AI is about to shake up the education industry big time, not just by shrinking costs, but also by ramping up profits with cooler and more effective products that attract new customers and keep existing ones coming back for more.

To spot the biggest potential winners in this industry, Morgan Stanley’s analysts checked out who’s got the cash, who’s diving deepest into AI, who’s got the smartest team and the best data, and who can really cash in on this tech. Then, they peeked at who’s dishing out content, who’s got a solid rep, and who’s keeping clients happy and hooked.

They pinpointed five stocks with big potential and lower risks: Docebo, Vitru, Coursera, Afya, and TAL Education.

Sometimes investors focus too much on risks and too little on opportunities. When ChatGPT burst onto the scene, investors sold off shares in education companies like Chegg, believing the new technology would edge these firms out. Those stocks have still not fully recovered. But, here’s the thing about generative AI: harnessed by education firms, it could actually accelerate their growth. Morgan Stanley’s taken a look at the industry’s top players to see how you can profit from its AI evolution…

How will genAI impact education?

We’re used to seeing sectors like tech and medicine leap forward at lightning speed, while education jogs the same old track. But that seems like it’s about to change: generative AI (genAI or, more broadly, AI) is quietly rewriting the rules of education and might be about to turn its classic classroom, lecture-style teaching on its head. And it’s not just a shift: it’s a seismic change.

The technology could ditch traditional education’s one-size-fits-all approach, adapting to individual learning styles and needs, and making education more effective and engaging. AI enhances accessibility, enabling students with different abilities and in remote locations to access quality education. The technology’s real-time feedback and assessment can accelerate learning, while AI-powered administrative tools could free up educators to focus more on teaching.

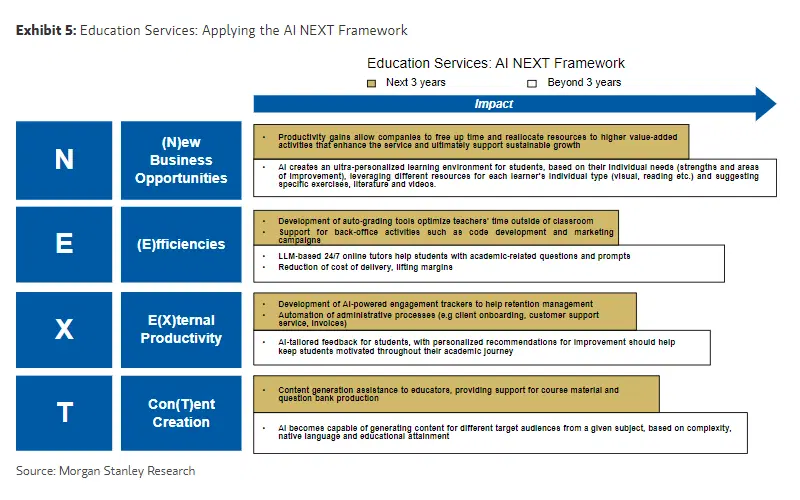

With all that going for it, it’s no wonder AI is reshaping the education sector’s business model too. Morgan Stanley’s global tech team analyzed its impact using its NEXT framework – a real stretch of an acronym that stands for analyzing the new business opportunities it creates, the efficiencies, as well as the impact it has on external productivity and content creation.

“NEXT” is the acronym Morgan Stanley’s using to analyze how generative AI will create meaningful opportunities for education companies. Source: Morgan Stanley.

They found that genAI will benefit companies in two major ways.

First, it’ll enhance productivity while reducing labor needs, leading to hefty cost savings. The technology can automate tasks with tools like virtual assistant chatbots for administrative duties, online tutors for academic inquiries, and automated assessment of homework. Its capabilities extend to generating course materials, reducing the workload on educators and diminishing the need for extensive teaching staff. Case in point: Coursera managed to slash the cost of translating a course into a different language from roughly $10,000 to around $20. In the long run, AI is expected to liberate resources, allowing companies to channel them into growth and innovation, focusing on higher-value products and services.

