India’s stocks have been hot stuff, rising more than 30% over the past year with so much excitement over the country’s rapidly expanding, consumption-driven economy. And, sure, with all that enthusiasm, stock valuations have been left looking pretty pricey. But I found a way you can get in on the cheap.

What makes India so appealing right now?

1. Attractive demographics.

India surpassed China as the world’s most populous country last year, in a pivotal moment for the neighbors and geopolitical rivals. The two are a study in contrasts: while China’s population is aging and shrinking, India’s is young and growing. And most of the people in India – about two-thirds of them – are of working age (between 15 and 64 years old), so the country can produce and consume more goods and services, drive further innovation, and more.

Looking ahead, while China's working-age population is projected to shrink by 31 million by 2033, India's is expected to grow by 85 million – more than triple the 25 million anticipated for Southeast Asia (Cambodia, Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam) combined.

2. Strong economic growth.

India’s economic story over the past decade has been remarkable. The country contributed an estimated 17.6% to global growth in 2023, compared to less than 8% in 2001. And Bloomberg Economics estimates that by 2028, India could overtake China as the number one contributor to world economic growth.

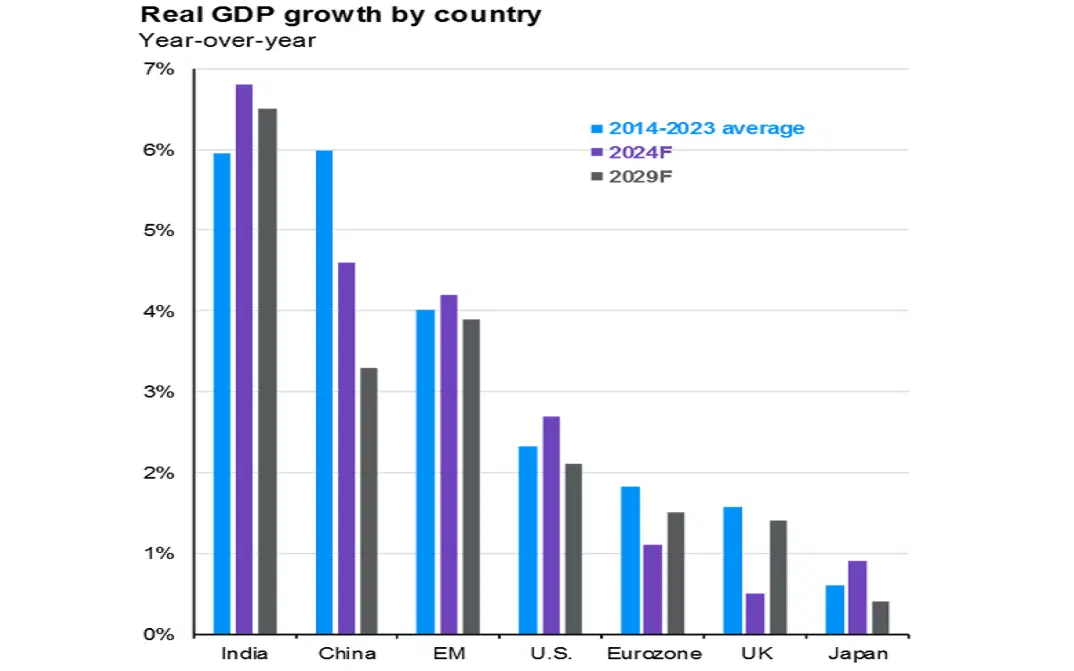

India’s young and growing population is part of this story, along with some big investments in infrastructure, a strong emphasis on STEM education, broad adoption of digital technologies, expansion in the manufacturing sector, business-friendly government reforms, and a whopping influx of foreign investment. All that has helped India achieve nearly 6% annual economic growth over the past decade – and it’s expected to help keep it going. In fact, India’s economy is projected to surpass both Japan’s and Germany’s in size by 2027, making it number three in the world.

