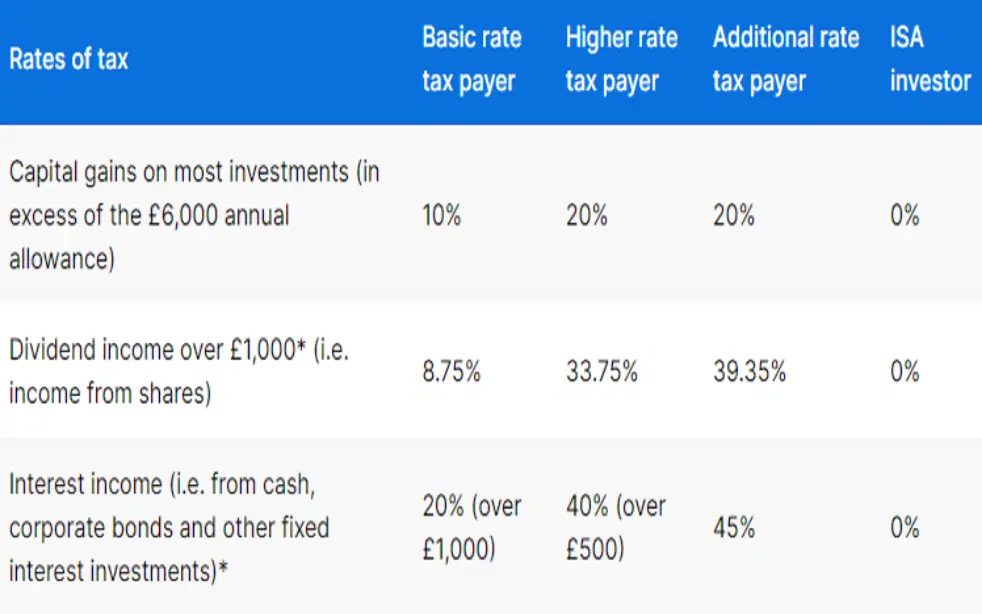

America’s Roth IRAs and Britain’s ISAs allow you to hold cash, shares, bonds, funds, and other permissible investments without paying tax on the interest, dividends, or capital gains they earn.

You can enjoy these generous tax benefits by getting started with whatever savings you can spare. But first, take a minute to define your financial goals, which will help you build a suitable, diversified portfolio.

To supercharge the size of your account, make sure you maximize your annual contributions, minimize your costs, and reinvest any income (such as dividends or interest earned). And remember to be disciplined and patient with your investing.

Tax-exempt individual investment accounts have become a favorite tool of savers – thanks to the perks they deliver later in life. Because you stash your already-taxed earnings into these kitties, you don’t face another hit when you withdraw them. And, sure, the government restricts how much money you can sock away each year in these accounts, but that hasn’t stopped some investors from building balances worth well over $1 million. Here are seven tips to help you follow in their footsteps.

First, what are these accounts exactly?

The most popular one in the US is the Roth Individual Retirement Account (Roth IRA). In the UK, it’s the Individual Savings Account (ISA). Neither is an investment in its own right. Instead, they’re protective “wrappers” that let investors shelter their money from tax. Essentially, they allow you to hold cash, stocks, and certain other assets without paying tax on the interest, dividends, or capital gains they earn. You can think of a Roth IRA or an ISA as a shark cage, with your money and investments floating around inside it, completely protected from encircling tax sharks.

The Roth IRA allows you to invest in a wide range of securities and funds. But the US government caps how much you can contribute each year: for 2024, that maximum is $6,500 ($7,500, if you’re 50 or older). More importantly, the cap is based on your income: the higher it is, the lower the limit.

The UK’s ISAs come in various forms, each tailored to different financial needs and risk appetites. But the most popular one is the Stocks and Shares ISA, which allows you to invest in individual stocks, bonds, ETFs, investment funds, and so on. And the ISA has a more generous contribution limit: you can put away a maximum of £20,000 ($25,000) every tax year. But note that these limits (Roth IRA and ISA) could change in the future.

Comparing different UK tax rates for a regular vs. ISA investor. Source: Hargreaves Lansdown.

Not only is the money you make – in interest, dividends, and capital gains – tax-free, but with the ISA, you can also pull your money out at any time without the taxman sticking his nose in (although some providers might charge a withdrawal fee). Taking money from a Roth IRA is a bit more complicated: you can take tax-free slices of your contributions (but not your earnings). But only under certain conditions – like if you’re disabled, 59.5 or older, or planning to use the funds to buy your first home – can you pull from your earnings.

Next, how do you become a Roth IRA or ISA millionaire?

1. Start today with what you have.

"The best time to plant a tree was 20 years ago. The second best time is now." – Chinese proverb.

