Japan’s companies have been cautious with their profit forecasts for this year, predicting almost zero profit growth. That’s much less than analysts are expecting, so that’s taking the wind out of the sails of Japanese stocks.

Now, when companies give their quarterly and half-year updates later in the year, they’ll likely beat their own downbeat projections. And that’s likely to give Japanese stocks a lift – along with investing incentives from regulators and the Bank of Japan.

Small-cap stocks in Japan have cheaper valuations and could be where the real value opportunities lie. Just keep in mind, if you’re investing in Japan, the exchange value of its currency, the yen, could have a serious impact on your returns.

It seemed like Japanese companies were unstoppable: seeing robust sales and strong profits, plus generally benefiting from a string of investor-pleasing reforms. But now firms are delivering some downbeat forecasts – and that’s put the stock market’s roaring rally on pause. Let’s catch up on what’s going on here, and what could happen next.

What’s going on with these stocks?

Most Japanese companies have a financial year that ends in February or March. And taken together, their updates for the latest year-end included some satisfying figures: a sales increase of 5.4% and a punchy net profit rise of 16.5% – a record, in fact, for the third year in a row. But that’s where the good news seemed to end: company guidance for sales and profits for this year look disappointing, with firms predicting a 3% dip in net profit, despite the fact that analysts are expecting a 5% to 6% rise. And now those firms’ tepid forecasts are undermining confidence and putting the positive stock market momentum on ice.

The question now is whether investors are right to be worried. And the general view from market pros is that this is just the usual way of things: Japanese companies often announce conservative guidance to avoid disappointing investors, figuring it’s better to lowball and then beat expectations. Plus, there’s a sense that, after decades of crippling deflationin Japan, firms are conditioned to be a tad downbeat about economic and business conditions.

But, if things do go well, quarterly and half-year results later this year will be above companies’ conservative forecasts, and that will undoubtedly get stocks moving higher again.

So, should you be optimistic about Japan’s stocks?

You certainly could be. Japan is enjoying steady economic growth and has successfully rid itself of deflation – an economic force that’s even more destructive than inflation. It’s now got sustained, moderate inflation with wages that are finally rising, and with companies able and willing to pass higher costs onto their customers through price rises. Its central bank, the Bank of Japan, has said it wants to keep interest rates low (but no longer negative) – to support economic growth and investment.

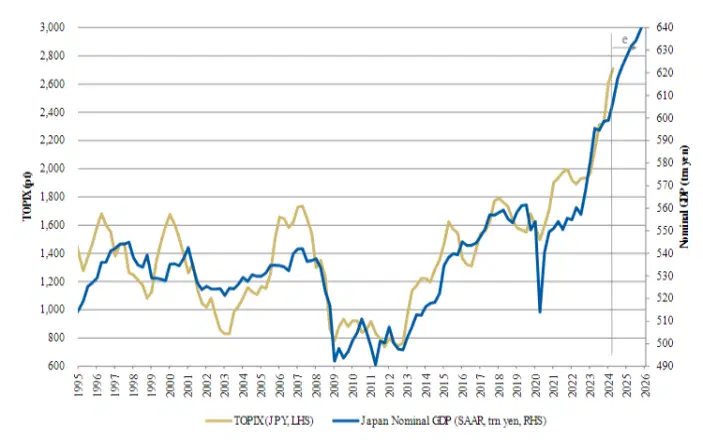

Japan’s economy and the benchmark Top ix stock index have tended to move hand-in-hand over the years. So it seems reasonable to assume that if the economy is poised to thrive, the Top ix would be too.

The price of Japan’s Topix stock index (yellow, left-hand axis) and the total value of the goods and services produced by Japan’s economy, or nominal gross domestic product, in trillions of yen (blue, right-hand axis). Source: Morgan Stanley.

What’s more, directives handed down from policymakers have led to major reforms in corporate governance. That’s improved companies’ profitability and shareholder returns, in both share buybacks and dividends.

