As a chocolate aficionado, I know a mouthwatering opportunity when I see it, and that’s why I’ve got my eyes on Barry Callebaut. The world’s biggest chocolate maker has seen its stock melt by 45% since 2022, after a series of unsavory setbacks. But beneath the wrapper here lies a tantalizing mix of factors: a resilient market, an expected cooling in cocoa prices, a plan to cut millions in costs, and a stock that’s already trading at a 60% discount to its historical average. Add in the rise in outsourcing trends from giants like Hershey and Mondelez, and you just might have a recipe for some sweet returns. Let’s have a look.

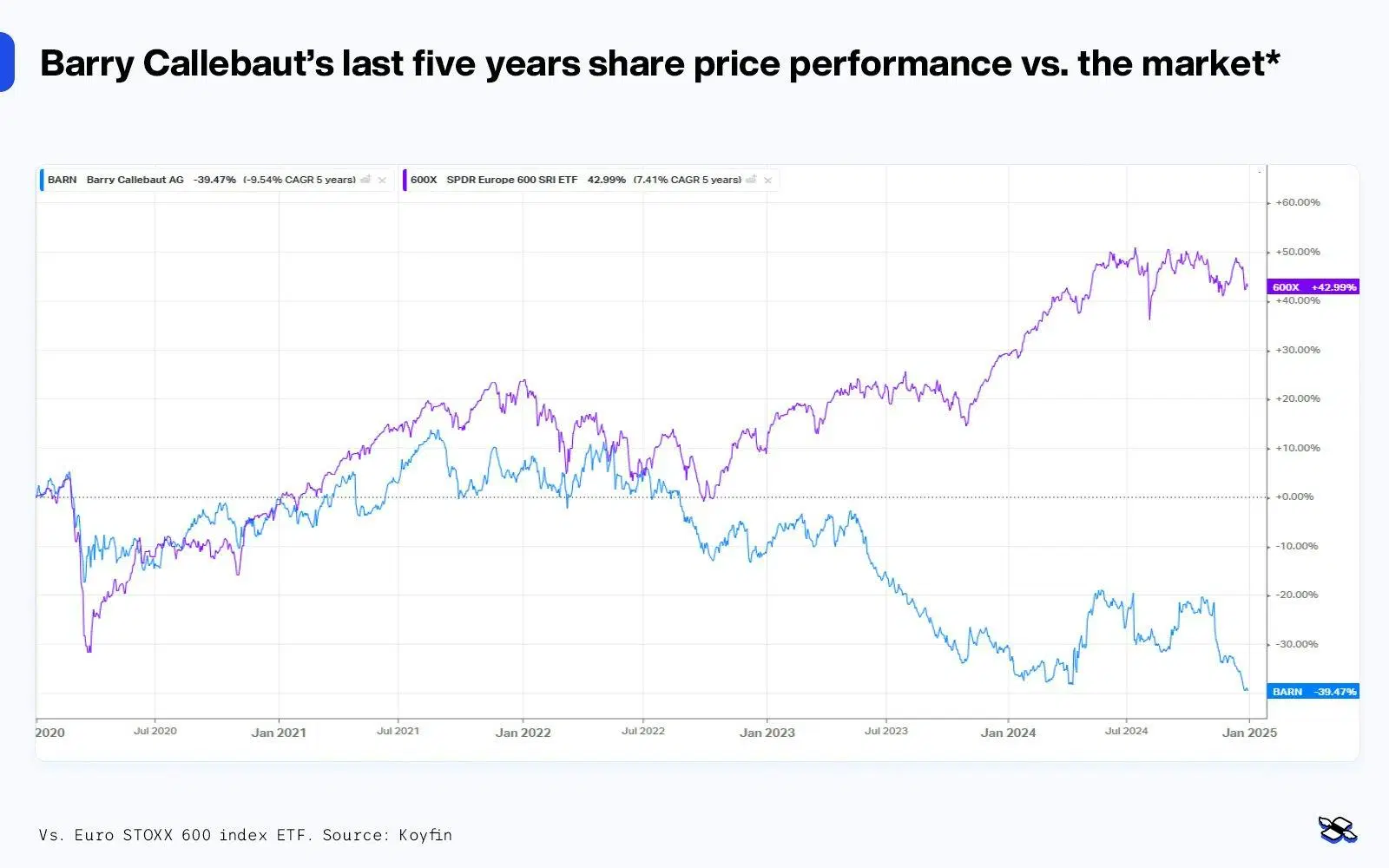

Barry Callebaut’s recent share price performance versus the Euro STOXX 600 ETF. Source: Koyfin.

