The stocks of all six of these mega-cap tech companies have been ripping, so expectations are generally pretty magnificently high.

Microsoft and Amazon shareholders are watching those firms’ cloud services businesses to see whether the recent growth trends continue. And Alphabet investors are hoping for a meaningful growth pickup here too.

But for Meta and Alphabet stockholders, the focus is on advertising growth. And for Apple, it’s a matter of proving the firm can continue to enjoy premium growth. Nvidia, meanwhile, is out on its own, shooting for the moon and a $20 billion revenue quarter.

Tesla’s earnings update was, well, anything but magnificent. The overall grim showing had the EV maker falling short of analyst expectations and warning of “notably lower” growth for this year.

But cheer up: there are six other mega-cap companies in this so-called Magnificent Seven – all set to deliver their quarterly reports over the next couple of weeks – and I’m willing to wager that they won’t all be this dreary.

Here’s a look at the earnings calendar for the other six, and the things you’ll want to pay close attention to when they deliver their results.

Microsoft: January 30th

It’s tempting to think of Microsoft and its big AI play in quasi-biblical terms, with B.C. standing for “Before ChatGPT”. The software giant’s $10 billion stake in the chatbot’s creator, OpenAI, seems to be just that revelatory. And that’s why the focus lately has been on Azure, Microsoft’s company’s cloud business, which houses all the fancy technology.

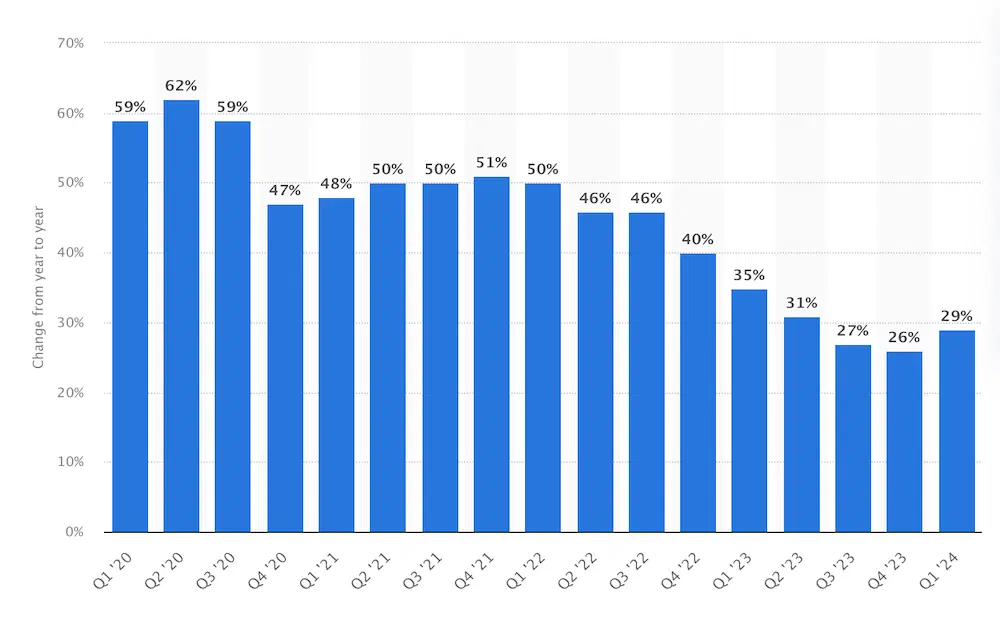

See, the prevailing wisdom is that AI will beef up Azure’s growth rates by around 3 percentage points in 2024, pulling the segment back above 30% revenue growth. For the latest quarter, investors expect Azure to have churned out an annual growth rate somewhere in the high 20s. So they’ll be watching that number and paying even closer attention to what the firm says about expectations for next quarter. Any lack of acceleration will likely be taken very badly – suggesting that AI isn’t having the impact most people envision.

The year-over-year revenue growth for Azure, Microsoft’s cloud services business, going back three years. Source: Statista.

But, listen, Microsoft’s actual software will be the key AI monetization engine for the firm. According to some, Copilot – that’s Microsoft’s core software, packaged with an AI assistant – could pull in hundreds of millions of dollars in additional revenue. Copilot’s been selling for a few months now, and investors are dying to know how it’s doing. Interestingly, the feedback so far (according to my social media feeds anyway) has been mixed, and there’s a general feeling that Copilot needs to get better. That won’t surprise most people: Windows 1 was pretty awful, by all accounts.