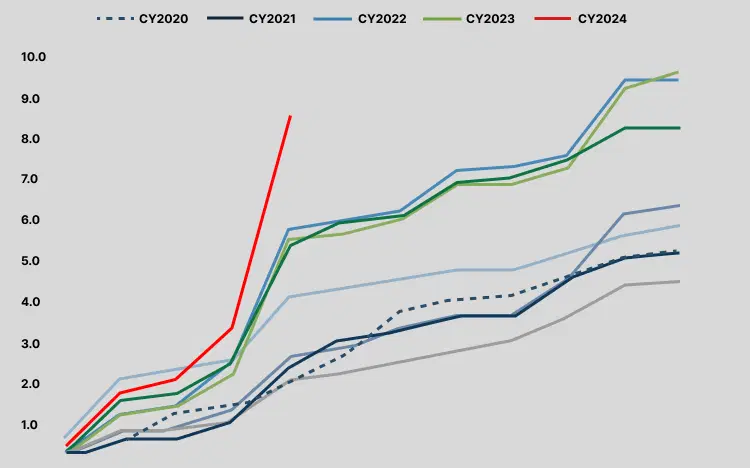

The cumulative value of announced share buybacks, measured in trillions of yen, by year. The 2024 cumulative value (in red) has risen more steeply than in previous years. Source: Goldman Sachs.

Companies are now being encouraged – both by regulators and investors – to sell off assets like cross-shareholdings and return excess cash holdings to shareholders to improve returns.

The government has also encouraged retail investors to invest in the stock market through a tax-friendly savings scheme – called the Nippon Individual Savings Account (NISA) – which has seen a sharp increase in inflows this year. Interestingly, a lot of folks are picking high-dividend-paying stocks. And that suggests they’re playing it somewhat safe: opting for more income than they’d get with the banks’ near-zero interest rates, but opting for slow-but-steady shares. Still, it's something.

See, back when Japan was struggling with deflation, keeping cash in the bank made total sense. Even earning absolutely no interest, money held its purchasing power and then some – as prices of goods and services stayed flat – or fell. But with inflation, that strategy has fallen apart. Money sitting idle loses its buying power, as prices on things go up. And that’s what’s driving folks now to look for higher returns and invest in stocks.

And what are the risks you should be aware of?

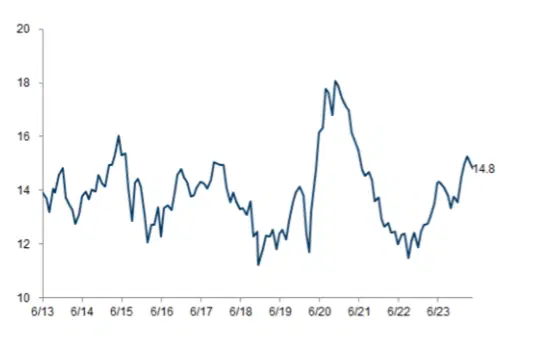

First and foremost: valuations. Japan’s stock market has adjusted higher, trading at a 14.8x forward price-to-earnings (P/E) ratio, up from around 12x just two years ago. And with Japanese companies reporting higher and higher returns, those valuations could jump up even more.

The 12-month forward price-to-earnings (P/E) ratio for Japan’s Topix, over time. Sources: Factset, Goldman Sachs.

