Growth stocks continue to outperform value stocks, leading the S&P 500 to record highs. But that edge now appears to have reached extreme levels.

History rhymes more than it repeats, so the strategists at Bank of America say it’s a good time to consider value stocks.

Trying to call the top in growth stocks when earnings and price momentum remain so strong is all but impossible. Remember this quote: “The greater fool in growth stocks isn’t the one who buys them but the one who sells them.”

Growth stocks and value stocks are often treated like they’re in opposite corners of the ring. But, with growth shares reliably delivering knockout blows for roughly the past 15 years, there’s not been much of a contest between them. Now, that might be changing: the folks at Bank of America say value is starting to look pretty scrappy and might be worth betting on over the next year. Let’s take a look.

Alright, what’s the blow-by-blow here?

Growth hasn’t always done better: these two have a long history. And for much of it, value stocks – those that appear to be selling for less than their book value or at very low price-to-earnings ratios – were the champ.

Look back 50 years to 1974: at the time, fiscal excesses (too much government spending), a war, high inflation, and global political tensions had created a rough backdrop for the US economy. The Federal Reserve (the Fed) hiked interest rates enough to rein in inflation but hobbled the stock market in the process.

Famed investor Benjamin Graham in the fall of that year led a seminar called “The Renaissance of Value”, in which he predicted an era of dominance for value stocks. Just weeks later, his protégé, Warren Buffett, was quoted in Forbes magazine, where he colorfully remarked about the vast array of opportunities in the market. Inflation peaked in December 1974 and value outperformed growth by 8% a year in the following period. Not for the first (or last) time, Graham and Buffett were right. But it was a bold prophecy at the time, and the two had correctly called the bottom of that raging selloff.

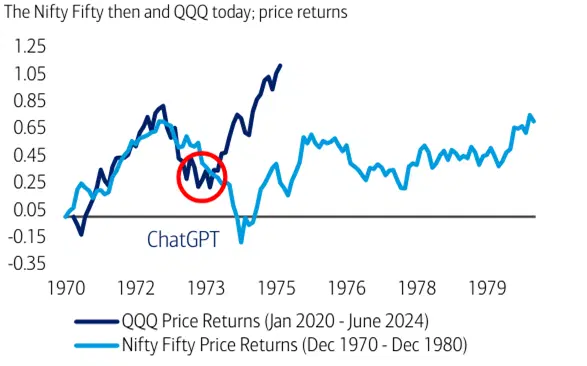

Now, interestingly, this all came after a period of market dominance for a small crew of US growth stocks – known as the “Nifty Fifty”. They’d been the market’s hotshots, widely considered to be “buy and never sell” assets. At the time, big-cap stocks with strong growth potential defied any valuation common sense – or at least they did until the Fed-fueled sobriety set in. Some of these shares had been trading at a staggering 100x price-to-earnings ratio. (That’s more than double the multiples of today’s Magnificent Seven stocks – absolute nosebleed territory.)

Anyway, history rhymes more often than it repeats, and a half-century later, the strategy team at Bank of America is once again noting the many similarities to the current backdrop, with one obvious, glaring difference: AI, whose advent is giving a handful of companies an unprecedented boost in profit margins and stock prices.

Price returns for the Nifty Fifty (light blue line) from 1970 to 1980, and for the Nasdaq 100 (dark blue line) from January 2020 to June 2024. Source: Bank of America.

The AI boom helped snap the selloff in related growth stocks that had initially been triggered by the Fed’s aggressive run of interest rate hikes, aimed at combatting inflation. Most other shares, meanwhile, languished.

So what’s the opportunity here?

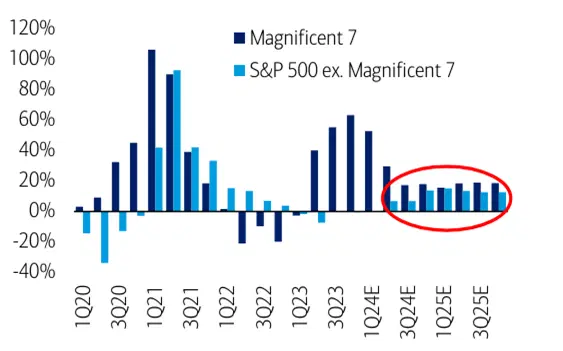

Bank of America sees the potential for another value renaissance in the coming years, based on its expectations that profit growth will broaden to include more companies and sectors between now and the end of 2025.