Alphabet: January 30th

Initially, investors weren’t sure where to position Alphabet in the new AI world. For years, the firm was seen as a thought leader in the space, showing off advanced chatbots at all its annual technology events. But, when AI became a reality last year, investors got all nervous, fretting that Google’s parent was suddenly behind the curve. In fact, they even went one further, worrying that the company’s bread and butter – search – could be disrupted by the technology and that Alphabet could lose everything that made it what it is today.

Fast forward a year, and most of those jitters have faded – if not outright vanished. Search revenue has accelerated nicely, posting more than 10% growth in the third quarter. That’s not quite the 20% growth the firm – and its investors – had become used to, but it’s much better than was feared only a year ago. Simply put, investors won’t want to see any growth reversal in search and you can expect 10% (or above) to be greeted warmly.

Mind you, while it’s nice that AI hasn’t killed Alphabet’s golden goose, investors aren’t convinced that AI is actually helping the firm. Google’s cloud business – which ranks third in size behind Amazon’s AWS and Microsoft’s Azure – revealed an unexpected growth slowdown during the last quarterly update. And that was a blow, as it had been outpacing its rivals and grabbing share. It sent Alphabet’s stock lower and it’s partly why Alphabet shares trade at a cheaper valuation than the others. But this time around, if search maintains a healthy growth clip, and Google’s cloud business can pick up again to, say, 25% growth or better, then Alphabet could barge its way back into the AI club. And that would likely send its shares higher.

Apple: February 1st

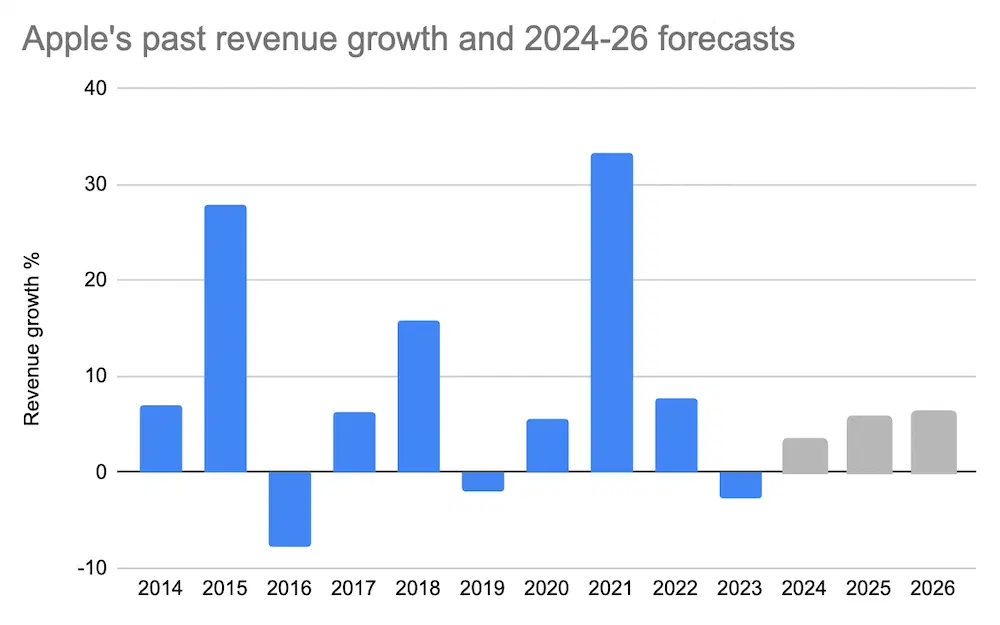

Apple’s stock price valuation is about as lux as it’s ever been, so the stakes for investors are pretty high right now. The big debate for the stock centers on what Apple’s medium-term growth prospects look like. If you think about it, stocks get handed a lofty valuation for just two reasons: fast profit growth or certainty of that growth. Apple’s had a lot of both for much of the past 20 years and it’d take a lot to knock the firm off its perch. But more than a few investors are wondering whether Apple’s future looks as good as its past. This chart shows Apple’s sales growth rate over the past ten years, and the rate expected for the next three.

Apple’s revenue growth since 2014 and analysts’ forecasts for the next three years. Source: Koyfin.

The first thing to note is that despite Apple’s reputation for reliable and predictable growth, actual sales growth has been all over the place over the past ten years. The second is that the coming three years aren’t expected to be anything like the past ten on average (around 9%).

What this means, at the very least, is that Apple – with its near-record valuation – can’t afford to disappoint anyone when it comes to its financial results. So there are two things to keep a very close eye on: iPhone and services growth.

