$158,000 would be the price of bitcoin if we equate the crypto’s total market value with the total value of gold held privately for investment purposes, and that’s where JPMorgan’s calculations begin.

The investment bank recommends then dividing that $158,000 by the expected bitcoin-to-gold volatility ratio to arrive at an estimated fair value that factors in the crypto’s higher risk.

But the exercise underestimates the true value of bitcoin, because it ignores the fact that the crypto has more utility than gold and that its supply is more capped.

About two years ago, JPMorgan unveiled an analysis aimed at determining bitcoin’s “fair value”. And with renewed interest in the world’s biggest cryptocurrency and its recent rise above $50,000, it seems like a good time to revisit that. Because while the investment bank’s valuation framework has certain flaws, it’s a great way to think about bitcoin’s price, and where it might go from here.

How did JPMorgan calculate bitcoin’s fair value?

First, the investment bank calculated a long-term theoretical price target for bitcoin by assuming that its total market value is equal to that of all the gold that’s held privately for investment purposes. That assumption was based on the growing argument that bitcoin is “digital gold” – i.e. a store of value in the digital age. After all, the crypto shares many similar characteristics with the shiny metal: it’s in limited supply, it’s durable, it’s fungible, it can be divided into smaller “nuggets” (Satoshis), and so on.

According to the World Gold Council, there are 212,582 metric tons of mined gold in the world with a total market value of almost $14 trillion. But it wouldn’t exactly be fair to equate bitcoin’s total market value with this figure: almost half of that gold is used as jewelry, and another 17% is held by central banks as reserves. Bitcoin, you might be disappointed to hear, can’t be used as jewelry, and we probably won’t see major central banks holding cryptocurrencies as part of their reserves anytime soon (but never say never).

That’s why the figure JPMorgan is focused on is the amount of gold held privately for investment purposes – that is, gold held by individuals and investors (both retail and institutional) as a store of value. The figure includes all the bars held by gold ETFs too, since private individuals and investors ultimately own them.

So how much gold is held privately?

According to the World Gold Council, there are 47,454 tons of gold held privately for investment purposes. This is what they refer to as “bars and coins (including gold-backed ETFs)” on this data page (note that it was previously called “private investment”).

One ton is equal to 32,150.7 troy ounces, which – at today’s gold price of around $2,030 a troy ounce – brings the total value of gold held privately to $3.1 trillion. And if we divide this by the total number of bitcoins in circulation (19,631,856 as I’m writing), we get a theoretical price target of around $158,000 per coin.

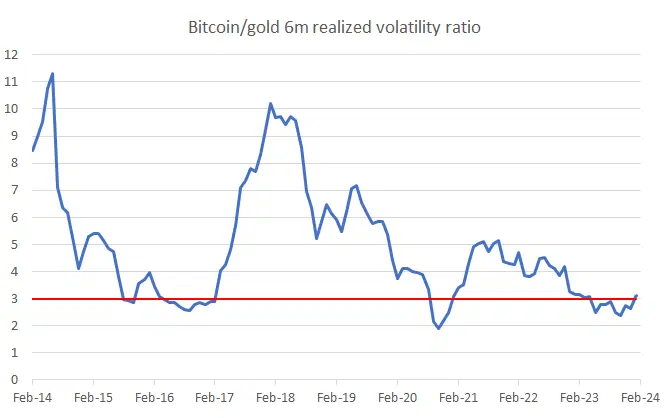

Now here’s where things get interesting. The assumption JPMorgan makes is that investors wouldn’t allocate an equal amount of bitcoin in their portfolios for store-of-value purposes as they would gold because, let’s face it, bitcoin is a lot more volatile – and therefore a lot riskier – than the metal. And in fact, bitcoin’s price movements today are around three times more volatile than those of gold. (Note that volatility here is calculated as the annualized standard deviation of bitcoin’s/gold’s movements over the past 180 trading days – i.e. six months).