Investing early harnesses the power of compounding and exponential growth, turning time into your greatest ally. Compounding occurs when the earnings on your investments begin to generate their own gains. Over time, these reinvested earnings grow exponentially. The longer your investment time horizon, the more opportunity there is for your initial investments to expand through this process.

To better highlight the importance of this concept, imagine you invest £10,000 every year with the goal of becoming an ISA millionaire. If you only have ten years to achieve this, you would need an average annual return of 47.4% to reach £1 million, which is extremely unrealistic. On the other hand, if you extend your investment horizon to 30 years, the average annual return you’d need becomes a more achievable 7.3%.

2. Determine your financial goals.

After you’ve funded your Roth IRA or ISA, but before you start investing the cash, you need to define your financial goals. After all, what you’re trying to achieve with your investment account will guide how you allocate your portfolio. A practical approach to writing out your financial goals is to craft an investment policy statement, which essentially forces you to answer four key questions:

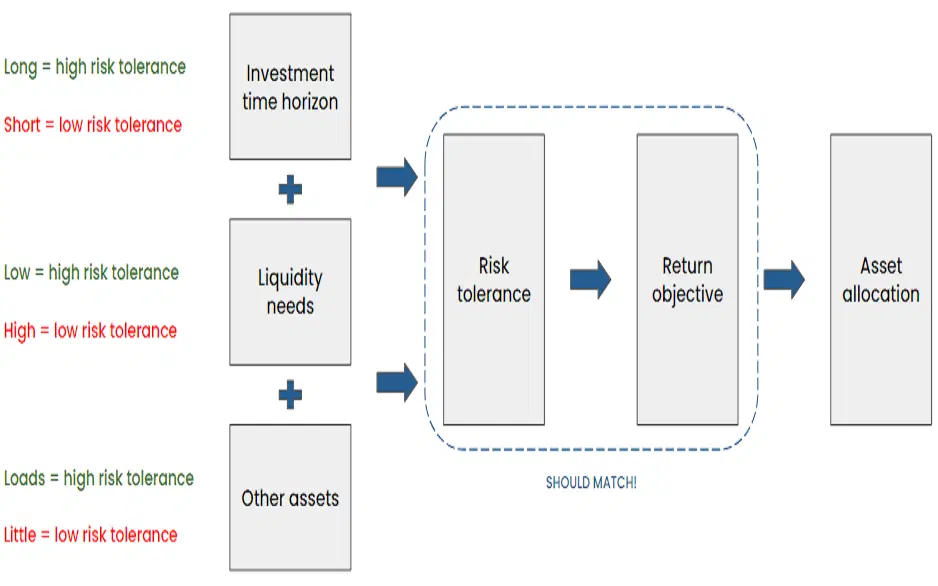

Time horizon: what’s the timeline for my goals?

Liquidity needs: how often will I need to withdraw cash (if at all)?

Risk tolerance: how much loss can I stomach?

Return objective: how much money do I hope to make?

There’s a reason why it’s important to answer the questions in that order: your time horizon and liquidity needs determine your risk tolerance, which, in turn, sets your return objective.

How your constraints and other assets determine your risk tolerance, return objective, and asset allocation. Source: Finimize.

3. Build a diversified portfolio.

Once you’ve defined your investment goals, it’s time to build a portfolio that matches your risk tolerance and return objective. If, for example, you can handle higher risk and are aiming for strong returns, then you might want to allocate a big part of your portfolio to high-risk, high-reward asset classes like stocks or emerging market bonds.

But remember not to put all your eggs in one basket. Diversifying a portfolio across different asset classes is crucial because it improves risk-adjusted returns – that is, investment return per unit of risk. And that’s because asset classes aren’t perfectly correlated: they tend to behave differently depending on the macroeconomic environment. A well-diversified portfolio, then, is a robust one that can withstand constantly changing economic conditions.

It's also crucial to diversify within asset classes. If 50% of your portfolio is allocated to stocks, make sure you’re not investing that entire portion in just one or two companies. If you do, you’ll be a lot more prone to big, devastating losses that are tough to recover from. If you experience a 60% loss, for example, you’d need to achieve a 150% gain just to get back to where you were.

4. Maximize your annual contributions.

The size of your portfolio comes down to how much you invest and how much return you generate. So the more you can invest, the bigger the size of your portfolio and the greater the potential for future gains. So, making the most of your annual Roth IRA or ISA allowance is the best way to maximize your account’s true potential. That’s because the annual allowance expires at the end of the tax year, and any unused amount is lost forever – you can’t roll it over to the following tax year.

The savviest Roth IRA and ISA investors contribute to their accounts early in the tax year and put that cash to work, allowing their money to grow sooner. In 2023, 40% of the ISA millionaires on interactive investor said they’d contributed their full £20,000 allowance by the end of April – less than one month into the UK tax year.