Investors are expecting that the iPhone (which makes up more than half of Apple’s sales and profit) will have grown almost 5% in the most recent quarter. Remember, last year the firm was struggling with supply chain disruptions, so anything less than 5% would be a serious letdown. Also, look out for this quarter’s guidance: those supply chain issues were mostly ironed out by this time last year, so Apple might struggle to keep that 5% growth rate up. Overall, I’d say a 5% growth report and above-zero company guidance for this quarter (Apple’s second fiscal quarter) should be well received.

As for services, investors should look for a growth rate similar to what Apple reported for its previous quarter – 16%. That was a nice acceleration from the quarter before. And, since services are a high-growth, profitable business that’s important for Apple’s future, investors will want to see its growth hold steady – or improve.

Meta: February 1st

The Facebook parent’s metamorphosis from a social media platform for olds, wasting billions chasing a metaverse dream, to a lean, mean, AI machine ended with the share price climbing back to new all-time highs. The results have generally matched that share price rise, too, with advertising growth recovering to an impressive 20% in the third quarter, and profit margins almost doubling to more than 50%.

Recently, Meta’s CEO has been hinting about loosening some purse strings, with the firm snapping up high-powered chips and aiming to get itself in among the AI elite. So investors won’t be expecting anything like another doubling of margins (which would be mathematically impossible from this level, of course), but they would hope for steady progress from here. The firm’s record earnings before interest and tax (EBIT) margin was 56%, incidentally, reached back in the fourth quarter of 2017.

From a revenue perspective, it’s unlikely that the third quarter’s 22% growth will be repeated, but investors will want to see healthy revenue growth in the mid-teens (or better), as further proof that the firm’s initiatives – think: reels – are holding their own in the face of fierce competition from TikTok.

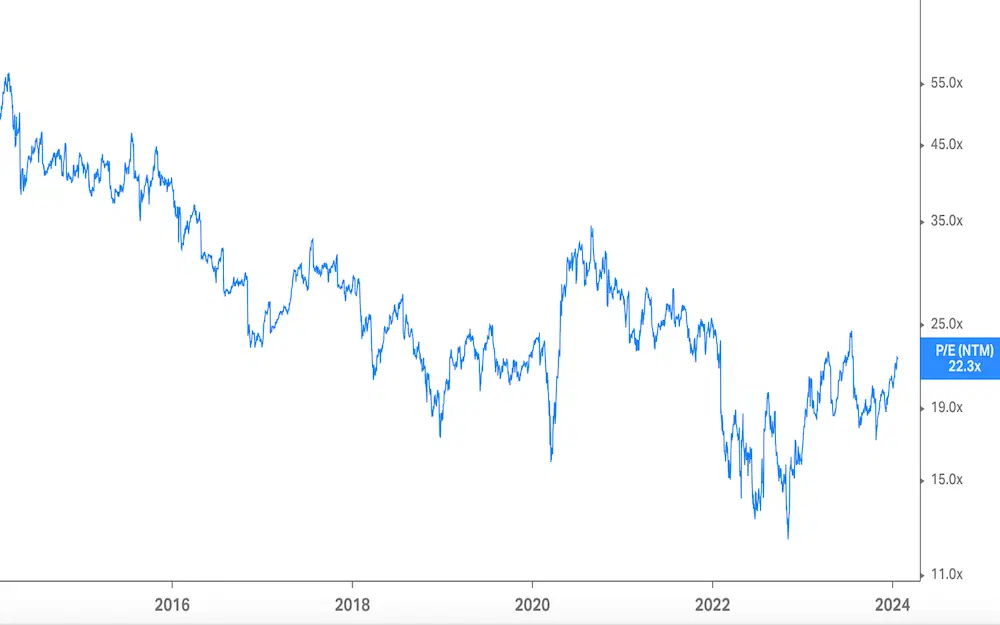

Meta is the least expensive of these six “magnificent” firms, with a price-to-earnings (P/E) ratio of just 22x, so continued financial performance momentum could see that valuation expand.

Meta’s forward price-to-earnings (P/E) ratio, over time. Source: Koyfin.

Amazon: February 1st

In the long term, how Amazon will make money from furnishing its shoppers, third-party sellers, and advertisers with the latest AI tools is probably what matters most for the stock price. But because that’s still all very uncertain, investors are staying focused on Amazon’s cloud business – AWS. Like Microsoft’s Azure, AWS should be getting a boost from AI, but the perception is that it’s falling behind Azure because it lacks the sophistication of Microsoft x OpenAI.