Second, it’ll improve product quality and open new revenue streams, potentially boosting company revenues. This technology enables the creation of more personalized and valuable learning experiences, which could potentially lead to increased sales, the ability to command higher prices, and improved customer retention. And it could also pave the way for novel revenue sources by monetizing AI-based solutions like proprietary large language models (LLMs).

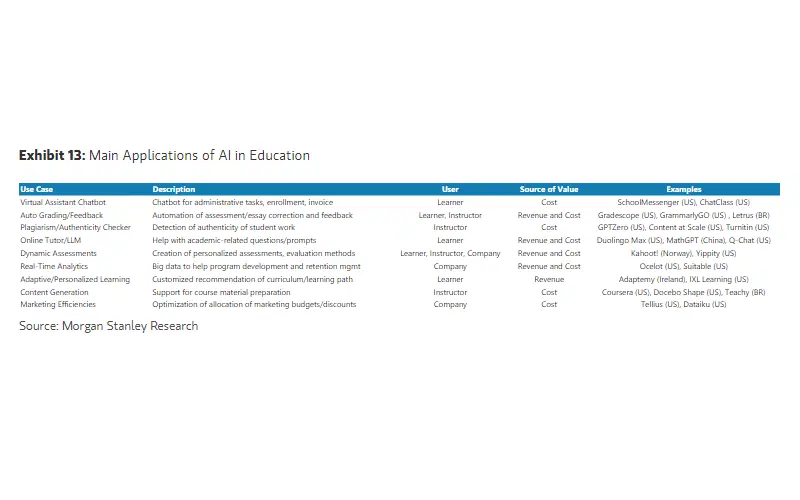

What it comes down to is this: there are lots of ways for education companies to use genAI to achieve stronger profit growth. Here’s some of what it can do:

GenAI has numerous use cases, and the potential to not just cut costs, but also to boost revenues. Source: Morgan Stanley.

That being said, diving into the world of GenAI in education is like riding a big wave – exciting, but tricky.

There’s a huge competitive risk, both from within the industry and from AI players. Chegg saw that risk up-close this year: its subscriber growth fell dramatically with the rise of AI tools like ChatGPT. Plus, increased reliance on digital platforms raises significant data security and privacy concerns: potential breaches could sharply erode trust and damage company reputations. And there’s a worry that AI-augmented education will raise questions about the depth and quality of learning, compared to traditional, human-centric methods. These factors could lead to a complex regulatory environment, where governments might enforce stringent regulations to ensure ethical AI usage, protect data privacy, preserve teaching jobs, and uphold high educational standards.

So, it’s important to remember that while the technology’s got some shiny perks, it may not be all smooth sailing.

What’s the opportunity here?

