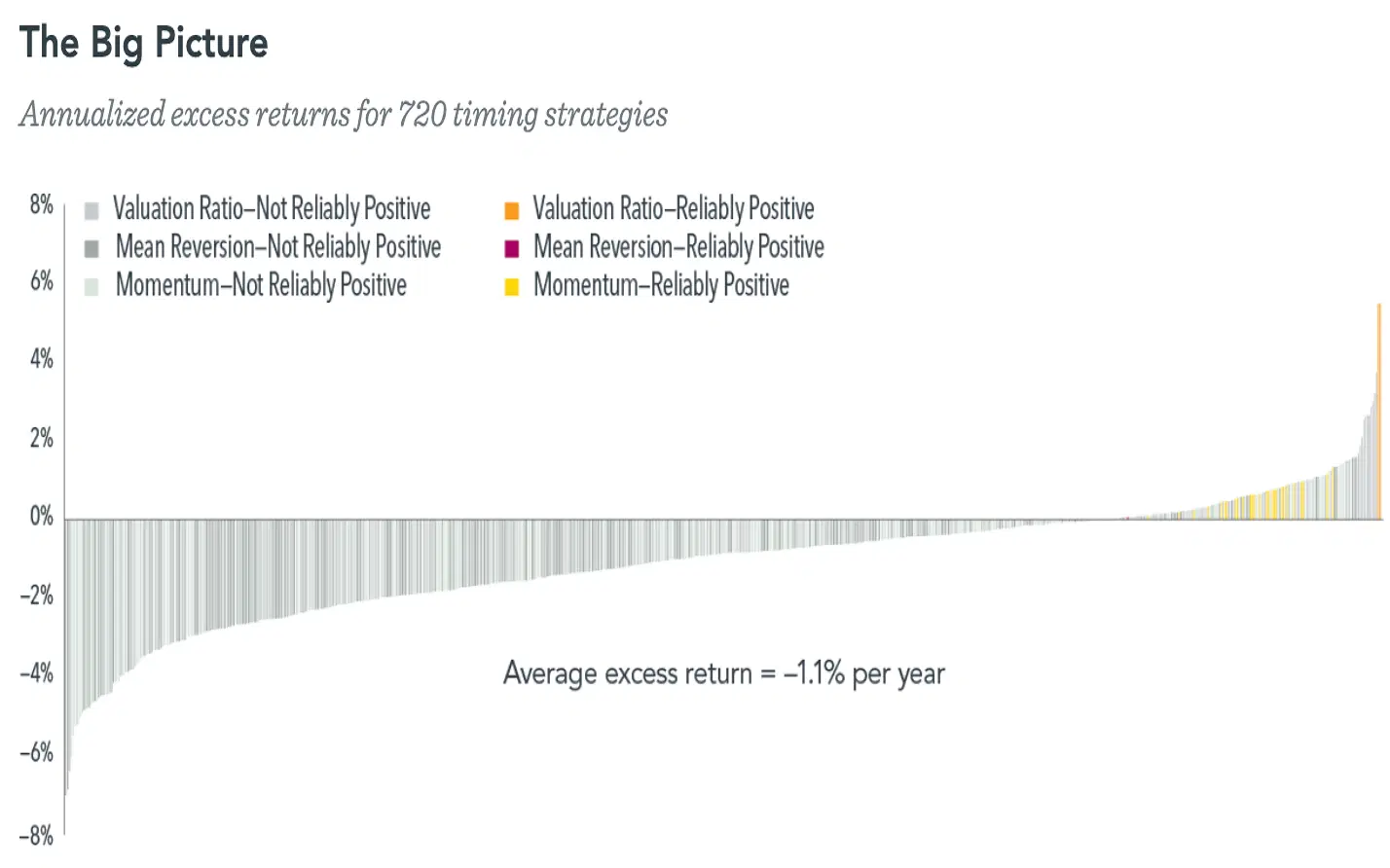

A new study simulated 720 strategies across a variety of stock markets, using three commonly applied timing signals, and found that 96% of them failed to beat a simple buy-and-hold strategy.

The success of the few strategies that did work was attributed to pure luck. And it’s worth keeping in mind that even if a strategy manages to work for a while, it’ll be replicated by others and consequently will stop working.

If you’re looking for a tried-and-tested investment approach, and have the patience and resilience to invest over the long term, a buy-and-hold strategy in low-cost index funds is often the most prudent choice.

It’s always tempting to try to time the market – selling your stocks just before they fall and buying back in just before they rise. Everyone wants above-average returns, after all. The problem is, it almost never works out. For the vast majority of us, trying to time the market is a recipe for losses. Here’s why, and what you should be doing instead.

What’s so hard about timing the market?

There are always stories about investors who manage to time the market perfectly and make a bundle in the process. And sure, that can happen some of the time, but it doesn’t happen all of the time. The trick to this feat isn’t just in knowing when to flee the market: you also need to know when to flood back in. And getting both decisions right – selling at the peak and buying at the trough – is rare in any single market cycle. Over decades, it’s virtually impossible.Mind you, you don’t have to take my word for it. Dimensional Fund Advisors recently released the results of a brilliant study that simulated 720 strategies across several stock markets, using three of the most commonly used timing signals:

1. Valuation: This involves buying stocks when their price-to-book ratio is low on a historical basis, and selling them when it’s high. The idea here is to buy stocks when they’re cheap and to dump them when they’re expensive.