Ratio of six-month realized volatility for bitcoin vs. gold. Source: Finimize.

If, hypothetically, bitcoin’s volatility were the same as gold’s, then JPMorgan’s framework would assume that the crypto’s fair value is the $158,000 per coin we calculated earlier. But in reality, bitcoin is more volatile, so the bank instead divides this number by the expected bitcoin-to-gold volatility ratio in the future. That means the higher bitcoin’s relative volatility is, the lower its fair value, according to this framework.

When JPMorgan first did this analysis two years ago, the ratio was at 5x, and the bank anticipated it would decrease to 4x in the future and remain roughly stable at that level. So, sure, adjusting bitcoin’s theoretical price by 4x would value the coin at $158,000/4 = $39,500.

However, the situation has since evolved: over the past two years, the bitcoin-to-gold volatility ratio has steadily decreased, as the crypto’s swings have become milder over time. The ratio currently stands at 3x, which would value bitcoin at $158,000/3 = $52,667, which is not too far from its price today.

And if you expect the ratio to stabilize at, let’s say, 2x in the future, then JPMorgan’s framework would put bitcoin’s fair value at $79,000. But feel free to play around with your own assumptions here.

What is JPMorgan missing?

While the investment bank’s framework is a good starting point, I think there are two key things it doesn’t factor in.

1. Bitcoin has more utility than gold.

If you own some gold bars or an ETF tracking the shiny metal, then you probably already know that there’s not much you can do with your gold. In contrast, there’s a load of stuff you can do with bitcoin. First, you can use it as a form of payment. According to Coinmap, more than 30,000 merchants worldwide currently accept bitcoin, including brands like Subway, Starbucks, BMW, Coca-Cola, and Microsoft. Second, you can easily and cheaply send bitcoin to another person on the other side of the globe without a middleman or any risk of censorship, making it an efficient method of money transfer.

Third, you can deposit your bitcoin at centralized or decentralized lending platforms to earn interest. Gold not only generates zero yield, but it also incurs storage costs in the form of custody and insurance fees if you hold it physically. And finally, you can use your bitcoin as collateral on certain lending platforms to borrow other cryptocurrencies – including stablecoins, whose values are pegged to fiat currencies like the US dollar. One fintech firm even allows you to use your bitcoin as collateral to take out a mortgage.

These are just some examples of bitcoin’s use cases, with more being created all the time. The point is that bitcoin is more useful than gold, and that utility is worth something. Worth a lot, actually: PayPal – whose value, like bitcoin, is tied up with electronic payments – is valued at $63 billion, while Wise and Western Union – whose value, like bitcoin, are tied up with money transfer – are valued at $11 billion and $5 billion, respectively. JPMorgan’s framework completely ignores this additional value.

2. Bitcoin’s supply is more capped.

Consider this: after the “halving” event due this April, 3.125 new bitcoins will be mined every ten minutes, the equivalent of 164,250 new coins every year. That represents just a 0.8% annual expansion to bitcoin’s supply base, which is less than half the 1.7% rate at which gold’s supply is increasing (with roughly 3,600 tons being mined every year).

What’s more, there are an estimated 59,000 tons of proven gold reserves in the ground. That means gold’s supply is set to eventually increase by 28% – or more if we discover new gold reserves. Meanwhile, there’s a hard limit of 21 million bitcoins, which means bitcoin’s supply can increase by roughly 7% from here, but no higher. Some people even argue that bitcoin’s true supply will fall shy of that 21 million, as users forget their digital wallet keys, accidentally send crypto to dead-end addresses, and so on.

In other words, with new bitcoins being generated at half the rate of gold, and with its total supply projected to rise by only 7% (compared to the metal’s 28%), the math skews in the OG crypto’s favor. And bitcoin’s naturally constrained supply should, at least in theory, boost its value over gold by making it a rarer asset.

-

Capital at risk. Our analyst insights are for information purposes only.