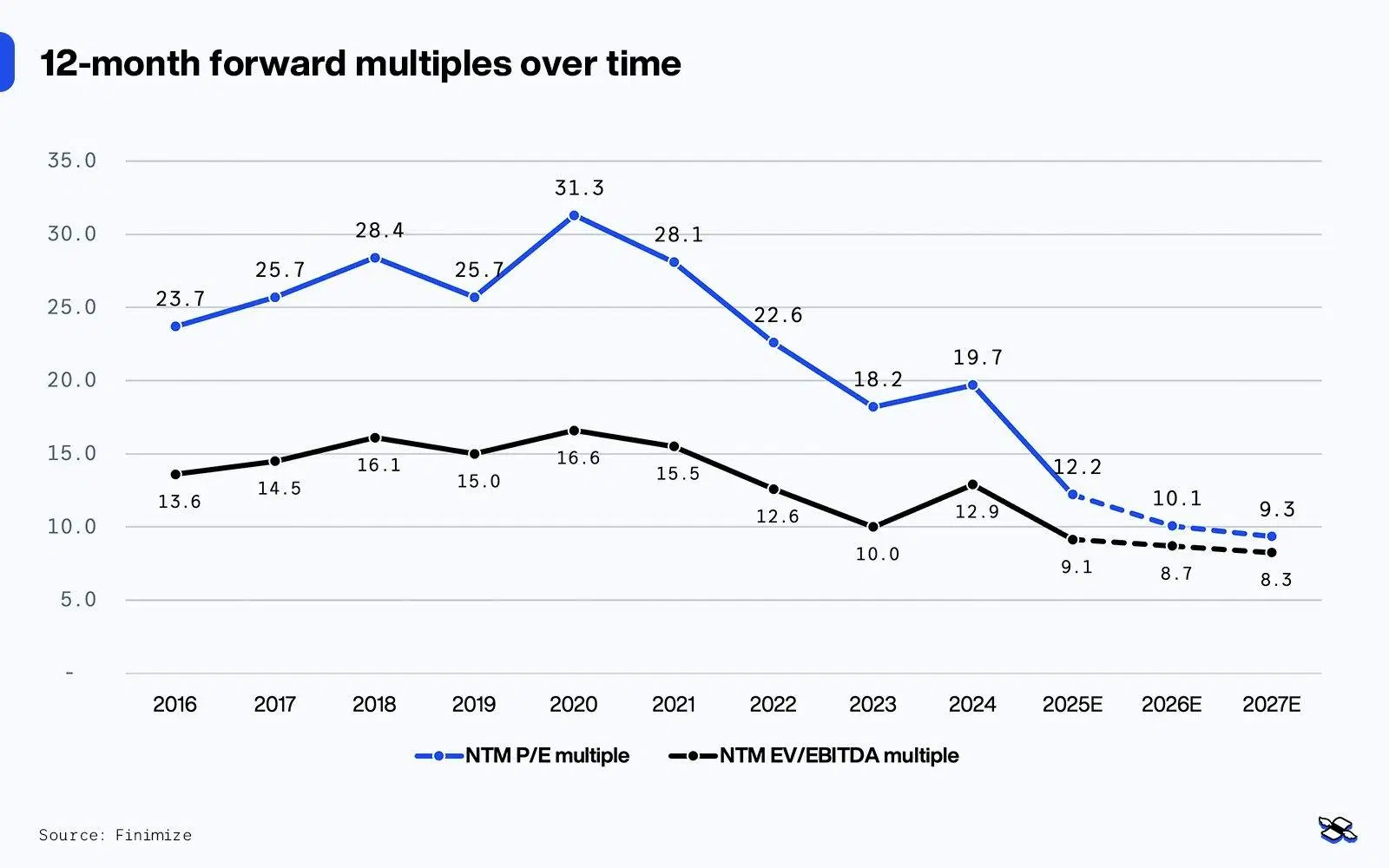

Barry Callebaut’s valuation over time. The blue line plots its price-to-earnings (P/E) ratio, and the orange plots its enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA). The firm has experienced a significant valuation reset since 2022, creating an appealing opportunity for investors in a stock with the potential to double. Source: Finimize.

Thesis

Barry Callebaut, the global leader in chocolate and cocoa production, presents a tempting investment opportunity, with its stock down 45% since 2022. And here’s the thing: that dip has happened because of a series of setbacks, but the structural resilience and long-term growth potential of the chocolate market remain intact, positioning Barry Callebaut for a notable recovery.

The company’s “BC Next Level” restructuring plan is set to deliver 250 million Swiss francs ($275 million) in annual cost savings, with the bulk of these efficiencies expected to materialize this year. These savings will provide a critical cushion against elevated cocoa prices, bolstering profitability and operational resilience.

Cocoa prices, which reached unprecedented highs in 2024, are expected to stabilize this year and next, offering relief to Barry Callebaut’s demand, cash flows, and balance sheet. And that makes this a potentially pivotal moment to invest in a high-quality company at what appears to be trough valuation levels.

Skyrocketing cocoa prices have forced smaller chocolate processors to shut operations or pursue acquisition deals. That disruption presents Barry Callebaut with potential opportunities to expand its market share by consolidating the industry and solidifying its leadership position.

The recent volatility in cocoa prices has highlighted the risks involved in in-house chocolate processing for major clients like Hershey and Mondelez, whose cash flows are seriously tied up in inventory during price spikes. And that may well accelerate the outsourcing of chocolate production to specialized players like Barry Callebaut, creating long-term growth potential.

