If you’re a hands-off investor, consider a target date fund: they’re structured to maximize your returns by your expected retirement age.

If income generation is your thing, consider a covered call ETF or the Pacer Cash Cow ETF series, which invests in companies with high free cash flow yields.

If recession worries have you fretting, buffer ETFs and managed futures ETFs could be calling your name. They tend to outperform during bear markets.

There’s a lid for every pot, or so they say. And in financial markets, that certainly seems to hold true Whether you’re a “set it and forget it” investor, a value investor, or a nervous one, the beauty of financial markets is that you can usually find something that suits you – even when the economic backdrop is a bit worrying. So with recession fears top of mind for all kinds of investors, I’ve dug out five under-the-radar investment tools that might be a good fit for you.

1. Target date funds for hands-off investors.

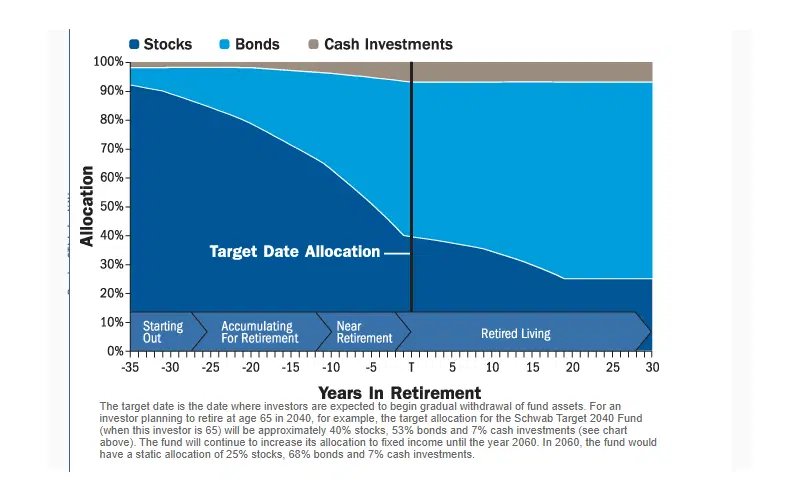

These funds are structured to maximize your returns by a specific date (usually your expected retirement year). They’re designed to build the steepest gains in the early years by focusing on riskier growth stocks, and then hang onto those gains in later years by leaning into safer, more conservative choices. Let’s say you plan to retire in 2050: a target date fund 2050 would kick off with about 80% of your money in stocks and 20% in bonds. And as you get closer to 2050, the stocks portion would get smaller and the bonds portion would get bigger. It’s like having a money manager who’s keeping your long-term plans in mind.

A sample target-date fund’s asset mix over time. Source: Charles Schwab.

Here’s what’s good about them: These funds do all the asset allocation and rebalancing legwork for you, so you don’t have to break a sweat. Since your risk tolerance will change over time, these funds attempt to match your pace. It’s a dynamic, yet passive approach – dynamic because the asset mix changes over time, but passive because (depending on the fund) it aims to invest part of its assets in funds that track an index. That also means costs are kept low, with some funds boasting an expense ratio of 0.24% or less.

Examples: Big-name investment providers like Vanguard, iShares, and JPMorgan all offer target date funds.