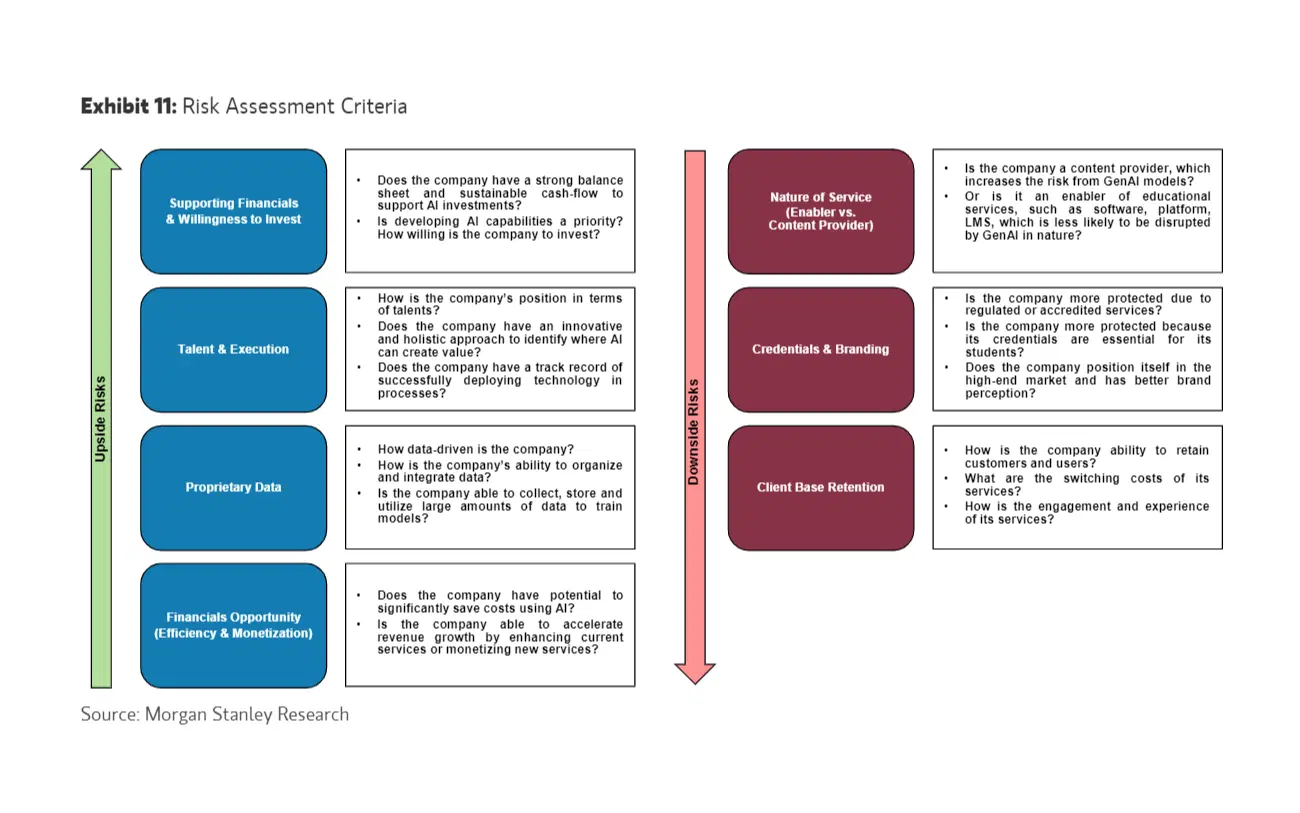

You can think about what’s happening with genAI and the education biz like a game of high-tech musical chairs: some companies will grab a seat and play on, while others will miss out. Luckily, Morgan Stanley’s brainiacs have a two-step game plan to spot the hotshots in this AI revolution.

In step one, they’re scrutinizing these four things: first, how strong the company is financially, and how willing it is to invest in AI, second, whether the company has the talent and an approach to successfully execute an AI strategy, third how data-driven the company is, and fourth how much AI can do to impact the firm’s bottom line.

And in step two, they’re using three criteria to estimate how exposed the company is to risks, determining: first, whether it’s a content provider (and more likely to be replaced by AI) or a content enabler (less likely), second, how strong its brand and credentials are, and third, how good it is at retaining clients.

Morgan Stanley’s framework allows it to analyze each company’s threats and opportunities. Source: Morgan Stanley.