Barry Callebaut trades at a forward price-to-earnings (P/E) ratio of 12.2x, representing a 60% discount to its three-year historical average (2019–2021). Based on a DCF and exit multiple valuation approach, the stock offers an attractive 80% upside, creating a rare opportunity to invest in a market leader at trough valuation levels.

Risks

Although cocoa prices are expected to stabilize in 2025 and 2026, prolonged price volatility or sustained record highs could continue to strain Barry Callebaut’s cash flows and balance sheet. The company’s cost-plus pricing model does offer some insulation, but persistently high prices might suppress chocolate demand, particularly in price-sensitive emerging markets.

Operational disruptions – such as factory shutdowns or supply chain issues – could present serious financial and reputational risks. A 2022 salmonella incident highlighted how certain bumps in the road can erode customer confidence and market share.

Barry Callebaut’s net debt increased quite a bit in 2024 because of higher financial needs related to those elevated cocoa prices. While much of that debt is tied to inventory and is expected to normalize, rising interest rates or liquidity constraints could limit financial flexibility and delay debt reduction efforts.

Shifting consumer preferences toward non-chocolate snacks or substitutes could reduce long-term demand for Barry Callebaut’s core products.

Global economic slowdowns, instability in key cocoa-producing countries, and currency fluctuations could disrupt supply chains and dampen chocolate demand.

So what exactly is the firm’s business model?

Barry Callebaut is a leading Swiss-Belgian chocolate and cocoa producer that supplies major food brands like Nestlé and Mondelez, alongside premium artisanal clients. The $7.5 billion company is “vertically integrated” – meaning, it owns other players across its supply chain – which gives it control over every production stage, driving better quality and efficiency. The firm is focused on emerging markets, premium chocolate, and expanding market share, making it well-positioned for long-term growth in a resilient industry.

