Geopolitics are seen as posing the number one risk to markets and the global economy this year. And the biggest potential hazards out there relate to the conflict in the Middle East, the US election, China-Taiwan tensions, and the war in Ukraine.

These hot spots could lead to some combination of obstructed oil supplies, blocked shipping routes, disrupted chip supplies, a new US trade war, and more. And any one of those could lead to higher inflation and lower economic growth.

Investors historically turn to a few trusted assets to hedge their bets in times of geopolitical uncertainty: commodities (especially oil and gold) and the Swiss franc. Inflation-linked bonds could also protect portfolios against rekindling price gains

“Hope for the best but plan for the worst” is good advice – in investing and in life. And, with all of the global risks out there, it seems like especially sage guidance right now. Geopolitics are posing, by far, the greatest threat to the world’s markets and economy, according to clients surveyed by Goldman Sachs. So it’s worth taking a closer look at a few of the biggest potential hazards and how you might hedge against them.

Conflict in the Middle East

After more than three months of Israel’s war in Gaza, the Middle East stands on the brink of a broader conflict that could potentially obstruct oil supplies, hinder global economic growth, and rekindle inflation. Sure, we’ve averted a disruption in energy supplies so far (and markets seem optimistic that we’ll continue to do so), but that threat is real and could escalate.

Bloomberg Economics, for example, estimates that in an extreme scenario where a direct conflict breaks out between Iran and Israel, one-fifth of global crude supply, as well as important trade routes, could be at risk. That could push oil prices above $150 a barrel, shaving about 1 percentage point off global economic growth and adding 1.2 percentage points to global inflation.

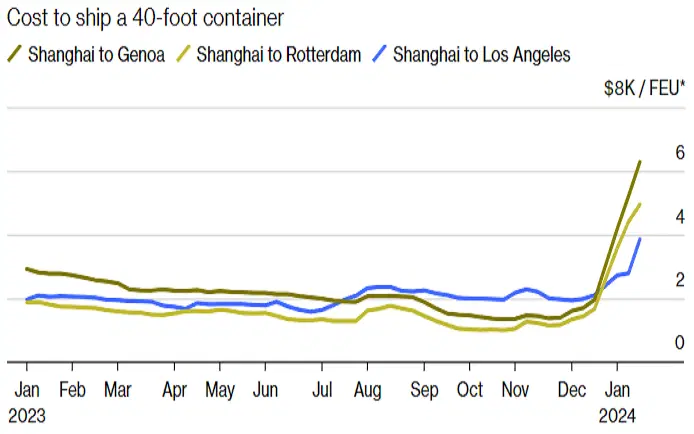

A key trade route is already being impacted by the conflict. Tensions have escalated in the Red Sea since the US and UK launched airstrikes in Yemen, a response to weeks of attacks by militants on vessels in a vital gateway for global commerce. The Red Sea is used for about 12% of the world’s seaborne trade, and the militants’ attacks have caused the heaviest diversion of international trade in decades, pushing up costs for transporters from Asia to North America. The cost of shipping containers from China to the Mediterranean Sea, for example, has more than quadrupled since late November. Those kinds of surges haven’t been seen since the pandemic-era crunch.

Container shipping costs via sea have skyrocketed this year. Source: Bloomberg.

This is a tanker-sized worry because upside risks to inflation stemming from shipping costs could offer central banks a new reason to keep interest rates high – raising recession risks in the process. Economists at JPMorgan, for instance, forecast a 0.7 percentage point increase in global goods inflation during the first half of this year if the shipping snarl persists.

The US election

The US presidential election in November, potentially featuring a rematch between Joe Biden and Donald Trump, could significantly impact global dynamics. Trump, who appears likely to land the Republican nomination, has proposed a 10% minimum tariff on all imports if he’s elected. The move would lead to higher costs for American consumers and drive up inflation, which could lead to even higher interest rates to combat it.

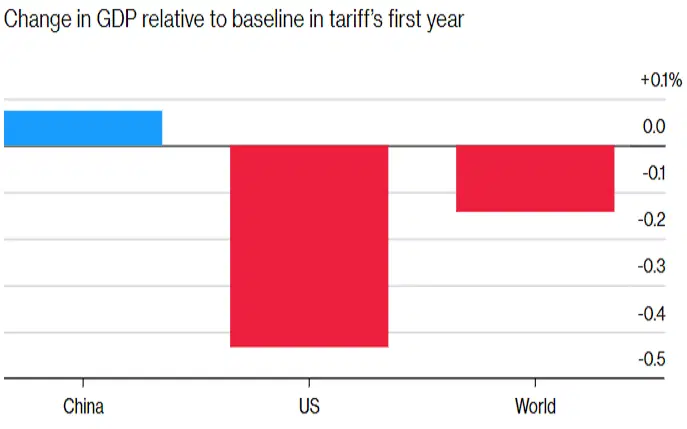

But the worldwide perspective is where things could get really ugly: if trade partners were to retaliate in kind, it could upset global trade while also shaving about 0.4% off US economic output, according to Bloomberg Economics. So if Trump does get the nomination and does get elected, you’ll want to brace for renewed trade tensions, especially with Europe and China, and possible shifts in America’s role in NATO, an alliance he has frequently described as a drain on US finances.

The estimated impact of a 10% tariff on all goods imported into the US, assuming trade partners retaliate in kind. Source: Bloomberg Economics.

Tensions between China and Taiwan

The Taiwanese elections in January resulted in a historic third term for the ruling Democratic Progressive Party (DPP), which was seen as a rebuff to the Chinese government. The DPP, which is known for its pro-sovereignty stance and is labeled a “separatist” group by Chinese authorities, has been advocating for Taiwan’s independence. So its victory, which comes amid already low trust levels between China and Taiwan, could potentially spark new tensions in the coming months.