India has seen growth that compares with China’s for the past ten years, and it’s expected to grow even faster in the next ten. Source: JPMorgan

3. Booming stockmarket.

Earlier this year, India’s stock market capitalization overtook Hong Kong’s for the first time, making it the fourth-biggest equity market in the world. That came on the heels of a strong yearlong rally, fueled by robust corporate earnings and a rapidly expanding crowd of retail investors – who increasingly look like they’re investing for the long haul. And things are unlikely to stop there: India’s stock market is expected to double in value, hitting $10 trillion by 2030, according to investment bank Jefferies.

And the Indian stock market isn’t just big – it’s also highly liquid. More than 170 stocks listed on Indian exchanges boast a market capitalization above $5 billion (the fourth-highest figure worldwide). What’s more, over 250 stocks have an average daily trading volume above $10 million, a figure surpassed only by markets in Japan, the US, and China.

Where’s the problem?

One word: valuation. India’s strong market rally over the past year has left stock valuations looking expensive, both relative to their own history and to other emerging markets. For example, the MSCI India’s forward price-to-earnings (P/E) ratio is currently 22x, or 15% higher than its ten-year average. That also marks a 76% premium on top of the MSCI Emerging Market index’s forward P/E ratio of 12.4x. And, sure, Indian shares have always traded at a premium to emerging market stocks, but this is next-level pricing, well higher than the ten-year average of 60%.

So, how can you invest in India on the cheap?

Great question. A logical answer would be to screen for high-quality companies whose stocks are trading at relatively low valuations. Unfortunately, though, because of government restrictions, there isn’t an easy way to directly invest in India-listed stocks. So that means you’ll have to invest via ETFs. That might naturally have you checking out the iShares MSCI India ETF (ticker: INDA; expense ratio: 0.65%), but, remember, the MSCI India is expensive relative to its own history and to other emerging markets.

Fortunately, I’ve found an interesting ETF that addresses the valuation conundrum. And, no, it’s not a simple Indian value stocks ETF, which might be nice, but for some reason doesn’t seem to exist in US and European markets. The ETF in question is the WisdomTree India Earnings Fund (EPI; 0.85%).

The fund invests in nearly 500 different Indian stocks, but the key thing that differentiates it from other ETFs is that it weights individual holdings by earnings instead of market capitalization. That helps it sidestep the more expensive and unprofitable parts of the market. Genius.

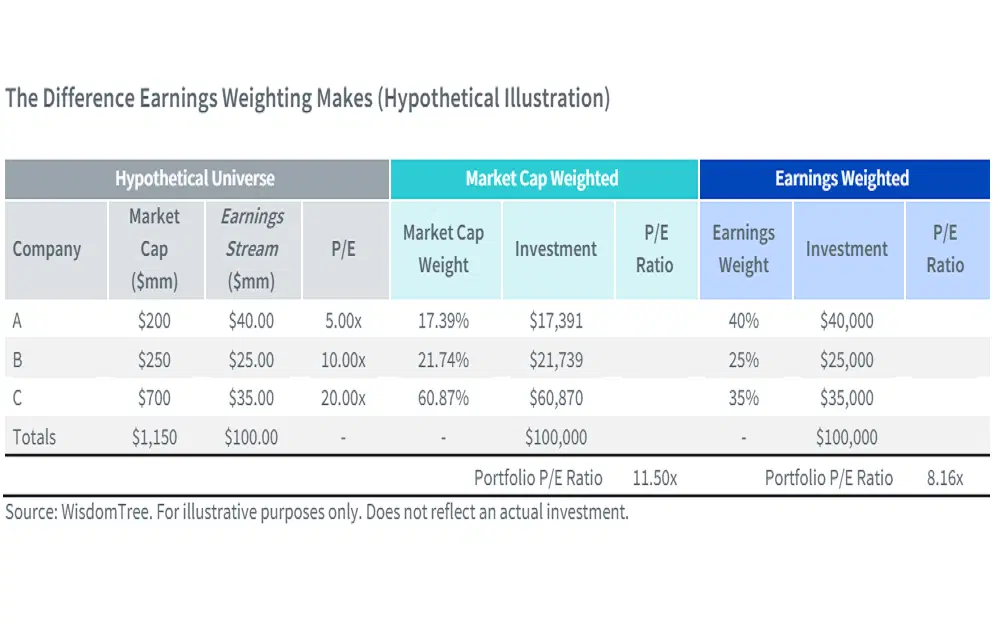

See, standard market cap-weighted indexes and ETFs inherently favor the most expensive stocks since more of their investing weight goes to the companies with the highest market values, and that potentially leads to concentrations in overvalued, expensive shares. On the other hand, weighting by earnings puts the focus on a company’s profitability (rather than market cap). That aligns the weight of each company with its financial performance, promoting a more balanced and potentially lower-risk portfolio by avoiding the bias toward overpriced stocks.