Barry Callebaut AG is a Swiss-Belgian company that’s a big player in the chocolate and cocoa world. With a market value of around $7.5 billion, it’s one of the top chocolate and cocoa product makers globally and handles everything from sourcing raw materials to creating finished chocolate products.

The company operates predominantly in the B2B space, working with clients across the food industry. Some of its biggest customers include well-known names like Nestlé, Mondelez, Hershey, and Unilever. But it also serves artisans, chocolatiers, pastry chefs, and food service companies with high-end gourmet products designed for premium markets. While chunky contracts bring steady income because of its long-term nature, the gourmet side usually earns better margins because of its premium pricing.

Barry Callebaut runs a fully integrated business model, powered by 62 factories and 25 Chocolate Academies worldwide. A fully integrated model means the company controls every stage of the process – sourcing cocoa beans, processing them into chocolate, and distributing the final products– ensuring quality, efficiency, and cost control at every step. This setup supports big-scale production, while also helping train and develop the company’s artisan and gourmet clients, ensuring they stay at the top of their game.

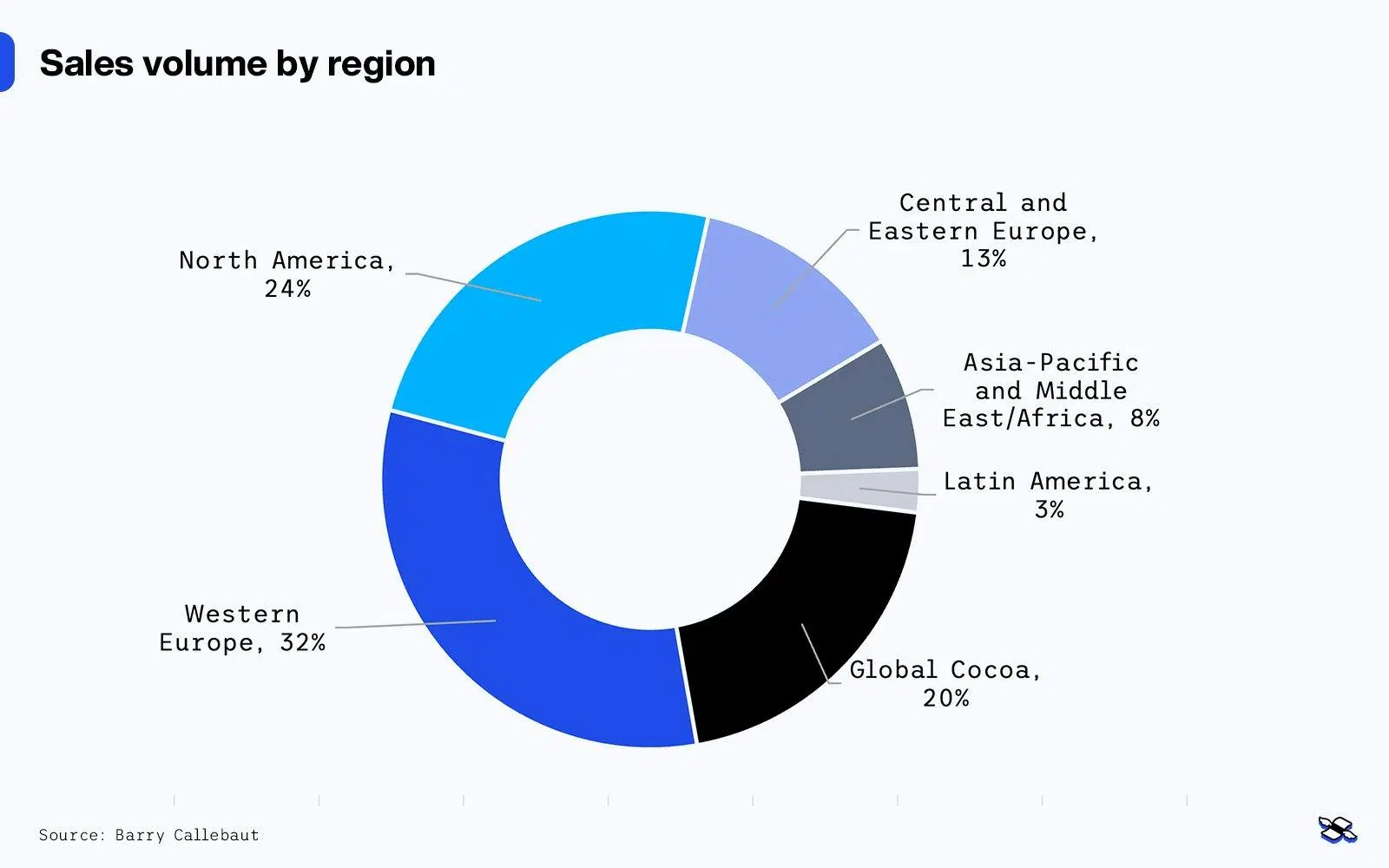

The breakdown of the company’s sales volume by region. Source: Barry Callebaut.

Its operations are structured into two major divisions: global chocolate and global cocoa. Here’s a look inside each one.

First, global chocolate.

This division has two segments: food manufacturers and gourmet and specialty products. The food manufacturers segment supplies food makers with the industrial chocolate that’s used in everything from candy bars to baked goods and drinks. The gourmet and specialties segment, meanwhile, focuses on premium chocolate and cocoa products tailored for artisanal and professional clients, like chocolatiers, bakers, and high-end hotels.

The global chocolate division is the biggest contributor to Barry Callebaut's revenue, with the food makers segment alone accounting for approximately 67% of total sales volume in the last fiscal year.

The global chocolate division – which includes revenue from food manufacturers (blue) and gourmet (orange) clients – accounts for most of the company’s sales. The rest comes from its cocoa division. Source: Barry Callebaut.