2. Covered call ETFs for fans of income generation.

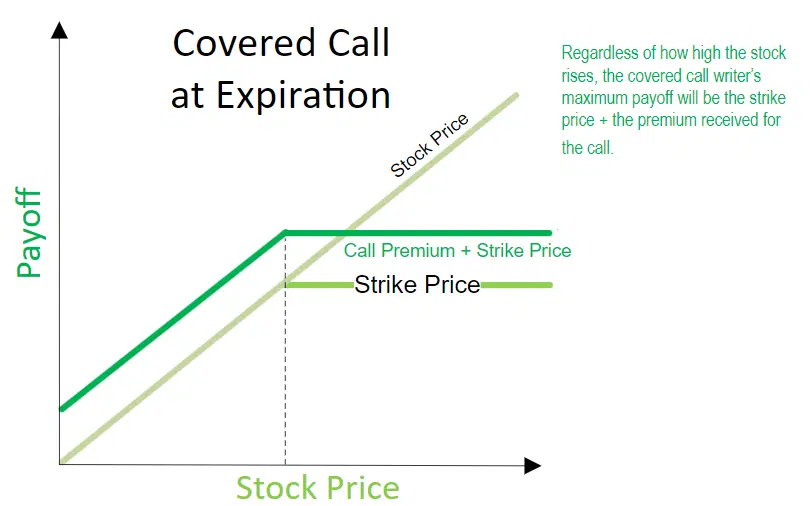

These ETFs allow you to benefit from option strategies that were once exclusive to institutional “big money” players. They aim to provide a balance between income generation and potential asset appreciation. These funds sell call options (the right to buy) on some of the stocks or indexes they already own to generate additional income from the price (or “premium”) of the options they sell. If the option is exercised by the buyer, the fund has to sell the stock that they own in their portfolio, at the agreed-upon price (or “strike price”).

The payoff profile of the typical covered call. Source: ThisMatter.com

What’s good about them: These funds generate a fair bit of income, with yearly returns that can hit 12%. But there’s a catch here: if markets shoot higher than a certain point, your potential profit stops growing. So these aren’t the vehicles to invest in if you think markets are going way up. They do their best work in volatile markets, specifically ones without consistent, major moves in one direction. These strategies can help reduce the overall volatility of your portfolio by capping potential gains in exchange for the income from options premiums. The income generated from selling call options can act as a cushion in declining markets: it can offset some of the losses on the underlying assets, providing downside protection.

Examples: Check out the JPMorgan Equity Premium Income ETF (ticker: JEPI; expense ratio: 0.35%) with a distribution yield of 9.6%, the Global X S&P 500 Covered Call ETF (XYLD; 0.6%), with 10.1%, and the Global X Russell 2000 Covered Call ETF (RYLD; 0.6%), with 12.4%.

3. Buffer ETFs for the risk-averse.

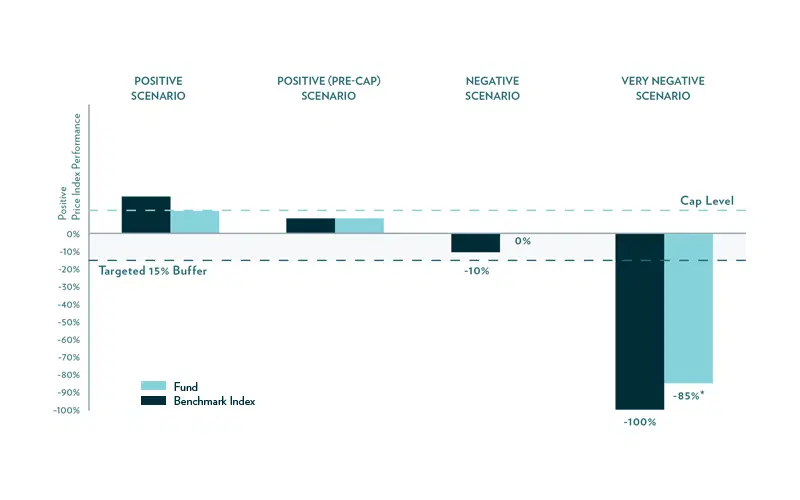

Buffer funds, or defined outcome funds, work like a safety net to protect you against market falls. They’re linked to an underlying asset (like a stock index) and aim to give you a specific performance pattern over a year or two. The big advantage is the built-in safety feature that protects you against market drops, usually around 10% to 15%. However, in exchange for this downside protection, there is also a cap on potential gains. This means that if the market performs exceptionally well during the outcome period, your returns may be limited to a certain percentage. When the set period ends, they check how the market did, and that affects how much money you get back.

Scenario analysis of different payoffs with a 15% buffer ETF compared to a benchmark index. Source: Innovator ETF.

