India’s economy is booming, but China’s has been slowing – and it’s a trend that’s expected to continue for a while. It’s no wonder, then, that India’s stocks have been seeing huge inflows, while China’s have been seeing outflows.

With China’s stocks now looking temptingly cheap, the question for investors is whether those shares are a value trap or whether fortune might favor the brave.

Super investors and insiders have been buying up Alibaba stock lately – with it trading at cheap valuations, holding buckets of cash, creating loads of free cash flow, and boasting an attractive buyback program.

Indian and Chinese markets are at opposite ends of the popularity spectrum right now, with India’s stocks attracting lots of affection and China’s drawing a cold shoulder. But popularity is a fickle thing. And now some investors may already be writing China back into its good books. Let’s take a look at what’s happening, and find out where you might find opportunities…

What’s going on with Chinese stocks?

Money flows drive asset prices and the past few years have seen billions of dollars say goodbye to Chinese stocks and hello to Indian ones. Mighty Wall Street banks Goldman Sachs and Morgan Stanley currently list India as their top investment destination for the coming decade. Morgan Stanley predicts it will become the third-largest stock market in the world by 2030, behind only the US and Europe.

The reason comes down to economic growth: when it strengthens, the stock market typically follows suit. China’s economy has been more sluggish of late, dragged down by a property crisis and rising geopolitical tensions. India’s economy, on the other hand, has clearly been working out.

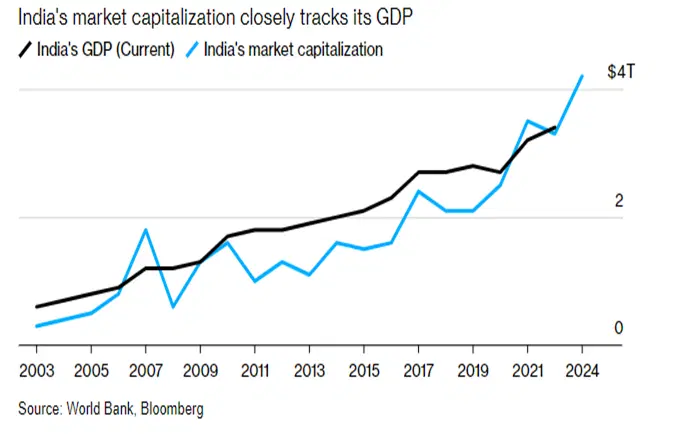

India’s market capitalization closely tracks its gross domestic product (GDP) – a measure of the value of the goods and services produced by an economy. Sources: World Bank, Bloomberg.

Over the past two decades, India’s gross domestic product (GDP) – basically, the broadest measure of the goods and services produced by the economy – and its stock market capitalization rose in tandem, climbing from $500 billion to $3.5 trillion. And investors expect that growth to continue, so they’re willing to pay a premium valuation for its shares. The MSCI Indian stock index trades at a pretty punchy 20x forward price-to-earnings (P/E) ratio (higher than the S&P 500) and a 3.5x price-to-book ratio. And that’s pretty spendy.

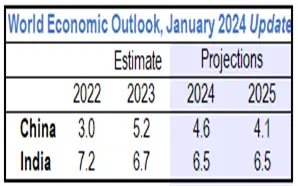

In China, the picture is not quite as bright, with economic growth expected to slow to 4.6% this year, and to 4.1% next year.

Projections for economic growth for India and China, by year. Source: International Monetary Fund.

China is forecast to grow faster than a lot of big economies, and its stocks do change hands at cheap valuations, nonetheless investors have been flocking out of – rather than into – Chinese shares.

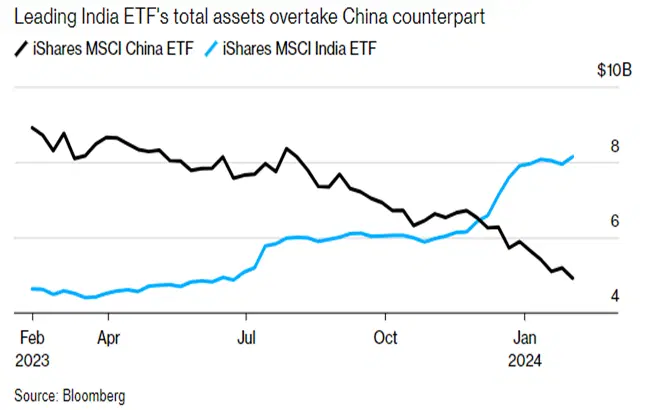

Total assets under management for a leading China ETF (the iShares China ETF) and a leading India ETF (the iShares India ETF). Source: Bloomberg.