Profit growth, on a year-over-year basis, for the Magnificent Seven stocks (dark blue) compared to the other 493 members of the S&P 500 over time, and consensus estimates for future quarters. Source: Bank of America.

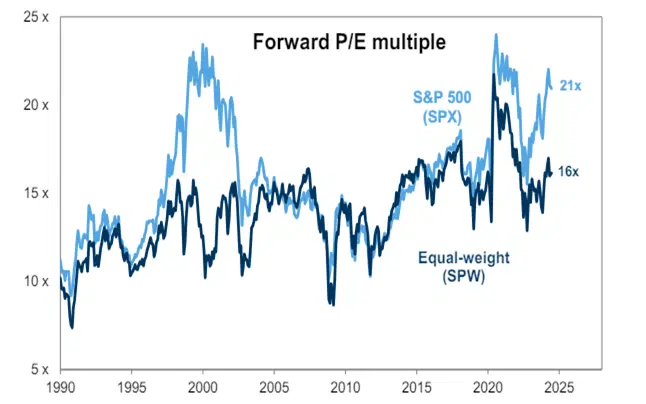

Since the starting point for valuations on those non-Magnificent stocks is so much lower, but their profit growth is expected to be almost as nice, it makes sense to expect a period of outperformance. The rally in a small number of the market’s mega-cap stocks has led to a massive outperformance of the traditionally weighted S&P 500, compared to an index that equally weights each of its 500 shares, with the difference between the two now reaching extreme levels. And if you think that’s likely to reverse, you could consider buying a bit of the Invesco S&P 500 Equal Weight ETF (ticker: RSP; expense ratio: 0.2%).

The forward price-to-earnings ratios for the S&P 500 equal weight index and the S&P 500 index. Source: Goldman Sachs.

Within the S&P 500, Bank of America sees value opportunities in the utilities, energy, and banking sectors. It also sees opportunities abroad.

Utilities. These firms control the power required for AI to realize its potential. And utilities have some of the most attractive ETF valuation scores, with price-to-earnings ratios that are at their lowest levels since 2009 versus the broader S&P 500 – although that’s the case for many sectors, with so few stocks able to keep pace with the S&P 500 in the past few years. The Utilities Select Sector SPDR Fund (XLU; 0.09%) could be a good play.

Energy. This sector’s companies should benefit from tight markets and the embrace of capital discipline – they’ve managed their costs and investments carefully and that’s putting them in a good spot. Bank of America highlights the Energy Select Sector SPDR Fund (XLE; 0.09%) for exposure to the US energy industry. And for you Buffett fans, it’s worth noting that his Berkshire Hathaway continues to increase its holding in Occidental Petroleum.

Banks. Bank of America sees strong performance continuing among its bigger peers and thinks regionals could get a boost once there’s more certainty about Fed cuts. And that thinking makes the Invesco KBW Bank ETF (KBWB; 0.35%) worth a look.

International. Outside of the US, value stocks are performing better than growth. Bank of America says Latin America in particular should do well when the Fed finally cuts rates. The iShares Latin America 40 ETF (ILF; 0.48%) has a 60% weighting in Brazilian companies and trades at an 8x price-to-earnings ratio. The bank also finds Indian and Japanese stocks look attractive

What’s the bigger picture?

Wall Street banks have been putting out their midyear outlooks in recent weeks, and almost all of them included upward revisions to their year-end predictions for the S&P 500. And really, that’s not too surprising, since the big US index has been hitting new highs – boosted by its three biggest stocks by weighting: Microsoft, Nvidia, and Apple. (All three are AI plays and all three have reached new records this week.) It’s growth stocks that continue to provide the best returns.

And that seems like a throwback to an earlier time too. As Carl Hathaway, an executive at Morgan Guaranty, said back in 1973, “The greater fool in growth stocks isn’t the one who buys them, but the one who sells them.”

He’s got a point: trying to call the top in growth stocks seems impossible. And so a small allocation to value stocks seems sensible now.

As that guru Benjamin Graham once said, “In my own thinking, the concept of value…has always lain at the heart of true investment, while price expectations have been at the center of speculation.”

The renaissance of value will happen, eventually. For now, while earnings and price momentum continue in mega-cap growth stocks, I’m not going to be the “greater fool” who sells them just yet.