42% of retail investors use social media significantly less than they used to for investing.

65% are more interested than ever in finding good financial advice and information.

85% of survey respondents said they favor a long-term approach and don’t adjust their investments daily or weekly.

74% of retail investors – a record number – think global stock markets will be higher in 12 months.

If you’re feeling pretty positive about the health of your portfolio, you’re not the only one. We just caught up with thousands of you savvy retail investing types and found that a record number are viewing the market through rose-tinted glass. And that’s despite some pesky fears about a potential bubble in AI and crypto assets. Here’s a closer look at our exclusive data, part of our latest modern investor survey.

You’ve got record levels of optimism – again.

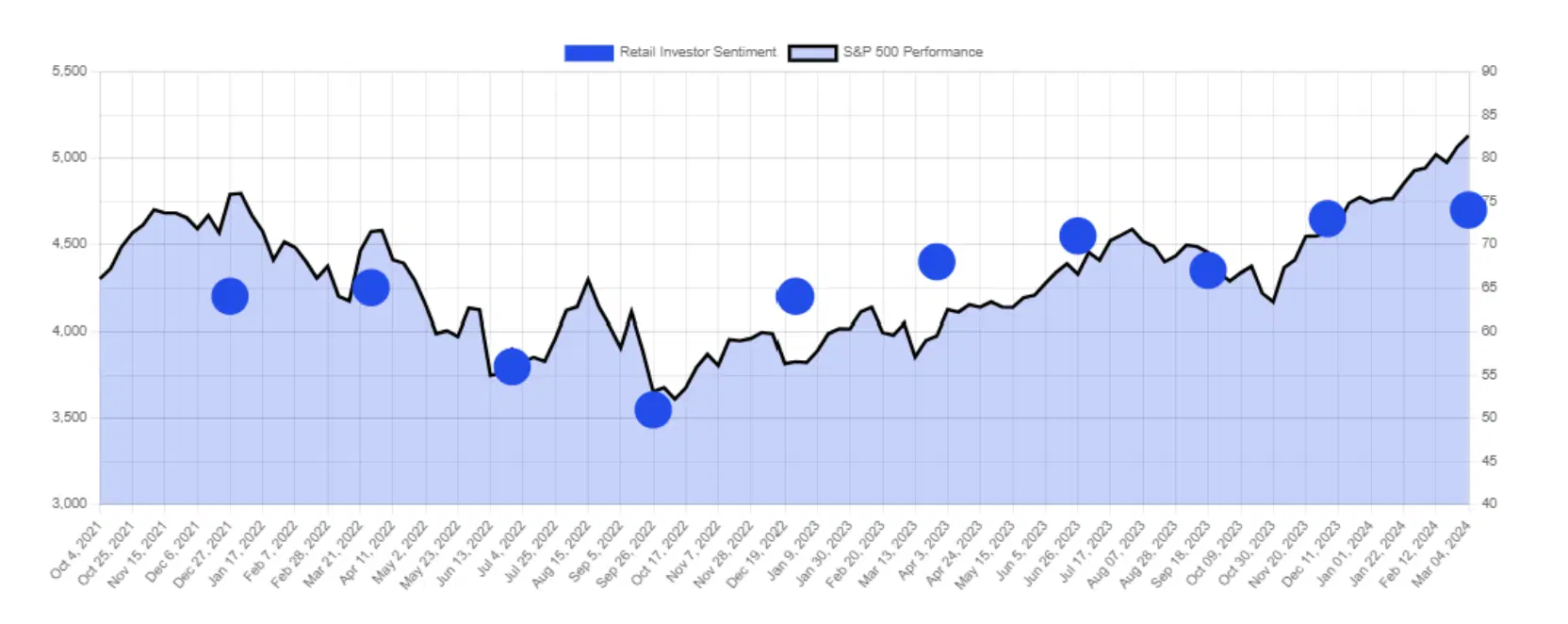

The Finimize Index tracks retail investor sentiment across our global community every quarter. In our latest survey, 74% of you said you expect global stock markets to be higher a year from now – that’s the highest figure since the Modern Investor Pulse began in December 2021.

Q: Do you think global stock markets will be higher 12 months from now? Source: Finimize Modern Investor Pulse.

You’re not investing based on stuff you saw on social media.

The role that social media has been playing in your investment decision-making has dropped a lot, with 42% of you saying you use social media “significantly less” than you used to in your portfolio process.

