Nvidia had a barnstorming 2023, so now the logical question is whether it can repeat that success in 2024.

After being caught off guard by Nvidia’s boom this year, Wall Street analysts have been drawing up some punchy growth forecasts for next year. And a lot of these expectations will be hard to meet.

It’s inevitable that Nvidia shares will have a tough time at some point. If you’re positive for the long term, you’ll want to expect that and hold on. It may require nerves of steel.

Let’s not beat around the bush: your favorite stock – Nvidia – smashed it this year. AI blasted onto the scene and turned this quiet little company with its AI-powering chips into a must-own stock for investors everywhere. Now, with Nvidia’s shares up 220% this year, the question everyone wants to know is whether next year can be anywhere near as good. Let’s take a look…

First, the obligatory glance back at 2023.

Coming into 2023, hardly anyone outside of the tech industry had even heard of the company. And like most tech stocks, it had an abysmal 2022, falling some 65% from its 2021 high. Maybe its die-hard shareholders knew that Nvidia had a bright AI future ahead of it, but the rest of us didn’t.

Everything changed in January when Microsoft announced that it had invested $10 billion into OpenAI, the startup behind ChatGPT. Somehow, that news made the AI theme real, and sparked a frenzy. And Nvidia’s stock was off to the moon.

Very quickly, investors discovered that Nvidia was one of the only ways to get early exposure to AI. The firm’s graphics processing units (GPUs) are the accelerating semiconductors that enable all the super-computing that’s needed to run large language models (LLMs) like ChatGPT. And the cloud services providers – like Microsoft, Amazon, and Google – were falling over themselves to get their hands on them.

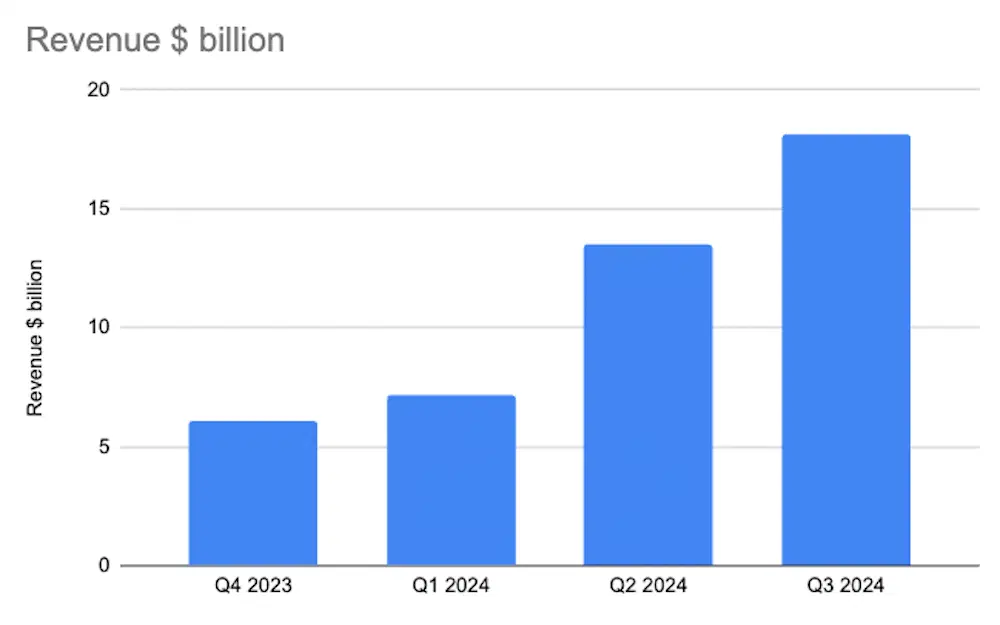

Take a look at Nvidia’s quarterly revenue progression over this past year in the chart. It’s basically tripled.

Nvidia’s revenue for the past four quarters (fiscal Q4 2023 through Q3 2024). Source: Koyfin.

It’s worth remembering just how much better this was than anyone expected. Coming into this year, analysts predicted Nvidia’s full-year revenue (ending in January 2024) would be around $30 billion. Those same analysts now think it’ll be about twice that, with the firm pulling in $20 billion this current quarter alone.

Next, let’s look ahead to 2024.

Let’s be honest, it’s impossible to know exactly what 2024 has in store, but the best place to start is with what analysts expect. At this point, you might shrug and say “what use would that be?” given how “wrong” they were with their pessimistic stock views for this year. Fair point. But AI’s sonic boom has caught everyone off guard, including Nvidia itself. My guess is that the level of upside surprise we saw this year probably won’t be repeated. If anything, analysts (now that they’ve caught up) could go too far in the other direction when it comes to setting their forward expectations.

