Japanese stocks and AI favorite Nvidia have seen strong rallies recently, and two key factors suggest that could continue.

The Indian stock market’s strength, however, has begun to fade, so momentum investors might want to wait for further inflows before opening a position.

You can find short-term trading and long-term momentum investing ideas when fundamental factors and technical indicators are both favorable.

When an asset’s price is on the rise or hitting new highs, it’s sure to grab the attention of momentum investors. These market players make money by riding a wave higher, and selling when it starts to fall. Of course, their savviest bets have something more than just price propulsion behind them, they’ve got a fundamental reason to move higher. So let’s take a look at three assets that have been high and climbing, and see what the momentum crowd might make of them…

Asset 1: Japanese stocks.

These are some of the brightest shining stars in Asia, with Japan’s main index – the Topix – up around 50% over the past three years. Foreign investors have come running to this market, drawn in by some attractive fundamentals: recent improvements in corporate governance and shareholder returns, strong company earnings and wage growth, reasonable valuations, and new hopes that the country’s extended bout of deflation might truly be over. The latest weekly data showed that foreigners bought a net $6.5 billion in Japanese stocks, the most since June 2023. And that’s helped drive Japan’s main indexes, the Topix and Nikkei, to 34-year highs this week.

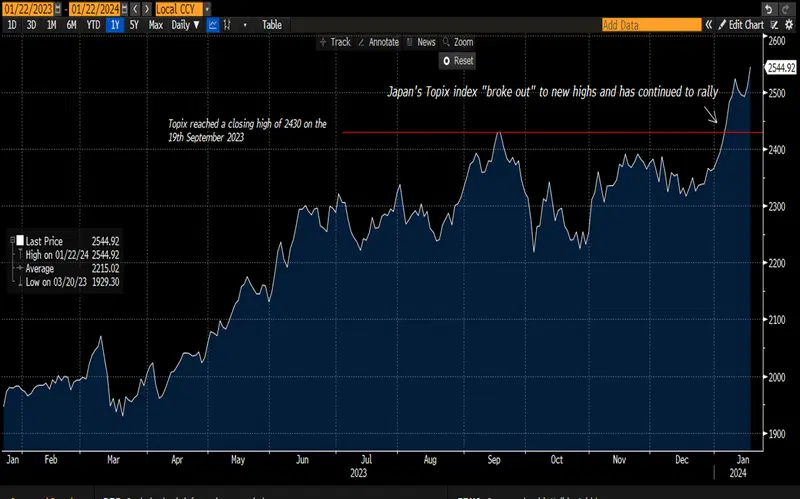

This one-year price chart shows Japan’s Topix index, along with its break-out level. Source: Bloomberg.

As you can see, the Topix (white line) reached a new 34-year high on January 10th, breaking out above its previous closing high of 2,430 (red line), which it notched back in September. With sustained price movement and those fundamental reasons to buy Japanese stocks, the momentum crowd might look to buy an asset like the Next Funds Topix Exchange Traded Fund (ticker: 1306; expense ratio: 0.06%). And those traders would likely stay “long” (i.e. continue to own the ETF) while the price momentum stays positive.

Of course, deciding when to sell is as important as when to buy. To mirror these traders, you could stay invested as long as the Topix index holds above the breakout level of 2,430 – knowing that levels that once served as a ceiling can often become more of a floor, or “support”. And you could set a selling level using a short-dated moving average – say ten days – to detect when price momentum may be fading.