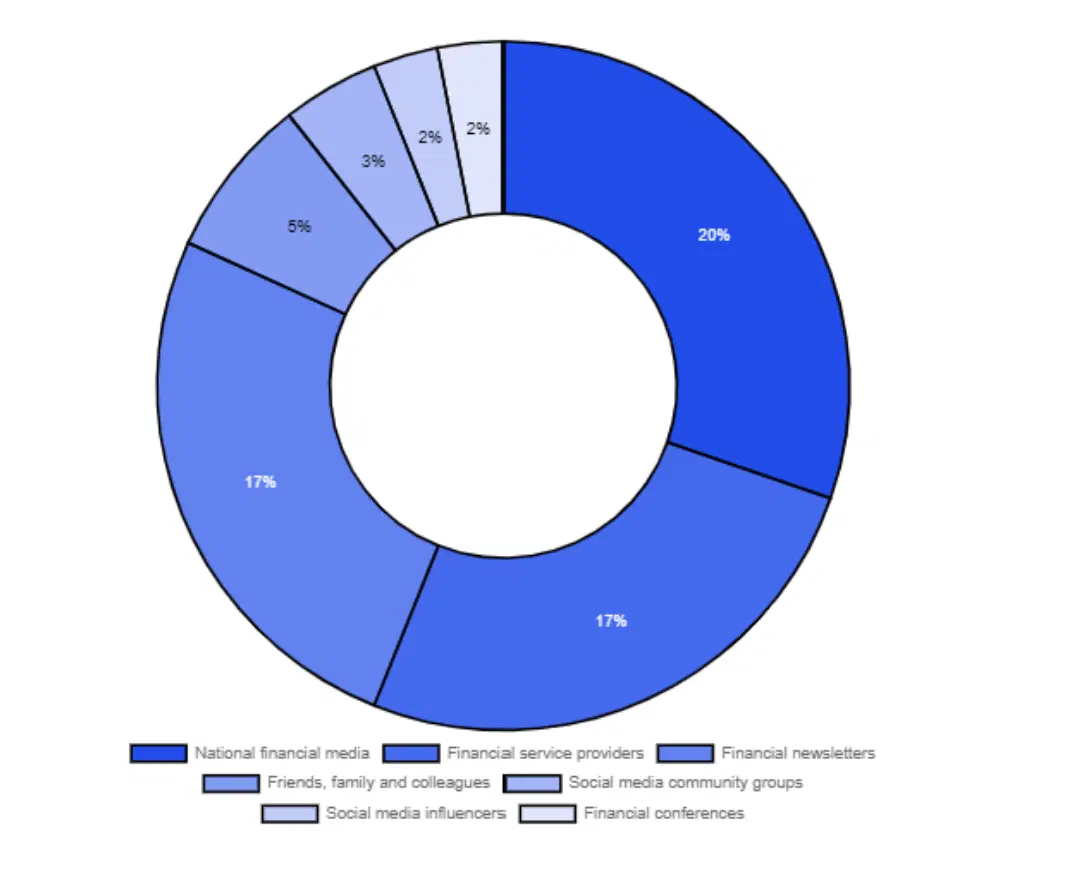

However, 65% of you are more interested than ever in financial advice and information. You rank independent trade and financial media as your most trusted source for that content, and social media groups and influencers as two of your least trusted.

Q: Which source do you trust most for information and news to inform your investments? Source: Finimize Modern Investor Pulse.

You’re fans of stocks and ETFs.

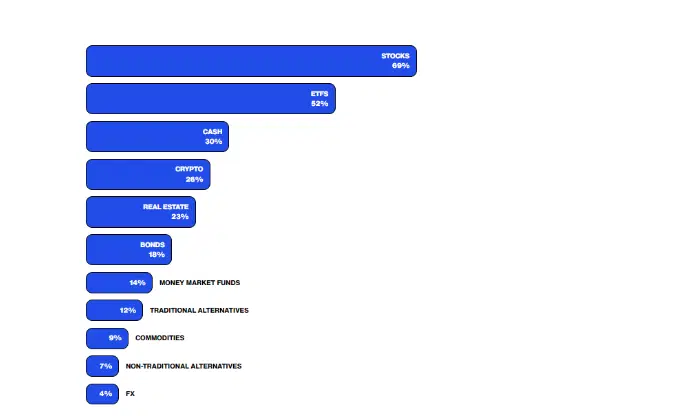

Companies linked to the AI theme are still surging and economists are continuing to forecast US interest rate cuts (albeit later in the year than they previously predicted). And that’s kept your love of stocks going strong, with 69% of you saying they’re looking to allocate more of your money toward the asset class.

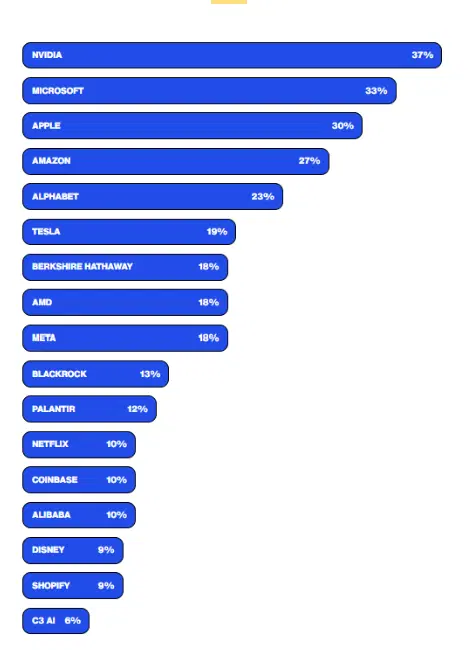

Nvidia (36%) overtook Microsoft (33%) as your top stock pick, closely followed by Apple (33%), Amazon (27%), and Alphabet (23%) – all companies that are benefiting from investors’ seemingly never-ending bout of AI fever.

Q: Which stocks do you plan to invest in over the next six to 12 months? Source: Finimize Modern Investor Pulse.

ETFs are your second most popular asset choice. The number of you planning to invest in cash products and money market funds dropped compared to the final quarter of 2023, while the number of you who said you’re planning to invest in crypto picked up – likely thanks to the arrival of spot bitcoin ETFs.

Q: Where do you plan to invest most of your surplus income over the next six to 12 months? Source: Finimize Modern Investor Pulse.

“Retail investors are back in a big way, but with a difference. We know they learn by doing and can see they’re employing lessons previously learned – particularly when it comes to adopting a degree of caution toward trending areas like AI and crypto. They’re hungrier than ever for financial information and guidance, but are turning away from social media and toward more trusted sources to make better-informed decisions – shrewdly taking the long-term view with their money.”

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.