K-pop and K-dramas have been captivating international audiences since the late 1990s. And they continue to shape mainstream media today as part of the Hallyu, or the Korean wave. But the world’s fascination with Korea isn’t strictly about entertainment: in the past ten years, interest in the country’s real estate has also been taking off – especially in the build-to-rent (BTR) market. So, naturally, I decided to crunch some numbers.

Is Seoul the next Tokyo?

The fundamentals for BTR in Seoul are promising. After a slight pandemic-related dip in 2021, net migration into Korea’s capital has bounced back in a big way. That’s thanks to a big influx of people in their 20s, drawn toward opportunities from big multinational companies and startups, and hoping to make inroads in their careers.

The correlation between office work and housing demand is strong in Seoul. With workers spending an average of 4.2 days per week in the office, most Seoullites prefer to rent somewhere close to their offices.

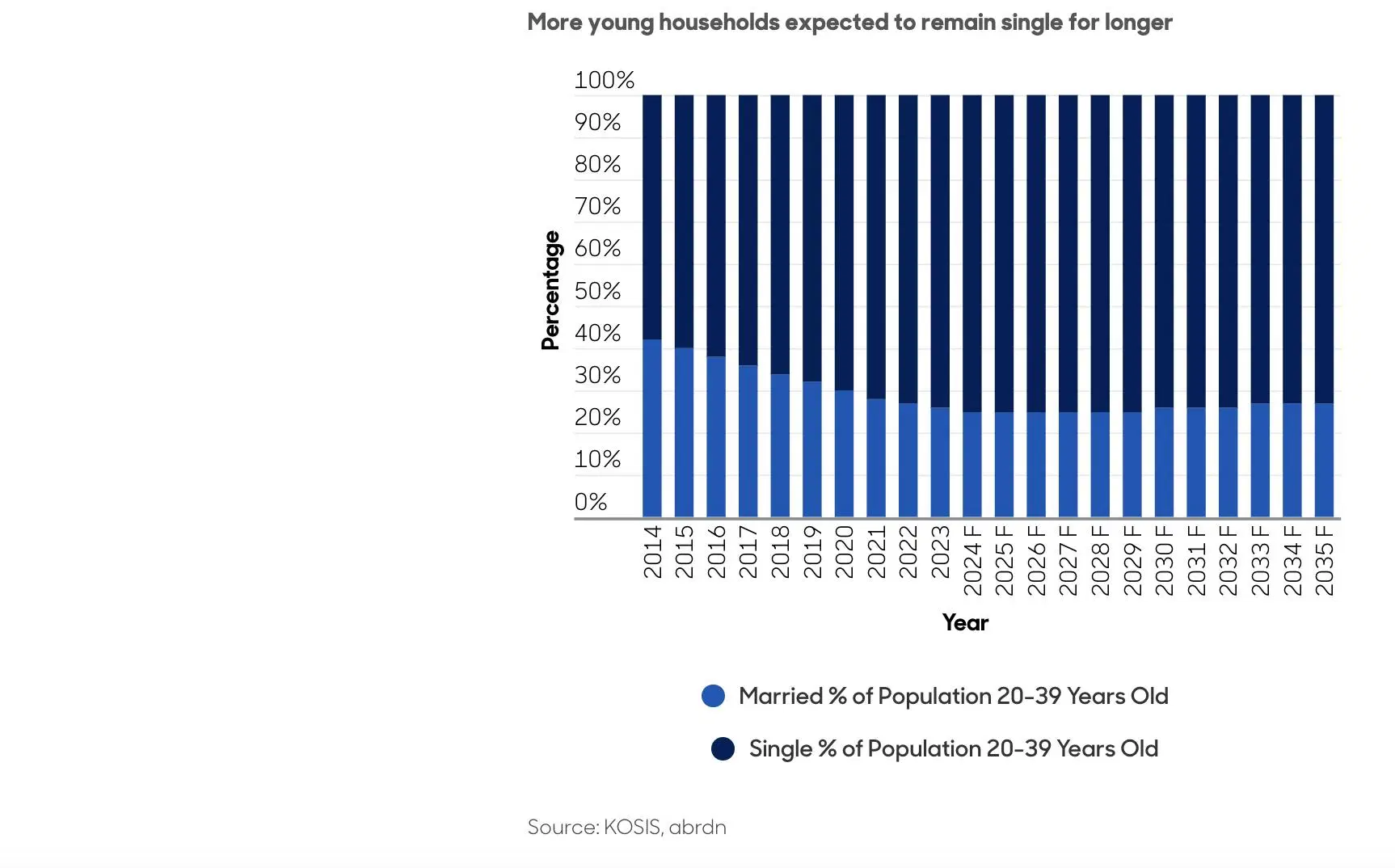

More young households expected to remain single for longer. Source: abrdn.