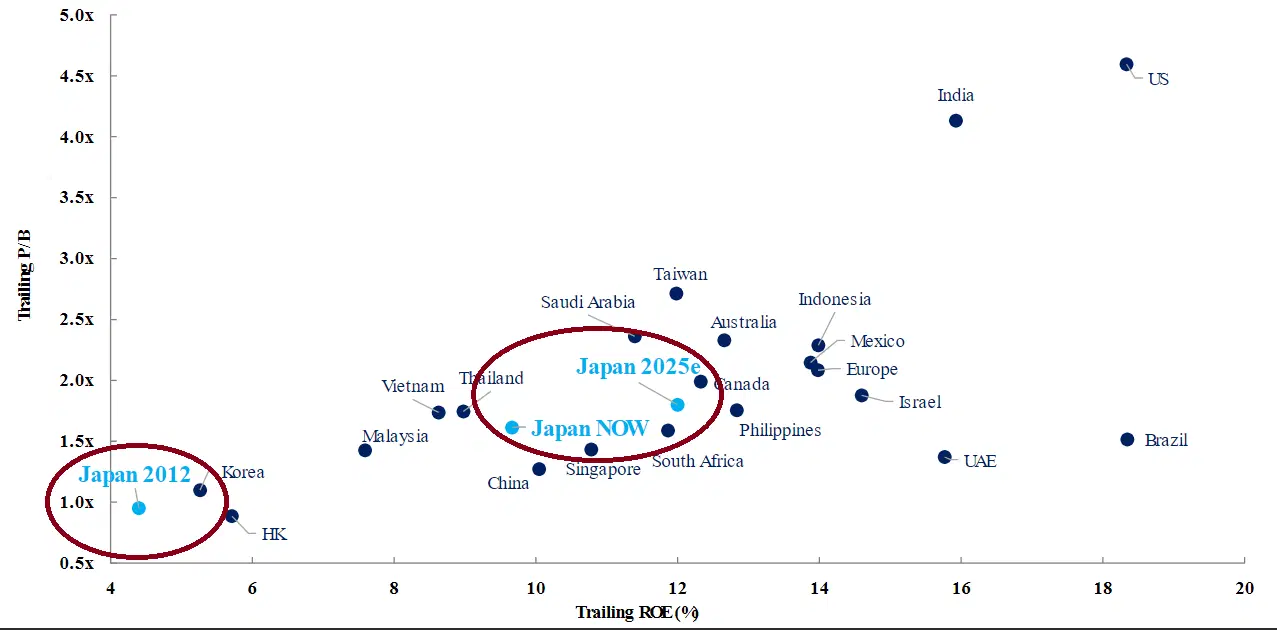

Just 12 years ago, before Japan embarked on a broad-based push to gussy up its stock market, the return on equity for Japanese stocks was dismal (sub 5%). Those low returns coincided with a price-to-book ratio of around 1x. Now, with the return on equity for companies having jumped to about 9%, the price-to-book that investors are willing to pay for the stock has increased. And it could increase even more: –Morgan Stanley sees the return on equity for Japan’s stocks rising even more – 12% this year.

Japan’s trailing price-to-book ratio and return on equity for 2012 and 2024, and its estimate for 2025. Plus the 2024 figures for other global economies. Sources: Factset, Morgan Stanley.

Now, if all goes well, Japanese companies’ profits will beat the current conservative estimates and put the Topix rally back on track. And if that happens, you may wish you would’ve followed Warren Buffett’s lead and put money on commodity companies like Mitsubishi Corp or banks like MUFG.

But, whatever you do, you will want to be aware of the other major risk: an unexpected change in the value of the Japanese currency, the yen.

This chart shows the returns you would have seen over the past five years, in investing in the iShares MSCI Japan ETF (ticker: EWJ: expense ratio: 0.5%), the iShares Currency Hedged MSCI Japan ETF (HEWJ; 1.03%), and the iShares MSCI Japan Small-Cap ETF (SCJ; 0.5%).

Five-year performance of the MSCI Japan Small-Cap ETF, MSCI Japan ETF, and the Currency Hedged MSCI Japan ETF. Source Koyfin.

While the five-year return for the MSCI Japan ETF (purple line) is 38%, the hedged version (blue line), which aims to protect the investor against a falling yen, has returned a massive 118%. But predicting currency moves is notoriously difficult, so it may make sense to go for a little of both funds if you want to invest in Japanese stocks.

Japan’s smaller companies, meanwhile, have underperformed the heftier ones – and that’s partly because big-cap companies benefit more from the weaker yen since they make more money abroad where the currencies have been stronger. And now those small firms may be where the real value opportunities are in Japan. If that’s your preferred route, you could look for an active fund manager who finds truly undervalued smaller companies – or simply buy a little of the MSCI Japan Small-Cap ETF.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.