What’s good about them: Buffer ETFs are a smart choice if you don’t want to take big risks with your investments, if you value stability, or if you’re getting close to retirement. They’re a good fit for more cautious investors who are willing to trade some of their potential gains in exchange for protection from losses. And they can be especially handy when the market gets all shaky. They’re also super easy to buy and sell, just like regular stocks. So you have the flexibility to adjust your investments whenever you want.

Examples: You could consider the Innovator US Equity Power Buffer ETFs – for November (PNOV), December (PDEC), or January (PJAN). Each carries an expense ratio of 0.79%.

4. Managed futures ETFs for the recession-stressed investor.

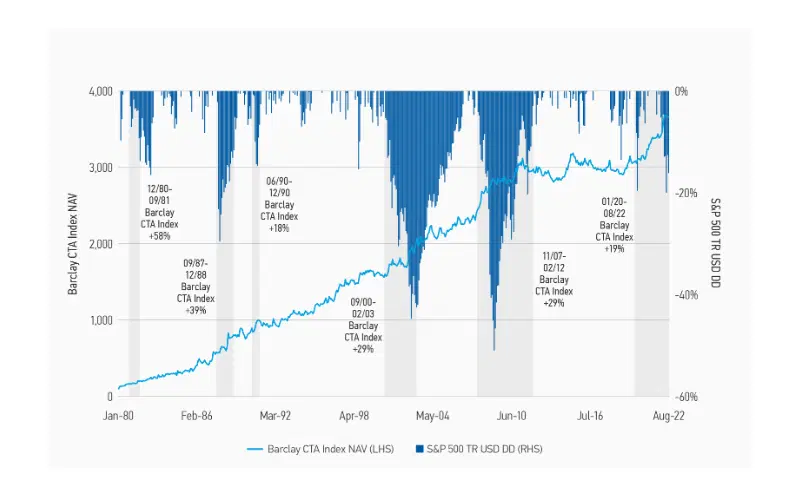

These ETFs are actively managed and trade in commodities, currencies, fixed income, and stock indexes, usually using futures contracts. Those futures contracts involve standardized agreements to buy or sell an underlying asset at a predetermined price at some future date, without the investor actually owning the asset. These ETFs are similar to hedge funds and fall under the category of alternative investments because they use different trading strategies. The most common strategies are the market-neutral approach, which aims to profit regardless of market direction by taking both long and short positions, and the momentum strategy, which seeks to capitalize on existing market trends.

The Barclays CTA Index (lighter blue line) and the S&P 500 Total Return (TR) Index (darker blue bars) from January 1980 through August 2022. Source: Morgan Stanley.

What’s good about them: Managed futures funds tend to have a low correlation with stocks or bonds markets, meaning they can help diversify your portfolio. That’s great when you don’t have a strong view on the market or even when you think a recession is imminent: they’ve historically performed well during bear markets.

Examples: Some of the big ones are the iMGP DBi Managed Futures Strategy ETF (DBMF; 0.85%), KFA Mount Lucas Index Strategy ETF (KMLM; 0.92%), or the First Trust Managed Futures Strategy Fund (FMF; 0.95%).

5. The Pacer Cash Cow ETF series for cash lovers.

This ETF series sticks with the mantra “cash is king”, seeking out quality companies with high free cash flow yields. Free cash flow is the money that’s left over after a company pays its expenses, interest, taxes, and long-term investments. Companies with high free cash flow yields often produce more cash than they need to run the business and can invest in growth opportunities, or return cash to shareholders via stock buybacks or dividends.

What’s good about them: In a higher-for-longer interest rate environment, investing in companies that can sustainably grow cash could be a winner. After all, these firms can grow cheaply compared to those that have to finance their expansions at a heftier borrowing cost. Whether you’re interested in dividends, or picking up quality companies that can weather economic downturns, you’d be smart to follow the cash trail.

Examples: There are eight Pacer Cash Cow ETFs in the US and elsewhere. And there are other free cash flow ETFs too: the Global X US Cash Flow Kings 100 ETF (FLOW; 0.25%) and the First Trust S&P 500 Diversified Free Cash Flow ETF (FCFY; 0.6%) are two examples. But be sure to do your homework: those funds don’t have as long a track record as the Pacer Cash Cow series.