The US economy is still flexing its muscles, and that show of strength is shining through the latest round of quarterly updates. Corporate earnings growth is set to show over 6% annual growth for the first quarter of this year.

Companies don’t seem as panicked about inflation now: they’re dipping into their cash reserves for stock buybacks and dividend payments. Over $180 billion in stock buybacks were announced just this season and dividend growth is pegged at 8% this year.

Firms are also splurging big on AI infrastructure projects as they gear for growth next year – and all that spending could benefit a range of sectors like energy, commodities, and utilities.

Businesses are the ultimate economic weather vanes, so if you’re feeling leery about that scene, you might want to check out where they’re pointing. And since most US stockshave recently delivered their quarterly earnings updates, this is a perfect time to do just that. JPMorgan Private Bank has been watching the reports closely, and it says these five themes cropped up a lot.

1. Profits are on the up.

Earnings growth has been in the green for three straight quarters now, with this latest period set to shine with a gain of over 6%, compared to a year ago. This healthy perk-up also reflects a little less stress in the C-suite. Back in 2022, about 90% of S&P 500 companies were dropping the dreaded I-word (that is, “inflation”) into their earnings calls. This season, only about half have brought it up. Far fewer have mentioned “economic slowdown” too. With those worries fading, companies are shifting their focus back to growth and innovation. About 40% of companies have said “AI and machine learning” – up from 15% a year ago – hinting that there’s more faith in the health of the economy and the transformative powers of the new technologies.

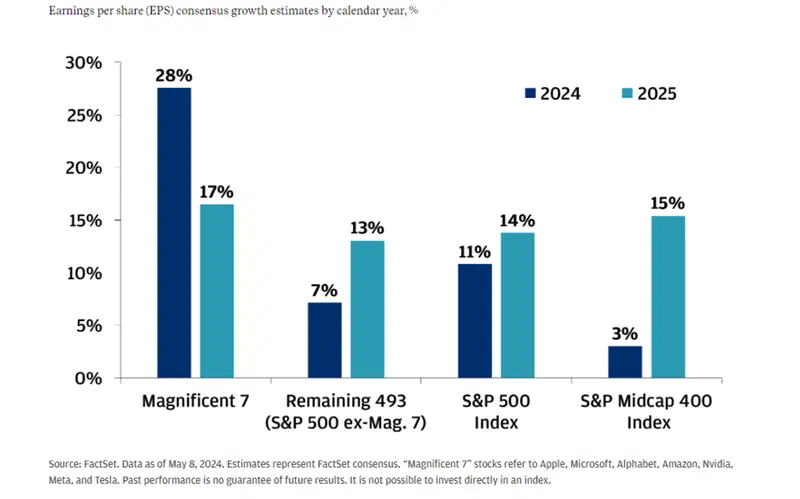

In fact, all US stock sectors are beating profit estimates this quarter. Tech is still the big dog driving this momentum – and for good reason. But the wealth is spreading. And JPMorgan Private Bank predicts that things will keep climbing next year: it’s forecasting double-digit earnings growth for the Magnificent Seven and S&P 500’s other, less-talked-about 493 companies.

Earnings per share consensus growth estimates for different groups of stocks, for 2024 and 2025. Sources: FactSet, JPMorgan Private Bank.

2. The consumer is getting picky.

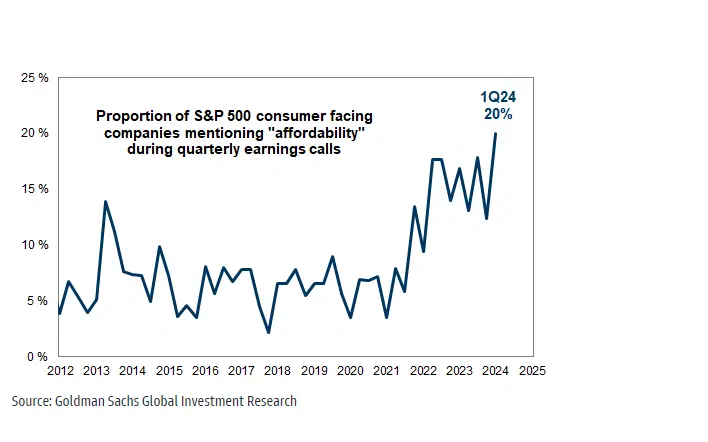

Consumersare becoming savvier in their spending habits. Financial firms in the S&P 500 are seeing strong consumer spending and sturdy bank balances. But the vibe has become more cautious among companies that deal directly with consumers. They say shoppers are getting pickier and are opting more often for lower-priced items. Companies are following suit – focusing more on the affordability of their products and services.

Proportion consumer-facing S&P 500 companies who mentioned “affordability” during quarterly earnings calls, over time. Source: Goldman Sachs Investment Research.

That said, certain sectors like cruise lines, airlines, and entertainment companies are still basking in strong consumerdemand. In fact, a whopping 83% of consumer staples companies reported better-than-expected results this last time out, the highest among all sectors, showing that things aren’t as bad as people feared.

Sure, there are signs that consumers are tightening their belts and feeling the pinch from higher prices. But that’s pushed companies to compete on delivering value.

3. The shareholder is getting paid.

Companies are more confident and they’re splurging with their extra cash. And they’ve got options for what to do with their money: paying down debt, making strategic investments, or rewarding shareholders.