Next, its global cocoa division.

This division handles everything cocoa-related: sourcing raw beans, processing them, and selling cocoa powder, butter, and liquor. It supplies both Barry Callebaut’s own chocolate production needs and external clients in the food and beverage industries.

The four areas below are some of the company’s core growth drivers:

Emerging markets. Asia-Pacific, Latin America, Africa, and other regions offer a lot of growth potential as rising middle-class populations fuel higher chocolate consumption.

The premiumization of chocolate. An expanded appetite for high-end chocolate boosts Barry Callebaut’s higher-margin product lines, driving profitability.

Mutually satisfying partnerships. Long-term collaborations with major global food manufacturers ensure consistent sales growth, with these partners relying on Barry Callebaut’s dependable supply chain and innovative product offerings.

Captive market share gains. Barry Callebaut has continued to grow by increasing its share of existing customers' chocolate needs. Essentially, once companies partner with Barry Callebaut, they tend to rely on the firm for an even chunkier portion of their chocolate supply. This strengthens customer loyalty and drives revenue growth.

Per-capita chocolate consumption by country (2023). Source: Statista.

So why has the firm’s stock taken a beating then?

Barry Callebaut's stock has been on a rocky road in recent years, after a salmonella outbreak, a stagnant sales run, and a jump higher in cocoa prices. The 2022 contamination mishap disrupted operations and eroded customer confidence, but the company eventually recovered with improved crisis management. Sales volumes then flatlined in 2023, after a pandemic-era boom. Finally, in 2024, escalating cocoa prices strained cash flow, but the company’s restructuring plan is positioned to help bring it back to profitability.

The sweet giant’s share price peaked in mid-2021 and then dropped by nearly 50%, underperforming the broader European market (STOXX 600) by more than 60%.

The company experienced more than two decades of strong performance before a series of challenges disrupted its momentum. Source: Koyfin.

The company had previously enjoyed a rich period of growth, consistently delivering mid-to-high single-digit annual growth rates. But then three recent, interrelated challenges began weighing on its performance.

First, salmonella contamination.

