A lot of people criticize market timing strategies and suggest buy-and-hold as the safer, more dependable play. But buy-and-hold is no picnic: you can go through extreme losses and wait ages to recover. It takes rock-solid faith to stay the course when things are uncertain.

It may sound controversial, but to make the journey smoother, you could try a simple market timing strategy: using a quick-and-dirty momentum filter to tell you when to exit and enter markets.

Over the years, this simple strategy would have dramatically improved your risk-adjusted returns, making it a lot more likely that you’d have stayed the course and actually achieved the long-term attractive compounded returns you were looking for.

Trying to time the market gets a bad rap. People dismiss the whole strategy of attempting to pinpoint market turning points so you can profit from its tops and bottoms. It seems hard to do, so they debunk it as a fool’s errand, touting the virtues of the buy-and-hope (sorry, buy-and-hold) approach. Well, I disagree. Market timing techniques can work, and they can make your portfolio a lot more robust. Let me show you how.

Wait, what’s wrong with buy-and-hold?

Nothing really. In theory, buy-and-hold is a great strategy – maybe even the best. And in theory, there’s no difference between theory and practice. But in practice, there is. (Thanks, Yogi Berra, for that quote).

What the buy-and-hold crowd doesn’t tell you, is that:

You’ll suffer massive losses along the way. (And, the longer your investment horizon, the sharper those losses might be). We’re talking losses that would make you seriously question your investment and increase the risk that you might pull the plug at the worst possible time. Losses that would demand exceptional rebounds just to break even, losses that could wipe out years of steady gains.

You’ll have to accept losses that last for years. It took the Nasdaq 16 years to recover from the dotcom crash. Other markets have taken decades to stage a comeback after a fall.

You’ll need rock-solid faith to stay the course. Your long-term conviction will be put to the test when market doubts looms largest.

Frankly, it’s a lot. Buy-and-hold might be among the surest ways to achieve attractive long-term compounded returns, but it’s by no means easy. It’s a roller coaster ride of uncertainty, with your emotions doing everything they can to try to derail you.

So is a market timing strategy better, then?

If by “better” you mean likely to see smaller losses and quicker recoveries, and keep you clear of emotional decision-making, then I’d say yes.

I know: it’s a controversial opinion. Everyone tells you that you shouldn’t try to time the market. Plus, there’s the adage that says time in the market is better than timing the market. But let’s be clear: this isn’t about making haphazard guesses or shorting every stock out there because of a few gloomy signals. I’m talking about a disciplined, emotion-free approach – one that doesn’t hinge on crystal ball forecasts or deep dives into economic indicators. It’s a strategy that will also tell you when to exit the fray and, crucially, when to re-enter it. In that context, timing isn’t so much about predicting the future. It’s more about aligning your moves with the market’s current rhythm.

The strategy’s simple: to follow it, you would buy and hold your investments during an uptrend. But when the tide turns and markets dip into a downtrend, signaling stormier times, you’d switch to cash, sidestepping the turbulence until it clears.

The best part is you don’t need a PhD in physics to know whether the market is trending up or down. You could just use a quick-and-dirty momentum filter, checking whether prices are higher today compared to four, eight, and 12 months ago. If the answer is “no” more than once, you could assume the market is on a downtrend and shift into cash.

Can such a simple strategy work?