2. Mean reversion: This entails buying stocks when their recent returns are low, compared to their historical average, and selling them when they’re high. The underlying principle is that stock returns tend to revert to the mean – that is, high recent returns are often followed by lower future ones.

3. Momentum: This involves buying stocks when their recent returns are relatively high, and selling when they’re low. The premise is that strong past performance may continue, at least for a while. It’s effectively the opposite of mean reversion.Here’s what the researchers found: 690 of the strategies (or 96% of them) didn’t work – meaning, they failed to beat a simple buy-and-hold strategy. And that’s before factoring in any trading or tax costs.

The annualized excess returns of the 720 timing strategies simulated in the study. Source: Dimensional Fund Advisors.

As for those 30 strategies that did work, well, it turns out that was down to pure luck, as the researchers readily acknowledged. See, if you ask a big enough number of people to repeatedly flip a coin, someone will flip ten heads in a row. And by the same law of numbers, you can expect some timing strategies to generate positive results just by chance if you try enough parameter combinations – shaking up things like rebalancing frequency, time frames used to calculate historical averages, percentiles (relative to historical averages) at which the strategy buys and exits stocks, and so on.

But if you take the best-performing strategy and tweak even a single parameter, that would reduce its excess return by more than half, making it no longer reliable. Certain parameter adjustments would turn the strategy’s returns negative. In fact, the researchers found a flaw in every one of the 720 approaches, including those that seemed superior. What’s more, it’s worth keeping in mind that even if a strategy works for a while, it’ll be quickly replicated by others, and ultimately will stop working.

So what’s the takeaway for your portfolio?

There’s an old adage in the investing world that says success isn’t about timing the market, but time in the market. In other words, you’re much better off staying invested over the long run with a well-diversified portfolio that’ll reap the benefits of compound interest (which Albert Einstein famously called the “eighth wonder of the world”). And that means accepting the reality that the stock market moves down as well as up, and that you can rarely time its movements.

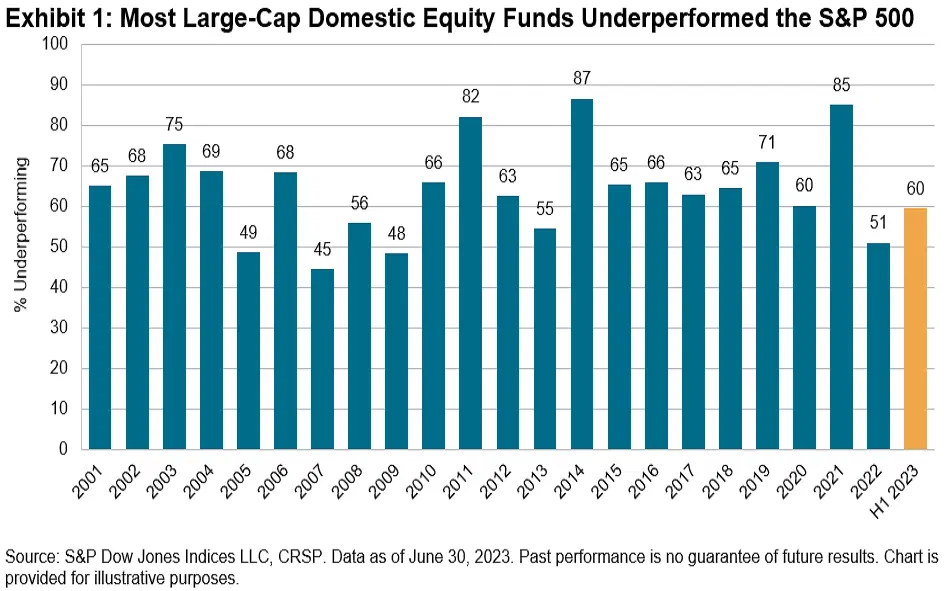

While the Dimensional research doesn’t delve into whether selecting individual stocks could be a consistently successful strategy, other studies have shown that achieving long-term success in stock-picking is also supremely uncommon. The S&P Dow Jones Indices’s research is one example: the firm keeps tabs on the overall performance of stock funds and finds that most active stock-picking fund managers consistently underperform the market. It’s a core pillar of passive investing beliefs: that it’s better to accept that you can’t beat the overall market, and focus instead on minimizing your costs so you can capture as much market return as possible.

Year after year, the majority of fund managers fail to outperform the S&P 500. Source: S&P Dow Jones Indices.

Taken together, the studies point to a single conclusion: timing the market or beating it with some clever stock-picking is exceedingly difficult. And so a simple, unspectacular strategy – buying and holding the entire market through low-cost index funds – is generally the best bet for most people. Granted, you’ll need to be willing and able to withstand substantial losses, sometimes for extended periods, because while the stock market has climbed higher over the long haul, it’s had plenty of downturns along the way. But if you can remain patient and resilient, a buy-and-hold approach with a low-cost index fund could help you become a more successful investor in the long run.

-

Capital at risk. Our analyst insights are for information purposes only.