A hypothetical example of how different weightings can impact a portfolio’s price-to-earnings (P/E) ratio. Source: WisdomTree.

To see the impact of earnings-based weighting on valuations, consider this: the WisdomTree India Earnings Fund’s consolidated P/E is 18.4x – almost 30% lower than the iShares MSCI India ETF’s 25.5x. What’s more, on top of being cheaper, stocks in the WisdomTree India Earnings Fund have, on average, higher returns on equity, earnings growth, and dividend yields.

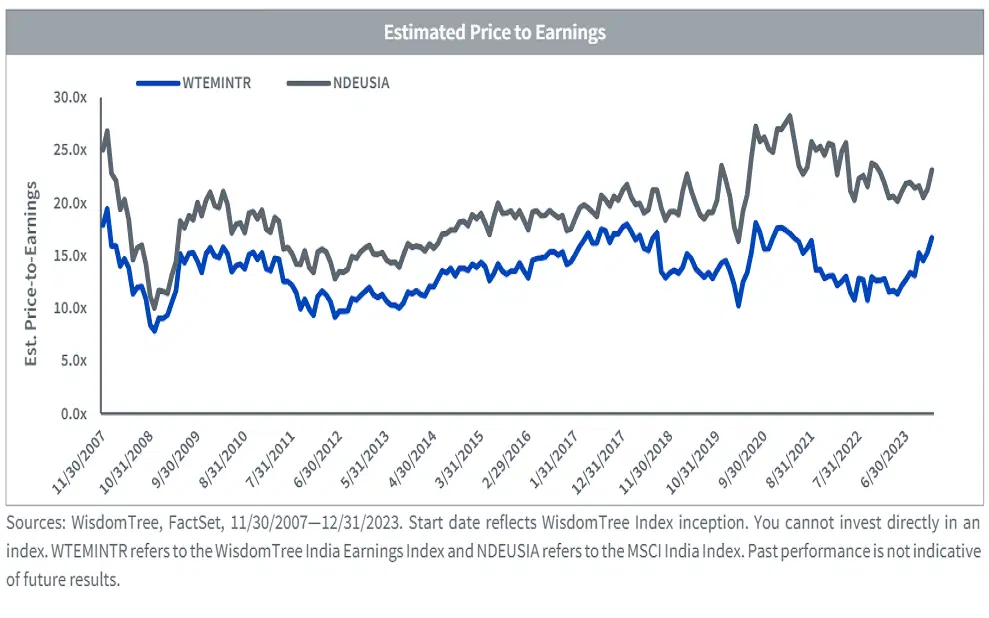

The WisdomTree India Earnings index (the underlying benchmark tracked by the ETF) has traded at a P/E discount to the MSCI India since its inception. Source: WisdomTree.

And now for the million-dollar question: has this bias toward cheaper stocksled to better performance? The answer is yes. Over the past ten years, the WisdomTree India Earnings index (the underlying benchmark tracked by the ETF) achieved a 12.3% annualized return – well higher than the MSCI India’s 9.7%. However, because of the ETF’s hefty expense ratio, its total annualized return was lower, at 10.3% (which is still higher than the MSCI India, to be fair).

Interestingly, the ETF underperformed its benchmark by 2 percentage points on an annualized basis over the past ten years, which is much higher than its current expense ratio of 0.85%. I suspect this discrepancy is because of a higher expense ratio in the past (although I struggled to find the data to confirm this).

I’ll end with a quick word of caution. While Indian stocks are currently in vogue, some investors are starting to question whether the enthusiasm has gone too far. If that skepticism grows, an investment in Indian stocks could underperform, regardless of which ETF you choose. That said, if you’re in it for the long haul and aren’t worried about short-term dips, adding some Indian stocks to your portfolio could help you gain exposure to one of the world’s fastest-growing major economies.