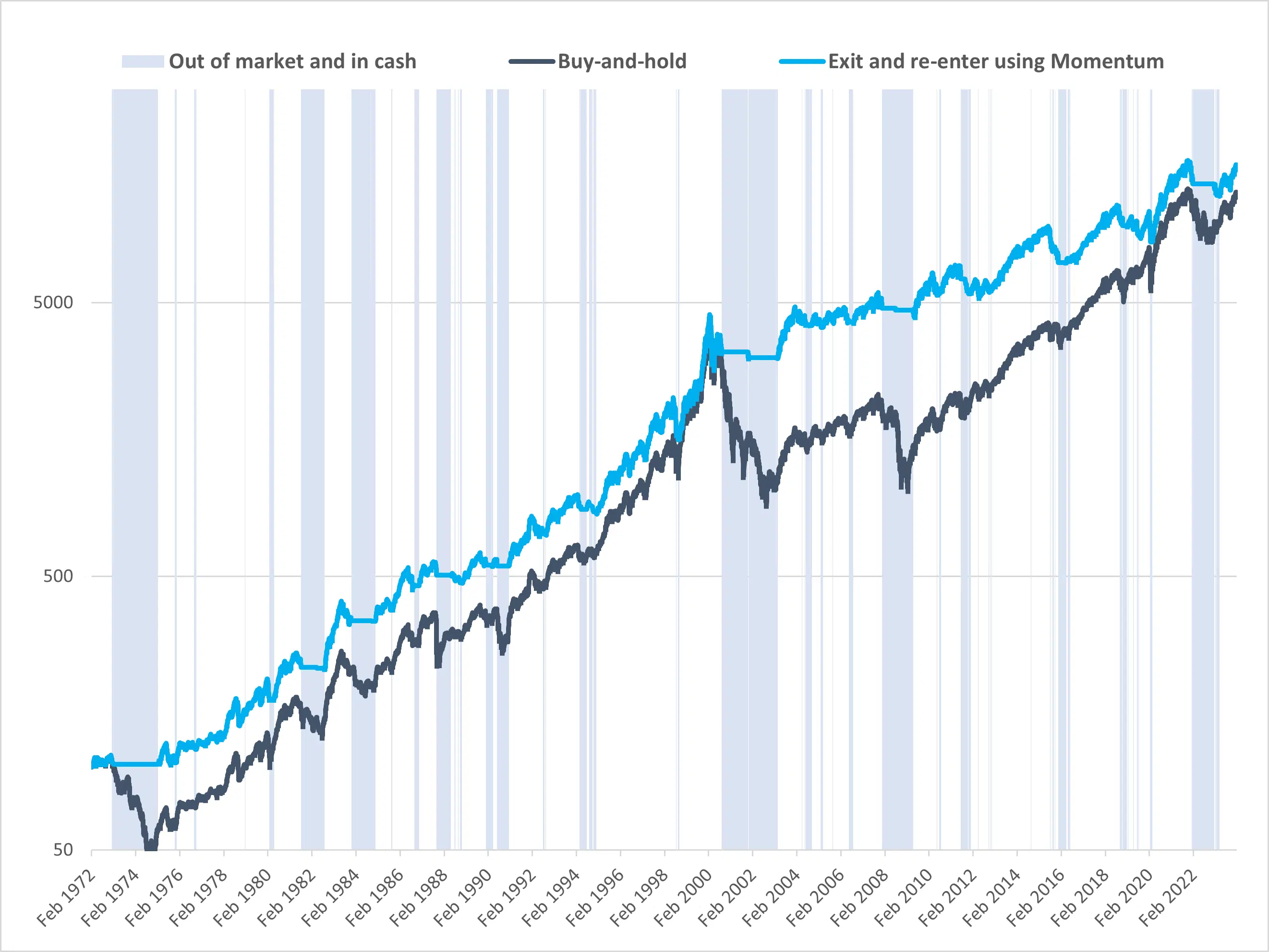

A picture is worth a thousand words, so here’s how this uncomplicated timing strategy would have performed for Nasdaq investors over the past half-century, compared to a buy-and-hold tactic.

This timing strategy would have outperformed buy-and-hold for Nasdaq investors, both in terms of returns and risks, over the past 52 years. Source: Finimize.

Impressively, you’d have achieved slightly higher returns by using the timing indicator than by buying and holding stocks. Now, true, the sample period I used begins with a crash, the signal I chose to calculate momentum was arbitrary, and I didn’t factor in transaction costs (for the record, they wouldn’t have changed the results as you’d have received few signals). So, yes, using a different indicator or testing on other markets or time periods would have produced different results.

But this strategy is about more than just returns: it’s also about smoothing out the ride. Imagine, for example, slicing a nightmare loss from a heart-stopping 80% to a more manageable sub-40%, or bouncing back from the dotcom crash by 2003, instead of 2015. And, what’s more, this isn’t a one-hit-wonder scenario. Over the past 52 years, buy-and-hold investors have endured seven stomach-dropping falls of more than 30%, but market-timers have experienced just two.

