SocGen plans job cuts at Paris HQ to slash costs

Societe Generale SA is set to cut around 900 jobs at its head office in France, aiming to reduce costs under CEO Slawomir Krupa’s new plan. This move will affect about 5% of their Paris headquarters staff but will steer clear of forced layoffs, with union consultations wrapping up by the second quarter. It's part of a wider trend among global banks trimming their workforce as the boost from rising interest rates fades. Krupa is on a mission to save €1.7 billion by 2026, aiming to make the bank more efficient, especially through IT improvements. Despite past job cuts affecting morale, SocGen is pushing forward with efforts to streamline operations and bolster capital, with eyes on upcoming quarterly earnings.

UK businesses plan price hikes amid lingering energy crunch

Four in five UK companies are set to raise their prices in the next couple of years due to high energy bills, a recent survey by PwC reveals. Despite a drop from their peak, energy prices in Europe remain high after the crisis sparked by Russia’s invasion of Ukraine. The survey, involving 750 organisations, found that 81% are planning to increase prices, a bit more than in the past two years. Energy costs still hover above the norm, affected by ongoing volatility. The Bank of England is keeping an eye on rising prices, wary of cutting interest rates due to persistent services inflation. In short, UK households might need to brace for costlier days ahead as businesses adjust to the energy climate.

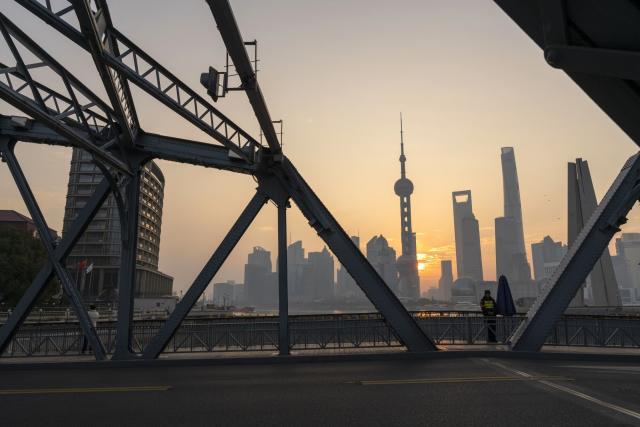

China's stock market swings wildly amid promises to stabilize

Chinese stocks experienced another day of sharp fluctuations, following a significant downturn last week, despite the government's promise to stabilize the market. After a shaky start, the CSI 300 Index managed to climb by over 1%, while smaller cap indexes still faced downward pressure. The turmoil has wiped out nearly $7 trillion in market value since early 2021, with recent losses deepened by concerns over margin calls and forced liquidations. The China Securities Regulatory Commission has vowed to combat abnormal market swings and illegal trading practices but has offered few concrete details, leaving investors sceptical. Amid these challenges, some see the market's dramatic moves as a potential sign of reaching a bottom, while calls grow for a substantial stabilization fund to restore confidence.