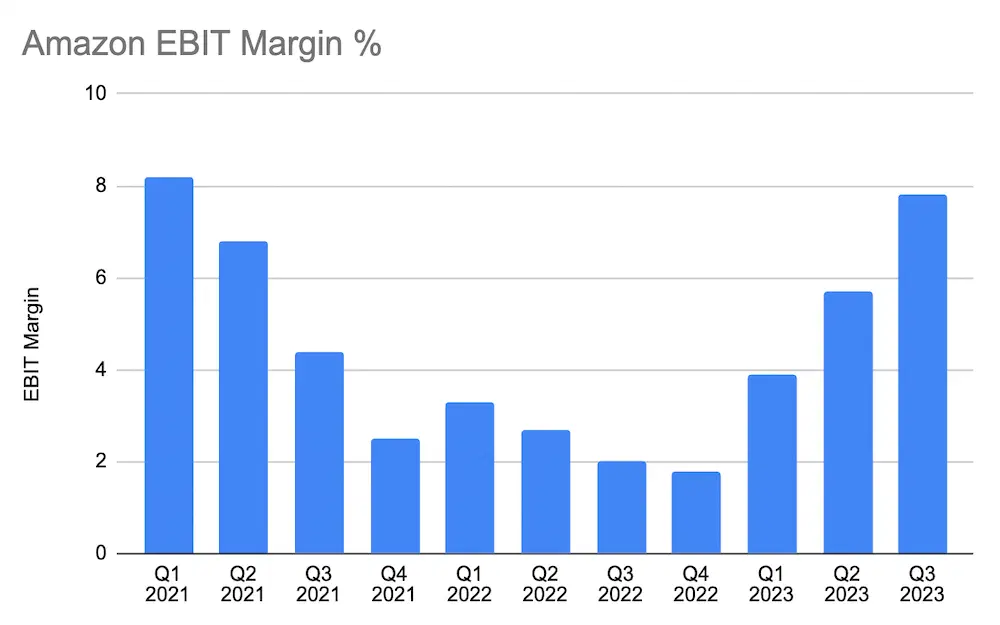

Now, AWS has been growing more slowly than Azure (although, to an extent, that’s to be expected since it’s a fair bit bigger), but directionally, they’ve been on the same path – they both went through a deceleration period and are now picking up steam again. That means AWS is expected to improve upon last quarter’s 15% growth – which itself was built on the prior period’s 12%. If it doesn’t, then you can bet the stock will hit a sizable air pocket.

Outside of AWS, Amazon’s core retail business profitability has improved a lot of late, scaling some massive investments in logistics, and seeing an easing in both wage inflation and supply bottlenecks. That matters, because Amazon’s fastest-growing businesses (AWS and advertising) have much fatter margins than its retail, and investors don’t want the core shopping business to spoil what should be a nice overall improving profitability picture. What’s more, the holiday shopping period was reportedly good for e-commerce, so investors are already, ahem, primed for good results from Amazon’s clicking-and-buying business. Anything less would end in disappointment.

Amazon’s earnings before interest and tax (EBIT) margin. Source: Koyfin.

Nvidia: February 21st

Over the past year, Nvidia’s earnings reports have become the most anticipated of them all. They’re also one of the quickest and easiest to decipher. That’s because only one thing really matters: revenue. The company is extremely profitable because of its eye-popping demand. Right now, Nvidia is running as fast as it can just to keep up, and when firms do that, they tend to be about as profitable as they’ll ever be. What that means is that Nvidia’s sky-high levels of profitability probably won’t last.

But none of that is very important as long as revenue growth keeps rolling in. No one knows how big Nvidia’s revenue could become: $100 billion seems a foregone conclusion, but what about $200 billion, or $500 billion? With each passing quarter, investors and analysts get a chance to recalibrate their thinking – and this one will be no different.

As a reminder, in the company’s third quarter (which ended in October), it unveiled an expectations-smashing $18 billion in revenue. And it predicted $20 billion for this quarter.

Now, with China somewhat dropping out of the big-customer crowd because of new export restrictions, there’s a little nervousness about that hefty revenue forecast (although you wouldn’t think so, looking at the price chart). Still, a revenue number that falls much short of that $20 billion would likely be met with a groan, and some stock selling. Unless, that is, the company hints at a massive first quarter, something above $20 billion maybe.

What’s remarkable about Nvidia is that its unbridled profit growth has actually kept its valuation in check. In fact, if you believe analysts’ forecasts for 2025 (i.e. Nvidia’s January fiscal year 2026) then the stock is only at a 24x price-to-earnings (P/E). That’s cheaper than all the other firms on this list – aside from Meta.

-

Capital at risk. Our analyst insights are for information purposes only.