It’s a demographic that’s not racing to get married and start families. And in that way, Seoul is a lot like Tokyo: both capital cities are experiencing high levels of in-migration, rise of young households staying single for longer, and a stunningly limited housing supply. But one key factor separates the two – inflation.

Japan’s BTR market matured in a unique environment caused by deflation – or falling prices – which encouraged people to rent rather than own homes. After all, why buy a house if homes just continue to fall in value? As a result, Tokyo now has a home-ownership rate of just 27% – well below other markets.

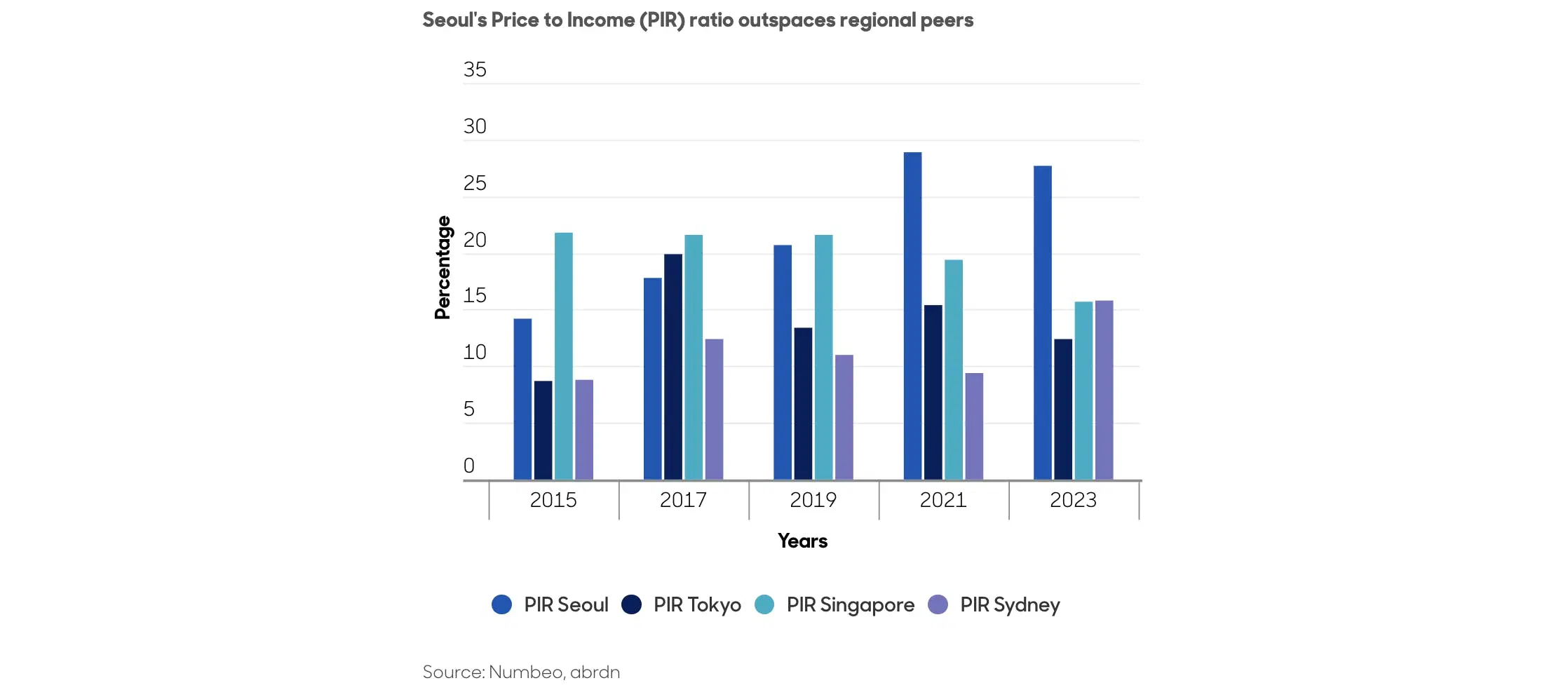

By contrast, Korean inflation has been healthy over the past two decades, leading to steady capital appreciation for residential properties. The potential for capital gains has motivated many South Koreans to invest in real estate over the past 20 years. But – and this probably sounds familiar depending on where you live – incomes in South Korea haven’t increased at the same rate as housing prices. Consequently, lots of younger people in Seoul just can’t afford to buy a home. And, yeah, it’s true that the unaffordability of housing drives the rental market. But the growth of the BTR sector in Korea might develop more slowly than it did in Japan.

