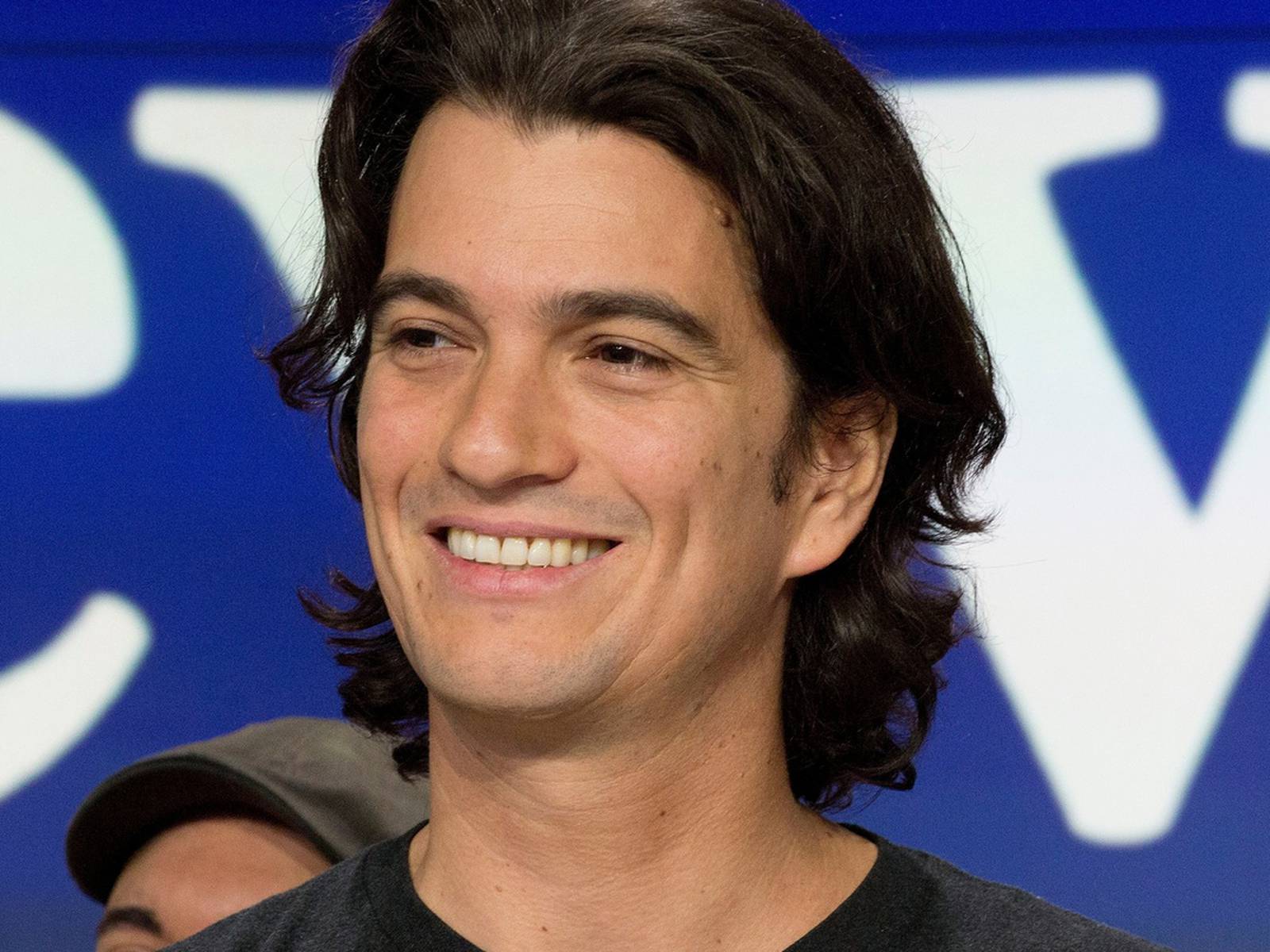

Adam Neumann eyes WeWork rescue amid bankruptcy

Adam Neumann, alongside investors including Dan Loeb's Third Point, is considering a bid to buy WeWork out of bankruptcy. Since December, Neumann's startup, Flow, has sought details from WeWork to make an offer, aiming to secure a deal that benefits all involved. Despite previous attempts to stabilize the company, including a proposed $1 billion capital raise and a recent offer of $200 million in bankruptcy financing, information access has been a challenge. WeWork's current bankruptcy plan involves transferring ownership to its senior creditors, leaving others potentially empty-handed. Amid these developments, Neumann remains a billionaire, illustrating the highs and lows of WeWork's journey from a co-working giant to seeking a financial lifeline.

Italy takes bold step with new capital-markets reform

Italy's lower house has passed a capital-markets reform bill aimed at enhancing the Italian stock market's appeal and safeguarding family-owned firms from unsolicited buyouts. This legislation, now awaiting Senate approval, introduces a notable change to the board appointment process for listed companies, moving away from the long-standing practice where the outgoing board could nominate its successors. This move, while controversial, is celebrated by some as a step towards preventing perpetual reappointments. The bill also targets the return of companies that relocated their headquarters, like Stellantis NV and Ferrari NV, back to Italy.

Pimco predicts BOJ to end negative rates

Pimco anticipates the Bank of Japan (BOJ) to abandon its negative interest rate policy as early as March, planning multiple rate hikes throughout the year. This shift is seen as a response to sustained inflation driven by wage growth. The firm suggests incremental rate increases to reach 0.25% by year's end, advising a cautious stance on Japanese bonds. Meanwhile, Pimco adopts a neutral view on Chinese bonds, expecting modest rate cuts, and shows a preference for Australian and emerging market investments, highlighting potential in sectors like toll roads and utilities.