Investors are heavily loaded up on stocks, the market’s momentum appears to be slowing, and technical support looks shaky.

The stock market could stumble if US interest rates stay at the current high levels for longer than people expect, or if geopolitical risks become even more elevated.

A balanced portfolio approach with a mix of stocks, bonds, and commodities is often sensible when the investing outlook is uncertain.

If you’ve ever played poker, you know it’s a lot easier to play the right cards when you can see what everyone else has in their hands. That’s true in investing too: catching a glimpse of what other folks are holding can inform how you play the game. Luckily, positioning data can give you that. Let’s take a peek at what it tells us now…

So how do you know what’s happening around the table?

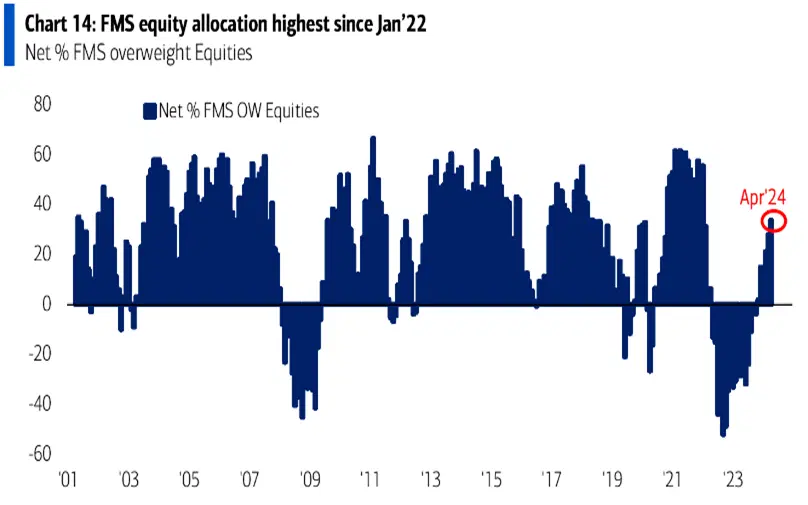

There are a few good ways to get a line of sight on that. And the Bank of America’s monthly Global Fund Manager Survey is one of the best: it offers a look at what the investing pros are thinking about the economy and the markets. The investment bank gets about 300 respondents each month and churns out a long report that’s chock full of useful charts and tracks changes over time. It’s an illuminating, nerdy, hugely useful deep dive.The players around the table now are a very optimistic crowd, with the latest survey showing that fund managers’ allocation to stocks is at the highest level in over two years. So that tells you that positioning in stocks is looking “extended”.

Percentage of fund managers that said they were disproportionately invested in stocks (or “overweight” stocks), by month, from 2001 to 2024. Source: Bank of America.

Now, having one source of positioning info is good. But more is better.

So it’s worth looking at the NAAIM Exposure Index. The gauge, which tracks investment managers’ average exposure to US stocks, peaked in March, but dropped a little this month, matching the recent decline in the S&P 500.

It’s also a good idea to check in with the American Association of Individual Investors (AAII) survey, which tracks sentiment among retail investors. It shows that this group’s bullishness is still high too, but drifted a bit lower this month after a peak in March.

Goldman Sachs’s trading desk, meanwhile, offers a look at what big asset managers and commodity trading advisers (CTAs) – those trend-following whales – are doing. The bank says they own massive stock positions too, through derivatives and futures. CTAs manage vast sums and follow systematic strategies that are momentum-based – they buy more when markets move up, and sell as the market falls.

Lastly, I always like to have a glance at CNN’s Fear & Greed index, keeping in mind that old Warren Buffett wisdom (“be fearful when others are greedy, and greedy when others are fearful”). And that trusty old gauge is already registering “Fear”, with two of its components – market volatility and demand for put options – pushing higher.

Think about it like this: when everyone’s optimistic (“bullish”) on an asset, that can suggest there might soon be no one left to buy – and in extreme cases, that can trigger a sharp market reversal. On the other hand, when everyone’s pessimistic (“bearish”) that can suggest there’s no one left to sell. And while that’s no reason to sell on its own, it is food for thought.

After all, some technical indicators are showing signs of weakness: for the first time since early November, major stock indexes, including the S&P 500 and the Nasdaq 100, closed below their 50-day moving averages. When markets break below important technical levels – and that one is very widely followed – your alarm bells should start to ring.

So what’s the smart play then?

Well, with stock positioning looking pretty extended, it’s reasonable to wager that this month’s pullback could become even bigger.

Recent US inflation and jobs data suggest that the Federal Reserve will likely hold off a little longer on lowering interest rates. And those higher-for-longer interest rates are a not-ideal scenario for stocks. That said, as we’ve seen in recent months, some shares can rally despite the interest rate outlook, boosted by the overall resilience of the consumer and the economy..

Now, if higher rates were the only concern, you could expect any pullbacks in stocks to be relatively short-lived and create an opportunity for you to pick up shares at cheaper prices. And sticking with recent winners like high-quality big-cap companies, AI-related names, and Japanese stocks would seem like a can’t-miss approach.

But there are other concerns: if economic growth or company earnings disappoint, or if geopolitical risks escalate, there could be a sharper market decline. And in times of panic, selling can be indiscriminate, as forced moves kick in and the most over-owned or crowded stocks get dumped – including, potentially, the biggest winners so far this year. If those CTAs, for example, start to sell, billions of dollars of index futures could take a tumble, along with the big-cap quality and AI stocks.

When the outlook is uncertain, maintaining a balanced portfolio with some stocks, bonds, and gold can be a relief, cushioning your overall portfolio from a steeper fall and saving you from making rash investment decisions based on emotion. And maintaining some cash on the side – potentially in a high-yielding money market fund – can give you the flexibility to be greedy, pouncing on opportunities as they come along.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.