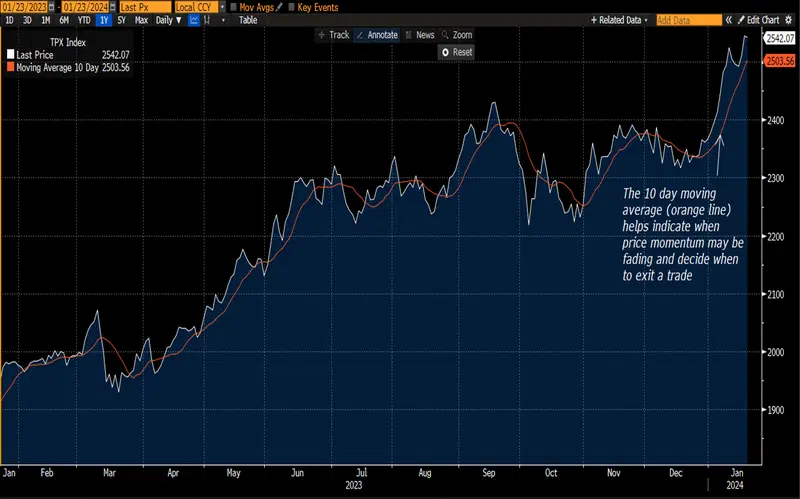

The ten-day moving average look at Japan’s Topix index (orange line), going back one year. Source: Bloomberg.

Since the break higher on January 10th, the index hasn’t fallen below its ten-day moving average – even though it has dropped back a little. By using a moving average to decide when momentum is fading, you keep your exit point moving with the market, which should help ensure that your profits are protected.

As the Topix index looks a little overbought right now – it’s gone up rapidly in a short time – it may be sensible to wait for a small pullback before buying in. However, if you’ve got a long-term investing horizon, you might opt not to wait. After all, it’s worth remembering the old mantra: time in the market, not timing the market is what matters.

Asset 2: Indian stocks.

Like an authentic vindaloo, Indian stocks have been bringing the heat, returning a little over 30% over the past three years. With a strong economy, business-friendly policies like the “Made In India” initiative, chunky capital investment programs, and a young and growing population, India is proving to be an attractive and low-cost manufacturing destination for many international companies like Apple and Micron. Rising tensions between the US and China are also playing into India’s hand, positioning it as an alternative location for Asian factories and other investments.

All of that is likely to keep the Indian economy and its companies simmering, says Goldman Sachs. It sees corporate profits growing by 15% in 2024 and another 14% in 2025.

This one-year price chart shows India’s Sensex Index, with a failed break-out attempt. Source: Bloomberg.

As you can see in the chart, the Indian Sensex index (white line) traded at a record high on January 10th, breaking above its previous high of 72,410, which it reached on December 28th. Despite strong price momentum and good fundamentals, the move faded, and the index fell back below its break-out level. That kind of thing happens: although the long-term growth outlook for India’s economy and stock market is still attractive, it would take more inflows for strong price momentum to return and shove the market back to record highs. So you could buy the iShares MSCI India ETF (INDA; 0.65%) now as a long-term investment, but a momentum investor would probably wait for stronger price action before stepping in.

Asset 3: Nvidia.

Just like its name suggests: Nvidia was the “envy” last year, leading the market with its quasi-monopoly on the microchips that are essential to training AI models. The company’s super-strong earnings growth is why, despite its rocketing share price, its forward price-earnings ratio for the year ending in January 2025 (one year forward) is still only 29x. That’s a relative bargain when you consider that analysts expect its profits to grow by 60% next year.

Nvidia’s one-year price chart with break-out level. Source: Bloomberg.

Nvidia has already turned out to be one of the best trades among growth, thematic, and momentum investors in 2024. (And, um, it’s still January.) With strong fundamentals and unique market positioning, the share price had traded between around $400 and $500 – the trading range – in the second half of 2023. However, on January 8th, that changed, with the stock breaking out to a new record high at $522. That price thrust prompted momentum investors to buy (or buy more), and the share price shot even higher, to around $600. That’s a pretty remarkable surge.

After a 20% price rise, it’s hard to be overly bullish, at least in the near term. That said, the company’s earnings results are due on February 15th, and some pretty high expectations are built into its share price, so the price could slip a bit if enough investors opt to sell and take their profits. But any dip is likely to remain muted, with Nvidia on everyone’s top stock lists. If, like them, you believe in a bright AI future and think Nvidia is going to win over the long term, then cost averaging – investing a set amount on a weekly or monthly basis – could be a smart way to invest. It keeps you from trying to time the market but makes sure you have varied price exposure so you don’t miss a move.

-

Capital at risk. Our analyst insights are for information purposes only.