5. Minimize your costs.

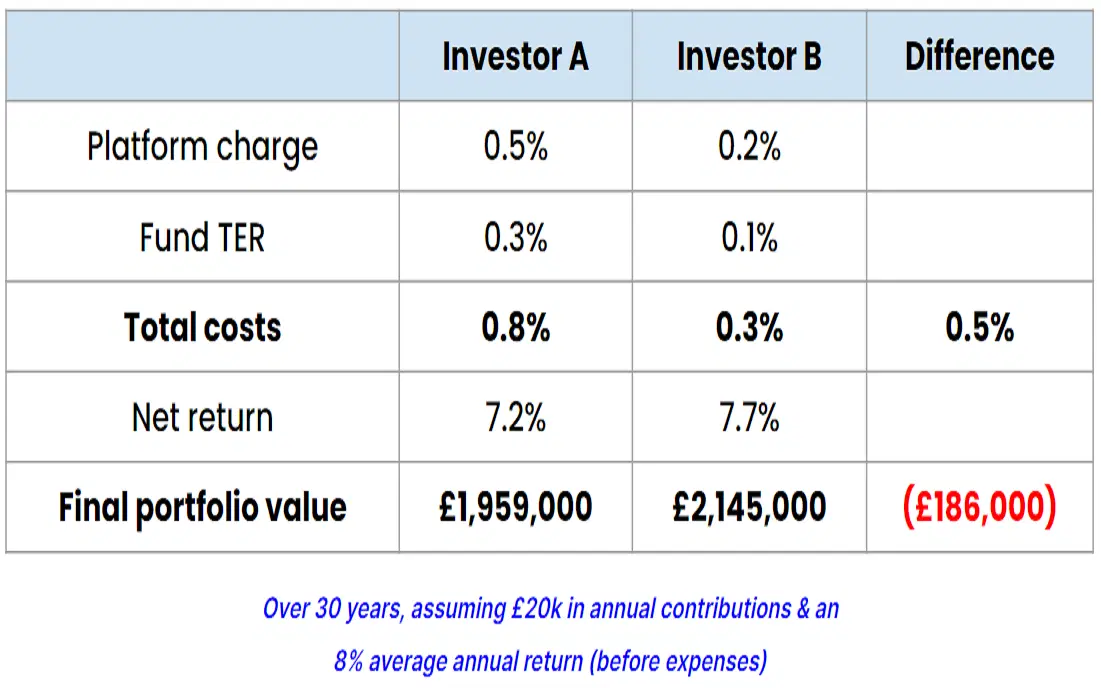

Hefty fees can frustratingly erode your investment returns over time. What might appear as a minor cost in percentage terms today can compound and accumulate exponentially, seriously reducing the final value of your investment portfolio.

There are three major costs to be aware of when using these individual accounts. First, there’s a platform charge, which is what you pay your provider to hold and manage your account. It can be quoted as a flat fee or as a percentage of your portfolio value. Second, there are investment fund and ETF expenses, which are captured by the total expense ratio (TER). Expressed as a percentage, it reflects the annual fees you pay the issuer to operate the investment fund or ETF. Third, you’ve got trading fees, which are incurred when buying and selling stocks, ETFs, investment funds, and other assets.

Example of how higher fees can significantly reduce the final value of your investment portfolio. Source: Finimize.

6. Reinvest income.

Reinvesting your income – such as dividends or interest earned – is a powerful strategy for building wealth over the long term. When that money stays invested, it can compound and generate additional returns over time, creating a snowball effect. This accelerates the rate at which your portfolio grows, ultimately leading to much higher final portfolio values compared to if you had withdrawn the income. What’s more, because dividends and interest are tax-free in these kinds of accounts, you can reinvest the full amounts without any deductions.

And if you think that seems complicated, don’t worry. It’s actually quite easy. When you invest in funds, you’re given the choice between “accumulation” units and “income” units. Select the accumulation units: they automatically reinvest any income earned back into the fund. When you invest in individual shares or ETFs, investment platforms usually offer an automatic dividend reinvestment service. Just like the name suggests, this service automatically uses any dividends earned to buy more shares of the company or ETF that issued them.

7. Be disciplined and patient.

Investing inevitably comes with its ups and downs. And during those down moments, it’s really important to be disciplined and to stick to your game plan. Plenty of studies have pointed to a similar conclusion: timing the market or beating it with some kind of clever stock-picking is exceedingly difficult. And a simple, unspectacular strategy – buying and holding the entire market through low-cost index funds – often delivers better results for people.

Granted, it’s not always easy to stay the course. You have to be willing and able to withstand substantial losses, sometimes for extended periods – because while the stock market has climbed higher over the long haul, it’s had plenty of downturns along the way. But if you remain disciplined and patient, a buy-and-hold approach with a low-cost index fund could help you become a more successful investor in the long run. And with a little bit of luck, you might become a Roth IRA or ISA millionaire yourself.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.