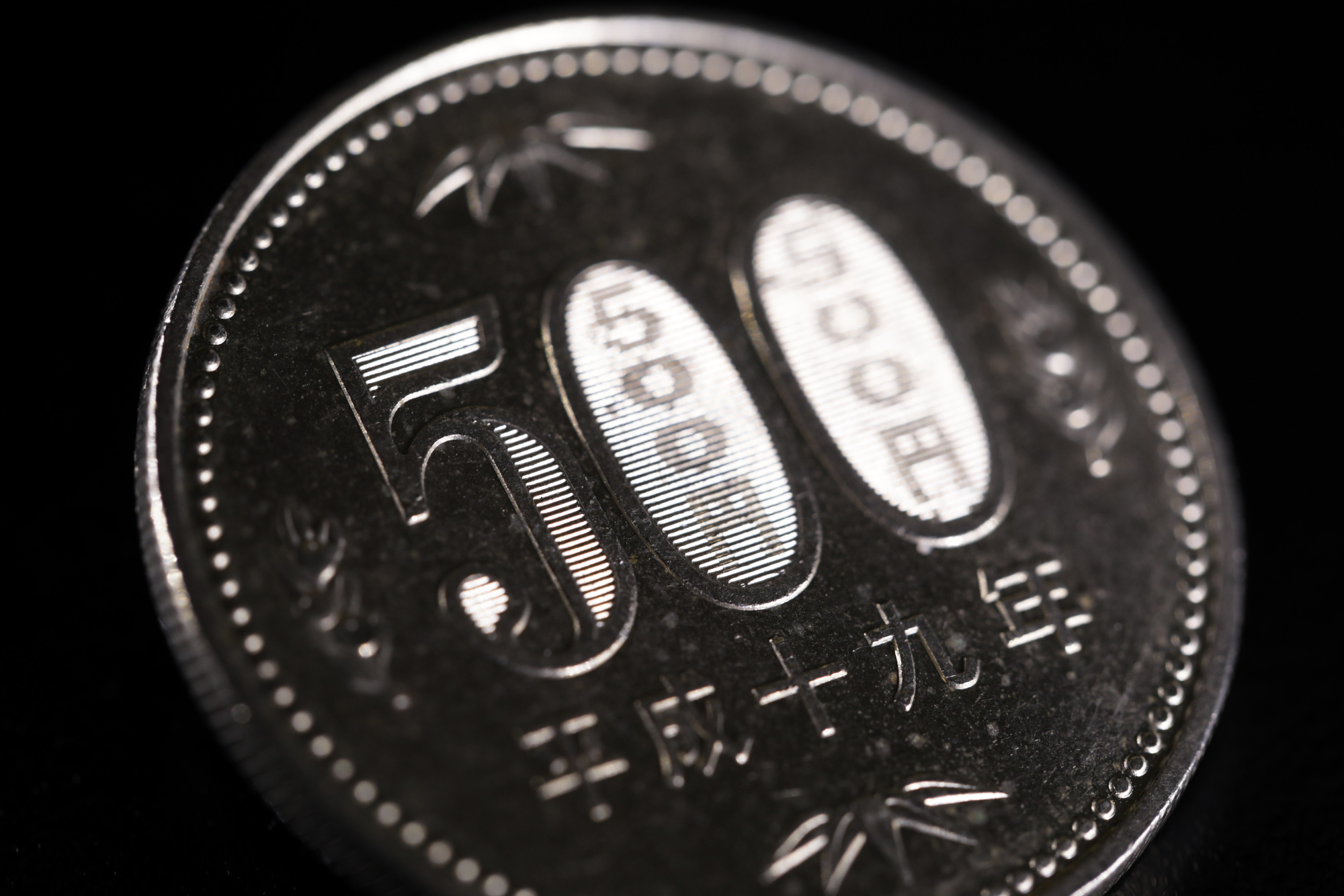

Yen drops to weakest since 1990

Japan's yen has fallen to its weakest point in about 34 years, making officials hint at stepping in to stop the slide. Finance Minister Suzuki is keeping a close eye and has mentioned "bold measures" might be taken if things don't improve. Despite efforts, including Japan's first interest rate hike since 2007, the yen continues to weaken, partly because of policies that keep financial conditions relaxed. The gap between US and Japanese interest rates is adding to the yen's troubles, as investors look for better returns elsewhere. This situation has led to a record level of bets against the yen, raising concerns about further declines if the currency passes the critical 152 level against the dollar.

NatWest CEO streamlines executive team to boost efficiency

Paul Thwaite, the newly confirmed CEO of NatWest Group, has made significant changes to the executive team, reducing its size from 15 to 10 members, in a bid to simplify operations and enhance the bank's efficiency. These adjustments come amid warnings of potential revenue declines due to falling interest rates. The reshuffle includes permanent appointments and several key departures, with the aim of creating a more integrated business structure. This strategic move is part of Thwaite's focus on cost-cutting and improving returns, following his official appointment after Alison Rose's departure. Additionally, the UK government's ongoing reduction of its stake in NatWest marks a move towards full privatization, indicating a significant shift in the bank's ownership and governance structure.

Premium credit card may cost more after Visa-Mastercard deal

In a groundbreaking deal between Visa and Mastercard and countless US shops, your next purchase with a fancy credit card might come with an extra charge. This change, aimed at cutting down on swipe fees by $30 billion over five years, could make shoppers think twice at the till. It marks the end of a long battle over fees that have become a huge expense for merchants. Now, using high-end cards like Visa Infinite or Mastercard World Elite could cost you more, as shops are allowed to pass on the extra fees these cards carry. While it's a win for retailers looking to save on costs, cardholders might have to weigh the benefits of their premium perks against these new surcharges.