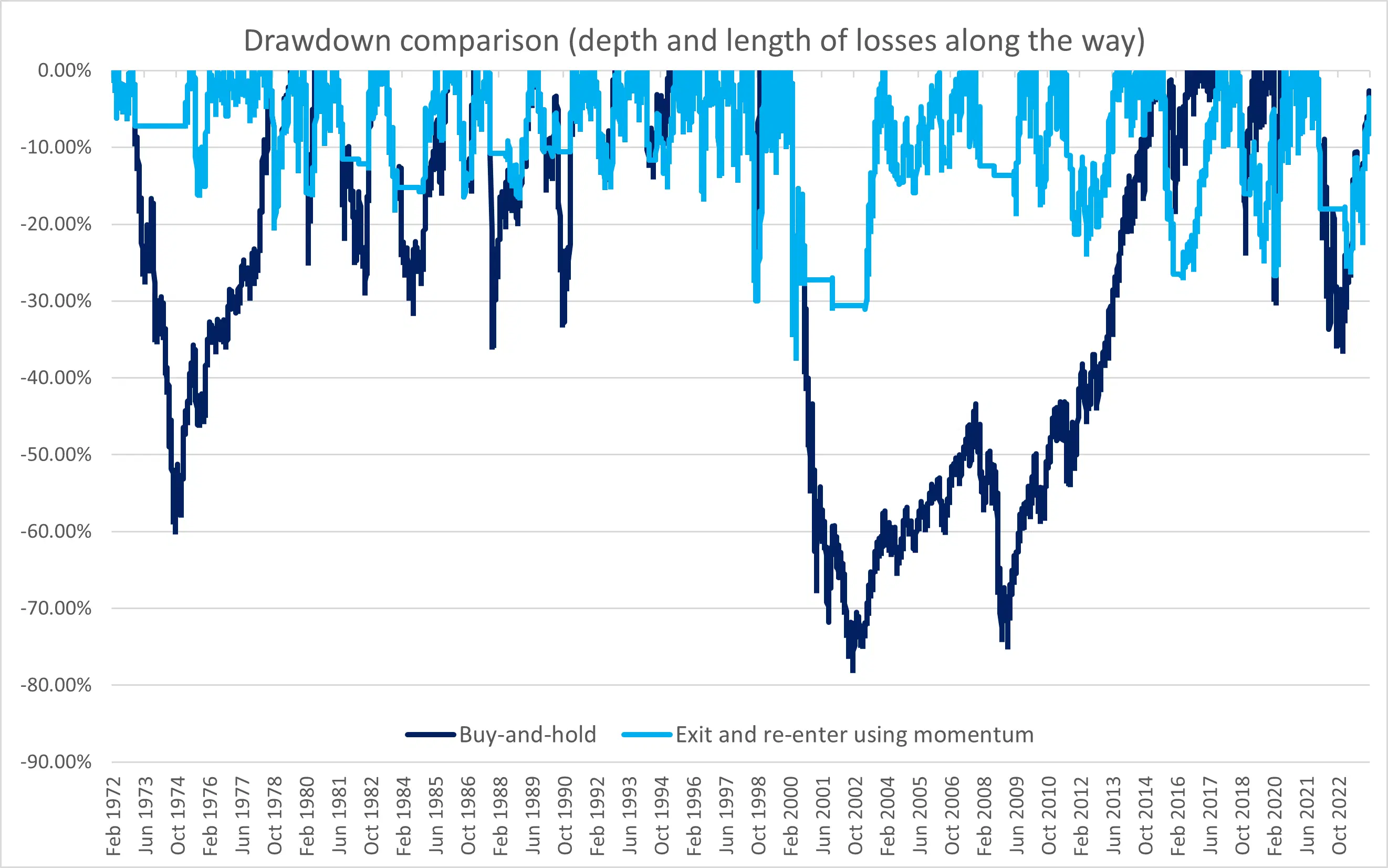

This next chart compares the drawdowns (that is, the depth of the losses and the length of time taken to get back to previous highs) for the two strategies. The buy-and-hold just looks so painful.