That last one was the big treat this quarter – and it can’t hurt that S&P 500 firms are sitting on a cash mountain – about $2 trillion between them. More companies have snapped up their own stocksat a faster clip, which means the “profitpie” gets cut into fewer slices, adding more value for current investors. Over $180 billion in stock buybacks have been announced in the first quarter alone, signaling increased confidence. Stock buybacks have stayed above their ten-year average for 13 consecutive quarters, keeping stocks hopping. Just look at Meta and Alphabet – they’ve both green-lit their first-ever dividendsthis quarter and authorized more stock repurchases. And Apple announced a stupefying $110 billion buyback, the biggest in its history and the market’s.

And don’t forget dividends. Management teams have been laser-focused on boosting shareholder value. That’s why dividend growth is at 8% this year, up from roughly 5% last year, and considerably higher than the ten-year average of 6.6%.

4. More companies have big spending plans.

Companies are on a spending spree, and capital expenditures (capex) are getting a big boost.

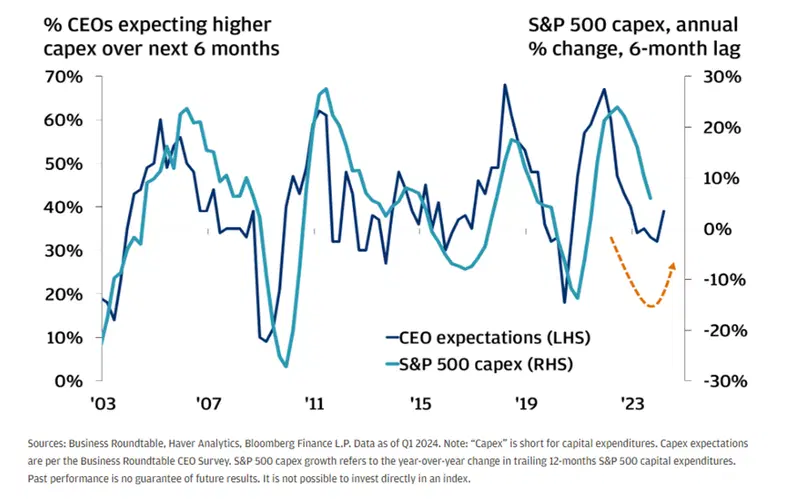

By reinvesting in their own businesses, they’re betting on a boost to future profits. So far, S&P 500 capex for the latest quarter is 7% higher than it was a year ago. And that’s nearly double the growth that we saw just one quarter before. Big tech companies are driving this surge – most of them with hefty AI investments. Amazon, Microsoft, Alphabet, and Meta are expected to shell out around $200 billion in the next 12 months.

And it’s not just the tech giants. The Business Roundtable’s CEO survey shows nearly 40% of CEOs expect to spend more in the next six months – a jump from 32% last quarter.

The percentage of CEOs who expect higher capex over the next six months (left-hand axis) vs. the S&P 500 capex annual percentage change (right-hand axis). Sources: Business Roundtable, Haver Analytics, Bloomberg, JPMorgan Private Bank.

5. Rising tides don’t lift all boats.

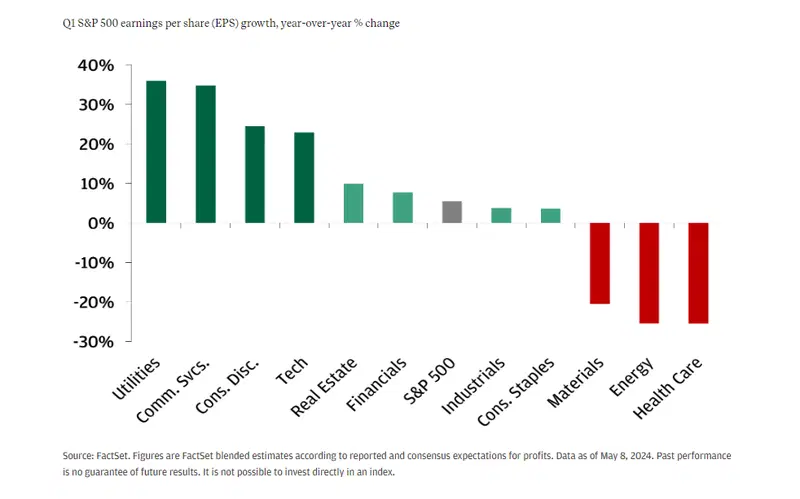

Sure, earnings growth has been strong and has benefited a wider range of companies in this latest go-round, but not everyone sailed the wave equally. Eight out of 11 S&P 500 sectors saw profitgains, but the growth varied widely. Utilities soared with over 35% growth, while consumerstaples barely scraped by with 3.5%. Meanwhile, healthcare, energy, and materials all saw declines.

The S&P 500’s year-on-year earnings per share in the first quarter of 2024, percentage change by sector. Sources: FactSet, JPMorgan Private Bank.

So what does it all mean for you?

If the latest company updates tell you anything, it’s that the US economy is still flexing its muscles. Although the tech rally isn’t showing any signs of slowing down, it might be smart to spread your bets beyond the Magnificent Seven. Yes, some of those giants are raking it in from increased capex, but that doesn’t mean you’ll want to sleep on the 493 other companies in the S&P 500 – they’re gearing up for growth next year. And there’s probably a major capex splurge on AI infrastructure just ahead, which could boost sectors like energy, commodities, and utilities so there’s every reason to want to diversify your holdings beyond simply tech.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.