The chart shows the outflow of money from the iShares China ETF (ticker: MCHI; expense ratio: 0.59%) and the inflows into the iShares India ETF (INDA; 0.65%) over the past year. It’s a chart that mirrors what’s been happening in the wider market.

We’ve seen this kind of thing play out before: in the late 1980s, for example, Japan’s property bubble burst, sending worries far and wide, just as China’s real estate market is doing now. A key difference, however, is in the valuations that investors see. Japanese stocks back then were trading around a 60x P/E ratio, which was rich even at the time. Chinese stock market, on the other hand, is trading cheap, at around 9x P/E.

Now, that doesn’t necessarily mean it’s the right time to buy. Some people have been warning that Chinese stocks are just a value trap – that is, an asset that’s going cheap relative to its history or peers, but that’s likely to fall even further in value. And so far they’ve been right.

But it’s worth remembering that fortune favors the brave – and that things can seem darkest before the dawn.

Where’s the opportunity, then?

Well, some of it may be in Indian stocks. The country’s growth story is almost impossible to ignore, which makes the iShares MSCI India ETF seem like a smart, easy bet. The more difficult question is whether to gamble on Chinese stocks now, and if so, how much to wager and where.

So there’s a few things to keep in mind here. First, Chinese authorities have continued to try to boost the stock market, restricting short-selling, replacing the chief securities regulator, and buying up shares in locally listed ETFs and the country’s biggest banks. And in the past year that’s led to the highest volume in “call” options traded on the iShares China Large-Cap ETF (FXI; 0.74%). Call options can be useful if you are positive about an asset but don’t want to risk too much of your own money in case you’re wrong. For a relatively modest price, they can give you the right, but not the obligation, to buy the asset at a specific price and time in the future. The downside is that they tend to be riskier instruments, since they’re much more volatile in price than stocks or ETFs.

Second, the government is aiming its stimulus at China’s “A shares”, which aren’t as readily available to foreigners. However, the iShares MSCI China A UCITS ETF (CNYA; 0.4%) does offer exposure to those.

And third, some of the world’s biggest money managers have been buying Alibaba recently. Michael Burry of “The Big Short” fame increased his position by 50%, making it the biggest position in his stock portfolio; David Tepper of Appaloosa increased his holding by 21%; and Howard Marks of Oaktree bought in. Jack Ma, Alibaba’s retired co-founder increased his stake, and Joe Tsai, Alibaba’s current chairman and co-founder, bought a hefty $157 million via his family investment company.

Now, if I’m being cynical, I might say that just because some famous investors and the company co-founders bought Alibaba stock last quarter doesn’t mean you and I have to follow suit. That group can fall into a value trap just like anyone – and, in fact, with the price where it is now, they might have all have lost a bit of money on those latest buys. On the other hand, those big investors are pretty sharp and the co-founders know the business better than most. So it just might be that they’re onto something.

If nothing else, Alibaba is cheap. It trades at an 8x P/E ratio – and it’s got a boatload of net cash on the balance sheet (that’s cash minus debt) – about $62 billion of it, according to Goldman Sachs. So if you factor in that cash, you come up with a P/E ratio (excluding cash) of just 5.3x. That’s pretty low.

Plus its huge cash pile, along with its ability to create about $23 billion in free cash every year, allowed it to boost its share buyback program by $25 billion when it announced quarterly results recently. Despite that good news and its cheap valuation, the stock still slumped, weighed down by all the gloomy sentiment about Chinese stocks.

Now this might not tell you whether this is the darkness before the dawn, or whether this is all a big value trap, but at these levels, you just might decide that a little Alibaba or Chinese stock exposure is worth the risk.

-

Capital at risk. Our analyst insights are for information purposes only.