The market timing strategy would have reduced the size of your losses and improved the speed of your recoveries over time. Source: Finimize.

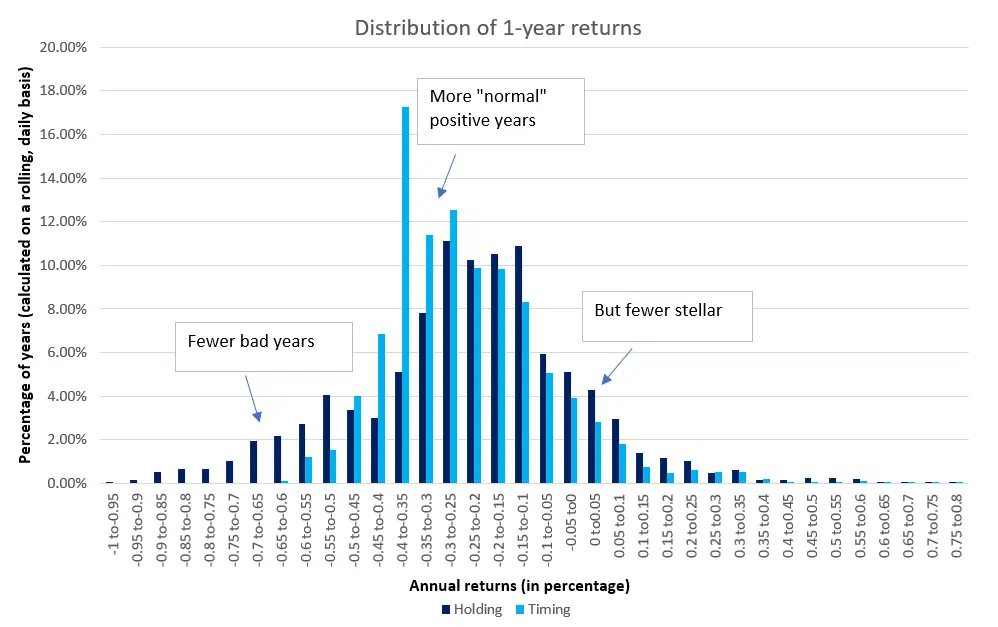

But let’s look at these two strategies from one more direction: from the distribution of one-year returns. This next chart stacks those up side-by-side, showing that returns would have been a lot more stable for the timing strategy, with the majority of its yearly returns ranging between 0% and 15%. Now, sure, you’d have experienced fewer stellar years, but that’s the price you’d have paid to significantly cut your number of really bad years.

Timing strategy has much more stable returns (more occurrences of annual returns falling between 0% and 15%, and fewer occurrences of extremely bad – or extremely stellar – years. Source: Finimize.

So what’s the opportunity?

Before you apply this momentum filter to all your investments, there are a few things you should know. First, just because the timing strategy achieved better returns than the buy-and-hold in this particular example, doesn’t mean it always will. In fact, you’d be wise to expect lower returns than buy-and-hold over the long term. That’s because, as with any type of insurance, protection against worst-case scenarios carries a cost, which for this strategy comes from sitting out markets that, on average, are rising, and from acting on false positive signals.

Put more simply, this strategy isn’t the holy grail of investing (but no strategy is) and it won’t work all the time.