In June 2022, Barry Callebaut uncovered a severe salmonella outbreak at its Wieze facility in Belgium. The discovery at the world’s biggest chocolate factory led to an immediate production shutdown and a recall of contaminated batches, which caused huge disruptions across global supply chains. The Wieze facility is a cornerstone of Barry Callebaut’s operations and its shutdown was expensive. The firm had to make costly sanitization, quality control, and regulatory upgrades – and halting its production lines resulted in lost sales and unfulfilled contracts. But the biggest blow was the loss in customer confidence and the damage to the company’s reputation as a standard-bearer for quality assurance.

My view: The firm has mostly recovered from this setback. The quick response and transparency in handling the crisis turned what could have been a disastrous, company-ending event into a demonstration of operational resilience. That said, the financial and reputational costs prompted sweeping management and operational changes, culminating in the “BC Next Level” restructuring plan the following year.

Second, stagnant sales volumes and operational disruptions.

In 2023, the company’s sales volumes stagnated at just above two million tons, missing market expectations despite higher prices aimed at offsetting cost rises. Operational disruptions, including a temporary halt at a Mexican facility, further compounded the issue. What’s more, the gourmet and specialties segment – a traditionally high margin driver – saw weakening demand. Investors interpreted the flat sales figures as a signal of structural weaknesses and questioned Barry Callebaut’s growth prospects.

Global chocolate confectionery growth has recently shown signs of a slowdown. Source: Barry Callebaut.

My view: The slowdown aligns with the recent normalization of chocolate demand after exceptional growth during lockdowns. Structurally, there is no reason to doubt that chocolate demand is in structural decline, and as cocoa prices stabilize, volumes are likely to recover.

And third, escalating cocoa prices.

By 2024, cocoa prices soared to unprecedented levels, nearly doubling to approximately $12,540 per metric ton. As a vertically integrated chocolate producer, Barry Callebaut was able to pass some of these costs onto customers through price increases, but it couldn’t fully offset the impact.

That sharp increase in input costs put immense pressure on cash flows and debt levels. Free cash flow turned negative, at 2.3 billion francs ($2.5 billion), and the company had to issue almost as much in bonds, effectively tripling its net debt burden.

My view: The timing of the company’s “BC Next Level” restructuring has been fortuitous, helping cushion the blow of soaring cocoa costs. As prices begin to stabilize, these cost-saving measures should deliver improved profitability and growth in 2026.

What’s next for chocolate prices?

Cocoa prices have hit record highs because of poor harvests, aging trees, disease, and underinvestment in farming. Prices could stabilize in 2025, but structural challenges likely will persist and supply relief from new farming initiatives won’t materialize until 2027 at the earliest.

Cocoa prices have wreaked havoc on the industry so far, and because that’s Barry Callebaut’s single biggest input cost, you’ll want to come to grips with cocoa price trajectories to get a sense of the firm’s growth outlook, profitability, and cash and debt levels.

Cocoa production is heavily concentrated in West Africa, with Ivory Coast and Ghana responsible for approximately 60% to 70% of global output. Unlike many other commodities, which are often cultivated on sprawling industrial plantations, cocoa is mostly grown on smallholder farms. This fragmented structure introduces unique vulnerabilities into the global cocoa supply chain.

Cocoa bean production is concentrated in the hands of only a few countries. Cocoa bean production by country in 2023. Source: Statista.

The recent surge in cocoa prices marks a historic departure from long-term trends. Throughout much of the past decade, cocoa prices hovered in a relatively stable range of $3,000 to $3,500 per ton. However, starting in early 2023, after some poor mid-crop harvests in West Africa, prices began to shoot higher. By early 2024, cocoa futures had surged past $10,000 per ton, eventually hitting an all-time high of approximately $12,500 per ton.

Cocoa prices have more than quadrupled since early 2024. Source: Trading Economics.

At the root of this price rally, there are some compounding challenges. For a start, extreme weather patterns – oscillating heavy rains and prolonged droughts – have severely stressed cocoa plantations. And diseases such as the swollen shoot virus and black pod disease have devastated crops, further crippling yields. Plus, many of West Africa’s cocoa trees are getting on in years, so that’s making them produce less. All these issues are worsened by chronic underinvestment in fertilizers, pesticides, and modern farming practices. Making matters more difficult are the government-mandated fixed farmgate prices in Ivory Coast and Ghana, which don’t exactly incentivize farmers to reinvest in their crops.

