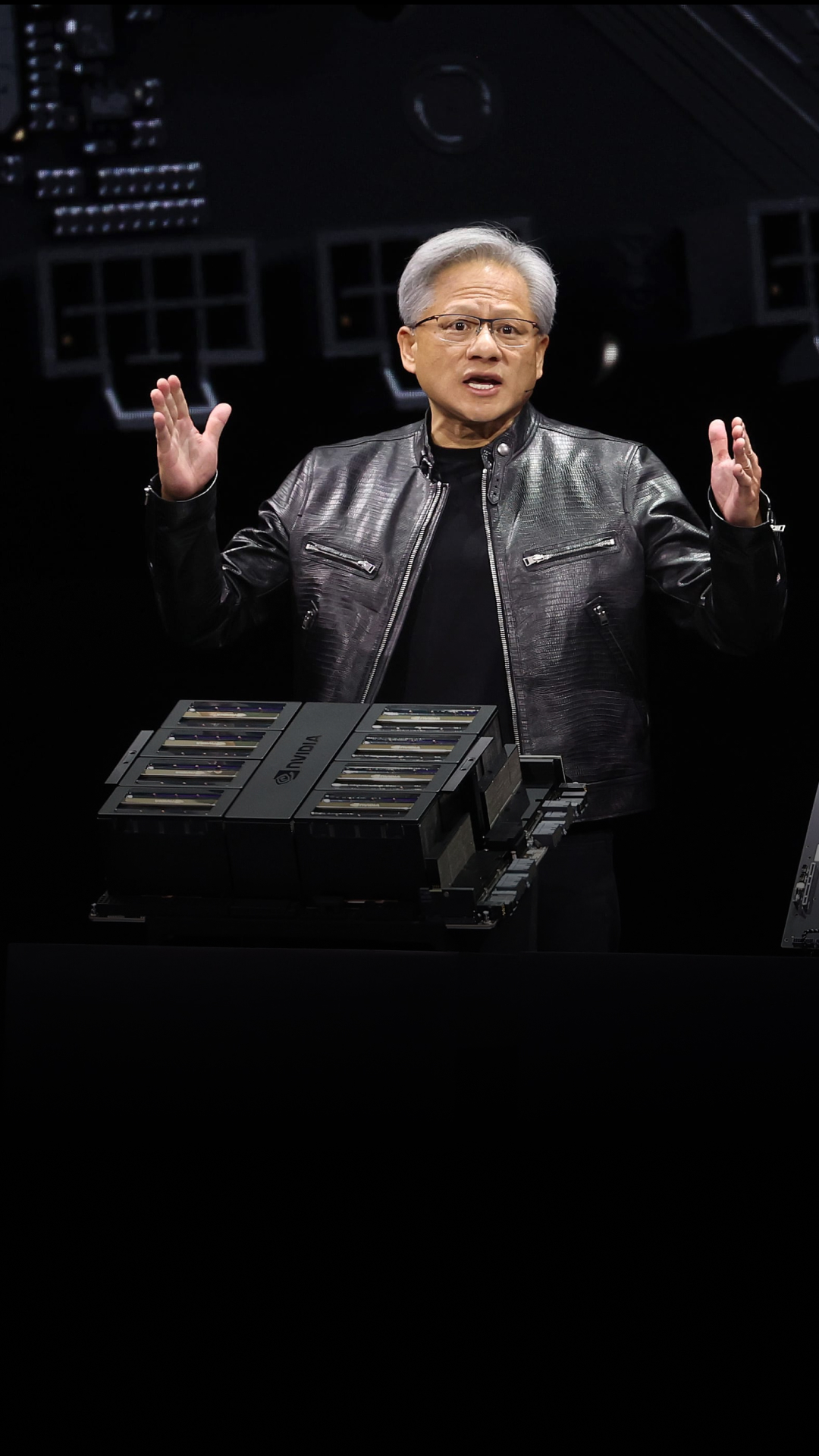

Nvidia's game-changing Blackwell chip sets new AI benchmarks

Nvidia has introduced the Blackwell chip, a new AI processor that's leaps ahead in performance, at the GTC conference in San Jose. Boasting 208 billion transistors, these chips are ready to revolutionize how AI models are trained and run, promising to be available later this year. Despite Nvidia's stock experiencing a slight dip post-announcement, CEO Jensen Huang's vision for Blackwell is clear: to fuel the next industrial revolution powered by AI. With partnerships across tech giants and innovations making AI more accessible and powerful, Nvidia is steering towards a future where AI integrates seamlessly into every facet of technology, including robotics and digital simulations

UBS Group AG has seen its market value soar past $100 billion

A year after the historic takeover of Credit Suisse, UBS Group AG has seen its market value soar past $100 billion, marking its highest level in nearly 16 years. This monumental growth has solidified UBS's position as a global leader in wealth management, with client funds jumping significantly overnight. Despite initial market jitters causing a dip in share prices, the merger has been termed the deal of the century for its immediate scale boost and bargain price. Now, with ambitious plans to grow its wealth management assets to over $5 trillion by 2028, UBS is focusing on expanding its presence in the US market, aiming to bridge the gap with rivals like Morgan Stanley. However, challenges remain, including integrating Credit Suisse's operations and meeting profitability targets amid pressure from investors.