Seoul's price-to-income rate (PIR) ratio outpaces regional peers. Source: abrdn.

What’s the rental market like then?

South Korea is a developed country, but its rental housing market behaves like a developing one. The preferred rental method is called Jeonse, which entails a one-time refundable rental deposit, equivalent to usually 80% of the property’s market value. Landlords retain the lump sum for the duration of the tenant's stay – typically two years. And they’re are required to return the full principal amount to the renter when the term ends. Instead of collecting monthly rent, the landlord benefits from reinvesting the principal. For landlords, Jeonse is an easy way to raise capital, which they often use to reinvest in fixed-term deposits or use as downpayment on additional rental properties. Jeonse bank loans are more accessible for renters, with considerably lower interest rates compared with regular mortgages. They also allow renters to borrow up to 80% of the rental deposit.

Wolse, on the other hand, operates on a monthly rent system And the shift from Jeonse to Wolse introduces challenges that could slow the institutionalization of the BTR market in Korea. See, that deeply rooted tradition of Jeonse among Korean renters poses a significant contrast to the conventional rental approach preferred by institutional BTR operators.

How can renters afford that?

Right, it begs the question: if tenants are already paying up to 80% of a property’s value, why not simply secure a mortgage to buy the place outright? The answer lies in restrictive bank loan-to-value (LTV) ratios. Mortgage LTV ratios in South Korea are typically set between 40% and 60%, requiring a significant initial cash payment to purchase a home. And that’s why many homeowners rely on a combination of savings and family support to get on the housing ladder. But that’s not always possible – and with the current economic climate, fewer parents are able to provide the necessary financial support.

What’s more, over the past two decades, rising home prices have pushed the Jeonse-to-value ratio close to 100% of the property’s underlying value. And that’s especially true in prime areas near Seoul’s central business district and Gangnam. As a result, Jeonse agreements in these locations have become virtually unaffordable, despite the availability of Jeonse bank loans. At the same time, Jeonse fraud has been on the rise, with many landlords unable to return the Jeonse at the end of the two-year lease.

With all of that going on – and with interest rates being higher – there’s been a broad shift toward monthly renting (Wolse). After all, the economics just make sese. Still, it’s not going to become the norm overnight. Remember, tenants are refunded their entire Jeonse deposit at the end of the lease. So a lot of folks view this as a form of savings. And that’s simply not the case with monthly rent – the interest on those payments are lower, sure, but you don’t walk away with that big sum at the end.

So, how do all these young people afford to live in Seoul?

Financial firms have recently taken a big interest in the Seoul BTR market. And that’s made for some joint ventures – KKR with Weave Living, and Honors AMC with Cove Living, to name two. Meanwhile, SK D&D and MGRV, already operating within Seoul, are also expanding, aiming to develop more co-living spaces. And that growth has been partly driven by government incentives, such as increased floor-area ratios and tax relief for co-living and so-called youth housing (basically: adults under 40). The latter program, for example, is a private-public partnership that’s aiming to provides subsidized apartments to that demographic at rents that are 15% to 25% below market value.

To qualify, housing sites must be within 350 meters (less than a quarter of a mile) of a metro station or medical center, or within 50 meters of a main road. The idea is to make co-living facilities suitable for young people and the elderly living alone.

So what’s the final takeaway here?

With elevated interest rates making Wolse a more economical renting option for tenants – not to mention and those increasing instances of Jeonse fraud – it’s likely that demand will increasingly shift toward institutional BTR landlords. And it’s probable that those landlords will predominantly offer Wolse as their standard rental system and protect tenants against rental fraud.

In the institutionalized BTR market, co-living appears to be a better investment option than youth housing. Co-living projects involve the conversion of hotels into offices and usually offer a relatively quick turnaround time – which can allow investors to quickly access the market. By contrast, youth housing projects are typically ground-up developments, which can be complex and take a lot of time.

What’s more, co-living is non-subsidized and can command higher rents than youth housing. And those properties are also categorized as “dormitories for rental purposes”, which exempts them from the minimum eight-year holding periods imposed on youth housing developments. As a result, co-living can generate superior internal rates of return and provide investors with greater flexibility for exit strategies, compared with youth housing.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.