The impact of high cocoa prices on the industry

The repercussions of these structural weaknesses have been felt across the cocoa supply chain, impacting upstream and downstream players. The chocolate industry operates in two primary segments. There are downstream processors such as Barry Callebaut, Cargill, and Olam, which source and process raw cocoa into semi-finished products. And there are upstream manufacturers, such as Hershey and Mondelez, which process their own cocoa while marketing branded chocolate products directly to consumers.

For Barry Callebaut, rising cocoa prices have led to steep cost inflation and operational uncertainty. Sure, the company’s hedging strategies and supplier relationships helped cushion the blow, but those measures are by no means foolproof. And smaller chocolate processors, lacking Barry Callebaut's scale and financial flexibility, have meanwhile struggled to secure affordable supplies, with some even ending production altogether.

Major chocolate manufacturers, such as Hershey and Mondelez, have also faced mounting cost pressures. Although both companies were largely hedged for 2024, securing adequate supplies for 2025 is still a top concern. So they’ve signaled plans to jack up prices – a move that could hurt demand in price-sensitive markets.

Consumer effects

With prices rising, manufacturers have responded with a range of strategies. Some have reformulated their products to shrink their cocoa content, taken “shrinkflation” steps (selling smaller products at the same price), or introduced non-chocolate alternatives. In extreme cases, manufacturers have experimented with cocoa-free chocolate substitutes.

Chocolate is important to people like me. And its consumption has historically been resilient during economic downturns, but the magnitude of recent price hikes has posed an unprecedented risk of demand destruction. That’s especially true in emerging markets, where consumers tend to be more price-sensitive. Should substitution effects – like the pivot toward non-chocolate snacks – take hold, it could have lasting consequences for the industry.

Cocoa price outlook

Cocoa prices have likely peaked now, but they’re expected to stay high for a while, with significant volatility driven by weather events, disease outbreaks, and market speculation. While some analysts predict a degree of stabilization in 2025, this hinges on the success of upcoming harvests. The bigger, structural issues – aging trees, underinvestment in farming practices, and poor price incentives – are deeply entrenched and won’t be resolved easily.

There is, however, some cause for optimism. In regions such as Brazil and Ecuador, big-scale replanting initiatives and investments in high-yield farming techniques are already underway. That said, cocoa trees take three to five years to mature, so any meaningful increase in supply won’t happen before 2027.

What is Barry Callebaut worth?

Barry Callebaut’s is trading for far less than its historical averages – potentially offering 80% to 110% upside based on a discount cash flow (DCF) and multiples valuation. And cost-saving initiatives, stabilizing cocoa prices, and market share gains have positioned the company for a recovery, with projected earnings before interest and taxes (EBIT) growth of 15% in 2026. What’s more, the firm’s short-term debt challenges should normalize as inventory cycles improve.

To determine its value, let’s start with a discounted cash flow (DCF) model: I built a template you can use here. Just note that you’ll have to make a copy of the template before you can actually play around with the cells and change the assumptions. With the DCF model, combined with a 15x EV/EBITDA exit multiple, I estimate a target price of 2,200 Swiss francs ($2,418) for Barry Callebaut over the next 12 to 18 months, using an 8% weighted average cost of capital (WACC). That’s the average rate that the business pays to finance its assets, calculated by averaging the rate of all of its sources of money – bonds and stocks – weighted by the proportion of each component.

Summary of DCF valuation assumptions. Source: Finimize.

Currently, the stock trades at a forward 12-month P/E multiple of 12.2x, which is a 60% discount to its three-year historical multiple (2019 to 2021). Similarly, its 12-month forward EV/EBITDA multiple of 9.1x represents a 40% discount to its historical average. The valuation chart below outlines a range of price targets based on different methodologies, indicating an upside potential of 80% to 110%.