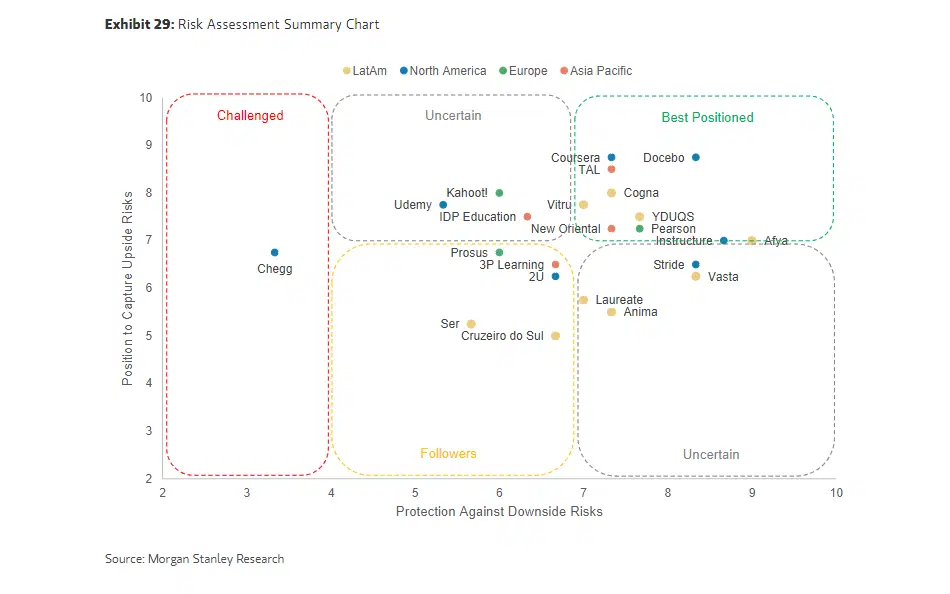

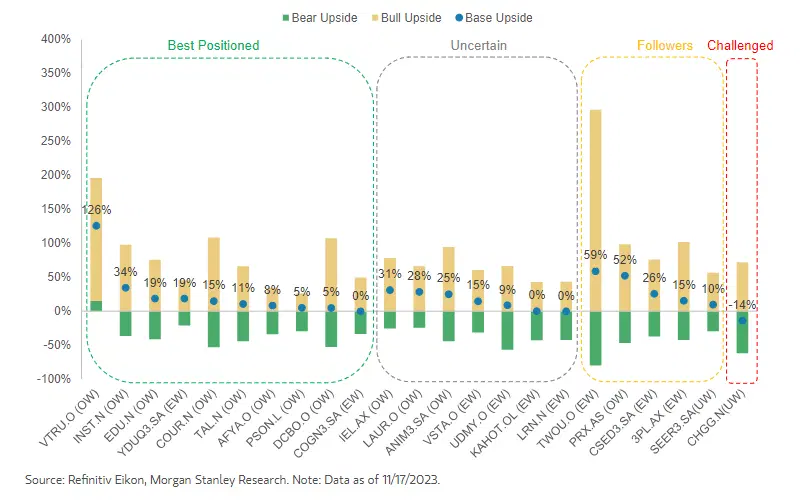

Here’s where that leaves each of the industry’s companies:

Companies at the top-right show the biggest potential upside (vertical axis), and the lowest potential risks (horizontal axis). Source: Morgan Stanley.

From those results, Morgan Stanley identified five stocks with attractive risk-reward and little AI upside priced in:

Docebo is the most highly ranked company based on the framework, acing the AI class with both high upside potential and minimal risks. It’s already a global leader in learning management software, and its AI-powered platform is setting the pace in workforce training. Docebo isn’t just an innovative AI early adopter; it’s financially solid, with a robust balance sheet and healthy cash flow. And, being a software-centric company adds an extra layer of defense against AI-related challenges, positioning Toronto-based Docebo at the top of the pack.

Vitru might not match Docebo’s grade point average, but it stands out in Morgan Stanley’s analysis, boasting the highest returns in both their “base” and “bear” scenarios. A dominant player in Brazil’s digital education scene, Vitru is skillfully navigating the AI terrain, offering a range of programs – from distance undergrad courses to digital grad programs, and even med schools. Despite its significant debt, Vitru’s strategic use of AI, particularly through cost-effective LLM tutors and personalized learning paths, positions it to reap substantial benefits.

Coursera is well positioned to connect learners with top-tier educators and institutions. Armed with a rich array of courses from elite universities, it’s set to harness AI for slicker operations and custom course experiences. As GenAI reshapes the corporate world, US-based Coursera is also gearing up to be a go-to for reskilling and B2B training.

Afya is a Brazilian powerhouse in medical education, offering everything from residency prep to lifelong learning programs, as well as services for physicians and the healthcare sector. Afya’s got a strong balance sheet and in-house AI expertise. And it’s set to enhance its educational services and digital offerings for doctors, which promises to boost its revenue further. The strong demand and limited supply of medical personnel make this sector especially resistant to potential downside risks.

TAL Education specializes in non-academic tutoring and content solutions, and the China-based company is now laser-focused on enhancing its AI capabilities. Central to this goal is MathGPT, a proprietary LLM that it plans to integrate into smart learning devices, which it will then roll out to the public, marking a significant step in its data-driven education strategy.

The potential returns for education stocks, according to Morgan Stanley analysts’ bull case, base case, and bear case. Source: Morgan Stanley.