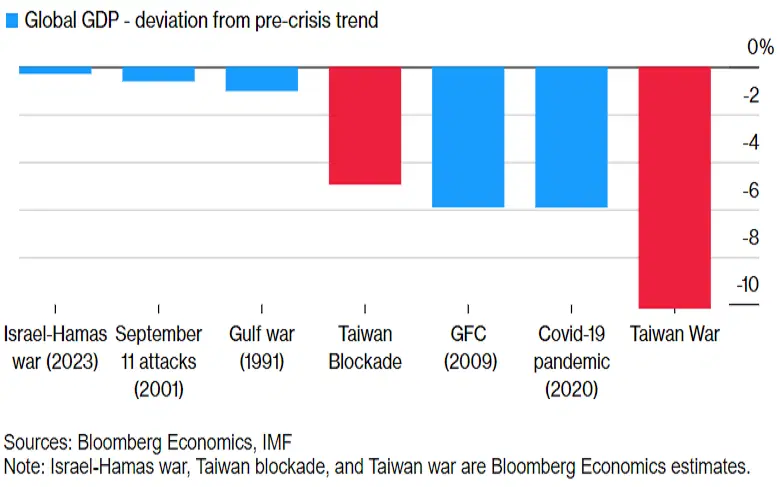

Taiwan’s crucial role in global semiconductor production makes the potential for conflict in the Taiwan Strait a major concern for the world economy. The likelihood of war might not be high, but its impact could be profound. Bloomberg Economics estimates that an outbreak in hostilities would disrupt chip supplies, block trade routes, and lead to economic sanctions costing up to 10% of global economic output. That kind of cataclysm would actually dwarf the impact of major shocks like the global financial crisis and the Covid-19 pandemic.

A war over Taiwan could have a bigger impact on global economic output than other notable recent shocks. Source: Bloomberg Economics.

The war in Ukraine

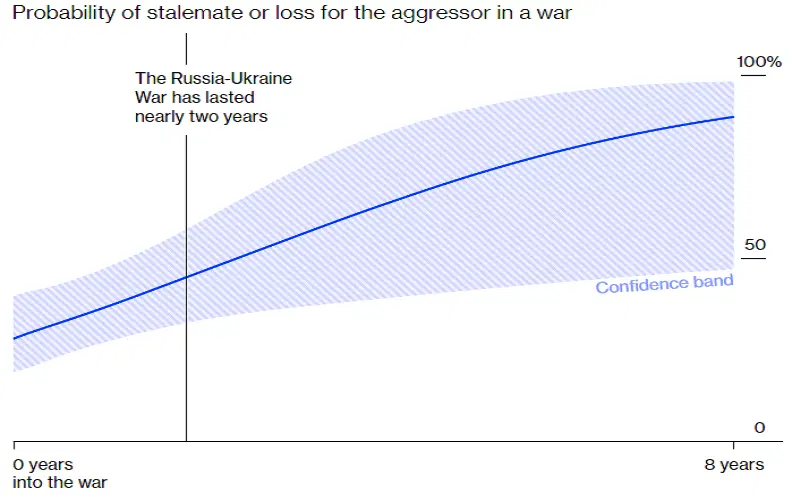

Ukraine’s failed counteroffensive has led Western allies to express concerns about the country facing defeat, especially if US military aid were to diminish, giving Russia a potentially significant advantage. A stalemate seems more probable, because history suggests that the longer a conflict goes on, the less likely it is that the aggressor will achieve a decisive victory.

Long wars often end in stalemate or the defeat of the aggressor. Source: Bloomberg Economics.

Eastern European countries are voicing increasing worries about the prospect of a strengthened Russian military at their borders and its potential further incursions. And analysts are warning that the US may soon face a difficult choice: focusing on deterring Russia in Europe, or China in Asia. But a Russian victory in Ukraine could challenge the US’s ability to project itself as a strong, reliable ally, possibly leading to increased global instability and territorial disputes – as evidenced by recent tensions between Venezuela and Guyana.

How can you hedge against these risks?

Investors historically turn to a few reliable assets to hedge their bets in times of geopolitical uncertainty: commodities (especially oil and gold), and in the currency market, the Swiss franc.

Escalating tensions in the Middle East could pose a big risk to oil supplies. Recall that Bloomberg Economics estimates that in an extreme scenario where a direct conflict between Iran and Israel erupts, one-fifth of global crude supply could be threatened, potentially pushing oil prices above $150 a barrel. So an obvious hedge against that scenario would be to invest in oil or even to buy long-dated, out-of-the-money call options on an oil ETF, such as the United States Oil Fund (ticker: USO; expense ratio: 0.6%).

Gold and the Swiss franc, meanwhile, are both perceived as safe-haven assets and so they tend to do well during periods of geopolitical volatility, like those that could potentially stem from rising tensions between China and Taiwan, or a turn for the worse in the war in Ukraine. What’s more, gold has intrinsic value that’s underpinned by its limited supply, which means it becomes more popular when inflation is rising and eroding the value of money. This matters because trade disruptions and rising shipping costs due to attacks in the Red Sea could send inflation higher. Check out our dedicated guide to learn more about how to invest in gold.

Another way to hedge against this risk is via inflation-linked bonds, whose principal and interest payments rise and fall with inflation. The iShares Global Inflation Linked Govt Bond UCITS ETF (IGIL; 0.2%) gives you exposure to a basket of investment-grade inflation-linked government bonds from around the world. If you wanted to specifically hedge against inflation rising in the US, stemming from, for example, Trump’s proposed 10% tariff on all imports, you might consider the iShares TIPS Bond ETF (ticker: TIP; 0.19%), which gives you exposure to inflation-linked Treasuries.

- Capital at risk. Our analyst insights are for information purposes only.