Barry Callebaut’s target stock price range, based on different valuation methodologies. Source: Finimize.

The cost-plus model and its implications

Barry Callebaut operates under a cost-plus pricing model, where raw material cost changes (in this case, cocoa) are passed along directly to customers with a fixed margin on top. This structure effectively protects its profit from commodity price swings but fundamentally alters the nature of revenue growth.

When cocoa prices rise, Barry Callebaut's revenue increases (as higher costs are reflected in elevated selling prices). Conversely, when cocoa prices fall, revenue declines, even if sales volumes remain stable. As a result, revenue growth is mostly driven by cocoa price trends rather than by operational efficiency or market share expansion.

For Barry Callebaut, volume growth remains the primary driver of profitability, because increased volumes flow directly through to the bottom line. I project 9% growth this year, driven by 2% volume growth and 7% commodity price adjustments. Beyond 2026, I anticipate average annual volume growth of just 4%, supported by:

Easier year-over-year comparisons (or “comps”)

Improved chocolate demand as prices normalize from historical highs

Market share gains from ongoing industry consolidation

Higher captive chocolate supply gains through stronger integration with key customers

Barry Callebaut still holds a relatively small share of outsourced chocolate production. Significant opportunities remain to capture additional market share, particularly from captive production by fast-moving consumer goods (FMCG) giants. Source: Barry Callebaut.

Profitability: Absolute EBIT versus EBIT margin

Under Barry Callebaut’s cost-plus model, the EBIT margin loses significance during periods of extreme cocoa price volatility. Instead, absolute EBIT becomes the key financial metric. So for 2025, I expect a decline in EBIT margin due to persistently high cocoa prices but project a 3% increase in absolute EBIT. By 2026, I expect EBIT to rise by 15%, reflecting a combination of cost savings, operational efficiency, and a gradual normalization of cocoa prices.

Long-term, Barry Callebaut is targeting an EBIT margin of 10%, but it’s important to note that this figure remains heavily influenced by the commodity price pass-through structure. More meaningfully, EBIT growth is forecasted to stabilize in the mid-to-high single digits over time. And that’s a pretty tempting longer-term level.

Debt and cash flow dynamics

Barry Callebaut's net debt increased significantly in 2024, rising from $1.3 billion to $3.6 billion. Two things drove that change. The first was net outflows in working capital, with over $2 billion tied up in higher inventory costs driven by elevated cocoa prices. The second was hedging related margin calls, with upfront cash payments and margin requirements straining the company’s bottom line.

And, look, those dynamics aren’t unusual for a vertically integrated cocoa processor like Barry Callebaut, which operates on an extended working capital cycle. As an agricultural commodity, cocoa beans are bought in hefty quantities months before they’re actually processed and sold. This creates a natural lag between cash outflows (procurement) and cash inflows (sales revenue).

Barry Callebaut’s free cash flow (FCF) breakdown by key components: operational (blue), investment capital expenses and restructuring investments (green), and bean price (orange). Source: Barry Callebaut.

Naturally, I spotted that sharp increase in debt, but I’m not too concerned about Barry Callebaut’s leverage position. Much of this debt is tied to higher inventory valuations, and that will eventually convert back into cash (albeit with a lag). And over the next few years, the working capital cycle is expected to normalize, improving free cash flow.

In my DCF valuation, I focused on adjusted free cash flow (FCF) to account for these seasonal and timing effects, providing a clearer picture of the firm’s long-term financial health.

In summary, while I’m a notable 11% below consensus on 2025 earnings per share, I’m on average 7% higher on 2026 and 2027 estimates. And that’s driven by:

Recovery in cocoa prices

Market share gains through consolidation

Improved chocolate demand as cost pressures ease

Barry Callebaut’s vertically integrated structure, combined with its strategic cost-saving initiatives and volume-driven growth, positions this chocolate giant for a stronger financial performance in the medium to long term. Although short-term challenges remain, the company’s fundamentals remain intact, offering upside potential as cocoa prices find their feet and operational efficiencies filter through to the bottom line.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.