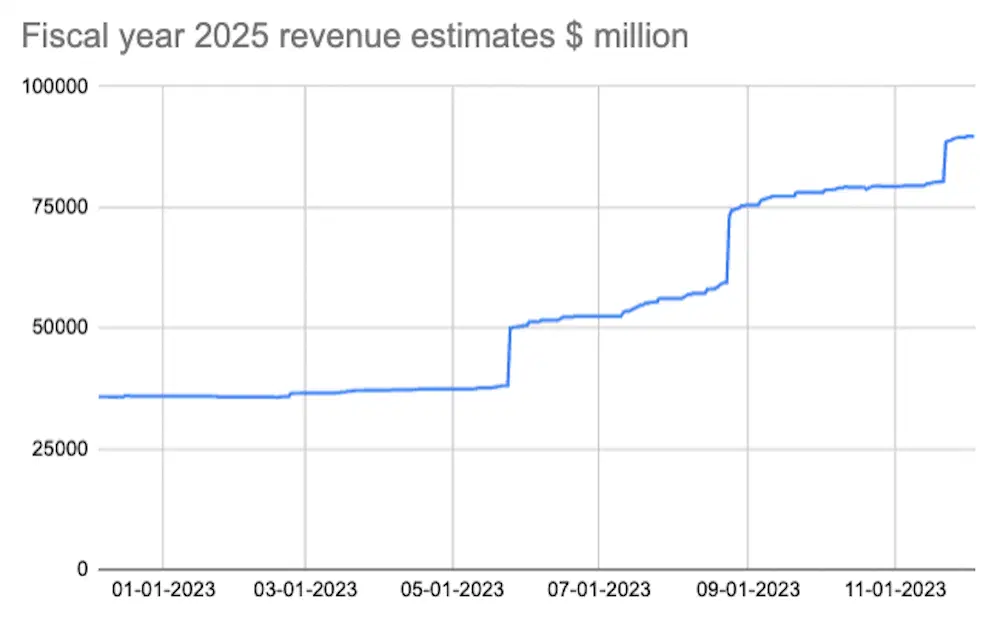

This next chart shows how next year’s revenue estimates (that is, for the year ending January 2025) have progressed through this year. They started at around $35 billion and as of today, they stand at $90 billion.

Average analysts’ revenue forecasts for fiscal year 2025. Source: Koyfin.

Now, that $90 billion would represent a 50% gain on what we’re likely to see this year. Profit is also forecast to keep piling up: these same analysts expect around $20 in earnings per share (EPS) next year – a roughly 60% jump on the latest expectations for this year.

And that all sounds tremendous, doesn’t it? With 50% revenue and 60% profit growth, surely the stock is still a buy, right? Well, maybe, maybe not. It all comes down to whether Nvidia will do better than those expectations – or worse.

So is Nvidia still a good investment?

I won’t lie: that’s a tricky question to answer. Expectations this high would be hard for any company to meet. But it’s worth taking a look at what we know about Nvidia and what common sense can tell us about its prospects.

So what do we know? Well, 50% revenue growth on a whopping $60 billion is a massive ask – there’s no getting away from that. It’d be a slowdown from this year’s 122% boom (assuming the current quarter plays out as expected) but as revenues get bigger, the growth hurdle gets higher. We also know that analysts tend to get a little carried away with these sorts of growth stocks. And the combination of those two factors makes me a bit concerned that Nvidia could disappoint relative to expectations for next year. That thought process isn’t scientific, granted, but it’s no less true.

The other thing we know is how the market is currently valuing the shares. This next chart shows Nvidia’s price-to-earnings (P/E) ratio using next year’s earnings forecast. At 23.4 times, it’s not exactly a rich valuation. In fact, it puts it in a similar valuation range to mere-mortal stocks like Coca-Cola or Procter & Gamble, and makes it cheaper than its “magnificent seven” peers Microsoft, Amazon, and Apple.

Nvidia P/E ratio using next year’s earnings forecast. Source: Koyfin.

If you’re wondering how that has happened, given Nvidia’s surging stock price, it’s all down to the fact that those earnings expectations have risen roughly in line with the price, which keeps a lid on the P/E ratio.So I’m going to wrap all that together and tie it with a big common-sense bow. I’ll start by saying I don’t think Nvidia shares are particularly expensive. In fact, if you perform a reverse discounted cash flow analysis on the stock (you can find out how to do that here) I think its long-term expectations are perfectly reasonable and could easily be exceeded. But, I do worry about near-term expectations. I mean, do you know anyone who isn't a little geeked about AI right now? I’m not sure I do. So that leaves me with a weird split view where I’m quite relaxed about the long-term but a bit twitchy about the next 12 months.So I think investors (full disclosure: I’m one of them) have a couple of options. The first is to ignore the near term and stay focused on the long term. That might be difficult if Nvidia runs into a bit of trouble and its shares fall 10%, 15%, or even 20%. But with big growth stocks like this, you can assume that will happen at some point. So if you’re in for the long haul, then just be warned that your nerve will be tested at some point.The second option is to take profit on those shares, or at least not buy any more for now. I don’t plan to do this, because I have a pretty nicely diversified portfolio of around 20 stocks, and I feel very comfortable with the long-term look of my portfolio as a whole. But if you’ve got all your money in Nvidia and one or two other names (and you shouldn’t, by the way), you might want to look to spread your eggs across a few more baskets.Much as I’d love to see Nvidia continue to go up in a straight line, I know that’s not how investing works. Eventually, then, my nerve will be tested too, and we’ll see if I can practice what I preach.

-

Capital at risk. Our analyst insights are for information purposes only.