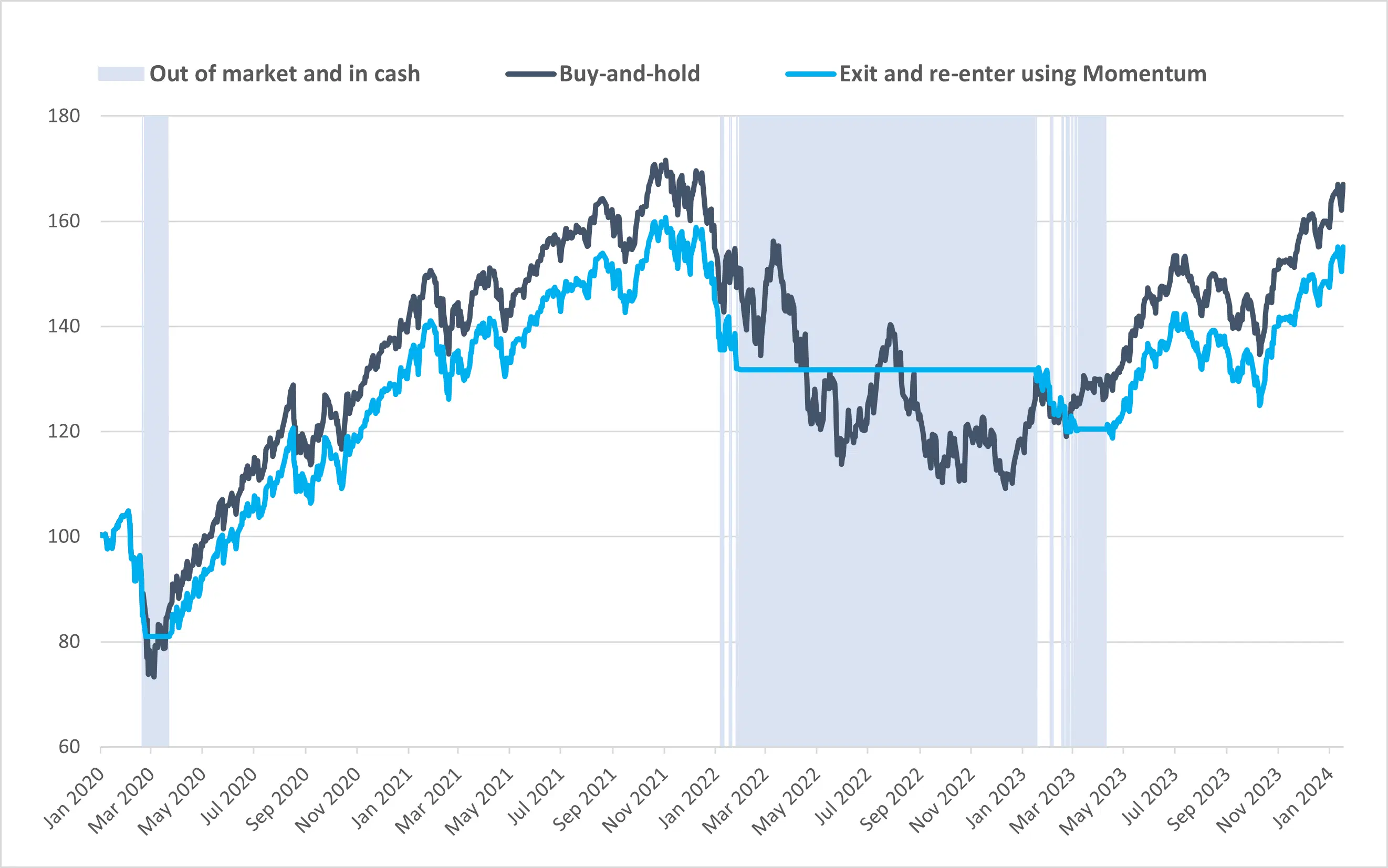

Snappy “v-shaped” crashes and recoveries (like 2020’s) and “w-shaped” ones (like 2015’s) would have been particularly painful, as you’d have exited markets at the bottom and missed the first part of the subsequent recovery. If you had used it since 2020, you could have reduced your losses – though you would have underperformed the buy-and-hold strategy because of the strong rebounds that followed each of the two drops.

The timing strategy would have slightly underperformed buy-and-hold since 2020 but would still have kept losses in check. Source: Finimize

So that’s the trade-off with choosing a market timing strategy over a buy-and-hold: the potential for slightly lower returns over the long-term, but an overall smoother journey that protects you from those worst-case scenarios. And that may be a compromise you’re willing to make, especially if you worry that markets may be headed for a crash, that stocks could see another lost decade, or simply that your emotions are at work against you. Personally, I’m very happy to opt for a cautious approach that brings me more peace of mind – even if it means potentially leaving some money on the table.

-

Capital at risk. Our analyst insights are for information purposes only.